National Mortgage Rates 2024 sets the stage for a captivating exploration of the ever-evolving landscape of home financing. This year, a complex interplay of economic forces, monetary policy, and market sentiment is shaping the cost of borrowing for homebuyers and impacting the strategies of sellers.

Understanding the current trends, factors influencing these rates, and potential future scenarios is crucial for anyone involved in the real estate market.

This comprehensive guide delves into the intricacies of mortgage rates in 2024, providing insights into the forces driving their fluctuations, the impact on borrowers and sellers, and strategies for navigating the current environment. We’ll examine historical trends, analyze expert predictions, and explore the potential implications for the housing market as a whole.

USAA offers mortgage services for military members and their families. If you’re a USAA member, you can check out their current mortgage rates for 2024, Usaa Mortgage Rates 2024.

Contents List

Current Mortgage Rate Trends in 2024

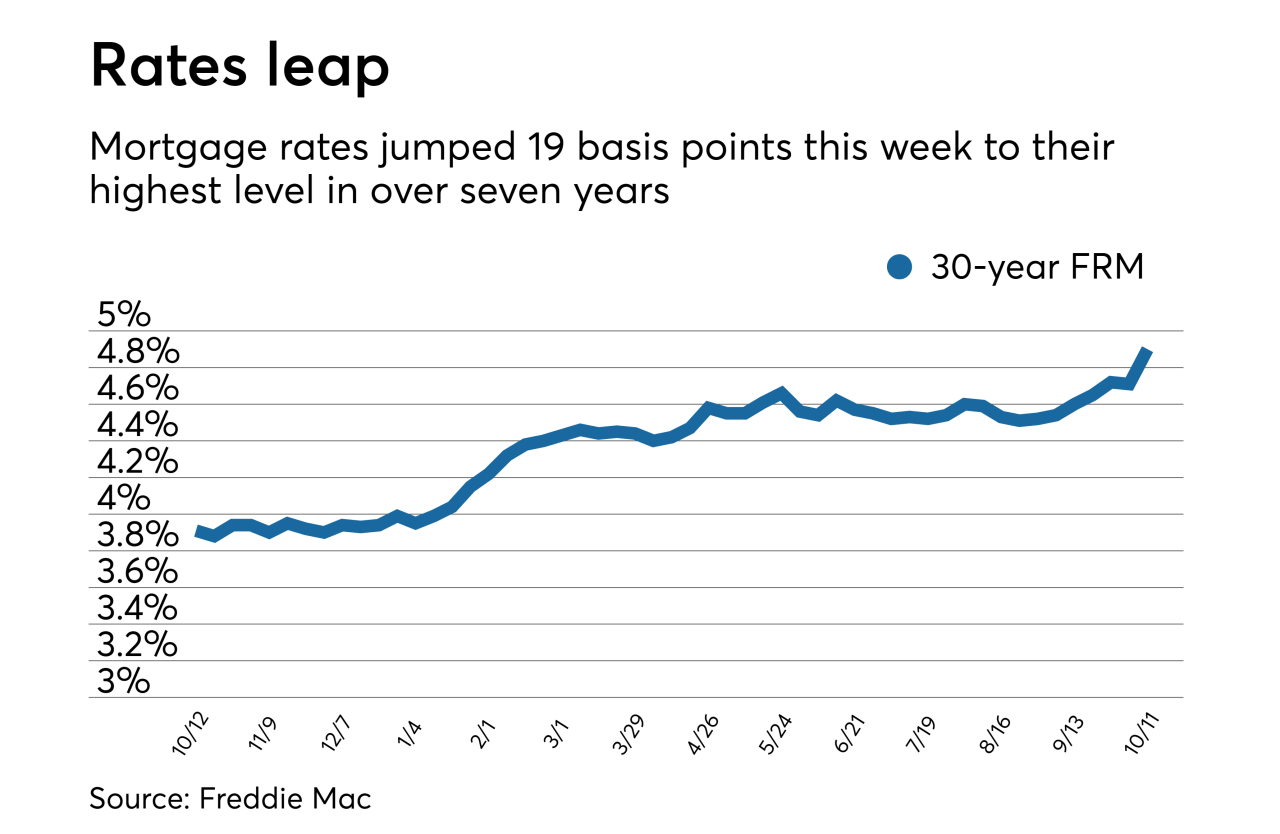

Mortgage rates have been on a roller coaster ride in recent years, and 2024 is shaping up to be no different. Understanding current trends and the factors driving them is crucial for anyone planning to buy, sell, or refinance a home.

Refinancing your existing mortgage can save you money on interest. Explore current refinance rates for 30-year fixed mortgages in 2024, Refinance Rates 30 Year Fixed 2024 , and see if refinancing is right for you.

Average Mortgage Rates

As of the beginning of 2024, average mortgage rates for various loan types are as follows:

- 30-Year Fixed-Rate Mortgage:Around 6.5% to 7.5%

- 15-Year Fixed-Rate Mortgage:Around 5.5% to 6.5%

- Adjustable-Rate Mortgage (ARM):Starting at 5% to 6%, with potential for rate adjustments over time.

Factors Influencing Mortgage Rate Trends

Several factors contribute to the fluctuations in mortgage rates, including:

- Federal Reserve Policy:The Federal Reserve’s monetary policy decisions, particularly interest rate adjustments, directly impact mortgage rates. Rate hikes typically lead to higher mortgage rates, while rate cuts can lower them.

- Inflation:High inflation erodes purchasing power and prompts the Federal Reserve to raise interest rates, which in turn can increase mortgage rates.

- Economic Indicators:Factors like unemployment rates, GDP growth, and consumer confidence can influence investor sentiment and affect mortgage rates.

- Market Sentiment:Investor expectations about future economic conditions and inflation can also play a role in shaping mortgage rates.

Historical Comparisons and Potential Rate Movements

Comparing current rates to historical averages reveals that they are currently higher than they were a few years ago but still within a reasonable range. However, the direction of future rate movements remains uncertain and depends on various economic factors.

Wells Fargo is a major lender, and understanding their mortgage rates is important for anyone considering them. See the latest Wells Fargo mortgage rates for 2024, Wells Fargo Mortgage Rates 2024 , to make informed comparisons.

Some experts predict that rates could remain relatively stable in the coming months, while others anticipate potential increases due to ongoing inflation and the Federal Reserve’s tightening policies.

Veterans United is a lender that specializes in mortgages for veterans. If you’re a veteran and considering a mortgage in 2024, My Veterans United 2024 , you can explore their loan options and rates.

Factors Affecting Mortgage Rates in 2024

Several economic factors play a significant role in shaping mortgage rates in 2024. Understanding these factors can help individuals and investors make informed decisions about their housing plans.

HELOCs can be a flexible way to access funds using your home equity. Check out current HELOC rates in 2024, Helocs 2024 , to see if a HELOC is a good fit for your needs.

Inflation’s Impact on Borrowing Costs

Rising inflation erodes the purchasing power of money, prompting the Federal Reserve to raise interest rates to control inflation. Higher interest rates, in turn, lead to increased borrowing costs, including mortgage rates. As inflation continues to be a concern, it’s likely to exert pressure on mortgage rates in the near future.

Planning to invest in a property? Understanding current rates is crucial. You can explore investment property loan rates for 2024, Investment Property Loans 2024 , to make informed decisions about your next real estate venture.

Federal Reserve’s Monetary Policy

The Federal Reserve’s monetary policy decisions are a major driver of mortgage rates. When the Fed raises interest rates to curb inflation or stimulate economic growth, mortgage rates typically follow suit. Conversely, rate cuts by the Fed can lead to lower mortgage rates.

Ally is a well-known financial institution that also offers mortgage services. If you’re considering Ally for your mortgage, check out their current rates for 2024, Ally Mortgage Rates 2024.

The Fed’s stance on monetary policy will play a crucial role in determining the trajectory of mortgage rates throughout 2024.

A 30-year VA mortgage can be a great option for eligible veterans. See current 30-year VA mortgage rates for 2024, 30 Year Va Mortgage Rates 2024 , and compare them to other loan options.

Other Economic Factors, National Mortgage Rates 2024

In addition to inflation and the Federal Reserve’s policies, other economic factors can influence mortgage rates. These include:

- Unemployment Rates:Low unemployment rates indicate a strong economy, which can support higher mortgage rates. Conversely, high unemployment rates might lead to lower rates as lenders become more cautious.

- Housing Supply and Demand:A tight housing market with high demand and low supply can push mortgage rates higher. Conversely, a balanced market with ample supply might lead to lower rates.

- Investor Confidence:Investor confidence in the economy and the housing market can influence mortgage rates. High confidence can lead to increased demand for mortgages, potentially pushing rates higher.

Impact of Mortgage Rates on Homebuyers and Sellers

Mortgage rates play a crucial role in the housing market, affecting both buyers and sellers. Understanding their impact is essential for making informed decisions.

Finding the best 30-year mortgage rates can save you money over the long term. Check out current rates for the best 30-year mortgages in 2024, Best 30 Year Mortgage Rates 2024 , to compare and find the best deal.

Affordability Challenges for Homebuyers

Rising mortgage rates can make homeownership less affordable for buyers. Higher rates increase monthly mortgage payments, potentially reducing the amount of home a buyer can afford. This can lead to increased competition for more affordable properties and potentially slow down the pace of home sales.

Strategies for Home Sellers

High mortgage rates can influence home seller strategies. Sellers might consider:

- Adjusting Pricing:In a market with higher mortgage rates, sellers might need to adjust their asking prices to account for reduced affordability for buyers.

- Enhancing Marketing:Sellers might need to invest in more effective marketing strategies to attract buyers in a challenging market.

- Offering Incentives:Sellers might consider offering incentives, such as seller concessions or closing cost assistance, to make their properties more appealing to buyers.

Implications for the Overall Housing Market

Changes in mortgage rates can have a significant impact on the overall housing market. Higher rates can lead to:

- Reduced Transaction Volume:Fewer buyers might be able to qualify for mortgages, potentially slowing down the pace of home sales.

- Stabilized or Declining Home Prices:Higher rates can put downward pressure on home prices as buyers become more price-sensitive.

While mortgage rates can be unpredictable, there are strategies that homebuyers, sellers, and homeowners can use to navigate the current market.

A mortgage loan originator can guide you through the mortgage process. If you’re looking for a mortgage loan originator in 2024, Mortgage Loan Originator 2024 , you can find information and resources to help you find the right professional.

Strategies for Homebuyers

To secure a favorable mortgage rate, homebuyers can consider:

- Improving Credit Score:A higher credit score can qualify you for lower interest rates.

- Saving for a Larger Down Payment:A larger down payment can reduce the loan amount and potentially lead to a lower interest rate.

- Exploring Different Loan Types:Consider various loan options, such as fixed-rate or adjustable-rate mortgages, to find the best fit for your needs and financial situation.

- Shopping Around for Rates:Compare rates from multiple lenders to secure the most competitive offer.

Strategies for Homeowners Considering Refinancing

Homeowners considering refinancing their mortgages should evaluate the following factors:

- Current Interest Rate:Determine if refinancing would result in a significantly lower interest rate.

- Loan Term:Consider the impact of a shorter or longer loan term on your monthly payments and overall interest costs.

- Refinancing Costs:Factor in closing costs and other expenses associated with refinancing.

Strategies for Home Sellers

To adjust to changing mortgage rates, home sellers can consider:

- Pricing Strategically:Set a realistic asking price that accounts for reduced affordability due to higher mortgage rates.

- Highlighting Value:Emphasize the features and benefits of your property to attract buyers in a competitive market.

- Offering Incentives:Consider offering seller concessions or closing cost assistance to make your property more attractive.

Outlook for Mortgage Rates in 2024: National Mortgage Rates 2024

Predicting future mortgage rate movements is challenging, but experts offer insights based on current economic conditions and market trends.

FHA loans offer flexible options for borrowers. Check out current FHA interest rates for 2024, Fha Interest Rates 2024 , and explore if an FHA loan is the right fit for your situation.

Expert Predictions and Forecasts

Some experts predict that mortgage rates could remain relatively stable in the coming months, while others anticipate potential increases due to ongoing inflation and the Federal Reserve’s tightening policies. The direction of future rate movements will depend on various economic factors, including inflation, unemployment, and investor sentiment.

Commercial interest rates can impact the cost of borrowing for businesses. Keep an eye on current commercial interest rates in 2024, Commercial Interest Rates 2024 , to make informed decisions about your business financing.

Factors Influencing Future Rate Trends

Key factors that could influence future mortgage rate trends include:

- Inflation:If inflation continues to be a concern, the Federal Reserve is likely to maintain or even increase interest rates, which could lead to higher mortgage rates.

- Economic Growth:Strong economic growth could support higher interest rates, while a slowdown in growth might lead to lower rates.

- Market Sentiment:Investor confidence in the economy and the housing market can also play a role in shaping mortgage rates.

Potential Scenarios for Mortgage Rates

Possible scenarios for mortgage rates in 2024 include:

- Optimistic Scenario:Inflation starts to moderate, and the Federal Reserve eases its monetary policy, leading to lower mortgage rates.

- Pessimistic Scenario:Inflation remains stubbornly high, prompting the Federal Reserve to continue raising interest rates, resulting in higher mortgage rates.

Final Wrap-Up

As we conclude our exploration of National Mortgage Rates in 2024, it’s clear that the landscape is dynamic and subject to continuous change. Navigating this environment requires a keen understanding of current trends, the factors influencing them, and the potential implications for your individual circumstances.

Home equity can be a valuable resource. Explore current point home equity rates in 2024, Point Home Equity 2024 , to understand your options for tapping into your home’s value.

Whether you’re a prospective homebuyer, a homeowner considering refinancing, or a seller looking to optimize your strategy, staying informed is paramount. By leveraging the insights and strategies discussed in this guide, you can make informed decisions and navigate the complexities of mortgage rates in 2024 with confidence.

Query Resolution

What are the main factors influencing mortgage rates in 2024?

Looking to buy a home with PenFed? Check out their current mortgage rates for 2024, Penfed Mortgage Rates 2024. You can find information on their fixed and adjustable-rate mortgages, as well as their various loan programs.

Mortgage rates are primarily influenced by inflation, the Federal Reserve’s monetary policy, unemployment rates, housing supply and demand, and investor confidence.

How do rising mortgage rates affect home affordability?

Higher mortgage rates increase the cost of borrowing, making it more expensive to buy a home. This can reduce affordability for buyers, potentially limiting their purchasing power and requiring larger down payments.

A fixed interest rate home loan can offer stability and predictability, especially in a fluctuating market. If you’re interested in securing a fixed rate for your home loan in 2024, check out the current rates, Fixed Interest Rate Home Loan 2024.

What strategies can homebuyers use to secure a favorable mortgage rate?

Homebuyers can improve their chances of getting a good rate by maintaining a strong credit score, saving for a substantial down payment, and comparing rates from multiple lenders.

Is it a good time to refinance my mortgage in 2024?

Whether refinancing is beneficial depends on your current interest rate, the potential savings, and the costs associated with refinancing. It’s advisable to consult with a mortgage professional to determine if refinancing is right for your situation.