Faye Travel Insurance October 2024 Claim Process provides a comprehensive guide for navigating the intricacies of filing a claim with Faye Travel Insurance. Whether you’re facing a medical emergency, lost luggage, or flight cancellation, understanding the process is crucial for a smooth and successful resolution.

While annuities can be a valuable tool, it’s important to be aware of their potential Immediate Annuity Disadvantages. Factors like limited flexibility and potential for lower returns compared to other investments should be considered.

This guide will delve into the steps involved in initiating a claim, the review process, claim resolution, and essential tips to ensure a positive outcome.

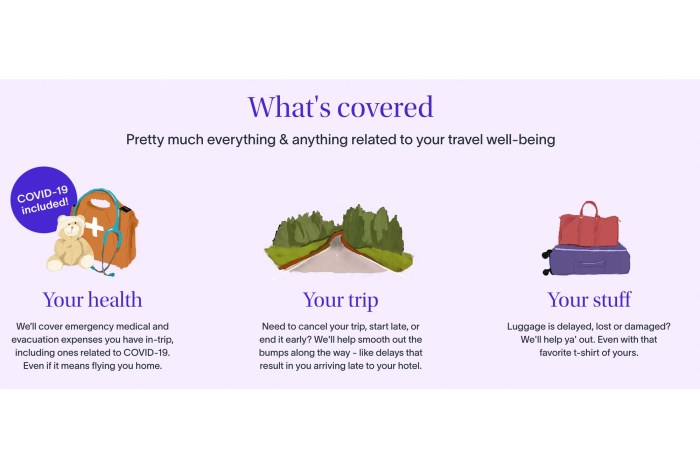

Faye Travel Insurance offers a range of plans designed to cater to diverse travel needs. Each plan includes specific coverage details, outlining the types of events and expenses covered. Understanding your policy’s coverage is essential before embarking on your journey.

HDFC offers a range of financial products, including Immediate Annuity Hdfc. Their offerings cater to different needs and financial goals, making it worth exploring their options for your retirement planning.

Contents List

Faye Travel Insurance Overview

Faye Travel Insurance is a reputable provider of comprehensive travel insurance plans designed to protect travelers against unforeseen circumstances during their trips. Faye offers a range of plans tailored to different needs and budgets, providing coverage for various travel-related risks, including medical emergencies, trip cancellations, lost luggage, and more.

Planning a trip abroad? Don’t forget about travel insurance! Aditya Birla Travel Insurance October 2024 for Seniors offers specialized coverage for older travelers, ensuring peace of mind during your adventures.

Types of Travel Insurance Plans

Faye offers a variety of travel insurance plans to cater to different traveler profiles and trip types. These plans typically fall into three main categories:

- Basic Plans:These plans provide essential coverage for medical emergencies, trip cancellations, and lost luggage, offering a foundation of protection for most travelers.

- Comprehensive Plans:These plans offer more extensive coverage, including additional benefits like travel delays, baggage delays, and emergency medical evacuation. They are suitable for travelers seeking greater peace of mind and protection against a wider range of travel risks.

- Luxury Plans:These plans are designed for travelers seeking the highest level of coverage and service. They typically include premium features such as concierge services, 24/7 emergency assistance, and higher coverage limits for various benefits.

Each plan has its own specific coverage details and limitations, which are clearly Artikeld in the policy documents. It’s crucial to carefully review the plan details before purchasing to ensure it meets your individual needs and travel requirements.

If you’re considering a lump sum payment for your retirement, a 500k Immediate Annuity might be an option to explore. It’s a financial product that provides regular income payments for life, offering a secure stream of income in your golden years.

Contact Information

For any inquiries or assistance regarding Faye Travel Insurance plans, you can contact their customer support team through the following channels:

- Phone:[Insert Faye’s customer support phone number here]

- Email:[Insert Faye’s customer support email address here]

- Website:[Insert Faye’s website address here]

Claim Process Initiation

Filing a travel insurance claim with Faye is a straightforward process. The initial steps involve gathering the necessary documentation and submitting your claim through one of the available methods.

Understanding the terminology used in annuities can be helpful. An Annuity 7 Letters 2024 might refer to a specific type of annuity or a particular feature within the product. It’s essential to clarify any terms before making any financial decisions.

Submitting a Claim

Faye offers various methods for submitting travel insurance claims, allowing claimants to choose the most convenient option:

- Online:Faye typically provides an online portal where claimants can submit their claims electronically. This method is often the fastest and most convenient option.

- Phone:Claimants can also initiate a claim by calling Faye’s customer support hotline. This method is suitable for individuals who prefer to speak with a representative directly.

- Email:In some cases, Faye may accept claim submissions via email. However, it’s recommended to check their website or contact customer support to confirm if this method is available.

Required Documentation

To initiate a travel insurance claim with Faye, you will typically need to provide the following documentation:

- Policy Details:This includes your policy number, effective dates, and coverage details.

- Proof of Loss:This may include medical reports, police reports, airline confirmation, or other relevant documentation depending on the nature of your claim.

- Receipts:Provide receipts for any expenses incurred related to the claim, such as medical bills, lost luggage costs, or flight cancellation fees.

It’s crucial to keep all relevant documentation organized and readily available for a smooth claim process. You can also consult Faye’s website or contact their customer support for specific documentation requirements based on your claim type.

Understanding how Calculating Annuity Interest 2024 works is crucial for maximizing your returns. Factors like the interest rate and the type of annuity can significantly influence your income stream.

Claim Processing and Review

Once you have submitted your travel insurance claim to Faye, their team will review your documentation and assess the validity of your claim. This process involves verifying the information provided, evaluating the claim against the policy terms, and determining the eligibility and potential payout amount.

With the ongoing pandemic, it’s important to have Travel insurance with COVID-19 quarantine coverage. This type of insurance can provide financial support in case you need to quarantine or face unexpected medical expenses related to COVID-19.

Claim Review Process

Faye’s claim review process typically involves the following steps:

- Initial Assessment:Faye’s claim team will review your claim documents and assess the initial eligibility based on the policy terms.

- Documentation Verification:They may request additional documentation or clarification if needed to support your claim.

- Claim Investigation:Depending on the nature of the claim, Faye may conduct an investigation to gather further information and verify the circumstances surrounding the incident.

Claim Processing Timeframe

The timeframe for processing a travel insurance claim with Faye can vary depending on the complexity of the claim and the availability of supporting documentation. However, Faye aims to provide a timely decision within a reasonable timeframe, typically within [Insert estimated timeframe for claim processing].

To get a clear picture of potential annuity payouts, using an Annuity Calculator Sbi 2024 is a helpful tool. It allows you to input your details and receive personalized estimates, providing valuable insights into your financial future.

Claim Eligibility and Payout, Faye Travel Insurance October 2024 Claim Process

Faye will determine your claim eligibility based on the specific terms and conditions of your travel insurance policy. This includes factors such as the type of coverage, the nature of the incident, and whether the claim falls within the policy’s scope.

The potential payout amount will depend on the approved coverage, the incurred expenses, and the policy’s limits.

For a deeper understanding of how variable annuities work, check out Variable Annuity Youtube 2024. These videos offer informative explanations and insights into the intricacies of this investment strategy.

Claim Resolution and Payment

After reviewing and processing your claim, Faye will notify you of their decision regarding your claim. This notification will detail the outcome, including whether your claim is approved, denied, or partially approved. If your claim is approved, you will receive information about the payment process and the methods available for receiving your payout.

If you’re in India and exploring annuity options, you might want to research Immediate Annuity Plan India 2020. This type of plan can provide a stable income stream throughout your retirement years.

Claim Decision Notification

Faye will typically communicate their claim decision to you via [Insert communication methods used by Faye for claim decisions]. This notification will provide a detailed explanation of the decision, including the reasons for approval, denial, or partial approval. It will also Artikel any further steps required from your end, such as providing additional documentation or appealing the decision.

In case of unexpected travel disruptions, having Chase Trip Delay Insurance Refund Policy in October 2024 can provide financial protection. It can help cover expenses related to delays, cancellations, or other travel mishaps.

Payment Methods

For approved claims, Faye offers various payment methods to ensure convenience for claimants. Common payment options include:

- Direct Deposit:This allows for a quick and secure transfer of funds directly to your bank account.

- Check:Faye may also issue a check to claimants who prefer this payment method.

The specific payment methods available may vary depending on your location and the claim amount. You can check Faye’s website or contact their customer support for details about available payment options.

For those who prefer using spreadsheets, you can learn how to Calculate Annuity Rate In Excel 2024. This can be a useful tool for understanding the potential returns and making informed financial decisions.

Claim Appeals

If your claim is denied or partially approved, you have the right to appeal the decision. Faye provides a process for appealing claims, allowing you to challenge the decision and provide additional information or evidence to support your claim. The appeal process is typically Artikeld in the policy documents or can be obtained from Faye’s customer support.

Traveling to a specific country? Make sure you have adequate Travel medical insurance for specific countries in October 2024. This type of insurance provides coverage for medical emergencies and other unforeseen situations while you’re abroad.

Claim Tips and Best Practices

To maximize your chances of a successful claim and streamline the claim process, it’s crucial to follow best practices and keep thorough documentation of your travel expenses and medical treatments.

Variable annuities can be categorized based on their expense ratios. A Class C Variable Annuity 2024 might have a higher expense ratio compared to other classes, so it’s essential to compare different options before investing.

Documentation Best Practices

- Keep all Receipts:Preserve all receipts for travel expenses, medical bills, and other relevant costs related to your claim.

- Document Medical Treatments:Maintain detailed records of any medical treatments received, including dates, times, diagnoses, and prescriptions.

- Take Photos:Capture photos of damaged luggage, lost items, or any other relevant evidence related to your claim.

- Maintain Trip Itinerary:Keep a detailed itinerary of your trip, including flight details, hotel bookings, and planned activities.

- Report Incidents Promptly:Report any incidents, such as medical emergencies or lost luggage, to the appropriate authorities and your travel insurance provider as soon as possible.

By diligently documenting your travel expenses and medical treatments, you can provide strong evidence to support your claim and increase your chances of a favorable outcome.

Real-World Claim Scenarios

| Scenario | Claim Type | Required Documentation | Expected Outcome |

|---|---|---|---|

| You experience a medical emergency while traveling abroad and require hospitalization. | Medical Emergency | Medical reports, hospital bills, receipts for medications, travel itinerary | Coverage for medical expenses, emergency evacuation, and related costs, subject to policy limits and terms. |

| Your luggage is lost during transit, and you need to purchase essential clothing and toiletries. | Lost Luggage | Airline baggage claim report, receipts for replacement items, travel itinerary | Coverage for reasonable expenses for replacing lost luggage contents, subject to policy limits and terms. |

| Your flight is canceled due to unforeseen circumstances, and you need to book a new flight. | Trip Cancellation | Airline confirmation, receipts for new flight bookings, travel itinerary | Coverage for non-refundable travel expenses, subject to policy terms and specific cancellation reasons. |

| You experience a travel delay due to bad weather, and you need to stay in a hotel overnight. | Travel Delay | Airline confirmation, receipts for hotel accommodations, travel itinerary | Coverage for reasonable expenses for hotel accommodations and meals during a travel delay, subject to policy limits and terms. |

Last Point: Faye Travel Insurance October 2024 Claim Process

Navigating a travel insurance claim can be daunting, but Faye Travel Insurance provides a clear and structured process. By familiarizing yourself with the steps involved, required documentation, and potential outcomes, you can confidently pursue your claim. Remember to keep all relevant documents organized and readily available, as this will expedite the process and increase your chances of a successful claim.

Faye Travel Insurance is committed to supporting travelers throughout their journey, including the unexpected events that may arise.

FAQ Insights

What if my claim is denied?

Understanding the Immediate Annuity Yields is crucial before making any decisions. Factors like your age, health, and the current interest rates influence the returns you can expect. Consulting with a financial advisor can help you navigate this complex landscape.

If your claim is denied, you have the right to appeal the decision. Faye Travel Insurance Artikels the appeal process, which typically involves providing additional documentation or presenting a compelling argument for reconsideration.

How long does it take to receive a claim decision?

The timeframe for claim processing varies depending on the complexity of the claim and the availability of required documentation. However, Faye Travel Insurance aims to provide a decision within a reasonable timeframe.

Can I file a claim online?

Yes, Faye Travel Insurance offers an online platform for submitting claims. This option allows you to conveniently file your claim at any time, providing necessary details and uploading supporting documents.