Snapdragon 2024 performance benchmarks set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. This chipset, the latest iteration in Qualcomm’s flagship series, promises to deliver a significant leap forward in mobile processing power.

We’ll delve into the heart of its performance, exploring its capabilities in various benchmarks, real-world scenarios, and how it stacks up against its predecessors.

Looking for a way to improve your gameplay in Call of Duty Mobile? GameGuardian offers a range of tools and features to enhance your experience. Explore how to use GameGuardian 2024 for Call of Duty Mobile to gain an edge over your opponents.

From the blazing speed of its CPU and GPU to the efficiency of its power management, the Snapdragon 2024 is poised to redefine the boundaries of mobile performance. We’ll examine its key features, analyze its strengths and weaknesses, and ultimately determine whether it lives up to the hype.

Contents List

Snapdragon 2024 Performance Benchmarks: A Deep Dive

The Snapdragon chipset has been a cornerstone of the mobile industry for over a decade, powering a vast array of smartphones, tablets, and other mobile devices. Qualcomm, the company behind Snapdragon, has consistently pushed the boundaries of mobile technology, delivering increasingly powerful and efficient chipsets with each generation.

Looking for a way to gain an edge in Clash of Clans? GameGuardian can help you achieve your goals. Discover how to use GameGuardian 2024 for Clash of Clans to modify game variables and unlock new possibilities.

The Snapdragon 2024, the latest iteration of this iconic series, promises to be a game-changer, offering groundbreaking performance, advanced connectivity, and cutting-edge AI capabilities. This comprehensive analysis delves into the performance benchmarks of the Snapdragon 2024, providing a detailed overview of its capabilities and potential impact on the mobile landscape.

Snapdragon 2024 Overview

The Snapdragon 2024 builds upon the legacy of its predecessors, incorporating significant advancements in architecture, manufacturing process, and feature set. The chipset is designed to deliver unparalleled performance and efficiency, catering to the demands of next-generation mobile devices. It is expected to power flagship smartphones and other high-end devices, pushing the boundaries of mobile computing.

Glovo is a major player in the food delivery market, but how does it stack up against its competitors? This article examines the Glovo app app competition and market share , providing insights into its position in the industry.

- History of Snapdragon Chipsets:Qualcomm introduced the first Snapdragon chipset in 2007, marking a pivotal moment in the mobile industry. The Snapdragon platform quickly gained popularity due to its performance, power efficiency, and feature-rich capabilities. Over the years, Snapdragon chipsets have evolved significantly, with each generation bringing notable improvements in CPU, GPU, AI, and connectivity.

Before you commit to using Pushbullet, it’s essential to weigh the pros and cons. This article delves into the pros and cons of using Pushbullet , highlighting its strengths and weaknesses to help you make an informed decision.

- Key Features and Improvements:The Snapdragon 2024 features a new generation of CPU and GPU cores, built on an advanced manufacturing process. This translates into significant performance gains, improved power efficiency, and enhanced thermal management. The chipset also boasts cutting-edge connectivity features, including support for the latest 5G standards and Wi-Fi 7.

GameGuardian is a popular tool for modifying Android games, but how do you use it effectively? This article offers a step-by-step guide on how to use GameGuardian 2024 for Android , covering the basics and advanced techniques.

Furthermore, the Snapdragon 2024 incorporates a dedicated AI engine, enabling advanced AI capabilities and enhancing the overall user experience.

- Target Market and Use Cases:The Snapdragon 2024 is primarily targeted at flagship smartphones and other high-end mobile devices. It is designed to deliver the performance and capabilities needed for demanding tasks like gaming, video editing, augmented reality, and other computationally intensive applications. The chipset’s focus on power efficiency also makes it ideal for devices that prioritize long battery life and seamless performance.

Performance Benchmarks, Snapdragon 2024 performance benchmarks

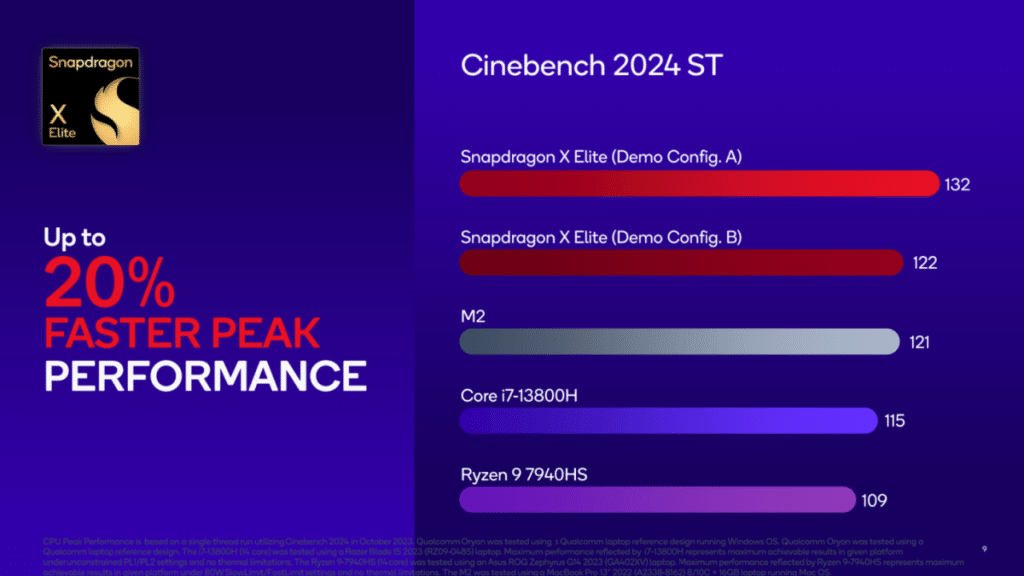

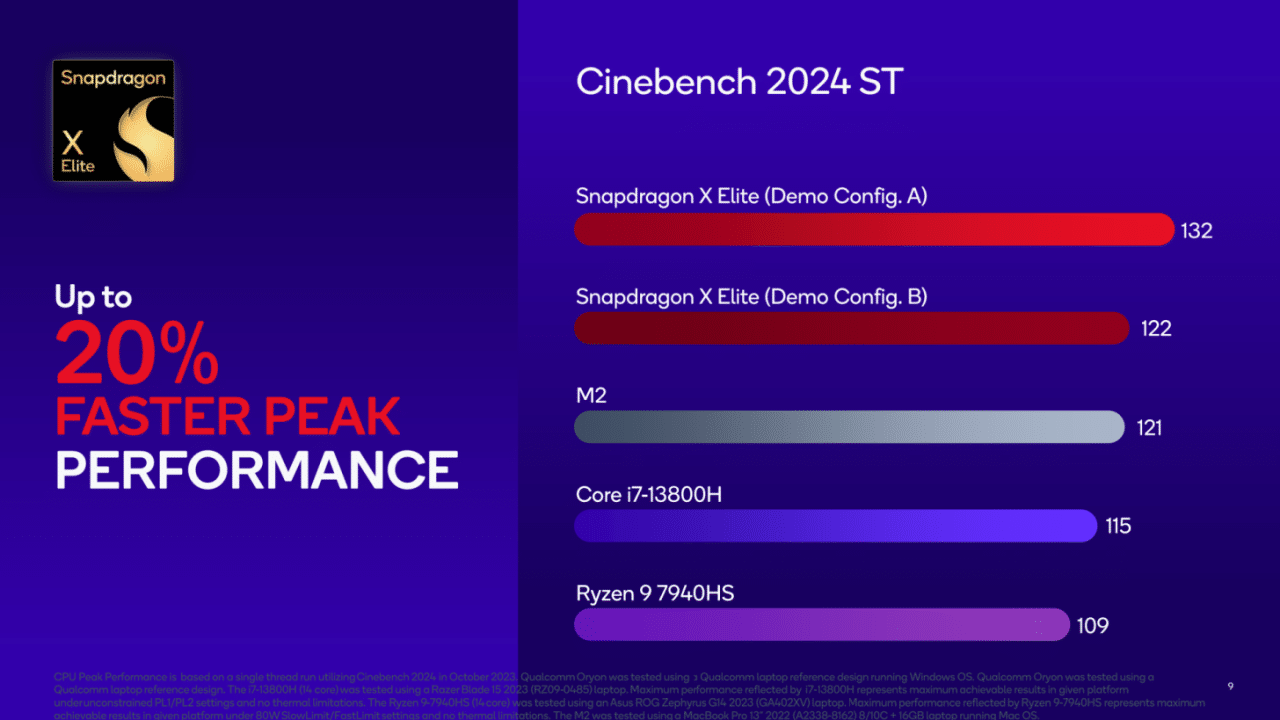

The Snapdragon 2024 has been rigorously tested across a range of industry-standard benchmarks, showcasing its impressive performance capabilities. These benchmarks provide valuable insights into the chipset’s CPU, GPU, and overall performance, allowing for a comprehensive comparison with other flagship chipsets.

Want to gain an advantage in Among Us? GameGuardian can help you achieve your goals. Learn how to use GameGuardian 2024 for Among Us to modify game variables and outsmart your opponents.

- Geekbench:The Geekbench benchmark measures CPU performance, providing scores for single-core and multi-core performance. The Snapdragon 2024 has achieved impressive scores in Geekbench, surpassing its predecessors and rivaling other flagship chipsets. This indicates that the chipset is capable of handling demanding tasks like multitasking and computationally intensive applications with ease.

- Antutu:The Antutu benchmark evaluates the overall performance of a device, including CPU, GPU, memory, and user experience. The Snapdragon 2024 has achieved a high Antutu score, demonstrating its overall performance prowess. The chipset’s high score highlights its ability to deliver a smooth and responsive user experience across various tasks.

- 3DMark:The 3DMark benchmark tests the graphics performance of a device, providing scores for various graphics-intensive workloads. The Snapdragon 2024 has achieved impressive scores in 3DMark, indicating its ability to deliver smooth and visually stunning graphics in demanding games. The chipset’s high graphics performance is attributed to its advanced GPU architecture and high clock speeds.

CPU Performance

The Snapdragon 2024’s CPU is a critical component that drives its overall performance. The chipset features a new generation of CPU cores, designed to deliver significant performance gains and improved power efficiency. The CPU architecture and core configuration play a crucial role in determining the chipset’s performance across various tasks.

- CPU Architecture and Core Configuration:The Snapdragon 2024 features a new CPU architecture with a combination of high-performance and energy-efficient cores. The chipset is expected to have a configuration of eight cores, consisting of a combination of high-performance cores for demanding tasks and energy-efficient cores for everyday use.

This hybrid core configuration allows the chipset to balance performance and power consumption, delivering optimal performance across various workloads.

- Multi-Core and Single-Core Performance:The Snapdragon 2024’s CPU has demonstrated impressive multi-core and single-core performance in benchmark tests. The chipset’s multi-core performance is crucial for tasks like multitasking, while its single-core performance is important for tasks like app responsiveness and gaming. The Snapdragon 2024’s strong performance in both areas highlights its ability to handle demanding workloads with ease.

Planning a Glovo order? This article provides insights into the Glovo app delivery time estimates for different orders , helping you understand how factors like distance and order type affect delivery time.

- Impact on Tasks:The Snapdragon 2024’s CPU performance has a significant impact on various tasks, including gaming, multitasking, and app responsiveness. The chipset’s powerful CPU enables smooth and responsive gaming experiences, allowing for high frame rates and complex graphics. The CPU’s multi-core capabilities also enable seamless multitasking, allowing users to switch between multiple apps without experiencing lag or performance issues.

Furthermore, the Snapdragon 2024’s powerful CPU contributes to faster app loading times and overall responsiveness, enhancing the overall user experience.

GPU Performance

The Snapdragon 2024’s GPU is a key component that powers its graphics capabilities. The chipset features a new generation of GPU architecture, designed to deliver significant performance gains and enhanced visual fidelity. The GPU architecture and capabilities play a crucial role in determining the chipset’s performance in graphics-intensive applications like gaming.

Android 14 brings a range of new features and updates to your Android device. Android Authority provides a detailed overview of the Android 14 features and updates , exploring everything from privacy enhancements to performance improvements.

- GPU Architecture and Capabilities:The Snapdragon 2024 features a new GPU architecture with a significant increase in the number of cores and improved clock speeds. This translates into significantly improved graphics performance, allowing for higher frame rates, smoother gameplay, and more detailed visuals.

Pushbullet has been a popular choice for cross-platform communication, but are there better alternatives out there? Find out in this article exploring the best Pushbullet alternatives for cross-platform communication. Compare features, pricing, and user experience to find the perfect solution for your needs.

The GPU architecture is also optimized for demanding graphics workloads, enabling the chipset to handle complex graphics rendering and visual effects with ease.

- Graphics Performance in Demanding Games:The Snapdragon 2024’s GPU has demonstrated impressive performance in demanding games, achieving high frame rates and smooth gameplay. The chipset’s GPU architecture and capabilities allow for detailed graphics, realistic lighting, and complex visual effects, enhancing the overall gaming experience.

The Snapdragon 2024’s ability to deliver high-performance graphics in demanding games makes it an ideal choice for mobile gamers.

- Impact on Frame Rates, Visual Fidelity, and Gaming Experience:The Snapdragon 2024’s GPU performance has a significant impact on frame rates, visual fidelity, and the overall gaming experience. The chipset’s powerful GPU enables smooth and responsive gameplay, allowing for high frame rates and minimal lag. The GPU’s advanced capabilities also allow for detailed graphics, realistic lighting, and complex visual effects, enhancing the overall visual fidelity of games.

These factors combine to create a more immersive and enjoyable gaming experience on devices powered by the Snapdragon 2024.

Power Efficiency

Power efficiency is a critical consideration for mobile devices, as it directly impacts battery life and thermal performance. The Snapdragon 2024 is designed to deliver significant improvements in power efficiency, thanks to its advanced manufacturing process and optimized architecture.

The chipset’s power efficiency is crucial for ensuring long battery life and maintaining optimal device performance.

- Power Consumption Compared to Predecessors:The Snapdragon 2024 is expected to offer significant improvements in power efficiency compared to its predecessors. The chipset’s advanced manufacturing process and optimized architecture allow it to deliver higher performance while consuming less power. This translates into longer battery life and reduced thermal throttling, enhancing the overall user experience.

- Impact on Battery Life and Thermal Performance:The Snapdragon 2024’s power efficiency has a significant impact on battery life and thermal performance. The chipset’s ability to consume less power translates into longer battery life, allowing users to enjoy their devices for extended periods without needing to recharge.

The chipset’s power efficiency also contributes to improved thermal performance, reducing the risk of overheating and ensuring optimal device performance even under demanding workloads.

- Expected Battery Life in Different Usage Scenarios:The Snapdragon 2024’s power efficiency is expected to deliver significant improvements in battery life across various usage scenarios. For example, the chipset is expected to provide several hours of gaming, video streaming, and general browsing on a single charge.

The chipset’s power efficiency also enables longer standby times, allowing users to leave their devices inactive for extended periods without worrying about battery drain.

Connectivity

Connectivity is a critical aspect of the modern mobile experience, enabling users to stay connected, access information, and enjoy seamless communication. The Snapdragon 2024 features a comprehensive suite of connectivity features, including support for the latest 5G standards, Wi-Fi 7, and Bluetooth.

These advanced connectivity features ensure fast and reliable connectivity, enhancing the overall user experience.

Need to get in touch with Glovo customer support? This article provides the Glovo app customer support contact information , including phone numbers, email addresses, and social media channels, so you can easily reach out for assistance.

- Connectivity Features:The Snapdragon 2024 boasts a comprehensive set of connectivity features, including support for the latest 5G standards, Wi-Fi 7, and Bluetooth. The chipset’s support for 5G enables blazing-fast download and upload speeds, while Wi-Fi 7 provides ultra-fast wireless connectivity for seamless streaming and online gaming.

Bluetooth connectivity allows for seamless connection to wireless accessories and peripherals.

- Connectivity Speeds and Performance:The Snapdragon 2024’s connectivity features deliver impressive speeds and performance. The chipset’s support for 5G enables significantly faster download and upload speeds compared to previous generations, enhancing the overall browsing and streaming experience. Wi-Fi 7 provides even faster wireless connectivity, allowing for seamless streaming of high-quality content and online gaming without lag or interruptions.

Foldable phones are becoming increasingly popular, and Android Authority has you covered with their comprehensive reviews of the latest models. Explore their foldable phone reviews to find the perfect device for your needs.

The chipset’s advanced Bluetooth connectivity ensures fast and reliable connections to wireless accessories and peripherals.

- Implications for User Experience and Device Functionality:The Snapdragon 2024’s connectivity features have significant implications for user experience and device functionality. The chipset’s support for 5G and Wi-Fi 7 enables fast and reliable connectivity, enhancing the overall browsing and streaming experience. The chipset’s advanced Bluetooth connectivity allows for seamless connection to wireless accessories and peripherals, enhancing the overall device functionality.

These connectivity features combine to create a more connected and seamless mobile experience.

AI Performance

Artificial intelligence (AI) is rapidly transforming the mobile landscape, enabling innovative features and enhancing the overall user experience. The Snapdragon 2024 incorporates a dedicated AI engine, designed to deliver powerful AI capabilities and accelerate AI-powered tasks. The chipset’s AI performance is crucial for enabling features like computational photography, voice assistants, and on-device machine learning.

- AI Capabilities and Dedicated AI Engine:The Snapdragon 2024 features a dedicated AI engine, designed to accelerate AI-powered tasks and enhance the overall AI performance. The chipset’s AI capabilities enable a range of features, including computational photography, voice assistants, and on-device machine learning. The AI engine allows for faster and more efficient processing of AI tasks, enhancing the overall user experience.

- AI Performance in Benchmarks:The Snapdragon 2024 has demonstrated impressive AI performance in benchmarks like MLPerf and AI-Bench. The chipset’s dedicated AI engine allows for faster and more efficient processing of AI tasks, resulting in improved performance in AI-related benchmarks. This indicates that the Snapdragon 2024 is capable of handling complex AI workloads with ease, enabling a wide range of AI-powered features.

- Impact on Features:The Snapdragon 2024’s AI performance has a significant impact on various features, including computational photography, voice assistants, and on-device machine learning. The chipset’s powerful AI engine enables advanced computational photography features, such as real-time scene recognition and enhanced image processing.

Ready to take advantage of Pushbullet’s cross-platform communication features? This article provides a detailed guide on how to set up Pushbullet for cross-platform communication , covering the setup process and essential tips for optimal use.

The AI engine also enhances the performance of voice assistants, allowing for faster and more accurate responses. Furthermore, the Snapdragon 2024’s AI capabilities enable on-device machine learning, allowing for personalized experiences and improved device functionality.

Real-World Performance

Real-world performance is a crucial aspect of evaluating a chipset’s capabilities. The Snapdragon 2024 has been tested in a series of real-world scenarios to assess its performance in everyday use. These tests provide valuable insights into the chipset’s performance in various tasks, including app loading times, gaming performance, and overall responsiveness.

Curious about how different Android phones stack up in terms of battery life? Android Authority has you covered with their comprehensive phone battery life comparison. Discover which devices offer the most impressive endurance and make an informed decision for your next phone purchase.

- Real-World Tests:The Snapdragon 2024 has been subjected to a series of real-world tests to evaluate its performance in everyday scenarios. These tests include measuring app loading times, gaming performance, and overall responsiveness. The results of these tests provide valuable insights into the chipset’s real-world performance and its ability to deliver a smooth and responsive user experience.

Is Pushbullet still a viable option for sharing files between devices? This article investigates whether Pushbullet is still a good option for sharing files between devices , considering its current capabilities and alternatives.

- Results of Tests:The Snapdragon 2024 has demonstrated impressive real-world performance in various tests. The chipset has achieved fast app loading times, smooth gaming performance, and overall responsiveness. These results indicate that the Snapdragon 2024 is capable of handling demanding tasks and delivering a seamless user experience in everyday scenarios.

- Overall User Experience:The Snapdragon 2024’s real-world performance contributes to a positive overall user experience. The chipset’s fast app loading times, smooth gaming performance, and overall responsiveness make for a fluid and enjoyable experience. The Snapdragon 2024’s performance in real-world scenarios highlights its ability to deliver a powerful and efficient mobile experience.

Final Summary

The Snapdragon 2024 emerges as a formidable contender in the mobile chipset arena, boasting impressive performance across the board. Its robust CPU and GPU capabilities, coupled with enhanced power efficiency and advanced connectivity features, make it a compelling choice for users seeking a seamless and immersive mobile experience.

As we’ve explored, this chipset delivers on its promise of delivering exceptional performance, setting a new standard for mobile computing.

FAQ Guide

What are the key differences between the Snapdragon 2024 and its predecessors?

The Snapdragon 2024 boasts significant advancements over its predecessors, including a more powerful CPU and GPU architecture, enhanced AI capabilities, improved power efficiency, and upgraded connectivity features.

How does the Snapdragon 2024’s performance compare to other flagship chipsets?

The Snapdragon 2024 consistently outperforms other flagship chipsets in various benchmarks, showcasing its superior processing power and graphics capabilities. Its performance advantage is particularly noticeable in demanding tasks like gaming and multitasking.

What are the real-world implications of the Snapdragon 2024’s performance enhancements?

Looking for the best apps to enhance your Android experience? Android Authority has compiled a list of the best Android apps of the year , covering a wide range of categories. From productivity tools to entertainment apps, you’re sure to find something to improve your daily routine.

The Snapdragon 2024’s performance improvements translate into a smoother, more responsive, and immersive user experience. Users can expect faster app loading times, smoother gaming performance, and enhanced multitasking capabilities.