Standard Deduction 2024 is a key aspect of federal income tax that allows taxpayers to reduce their taxable income. It offers a straightforward way to lower your tax bill, but understanding how it works is crucial. This guide will delve into the details of the standard deduction, explaining its purpose, amounts, eligibility, and how it interacts with other tax provisions.

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) before calculating your tax liability. It’s designed to simplify the tax filing process for many taxpayers, eliminating the need to itemize deductions for expenses like mortgage interest, state and local taxes, or charitable contributions.

Contents List

- 1 What is the Standard Deduction?

- 2 Standard Deduction Amounts for 2024

- 3 Who Benefits from the Standard Deduction?

- 4 Factors Affecting the Standard Deduction: Standard Deduction 2024

- 5 Standard Deduction vs. Itemized Deductions

- 6 Claiming the Standard Deduction

- 7 Standard Deduction and Other Tax Provisions

- 8 Standard Deduction and Tax Reform

- 9 Standard Deduction and Retirement Planning

- 10 Standard Deduction and Charitable Giving

- 11 Last Word

- 12 Answers to Common Questions

What is the Standard Deduction?

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability. It’s a valuable tax benefit that helps reduce your taxable income and the amount of taxes you owe.

In simpler terms, it’s a way for the government to recognize that everyone has certain basic expenses, like housing, food, and clothing, and it helps to offset the cost of these expenses by reducing your tax bill.

Explanation of the Standard Deduction

The standard deduction is a fixed amount that is adjusted annually for inflation. The amount you can claim depends on your filing status, which reflects your marital status and whether you are a dependent or head of household. For instance, if you are single, you can claim a higher standard deduction than if you are married filing jointly.

Want to take your YouTube audio to the next level? Acoustic foam can significantly improve your sound quality. Discover the benefits of using acoustic foam and find the best options for your setup in this article on Acoustic Foam Youtube 2024: Elevate Your Audio.

The standard deduction is a direct reduction from your adjusted gross income (AGI) to determine your taxable income.

Taxable Income = Adjusted Gross Income (AGI)

Standard Deduction

History of the Standard Deduction

The standard deduction has been a part of the U.S. tax code since the 1940s, evolving significantly over time. It was initially introduced as a simplified alternative to itemizing deductions, which involves claiming specific expenses on your tax return. The standard deduction was designed to make tax filing easier for taxpayers with relatively simple financial situations.

Over the years, the standard deduction has been increased and adjusted to reflect changes in inflation and the cost of living. The goal of these adjustments has been to ensure that the standard deduction remains relevant and beneficial for taxpayers.

Standard Deduction Amounts for 2024

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) when calculating your federal income tax liability. It’s a valuable benefit that reduces your taxable income and potentially lowers your tax bill. This guide provides a comprehensive overview of the standard deduction amounts for 2024, along with details on how they can vary based on your age, filing status, and other factors.

Standard Deduction Amounts for 2024

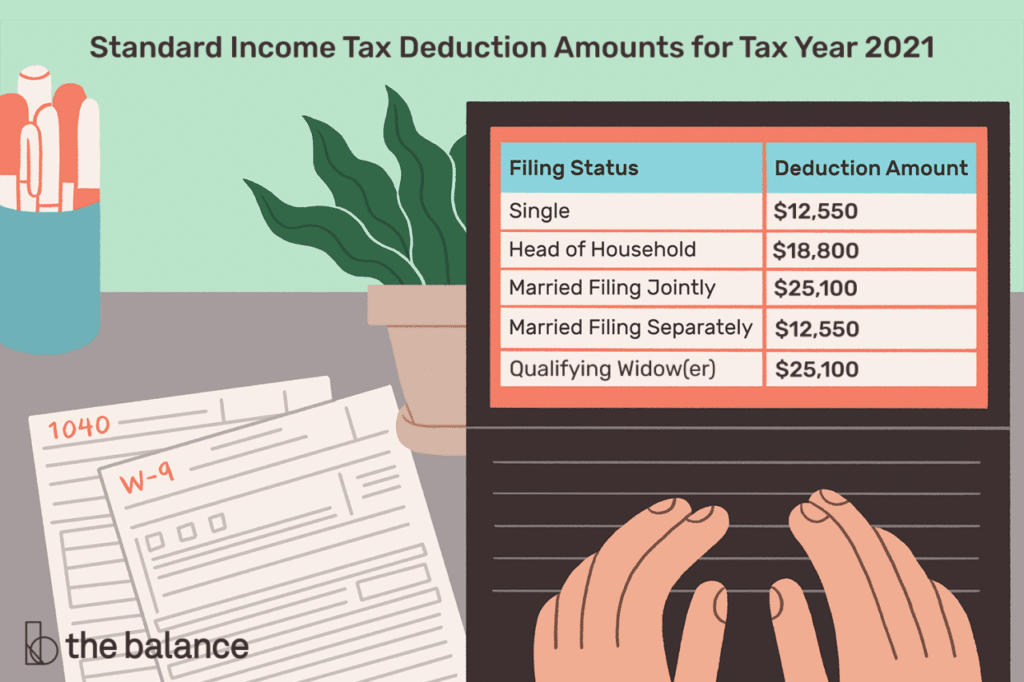

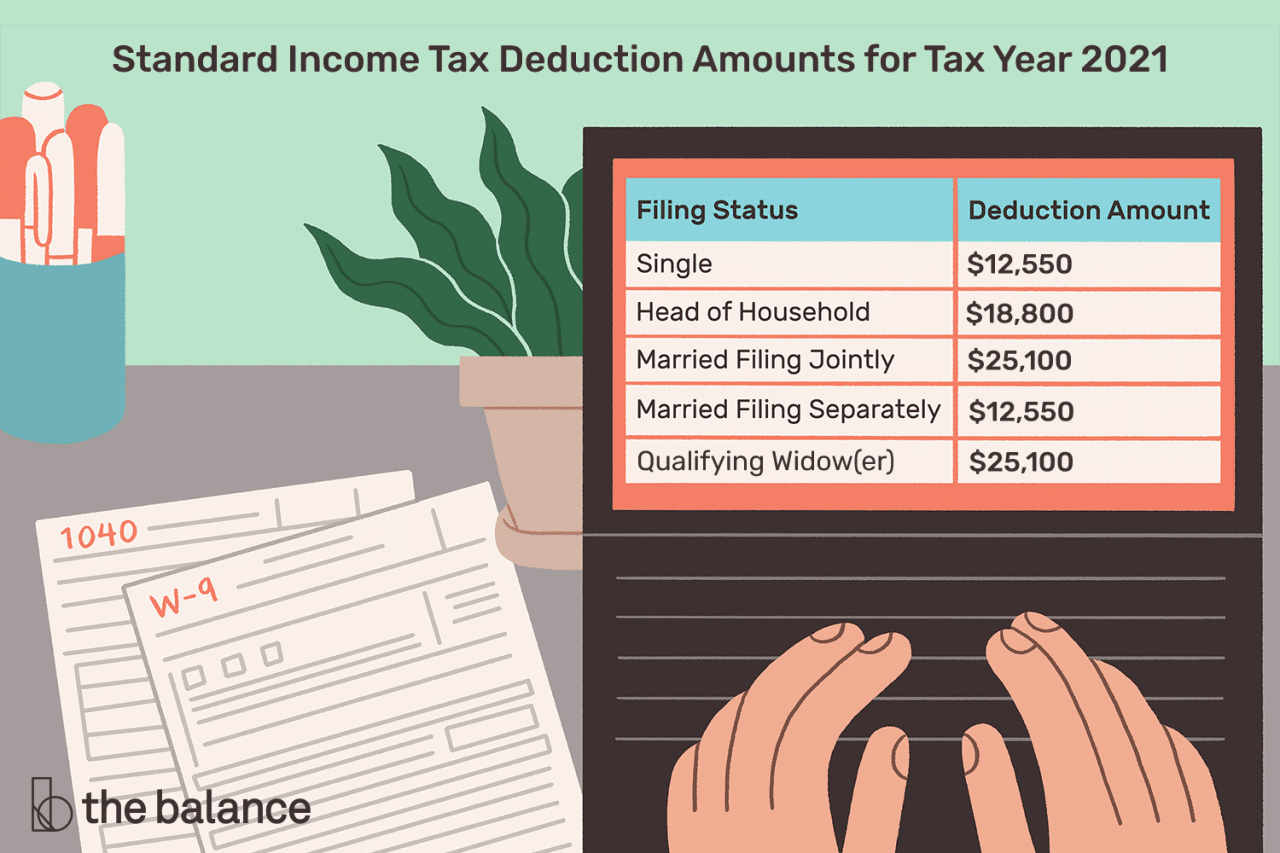

The following table Artikels the standard deduction amounts for each filing status in 2024:

| Filing Status | Standard Deduction Amount | Notes |

|---|---|---|

| Single | $13,850 | |

| Married Filing Jointly | $27,700 | |

| Married Filing Separately | $13,850 | |

| Head of Household | $20,800 | |

| Qualifying Widow(er) | $27,700 | This filing status is available for two years following the death of a spouse. |

Age-Related Adjustments

Taxpayers who are 65 years or older, or blind, are eligible for an increased standard deduction. These additional amounts are added to the standard deduction amounts listed in the table above.* Additional Standard Deduction for Age:

Single

$1,800

If you’re a California resident, you might be eligible for a stimulus check in October 2024. To learn more about the amount and payment schedule, check out this article on California Stimulus Check October 2024: Amount and Payment Schedule.

Married Filing Jointly

$1,800 (each spouse)

Married Filing Separately

$1,800

Head of Household

$1,800

Qualifying Widow(er)

$1,800

Additional Standard Deduction for Blindness

Single

$1,800

Married Filing Jointly

$1,800 (each spouse)

Married Filing Separately

$1,800

Head of Household

$1,800

Qualifying Widow(er)

$1,800For example, a single taxpayer who is 65 years old and blind would be eligible for a total standard deduction of $17,450 ($13,850 + $1,800 + $1,800).

Other Factors Affecting the Standard Deduction

The standard deduction amount can also be affected by other factors, such as:* Dependence Status:The standard deduction for dependents is generally limited to the greater of $1,200 or their earned income. For example, a 17-year-old dependent who earns $1,500 in wages would have a standard deduction of $1,500.

Filing Status Changes

Looking to secure your retirement? Annuity King Sarasota can help you navigate the complex world of annuities. Learn about their services and how they can help you achieve your financial goals with this guide on Annuity King Sarasota 2024: Your Guide to Secure Retirement.

If your filing status changes during the year, you’ll need to calculate the standard deduction based on your filing status for each portion of the year. For example, if you were single for the first six months of the year and married filing jointly for the remaining six months, you would need to calculate the standard deduction for each filing status and prorate it accordingly.

Other Deductions

You can choose to itemize your deductions instead of taking the standard deduction. If you itemize, you can deduct specific expenses, such as medical expenses, state and local taxes, and charitable contributions. If your itemized deductions exceed the standard deduction amount, it’s usually advantageous to itemize.

However, the standard deduction is generally simpler to calculate and can be a good option for many taxpayers.

Who Benefits from the Standard Deduction?

The standard deduction is a valuable tax benefit that simplifies the tax filing process for many taxpayers. This deduction allows individuals to reduce their taxable income without having to itemize their deductions. While it’s a straightforward concept, understanding who benefits most from the standard deduction is crucial for effective tax planning.

Identifying Beneficiaries

The standard deduction is designed to benefit taxpayers with relatively simple tax situations and limited itemized deductions. Here are some demographic groups and income brackets that are most likely to find the standard deduction advantageous:

- Individuals with lower incomes:Those with lower incomes often have fewer itemized deductions, making the standard deduction a more beneficial option.

- Younger taxpayers:Younger individuals are less likely to have significant homeownership expenses or charitable contributions, making the standard deduction a simpler and often more advantageous choice.

- Renters:Renters generally don’t have mortgage interest or property taxes to deduct, making the standard deduction a more attractive option.

- Individuals with limited itemized deductions:Taxpayers with minimal deductions for medical expenses, state and local taxes, or charitable contributions may find that the standard deduction provides a larger tax benefit.

Standard vs. Itemized Deductions

Choosing between the standard deduction and itemizing deductions depends on individual circumstances. While the standard deduction simplifies tax filing, itemizing can be more beneficial if you have significant deductible expenses. Here’s a table comparing the two options:

| Feature | Standard Deduction | Itemized Deductions |

|---|---|---|

| Benefits | Simpler tax filing, fixed amount, no need to itemize | Higher potential tax savings if you have significant deductible expenses |

| Disadvantages | Lower potential tax savings than itemizing | More complex tax filing, requires detailed documentation |

| Eligibility | All taxpayers | Taxpayers who meet specific criteria for deductible expenses |

Tax Planning Examples

Here are some examples of taxpayers who can utilize the standard deduction effectively for tax planning:

- A young professional starting their career:A young professional with a modest income and limited deductions, such as student loan interest, may find that the standard deduction provides a significant tax benefit.

- A retired individual with a fixed income:A retired individual with a fixed income and minimal itemized deductions, such as medical expenses, may benefit from the standard deduction’s simplicity and potential for tax savings.

Factors Affecting the Standard Deduction: Standard Deduction 2024

The standard deduction is a fixed amount that you can subtract from your adjusted gross income (AGI) when calculating your taxable income. This deduction can help reduce your tax liability. The amount of the standard deduction you can claim depends on several factors, including your age, filing status, and dependency status.

Age

Your age can impact your standard deduction if you are 65 or older. You can claim an additional standard deduction amount if you are 65 or older, or if you are blind.

Filing Status

Your filing status plays a significant role in determining your standard deduction amount. The IRS recognizes five filing statuses:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

- Qualifying Widow(er)

Each filing status has a specific standard deduction amount, and these amounts are adjusted annually for inflation.

Dependency Status

Your dependency status also affects your standard deduction. If you are claiming dependents, such as children or other qualifying relatives, you may be eligible for an additional standard deduction amount. The standard deduction amount for dependents is added to your standard deduction amount.

Standard Deduction vs. Itemized Deductions

The standard deduction is a set amount that taxpayers can deduct from their taxable income. Itemized deductions are specific expenses that taxpayers can deduct from their taxable income. Both options can reduce a taxpayer’s tax liability, but the choice between them can significantly impact their tax burden.

Comparing and Contrasting Standard Deduction and Itemized Deductions

The standard deduction and itemized deductions differ in how they are calculated and the types of expenses they cover.

- The standard deduction is a fixed amount that is determined by the taxpayer’s filing status. This amount is adjusted annually for inflation.

- Itemized deductions are specific expenses that taxpayers can deduct if they meet certain criteria. The amount of the deduction is based on the actual expenses incurred.

When Taxpayers Choose to Itemize

Taxpayers may choose to itemize deductions instead of claiming the standard deduction if their itemized deductions exceed the standard deduction amount. This is because itemizing allows taxpayers to deduct more from their taxable income, resulting in a lower tax liability.

Examples of Itemized Deductions

Some common itemized deductions include:

- Medical expenses exceeding a certain percentage of adjusted gross income (AGI).

- State and local taxes (SALT), subject to limitations.

- Home mortgage interest.

- Charitable contributions.

- Property taxes.

Claiming the Standard Deduction

The standard deduction is a set amount that you can subtract from your adjusted gross income (AGI) to reduce your taxable income. It is a simpler alternative to itemizing your deductions. Claiming the standard deduction is straightforward and can be done by following a few simple steps.

Claiming the Standard Deduction on Tax Forms

The standard deduction is claimed on your federal income tax return, specifically on Form 1040. The process of claiming the standard deduction involves identifying the correct amount based on your filing status and age and then entering it on the appropriate line on your tax form.

- Locate the section on the tax form where you choose between itemizing deductions and taking the standard deduction.This section is typically found on the first page of Form 1040.

- Mark the box indicating that you are taking the standard deduction.This will tell the IRS that you are not itemizing your deductions.

- Identify the correct standard deduction amount based on your filing status (single, married filing jointly, etc.) and age.The standard deduction amounts vary based on your filing status and age.

- Transfer the standard deduction amount to the appropriate line on your tax form.The line number for the standard deduction will be listed on the form.

Standard Deduction Amounts for 2024

The standard deduction amounts for 2024 are as follows:

| Filing Status | Standard Deduction |

|---|---|

| Single | $13,850 |

| Married Filing Jointly | $27,700 |

| Qualifying Widow(er) | $27,700 |

| Head of Household | $20,800 |

| Married Filing Separately | $13,850 |

Standard Deduction and Other Tax Provisions

The standard deduction, while a straightforward tax benefit, interacts with other tax provisions, potentially influencing the overall tax liability of taxpayers. Understanding these interactions can help individuals maximize their tax savings.

Interaction with the Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a refundable tax credit for low-to-moderate-income working individuals and families. The EITC can significantly reduce tax liability or even result in a tax refund. When claiming the standard deduction, taxpayers can still be eligible for the EITC.

The EITC is calculated based on income and family size, and it is not directly affected by the choice between itemized deductions and the standard deduction.

For example, a single filer with an adjusted gross income (AGI) of $20,000 and one qualifying child may be eligible for an EITC of $3,584 in 2024. This credit would reduce their tax liability by $3,584, regardless of whether they claim the standard deduction or itemized deductions.

Impact on Tax Liability

The standard deduction and other tax provisions can influence a taxpayer’s overall tax liability in various ways. For instance, the standard deduction can reduce taxable income, potentially lowering the amount of taxes owed. However, certain tax provisions, like the EITC, are calculated based on income and other factors, independent of the standard deduction.

The EV tax credit is having a significant impact on the auto industry in 2024. To understand how this is shaping the market, read this article on EV Tax Credits Impact on the Auto Industry in 2024.

Therefore, claiming the standard deduction does not necessarily affect the eligibility or amount of these provisions.

For instance, a taxpayer with a high AGI may be ineligible for certain tax credits or deductions, even if they claim the standard deduction.

Examples of Interactions

Here are a few scenarios where the standard deduction interacts with other tax provisions:

- Child Tax Credit:The Child Tax Credit is a nonrefundable tax credit for each qualifying child. Claiming the standard deduction does not affect eligibility for the Child Tax Credit, but it can reduce the amount of taxes owed, which may influence the amount of the credit received.

- Retirement Contributions:Taxpayers who make contributions to traditional IRAs or 401(k) plans can deduct these contributions from their taxable income. This deduction can reduce the amount of taxes owed, potentially making the standard deduction more beneficial.

- Student Loan Interest Deduction:The student loan interest deduction allows taxpayers to deduct up to $2,500 in interest paid on qualified student loans. This deduction can be claimed regardless of whether the taxpayer itemizes or takes the standard deduction.

Standard Deduction and Tax Reform

The standard deduction, a cornerstone of the U.S. tax system, has been a focal point of recent tax reform efforts. Tax reform proposals often aim to simplify the tax code, adjust tax burdens, and stimulate economic growth. These objectives can significantly impact the standard deduction and its role in taxpayers’ financial lives.

Changes to the Standard Deduction in Tax Reform

Tax reform often involves adjustments to the standard deduction. These changes can be driven by a variety of factors, including:

- Simplifying the Tax Code:Increasing the standard deduction can simplify tax filing by encouraging more taxpayers to use the standard deduction instead of itemizing deductions. This can reduce the complexity of tax preparation and compliance.

- Adjusting Tax Burdens:Raising the standard deduction can provide tax relief to lower- and middle-income taxpayers, potentially reducing their tax liability. Conversely, lowering the standard deduction might aim to shift the tax burden towards higher-income earners.

- Stimulating Economic Growth:Tax reform proposals often aim to stimulate economic growth by increasing disposable income. Increasing the standard deduction can put more money in taxpayers’ pockets, potentially leading to increased spending and economic activity.

Arguments for and Against Changes to the Standard Deduction

There are various perspectives on how tax reform should address the standard deduction.

- Arguments for Increasing the Standard Deduction:

- Tax Relief for Lower- and Middle-Income Taxpayers:A higher standard deduction can reduce the tax burden on individuals and families with lower incomes, providing them with more financial resources.

- Simplification of the Tax Code:A higher standard deduction can encourage more taxpayers to use the standard deduction, simplifying tax filing and reducing compliance costs.

- Stimulating Economic Growth:Increased disposable income resulting from a higher standard deduction can lead to increased consumer spending and economic activity.

- Arguments Against Increasing the Standard Deduction:

- Reduced Tax Revenue:A higher standard deduction can reduce the amount of tax revenue collected by the government, potentially leading to budget deficits or cuts in government programs.

- Disincentive to Itemize Deductions:A higher standard deduction could discourage taxpayers from itemizing deductions, potentially limiting the benefits of certain tax deductions for charitable giving, homeownership, and other expenses.

- Fairness Concerns:Some argue that increasing the standard deduction disproportionately benefits higher-income taxpayers who are less likely to itemize deductions.

Impact of Tax Reform Proposals on the Standard Deduction

Tax reform proposals can have a significant impact on the standard deduction, affecting taxpayers in various ways.

- Increased Standard Deduction:Some tax reform proposals aim to increase the standard deduction to provide tax relief and simplify the tax code. This can benefit taxpayers by reducing their tax liability and simplifying their tax filing process.

- Decreased Standard Deduction:Other tax reform proposals might aim to lower the standard deduction to generate more tax revenue or shift the tax burden towards higher-income earners. This could increase the tax liability of some taxpayers, particularly those who rely heavily on the standard deduction.

- Changes to Deductibility:Tax reform proposals can also change the deductibility of certain expenses, potentially affecting the decision to itemize or take the standard deduction. For example, changes to mortgage interest deductions or charitable contribution deductions could influence taxpayers’ choices.

Standard Deduction and Retirement Planning

The standard deduction plays a crucial role in retirement planning, influencing how much of your retirement income is subject to taxation. Understanding how the standard deduction interacts with retirement income and distributions can help you optimize your tax planning strategies and maximize your retirement savings.

Standard Deduction and Retirement Income, Standard Deduction 2024

The standard deduction can significantly affect the taxability of your retirement income. As your retirement income increases, your tax liability also tends to rise. However, the standard deduction can help offset this increase by reducing your taxable income.For instance, if you receive $50,000 in annual retirement income and have a standard deduction of $13,850, your taxable income will be reduced to $36,150 ($50,000$13,850).

This lower taxable income will result in a lower tax bill compared to a situation where you do not claim the standard deduction.

Standard Deduction and Retirement Distributions

When you take distributions from your retirement accounts, such as 401(k)s or IRAs, these distributions are generally taxable as ordinary income. The standard deduction can help reduce the tax liability associated with these distributions.For example, if you withdraw $20,000 from your IRA and have a standard deduction of $13,850, your taxable income from the distribution will be reduced to $6,150 ($20,000$13,850).

This can significantly reduce your tax burden on your retirement income.

Standard Deduction and Roth IRA Conversions

The standard deduction can also be beneficial when converting traditional IRAs to Roth IRAs. A Roth IRA conversion involves paying taxes on the converted amount, but the distributions in retirement are tax-free.The standard deduction can help reduce the tax liability associated with the conversion.

For instance, if you convert $50,000 from a traditional IRA to a Roth IRA and have a standard deduction of $13,850, your taxable income from the conversion will be reduced to $36,150 ($50,000$13,850). This can lower the tax burden on the conversion and make the strategy more attractive.

Standard Deduction and Charitable Giving

The standard deduction can impact the tax benefits you receive from charitable giving. Understanding this interaction is crucial for maximizing your charitable contributions and minimizing your tax liability.

Curious about the eligibility requirements for the California stimulus check in October 2024? This article on California Stimulus Check October 2024 Eligibility Requirements provides a detailed breakdown of who qualifies.

Interaction with Itemized Deductions

The standard deduction and itemized deductions, which include charitable contributions, are mutually exclusive. This means you can choose to take either the standard deduction or itemize your deductions, but not both. If you itemize, you can deduct your charitable contributions, potentially leading to a larger tax benefit.

However, if you choose the standard deduction, you forgo the opportunity to deduct your charitable contributions.

If your itemized deductions, including charitable contributions, exceed the standard deduction amount, itemizing will result in a lower tax liability.

Factors Influencing the Decision

Several factors can influence your decision to take the standard deduction or itemize deductions:

- Amount of Charitable Contributions:If you make significant charitable contributions, itemizing might be advantageous as you can deduct a portion of your contributions. The amount you can deduct depends on the type of contribution and your adjusted gross income (AGI).

- Other Itemized Deductions:If you have other significant itemized deductions, such as medical expenses or state and local taxes, itemizing might be beneficial even if your charitable contributions are relatively small.

- Standard Deduction Amount:The standard deduction amount varies based on your filing status. If your itemized deductions are close to the standard deduction amount, you might be better off taking the standard deduction to simplify your tax filing.

Example:

Imagine you are single and your AGI is $50,000. The standard deduction for single filers in 2024 is $13,850. You made a charitable contribution of $5,000 to a qualified charity.* Scenario 1: Itemizing:If you itemize, you can deduct $5,000 in charitable contributions.

Your taxable income would be $36,150 ($50,000$13,850), leading to a lower tax liability.

-

Scenario 2

Standard Deduction: If you take the standard deduction, you cannot deduct your charitable contributions. Your taxable income would be $36,150 ($50,000

- $13,850), resulting in the same tax liability as Scenario 1.

In this example, itemizing might not provide a significant tax benefit as your charitable contribution is relatively small compared to the standard deduction. However, if your charitable contributions were larger, itemizing would likely result in a lower tax liability.

Last Word

The standard deduction is a valuable tool for many taxpayers, providing a straightforward way to reduce their tax burden. By understanding its purpose, amounts, and eligibility criteria, you can make informed decisions about your tax planning and ensure you’re maximizing your tax benefits.

Remember, tax laws are constantly evolving, so it’s always advisable to consult with a tax professional for personalized advice.

Answers to Common Questions

Can I claim the standard deduction if I’m self-employed?

Yes, self-employed individuals are eligible for the standard deduction just like other taxpayers. You’ll report your business income and expenses on Schedule C and then claim the standard deduction on Form 1040.

What happens if I’m audited by the IRS and I claimed the standard deduction?

The IRS can review your tax return, including your choice of standard deduction or itemized deductions. If you claimed the standard deduction, they will verify that you meet the eligibility requirements and that your AGI falls within the applicable income limits.

If I claim the standard deduction, can I still contribute to a traditional IRA?

Yes, claiming the standard deduction does not affect your eligibility for contributions to a traditional IRA. However, the amount you can deduct for your IRA contribution may be limited based on your income and filing status.

How do I know if I should claim the standard deduction or itemize?

It’s best to compare the standard deduction amount to the total of your itemized deductions. If your itemized deductions exceed the standard deduction, you’ll generally benefit from itemizing. However, it’s always a good idea to consult with a tax professional for personalized advice.