Current Jumbo Mortgage Rates 2024: Navigating the Market, the landscape for those seeking loans exceeding conventional limits is constantly evolving. This guide explores the current trends, influencing factors, and strategies for securing competitive jumbo mortgage rates in 2024. Understanding the nuances of jumbo mortgages is crucial for borrowers seeking to finance larger properties, as they often come with unique considerations and rate dynamics.

Jumbo mortgages, exceeding the conforming loan limits set by Fannie Mae and Freddie Mac, offer a pathway for acquiring larger homes or properties. However, these loans often come with higher interest rates and stricter qualification criteria. This guide provides a comprehensive overview of jumbo mortgage rates, delving into current trends, factors influencing rate fluctuations, and strategies for obtaining competitive rates in today’s market.

Contents List

- 1 Jumbo Mortgage Rate Overview

- 2 Current Jumbo Mortgage Rate Trends

- 3 Factors Affecting Jumbo Mortgage Rates

- 4 Jumbo Mortgage Rate Predictions

- 5 Strategies for Obtaining a Competitive Jumbo Mortgage Rate

- 6 Jumbo Mortgage Rate Impact on Homebuyers: Current Jumbo Mortgage Rates 2024

- 7 Outcome Summary

- 8 Essential FAQs

Jumbo Mortgage Rate Overview

A jumbo mortgage is a home loan that exceeds the conforming loan limits set by the Federal Housing Finance Agency (FHFA). These limits vary by location and are adjusted annually. In 2024, for instance, the conforming loan limit for a single-family home is $726,200 in most areas, while it’s higher in certain high-cost housing markets.

Looking to tap into your home equity? Va Cash Out Refinance 2024 offers a convenient way to access your home’s equity.

Loans exceeding these limits are considered jumbo mortgages.

Finding the right mortgage lender can be overwhelming. Mortgage Lender 2024 provides a comprehensive list of lenders and their offerings.

Jumbo mortgages differ from conventional loans in several key aspects. They typically come with stricter underwriting guidelines, requiring borrowers to have excellent credit scores, a substantial down payment, and a proven track record of financial stability. This stringent qualification process is due to the higher risk associated with larger loan amounts.

Jumbo mortgages also tend to have higher interest rates compared to conventional loans, reflecting the increased risk for lenders.

Planning to expand your business? Business Mortgage 2024 can help you secure the funding you need to achieve your goals.

Factors Influencing Jumbo Mortgage Rates

Jumbo mortgage rates are influenced by a complex interplay of factors, including:

- Federal Reserve Monetary Policy:The Federal Reserve’s actions, such as adjusting interest rates, significantly impact the cost of borrowing across the market, including jumbo mortgages. When the Fed raises interest rates, it typically leads to higher mortgage rates, and vice versa.

- Investor Demand:The demand for jumbo mortgage-backed securities by investors, such as pension funds and insurance companies, plays a role in shaping rates. When investor demand is high, rates tend to be lower, and vice versa.

- Market Conditions:Economic factors, such as inflation, unemployment, and overall economic growth, influence investor sentiment and risk appetite, ultimately affecting jumbo mortgage rates.

- Credit Scores and Loan-to-Value Ratios:Borrowers with higher credit scores and lower loan-to-value ratios (LTVs) generally qualify for more favorable jumbo mortgage rates.

Historical Perspective on Jumbo Mortgage Rates

Jumbo mortgage rates have fluctuated significantly over the past few years, mirroring broader trends in the mortgage market. For instance, during the period of historically low interest rates in 2020 and 2021, jumbo mortgage rates also reached record lows.

Looking for the best mortgage rates for 2024? Check out Huntington Bank Mortgage Rates 2024 to see if they offer competitive rates and terms.

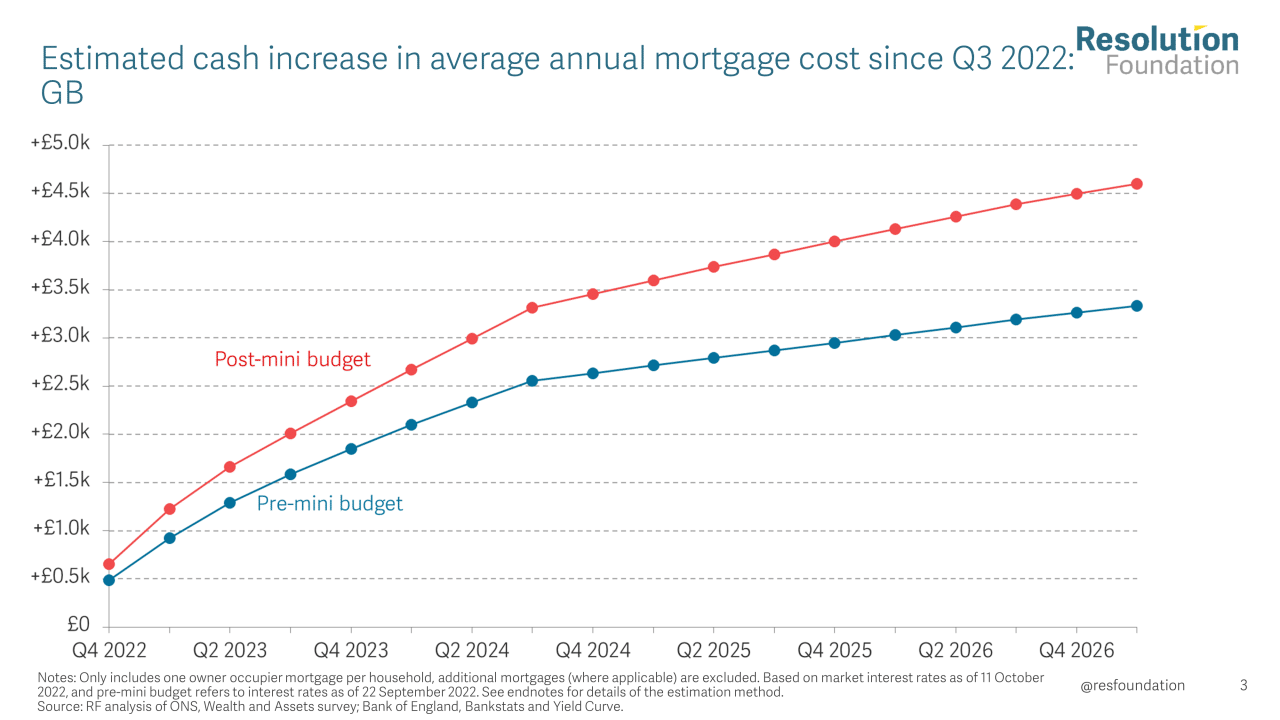

However, with the Federal Reserve’s tightening monetary policy in 2022 and 2023, jumbo mortgage rates have risen considerably.

Want to stay up-to-date on current mortgage rates? Current Mortgage Rates 2024 provides real-time information on various mortgage options.

It’s essential to remember that past performance is not necessarily indicative of future results.

If you’re a first-time homebuyer, Fha Home Loan 2024 can offer you a flexible and affordable way to purchase your dream home.

Current Jumbo Mortgage Rate Trends

As of [current date], the average jumbo mortgage rates for various loan terms are as follows:

| Loan Term | Average Jumbo Mortgage Rate |

|---|---|

| 15-Year Fixed-Rate Mortgage | [Insert average rate] |

| 30-Year Fixed-Rate Mortgage | [Insert average rate] |

These rates are subject to change daily, depending on market conditions and lender pricing. It’s crucial to consult with a mortgage professional for the most up-to-date information.

Rocket Mortgage is a popular online lender. Check out Rocket Mortgage Com 2024 for their latest mortgage offerings.

In recent months, jumbo mortgage rates have experienced some fluctuations, primarily influenced by the Federal Reserve’s monetary policy decisions and investor sentiment. While rates have generally trended upward, there have been periods of slight declines as well.

Thinking about refinancing your FHA loan? Fha Refinance 2024 provides information on the process and available rates.

Comparing current jumbo mortgage rates with historical averages, we can see that rates are currently higher than they were during the period of historically low interest rates in 2020 and 2021. However, they are still lower than the highs reached during the financial crisis of 2008-2009.

Considering a second mortgage? 2nd Mortgage Rates 2024 provides information on rates and options for second mortgages.

Factors Affecting Jumbo Mortgage Rates

Impact of the Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy plays a significant role in influencing jumbo mortgage rates. When the Fed raises interest rates, it becomes more expensive for lenders to borrow money, which in turn leads to higher mortgage rates. Conversely, when the Fed lowers interest rates, it becomes less expensive for lenders to borrow, resulting in lower mortgage rates.

Influence of Investor Demand and Market Conditions, Current Jumbo Mortgage Rates 2024

Investor demand for jumbo mortgage-backed securities also impacts rates. When investors are eager to purchase these securities, it drives down rates, making it more affordable for borrowers to secure a jumbo mortgage. Conversely, when investor demand is weak, rates tend to rise.

Market conditions, such as inflation, unemployment, and economic growth, influence investor sentiment and risk appetite, ultimately affecting jumbo mortgage rates.

Role of Credit Scores and Loan-to-Value Ratios

Credit scores and loan-to-value ratios (LTVs) are critical factors in determining jumbo mortgage rates. Borrowers with higher credit scores generally qualify for more favorable rates, as lenders perceive them as lower risk. Similarly, borrowers with lower LTVs (meaning they have a larger down payment), are also considered less risky, leading to potentially lower rates.

Looking for the best VA loan rates? Best Va Loan Rates 2024 provides a comparison of current rates and lenders.

Jumbo Mortgage Rate Predictions

Predicting future jumbo mortgage rate movements is a complex endeavor, as numerous factors can influence rates. However, by analyzing current economic indicators and historical trends, we can gain insights into potential scenarios.

St. George is known for its competitive home loan rates. Check out St George Home Loan Rates 2024 to see if they have the right loan for you.

Current economic indicators, such as inflation, unemployment, and consumer spending, provide clues about the direction of the economy and the Federal Reserve’s future policy decisions. If inflation remains elevated, the Fed is likely to continue raising interest rates, which could lead to higher jumbo mortgage rates.

Refinancing your current mortgage? Refinance Rates Today 2024 can help you find the best deals and save money on your monthly payments.

Conversely, if inflation cools down, the Fed might adopt a more accommodative stance, potentially resulting in lower rates.

Industry experts and analysts offer a range of predictions for jumbo mortgage rates in the coming months. Some experts anticipate further rate increases, citing continued inflationary pressures and the Fed’s commitment to controlling inflation. Others foresee a stabilization or even a slight decline in rates, particularly if economic growth slows down and inflation subsides.

Need a commercial mortgage for your business? Commercial Mortgage 2024 offers resources and information on commercial mortgage options.

It’s important to remember that these are just predictions, and actual rates can vary significantly based on market conditions and other factors.

Want to estimate your monthly mortgage payment? Estimated Mortgage Payment 2024 can help you calculate your potential payments.

Strategies for Obtaining a Competitive Jumbo Mortgage Rate

Securing a favorable jumbo mortgage rate requires a strategic approach. Here are some strategies to consider:

| Strategy | Explanation |

|---|---|

| Improve Credit Score | A higher credit score demonstrates financial responsibility to lenders, potentially leading to lower interest rates. |

| Increase Down Payment | A larger down payment reduces the loan amount, making you a less risky borrower and potentially lowering rates. |

| Shop Around for Rates | Compare rates from multiple lenders to find the most competitive offer. |

| Consider a Mortgage Broker | A mortgage broker can help you navigate the complex process of securing a jumbo mortgage and may have access to lenders offering competitive rates. |

By implementing these strategies, borrowers can increase their chances of securing a competitive jumbo mortgage rate.

USAA offers competitive home loan rates for military members and their families. Explore Usaa Home Loans 2024 for more details.

Jumbo Mortgage Rate Impact on Homebuyers: Current Jumbo Mortgage Rates 2024

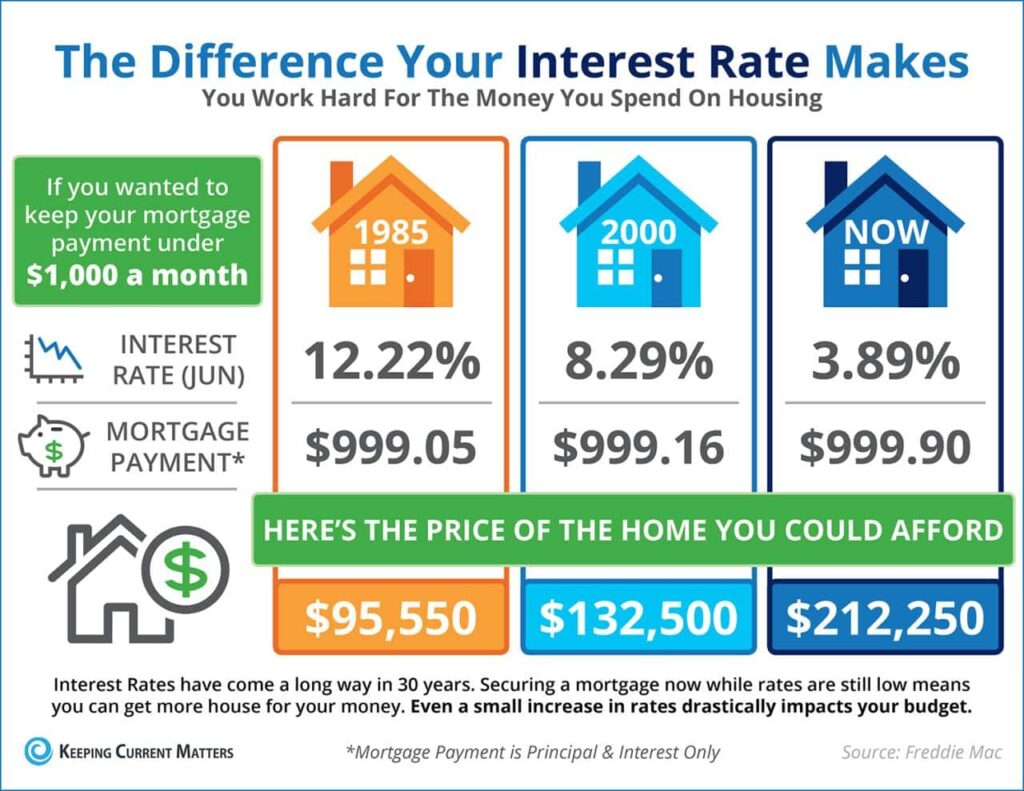

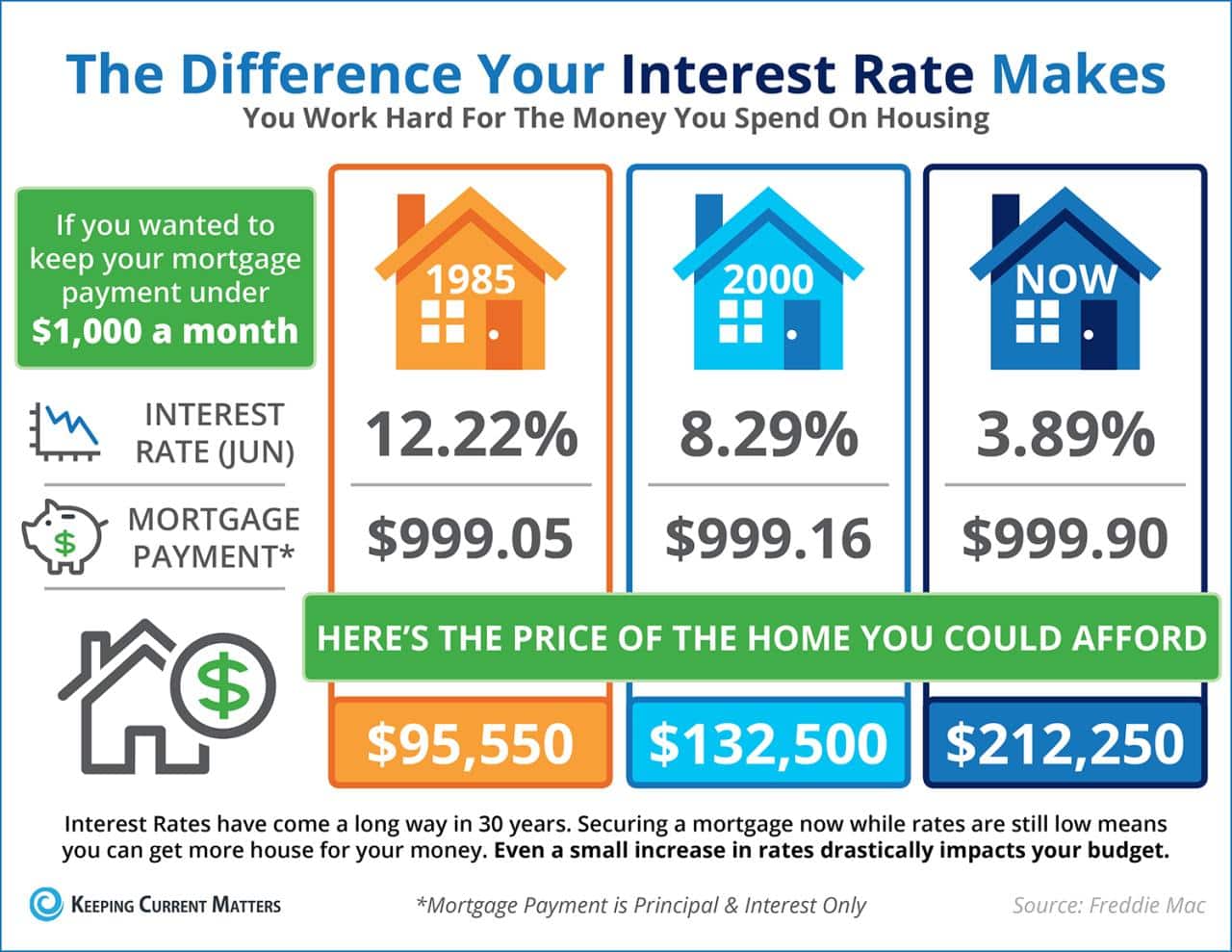

Current jumbo mortgage rates have a significant impact on affordability for potential homebuyers. Higher rates mean higher monthly mortgage payments, making it more expensive to purchase a home, particularly for those seeking larger or more expensive properties.

Comparing the cost of purchasing a home with a jumbo mortgage versus a conventional loan, we can see that jumbo mortgages generally come with higher interest rates. This difference in rates can translate into a substantial increase in monthly payments and overall borrowing costs.

Homebuyers navigating the current jumbo mortgage rate environment should carefully consider their financial situation, affordability, and long-term goals. It’s essential to work closely with a mortgage professional to explore various loan options and determine the best fit for their individual circumstances.

Outcome Summary

In conclusion, navigating the world of jumbo mortgage rates requires careful consideration of current trends, influencing factors, and strategic planning. By understanding the dynamics of this market, borrowers can make informed decisions, secure favorable rates, and achieve their homeownership goals.

Whether you are a seasoned investor or a first-time buyer, the insights provided in this guide can empower you to confidently navigate the complexities of jumbo mortgages in 2024.

Essential FAQs

What is the difference between a jumbo mortgage and a conventional mortgage?

A jumbo mortgage exceeds the conforming loan limits set by Fannie Mae and Freddie Mac, while a conventional mortgage falls within those limits. Jumbo mortgages often have higher interest rates and stricter qualification requirements.

How do jumbo mortgage rates compare to conventional mortgage rates?

Jumbo mortgage rates are typically higher than conventional mortgage rates due to the increased risk associated with larger loan amounts. However, the exact difference in rates can vary depending on factors like credit score, loan-to-value ratio, and market conditions.

What are some strategies for obtaining a competitive jumbo mortgage rate?

Strategies for securing a favorable jumbo mortgage rate include improving your credit score, strengthening your loan application, and working with a mortgage broker or lender specializing in jumbo loans.