Faye Travel Insurance October 2024 for Flight Delays offers comprehensive protection for travelers facing unexpected flight disruptions. This guide delves into the specifics of their flight delay coverage, exploring the conditions, limits, and claim process. We’ll examine common flight delay scenarios and how Faye Travel Insurance responds, ensuring you understand the benefits and potential limitations of this coverage.

For those traveling internationally, especially in October 2024, consider travel insurance for medical emergencies. This can provide peace of mind and financial protection.

With insights into Faye Travel Insurance’s reputation, customer reviews, and relevant awards, this analysis provides a clear picture of their offerings. By understanding the intricacies of their flight delay coverage, travelers can make informed decisions about their travel insurance needs, maximizing their peace of mind during potentially stressful situations.

Planning a cruise? Don’t forget about insurance! Check out our guide on cruise insurance in October 2024 to learn about the different types of coverage available.

Contents List

Faye Travel Insurance: Comprehensive Flight Delay Coverage in October 2024

Planning a trip in October 2024? Flight delays can be a major inconvenience, potentially disrupting your travel plans and costing you extra money. Faye Travel Insurance offers comprehensive flight delay coverage to help you navigate these unexpected situations. This article delves into the specifics of Faye Travel Insurance’s flight delay coverage, providing valuable insights into its benefits, claim process, and alternative solutions.

It’s possible to purchase an immediate annuity before age 59 1/2 , but there may be tax implications.

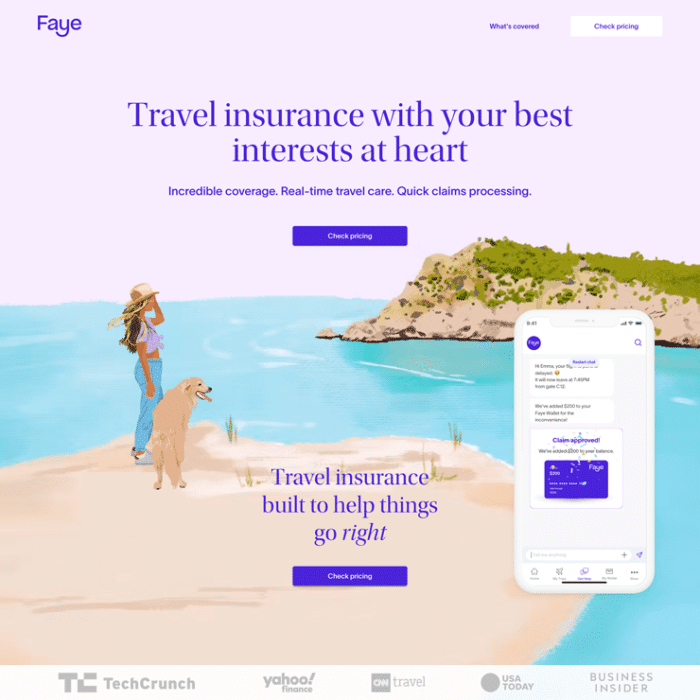

Faye Travel Insurance Overview

Faye Travel Insurance is a reputable provider of travel insurance policies designed to protect travelers from various unforeseen events, including flight delays. The company prides itself on offering comprehensive coverage, competitive rates, and excellent customer service. Faye Travel Insurance has earned a positive reputation in the industry, consistently receiving high customer satisfaction ratings and accolades for its commitment to traveler well-being.

If you’re studying for the Jaiib exam, understanding annuity formulas is crucial. Check out our guide on the Annuity Formula Jaiib 2024 to learn more.

Faye Travel Insurance’s key features and benefits include:

- Comprehensive Coverage:Faye Travel Insurance offers a wide range of coverage options, including flight delay, cancellation, medical emergencies, lost luggage, and more.

- Flight Delay Coverage:Faye Travel Insurance provides financial compensation for flight delays exceeding a specified duration. This coverage helps offset expenses incurred due to delays, such as meals, accommodation, and additional travel arrangements.

- 24/7 Customer Support:Faye Travel Insurance offers round-the-clock customer support, ensuring assistance is available whenever you need it. Their dedicated team can assist with claim filing, travel arrangements, and any other concerns you may have.

- Flexible Policy Options:Faye Travel Insurance provides various policy options to suit different travel needs and budgets. You can customize your coverage based on your specific requirements, ensuring you have the right protection for your trip.

Flight Delay Coverage in October 2024, Faye Travel Insurance October 2024 for Flight Delays

In October 2024, Faye Travel Insurance offers comprehensive flight delay coverage, providing financial compensation for delays exceeding a certain threshold. The coverage limits, conditions, and exclusions may vary depending on the specific policy you choose.

If you’re considering an immediate annuity, it’s important to understand the requirements. To buy an immediate annuity, like Josef , you’ll need to use a lump sum of money.

Here’s a breakdown of Faye Travel Insurance’s flight delay coverage in October 2024:

- Coverage Limits:The maximum amount payable for flight delays is typically capped at a specific amount, depending on the policy chosen. For example, some policies may offer up to $500 per day for flight delays exceeding four hours.

- Conditions for Claiming:To be eligible for flight delay compensation, the delay must be caused by factors beyond the traveler’s control, such as weather, mechanical issues, or air traffic control delays. The delay must also exceed the specified duration Artikeld in the policy.

When it comes to variable annuities, T Rowe Price is a well-known provider. Understanding the terminology associated with these annuities, as outlined in our guide on variable annuity terminology , is essential for making informed decisions.

- Claim Process:Filing a claim for flight delay compensation typically involves providing documentation, such as flight tickets, boarding passes, and delay confirmation. The claim process is straightforward and guided by Faye Travel Insurance’s customer support team.

- Exclusions and Limitations:There may be certain exclusions or limitations associated with flight delay coverage. For instance, some policies may exclude delays caused by strikes, political unrest, or natural disasters.

Common Flight Delay Scenarios

Flight delays can occur due to various reasons, each potentially impacting your travel plans. Faye Travel Insurance’s coverage applies differently depending on the cause of the delay. The table below illustrates common flight delay scenarios and how Faye Travel Insurance’s coverage applies.

Speaking of inflation, it’s important to consider its impact when planning for retirement. A calculator that accounts for inflation can help you ensure your income keeps pace with rising costs.

| Scenario | Cause | Coverage Applicability | Claim Process |

|---|---|---|---|

| Delayed Departure | Severe Weather | Covered, if delay exceeds policy threshold | File a claim with documentation, including flight tickets, boarding passes, and weather reports. |

| Delayed Arrival | Mechanical Issues | Covered, if delay exceeds policy threshold | File a claim with documentation, including flight tickets, boarding passes, and delay confirmation from the airline. |

| Delayed Connecting Flight | Air Traffic Control Delays | Covered, if delay exceeds policy threshold | File a claim with documentation, including flight tickets, boarding passes, and delay confirmation from the airline. |

Claim Process and Documentation

Filing a claim for flight delay compensation with Faye Travel Insurance is a straightforward process. Here are the steps involved:

- Contact Faye Travel Insurance:Reach out to Faye Travel Insurance’s customer support team to initiate the claim process. They will guide you through the necessary steps.

- Gather Documentation:Collect all relevant documentation to support your claim, including:

- Flight tickets

- Boarding passes

- Delay confirmation from the airline

- Receipts for expenses incurred due to the delay (e.g., meals, accommodation)

- Submit Your Claim:Submit your claim form along with the required documentation to Faye Travel Insurance. You can typically do this online, by phone, or by mail.

- Claim Processing:Faye Travel Insurance will review your claim and process it within a reasonable timeframe. The processing time may vary depending on the complexity of the claim and the availability of supporting documentation.

- Payment:If your claim is approved, Faye Travel Insurance will issue payment for the covered expenses, typically within a few weeks.

Alternative Flight Delay Solutions

While Faye Travel Insurance provides comprehensive flight delay coverage, other solutions exist for travelers facing flight delays. These alternatives may offer varying levels of compensation and benefits. The table below compares and contrasts these options with Faye Travel Insurance’s coverage.

When it comes to immediate annuities, you might be wondering about Medicaid compliance. Our article on Medicaid-compliant immediate annuities explores this topic in detail.

| Solution | Provider | Benefits | Drawbacks |

|---|---|---|---|

| Airline Compensation Policies | Airlines | May offer compensation for delays exceeding a certain duration, depending on the airline’s policy. | Compensation amounts and eligibility criteria vary significantly between airlines. The process for claiming compensation can be complex and time-consuming. |

| Travel Insurance from Other Providers | Other Travel Insurance Companies | Offers varying levels of flight delay coverage, with different conditions and exclusions. | Coverage limits and claim processes may differ from Faye Travel Insurance. It’s essential to compare policies and choose one that meets your specific needs. |

| Legal Options | Lawyers Specializing in Travel Law | May pursue legal action against airlines for flight delays, potentially securing higher compensation. | Can be expensive and time-consuming. Requires extensive documentation and legal expertise. |

Travel Insurance Tips for October 2024

To minimize the risk of flight delays and ensure a smooth travel experience, consider these tips for your October 2024 trip:

- Book Flights in Advance:Booking flights well in advance can increase your chances of securing a flight with fewer potential delays.

- Choose Reputable Airlines:Research airlines known for their reliability and on-time performance. Check online reviews and ratings to gauge an airline’s track record.

- Consider Travel Insurance:Purchase travel insurance with comprehensive flight delay coverage to protect yourself financially in case of unexpected delays. Faye Travel Insurance offers a range of policies to meet your needs.

- Pack a Carry-on Bag:Pack essential items in a carry-on bag to minimize the impact of lost or delayed luggage. This ensures you have access to your necessities during your trip.

- Download Airline Apps:Download your airline’s app to receive real-time flight updates, notifications, and potentially track your luggage.

- Prepare for Delays:Pack snacks, entertainment, and essential medications in your carry-on bag to stay comfortable during potential delays.

- Understand Travel Insurance Policies:Carefully review your travel insurance policy before your trip to understand the coverage limits, conditions, and exclusions.

Summary

In conclusion, Faye Travel Insurance October 2024 for Flight Delays presents a valuable option for travelers seeking protection against unexpected flight delays. By carefully considering the coverage limits, claim process, and alternative solutions, you can determine if Faye Travel Insurance aligns with your specific travel needs and risk tolerance.

The sales of variable annuities have fluctuated over the years, reflecting changing market conditions and investor preferences.

Remember, thorough research and understanding of your travel insurance policy are crucial for a smooth and stress-free journey.

Top FAQs: Faye Travel Insurance October 2024 For Flight Delays

What are the common causes of flight delays covered by Faye Travel Insurance?

If you’re looking to plan for your financial future, understanding annuities can be a valuable step. An annuity calculator, like the one provided by Edward Jones , can help you estimate your potential income stream.

Faye Travel Insurance covers a range of common causes, including weather conditions, mechanical issues, air traffic control delays, and airport congestion.

Can I claim for flight delays caused by my own actions?

Other online platforms, such as Groww , also offer annuity calculators. These tools can help you understand how different variables, like inflation, might affect your annuity payments.

No, Faye Travel Insurance does not cover delays caused by the insured’s own actions, such as missing a connecting flight due to late arrival at the airport.

What documentation is required to file a claim for flight delay compensation?

You’ll need to provide your flight tickets, boarding passes, and confirmation of the delay from the airline.

Figuring out how much annuity you can get with a specific amount, like $100,000, can be tricky. Our article on how much annuity for $100,000 in 2024 can help you estimate your potential income.

Variable annuities offer the potential for growth, but what happens after you annuitize? Our guide on variable annuities after annuitization provides valuable insights.

Finally, the number “712” might seem random, but it could relate to an annuity. If you’re curious about annuity 712 in 2024 , we have information on that as well.