W9 Form 2024 is a vital document for anyone who receives payments from businesses or individuals for services, rent, or other transactions. This form provides the IRS with crucial information needed for accurate tax reporting and withholding. Whether you’re a freelancer, contractor, or a business owner, understanding the purpose and requirements of the W9 form is essential for ensuring tax compliance and avoiding potential penalties.

This comprehensive guide delves into the intricacies of the W9 form, providing a step-by-step walkthrough of its completion, submission methods, and potential updates. We’ll also explore the importance of data security when handling W9 forms and offer insights into common errors and how to avoid them.

By understanding the W9 form and its implications, you can confidently navigate the tax reporting process and ensure your financial obligations are met.

Contents List

- 1 W9 Form Overview: W9 Form 2024

- 2 Completing the W9 Form

- 3 4. W9 Form Updates and Changes

- 4 6. W9 Form and Electronic Filing

- 5 W9 Form and Business Operations

- 6 8. W9 Form and Tax Professionals

- 7 W9 Form and International Transactions

- 8 W9 Form and Data Security

- 9 W9 Form and Common Errors

- 10 W9 Form and IRS Resources

- 11 W9 Form and Future Developments

- 12 14. W9 Form and Real-World Examples

- 13 W9 Form and Legal Considerations

- 14 Closure

- 15 FAQ Resource

W9 Form Overview: W9 Form 2024

The W9 form is a critical document in the United States tax system. It’s used to provide your tax identification information to payers, allowing them to accurately report payments made to you and withhold the correct amount of taxes. This form ensures compliance with tax regulations and facilitates accurate reporting for both the payer and payee.

Purpose of the W9 Form

The W9 form serves as a crucial tool for tax reporting and withholding. It provides essential information for payers to correctly identify payees and report income paid to them on their tax returns. This form is essential for various financial transactions, including:* Reporting income:Payers use the information on the W9 form to report income paid to you on their tax returns, ensuring accurate tax reporting.

Withholding taxes

Payers use the W9 form to determine the correct amount of taxes to withhold from payments made to you. This ensures compliance with tax regulations and prevents underpayment or overpayment of taxes.

Identifying payees

The W9 form helps payers identify payees accurately, preventing errors in tax reporting and withholding.The W9 form is essential for both the payer and payee. It ensures that the payer accurately reports payments made to you and withholds the correct amount of taxes.

For the payee, it allows for accurate reporting of income received and ensures proper tax withholding.

Individuals and Entities Required to Complete the W9 Form

The W9 form is required for a wide range of individuals and entities, including:* Individuals:Anyone who receives payments for services rendered, goods sold, or other transactions that require tax reporting must complete a W9 form. This includes individuals working as independent contractors, freelancers, consultants, or those receiving payments for rent, interest, or dividends.

Businesses

Businesses that receive payments for goods or services, including corporations, partnerships, limited liability companies (LLCs), and sole proprietorships, are typically required to complete a W9 form.

Non-profit organizations

Non-profit organizations that receive payments for services or goods must complete a W9 form to report income received and ensure proper tax withholding.Specific examples of situations where a W9 form might be required for a business entity include:* Selling goods or services to a company:If you are a business selling goods or services to a company, you will likely be required to complete a W9 form to ensure accurate reporting of payments received.

Receiving rent payments

If you own a property and receive rent payments from a tenant, you will need to complete a W9 form to report the income received.

Receiving interest or dividends

If you receive interest or dividends from a company or financial institution, you will likely be required to complete a W9 form to report the income received.

Key Information Sections on the W9 Form

The W9 form includes several key sections that gather essential information for tax reporting and withholding. These sections are:

- Name:This section requires you to provide your full legal name as it appears on your tax records. This information is used to accurately identify you for tax reporting and withholding purposes.

- Taxpayer Identification Number (TIN):This section requires you to provide your Social Security Number (SSN) or Employer Identification Number (EIN), depending on your status. This number is crucial for identifying you for tax purposes and determining the correct amount of taxes to withhold.

- Address:This section requires you to provide your current mailing address. This information is used for accurate tax reporting and communication regarding payments made to you.

- Exemption from Backup Withholding:This section allows individuals and entities to declare their exemption status from backup withholding. This exemption can reduce withholding requirements for certain individuals and entities, such as those who are exempt from US income tax or who have provided their TIN to the payer in the past.

Penalties for Inaccurate or Incomplete W9 Forms

Submitting an inaccurate or incomplete W9 form can result in significant penalties for both the payer and payee. The IRS can impose various penalties, including:* Backup withholding:The payer may be required to withhold a higher percentage of payments made to you if they do not have a valid TIN or if they are uncertain about your tax status.

Civil penalties

The payer may be subject to civil penalties for failing to report income accurately or for failing to withhold the correct amount of taxes.

Criminal penalties

In cases of intentional misrepresentation or fraud, the payer and payee may face criminal penalties, including fines and imprisonment.The impact of these penalties can be substantial, potentially leading to financial hardship for both the payer and payee. Therefore, it is crucial to ensure that your W9 form is accurate and complete to avoid potential penalties.

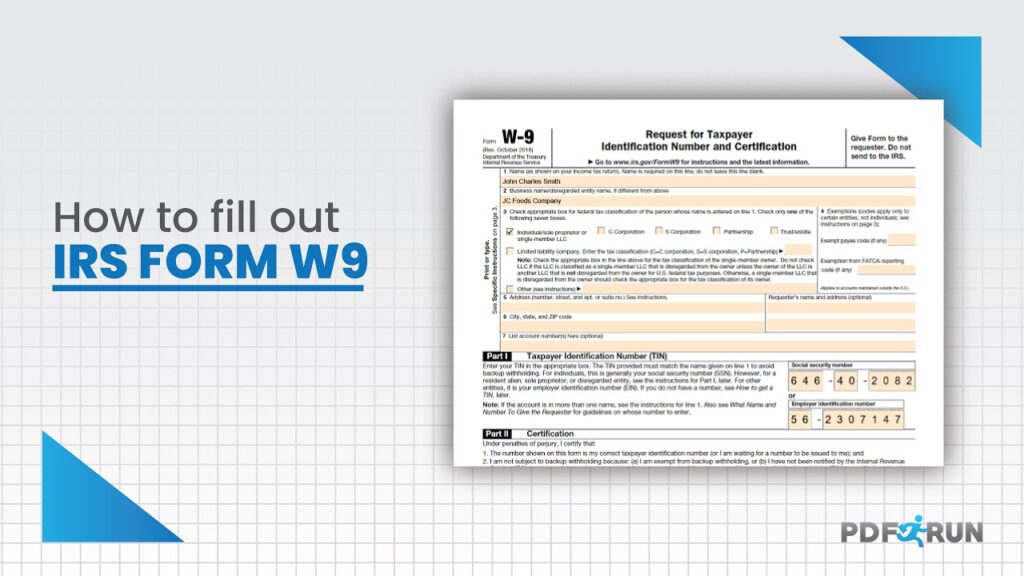

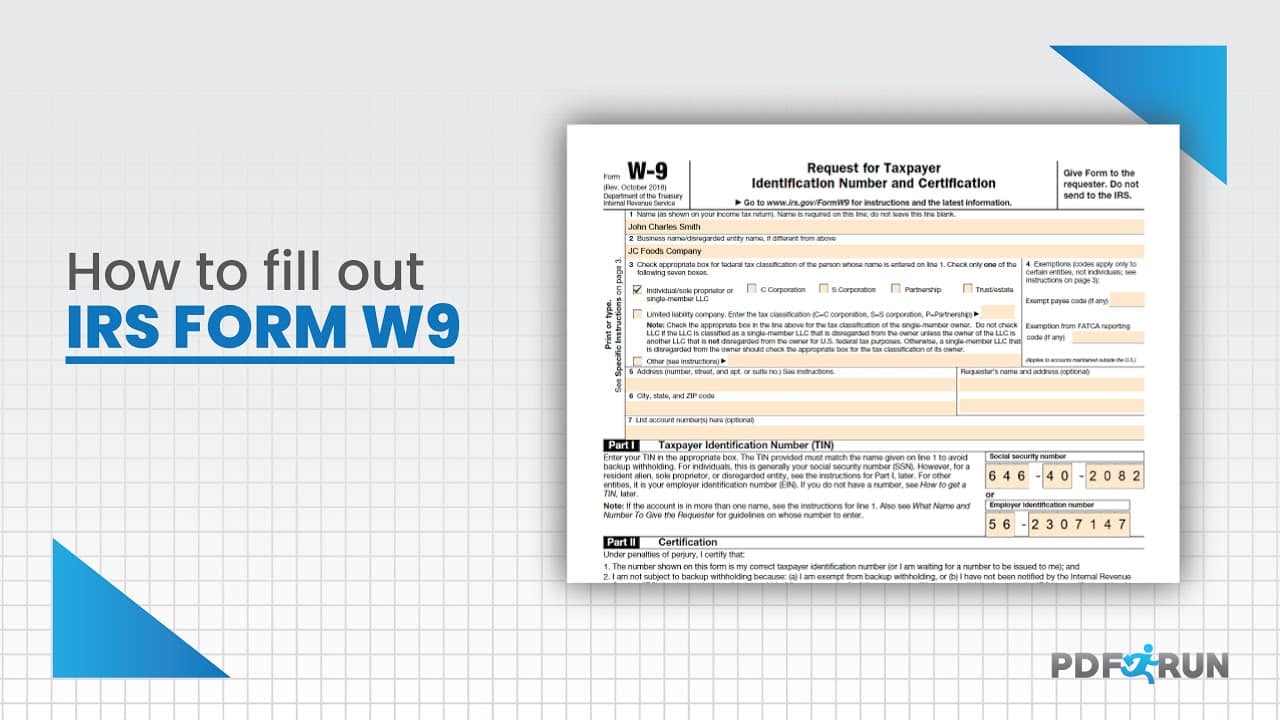

Writing a W9 Form

Completing a W9 form accurately is essential for both the payer and payee. Here is a detailed guide to filling out a W9 form:

- Provide your name:In the “Name” section, enter your full legal name as it appears on your tax records. Ensure the spelling is accurate and consistent with your tax identification documents.

- Enter your TIN:In the “Taxpayer Identification Number (TIN)” section, enter your Social Security Number (SSN) if you are an individual or your Employer Identification Number (EIN) if you are a business entity. Double-check the accuracy of the number entered to avoid any errors.

- Provide your address:In the “Address” section, enter your current mailing address where you receive important tax-related communications. Ensure the address is accurate and up-to-date to avoid any delays in receiving essential information.

- Declare exemption status:In the “Exemption from Backup Withholding” section, check the appropriate box if you are exempt from backup withholding. This section is typically used by individuals and entities who are exempt from US income tax or who have provided their TIN to the payer in the past.

- Sign and date:Sign and date the form in the designated areas to acknowledge that the information provided is accurate and complete.

Remember to keep a copy of the completed W9 form for your records. You may also need to provide a W9 form to other payers in the future.

Completing the W9 Form

The W9 form is a critical document for individuals and businesses who are paid by others, including companies, government agencies, and even individuals. It serves as a vital tool for ensuring accurate tax reporting and proper withholding of taxes. Completing the W9 form correctly is crucial to avoid potential tax penalties and ensure smooth financial transactions.

Understanding the Taxpayer Identification Number (TIN)

The TIN is a unique identifier used by the Internal Revenue Service (IRS) to track taxpayers. It is essential for accurate tax reporting and helps ensure that the correct amount of taxes is withheld from payments. The TIN can take one of two forms:

- Social Security Number (SSN):This is the most common form of TIN for individuals. SSNs are assigned by the Social Security Administration and are used to track earnings and benefits.

- Employer Identification Number (EIN):This is a nine-digit number assigned to businesses and other entities. It is used for tax reporting and other purposes.

The correct TIN should be entered in the designated box on the W9 form.

Exemption from Backup Withholding

The “Exemption from Backup Withholding” section of the W9 form is crucial for individuals and businesses who believe they are exempt from backup withholding. Backup withholding is a measure implemented by the IRS to collect taxes on payments that might not have been reported or where the payer does not have sufficient information to determine the correct withholding amount.

The IRS may require backup withholding if you:

- Fail to provide a valid TIN.

- Are subject to a penalty for failing to report income.

- Have been notified by the IRS that you are subject to backup withholding.

To claim exemption from backup withholding, you must provide a valid TIN and certify that you are not subject to backup withholding.

Scenarios Requiring a W9 Form

A W9 form is typically required in various situations where payments are made for services, rent, or other transactions. Here are some common scenarios:

- Payments for Services:When an individual or business is paid for services rendered, such as consulting, freelance work, or independent contracting, the payer will typically require a W9 form to ensure proper tax reporting and withholding.

- Rent Payments:Landlords often require tenants to provide a W9 form to verify their identity and TIN for tax purposes, especially if the rental income exceeds certain thresholds.

- Other Transactions:A W9 form might also be required for various other transactions, such as payments for royalties, awards, or prizes.

It’s essential to consult with a tax professional or review the IRS guidelines to determine when a W9 form is required for specific situations.

4. W9 Form Updates and Changes

The W9 form, used to provide your tax identification number (TIN) to recipients of certain payments, undergoes regular updates to reflect changes in tax laws and reporting requirements. Staying informed about these changes is crucial for ensuring your tax compliance and avoiding potential penalties.

I. Identifying Recent Changes

Understanding the recent changes to the W9 form is important for accurate reporting and compliance. Here is a summary of the most significant updates over the past three years:

| Year | Description of Change | Effective Date |

|---|---|---|

| 2021 | Revisions to instructions for reporting TINs for foreign entities. | January 1, 2021 |

| 2022 | Updated language for the “Exemption from Backup Withholding” section. | January 1, 2022 |

| 2023 | Clarifications added regarding the reporting of foreign TINs. | January 1, 2023 |

II. Understanding the Impact

Each change to the W9 form aims to improve clarity and streamline reporting processes. Let’s explore the rationale behind each change and its impact on taxpayers:

- 2021: Revisions to instructions for reporting TINs for foreign entities– This change aimed to provide more specific guidance for foreign entities when reporting their TINs. This improved clarity for foreign entities and helped ensure accurate reporting of their tax information.

- 2022: Updated language for the “Exemption from Backup Withholding” section– This update provided a more concise and understandable explanation of the exemption from backup withholding. This made it easier for taxpayers to understand the requirements for claiming this exemption.

- 2023: Clarifications added regarding the reporting of foreign TINs– These clarifications aimed to address potential confusion surrounding the reporting of foreign TINs, ensuring consistency and accuracy in reporting.

III. Accessing the Latest Version

The IRS provides the latest version of the W9 form on its website. To access it, follow these steps:

- Visit the IRS website: [https://www.irs.gov/forms-pubs/about-form-w9](https://www.irs.gov/forms-pubs/about-form-w9)

- Search for “Form W9” in the search bar.

- Click on the link for “Form W9, Request for Taxpayer Identification Number and Certification.”

- Download the form in PDF format.

IV. Updating Existing W9 Forms

If your information changes, you must update your W9 form. Here’s how to do it:

- Submit a revised W9 form:Fill out a new W9 form with your updated information and submit it to the recipient of the payments. This could be your employer, a bank, or any other entity that requires your TIN.

- Provide supporting documentation:If you are making a significant change, like changing your name or address, you may need to provide supporting documentation, such as a copy of your driver’s license or passport.

- Consequences of not updating:Failing to update your W9 form with changed information can result in incorrect reporting, potential penalties, and delays in receiving payments.

V. Writing

Recent updates to the W9 form are designed to improve accuracy and compliance. Here’s a summary of the key changes and what they mean for you:

- Foreign entity reporting:The IRS has clarified instructions for foreign entities reporting their TINs, ensuring accuracy and consistency.

- Exemption from backup withholding:The language regarding exemptions from backup withholding has been updated to make it easier to understand.

- Foreign TIN reporting:Additional clarifications have been added regarding the reporting of foreign TINs to address any potential confusion.

It’s important to use the latest version of the W9 form to ensure your tax information is accurate and up-to-date. If your information has changed, be sure to update your W9 form promptly. For the latest information and guidance, visit the IRS website.

6. W9 Form and Electronic Filing

The W9 form is a crucial document that tax payers use to provide their tax identification number (TIN) and other essential information to recipients of income, such as banks, employers, and other entities. Traditionally, taxpayers would complete a paper W9 form and mail it to the recipient.

However, with the advent of technology, electronic filing systems have emerged as a convenient and efficient alternative to traditional methods.

Electronic Filing Systems

Electronic filing systems allow taxpayers to submit their W9 forms electronically, eliminating the need for paper forms and physical mailing. These systems typically involve a secure online platform where taxpayers can fill out a digital version of the W9 form and submit it directly to the recipient.Electronic filing systems offer several advantages over traditional methods:* Convenience:Taxpayers can complete and submit W9 forms anytime, anywhere with an internet connection, eliminating the need for physical forms and trips to the post office.

Speed

Electronic filing systems process W9 forms quickly, often within minutes or hours, compared to days or weeks for traditional mail.

Accuracy

Digital forms can minimize errors associated with handwritten information, ensuring accurate data is submitted.

Security

Reputable electronic filing systems employ robust security measures to protect sensitive taxpayer information.

- System name

- Key features

- Pricing

- Compatibility

- Security measures

- Customer support

| System name | Key features | Pricing | Compatibility | Security measures | Customer support |

| System 1 | Feature 1, Feature 2, Feature 3 | Pricing information | Compatibility details | Security measures description | Customer support information |

| System 2 | Feature 1, Feature 2, Feature 3 | Pricing information | Compatibility details | Security measures description | Customer support information |

Electronic filing of W9 forms offers several benefits:* Increased efficiency:Eliminates the need for paper forms and manual processing, saving time and resources.

Reduced errors

Digital forms minimize the risk of human error, ensuring accurate information is submitted.

Improved security

Electronic filing systems often employ robust security measures to protect sensitive taxpayer information.

Enhanced compliance

Electronic filing systems can help taxpayers comply with tax regulations and reporting requirements.However, there are also some limitations to electronic filing:* Technical requirements:Taxpayers need access to a computer and internet connection to use electronic filing systems.

Digital literacy

Some taxpayers may not be familiar with using electronic filing systems, requiring them to learn new skills.

Security risks

While electronic filing systems generally employ security measures, there is always a risk of data breaches.

System compatibility

Not all electronic filing systems are compatible with all tax software or financial institutions.

Popular Electronic Filing Platforms

Numerous electronic filing platforms offer W9 form submission capabilities. Here are a few examples:* Platform 1:This platform allows taxpayers to electronically submit W9 forms to various recipients, including banks, employers, and other businesses. It offers features like secure data storage, automated form filling, and integration with popular tax software.

Target audience

Individuals, small businesses, and freelancers.

Link

Looking for financial assistance in California? The state is offering a stimulus check in October 2024, and you can learn about the amount and payment schedule here. Make sure to check your eligibility requirements here to see if you qualify for this financial aid.

[Official website URL]* Platform 2:This platform specializes in providing electronic filing solutions for businesses. It offers a wide range of features, including W9 form management, tax compliance tools, and automated reporting.

Target audience

Businesses of all sizes.

Link

[Official website URL]* Platform 3:This platform offers a user-friendly interface for submitting W9 forms electronically. It is designed for individuals and small businesses who need a simple and efficient way to manage their tax information.

Target audience

Individuals and small businesses.

Link

[Official website URL]* Platform 4:This platform provides a comprehensive suite of electronic filing services, including W9 form submission, tax preparation, and payroll processing.

Target audience

Individuals, businesses, and tax professionals.

Link

[Official website URL]* Platform 5:This platform focuses on providing electronic filing solutions for freelancers and independent contractors. It offers features like secure payment processing, invoice generation, and W9 form management.

Target audience

Freelancers and independent contractors.

Link

[Official website URL]

Security and Compliance

Electronic filing platforms implement various security measures to protect taxpayer information, such as:* Data encryption:All data transmitted and stored on the platform is encrypted to prevent unauthorized access.

Two-factor authentication

Users are required to provide multiple forms of authentication to access their accounts, enhancing security.

Regular security audits

Platforms undergo regular security audits to identify and address potential vulnerabilities.

Compliance with industry standards

Planning for retirement? Annuity King Sarasota can help you create a secure financial future. Discover their services and get a personalized plan here to ensure a comfortable and worry-free retirement.

Platforms adhere to industry standards for data security and privacy, such as the Payment Card Industry Data Security Standard (PCI DSS).Electronic filing of W9 forms must also comply with legal and regulatory requirements. The IRS provides guidance on the acceptable methods for submitting W9 forms electronically.

Platforms must ensure their systems comply with these regulations to maintain legal and ethical standards.

Best Practices

Here are some best practices for submitting W9 forms electronically:* Choose a reputable platform:Select a platform with a proven track record of security and reliability.

Review platform terms and conditions

Understand the platform’s privacy policy, security measures, and any associated fees.

Verify recipient information

Ensure you are submitting the W9 form to the correct recipient.

Double-check accuracy

Carefully review all information entered on the form before submitting.

Retain a copy

Keep a copy of the submitted W9 form for your records.

Update information promptly

Want to elevate your audio quality for YouTube videos? Acoustic foam can make a huge difference. Explore the best acoustic foam options for your studio and get expert tips here to create professional-sounding content.

If your tax identification number or other information changes, update your W9 form accordingly.

W9 Form and Business Operations

The W9 form is a crucial document in various business operations, particularly when dealing with vendors and contractors. It provides essential information for tax reporting and ensures compliance with IRS regulations.

Importance in Vendor Management and Payroll

The W9 form is essential for efficient vendor management and payroll processes. It enables businesses to accurately report payments made to vendors and contractors, facilitating accurate tax reporting and avoiding potential penalties.

- Vendor Management:Businesses require the W9 form to correctly classify vendors as independent contractors or employees. This distinction impacts tax withholdings and reporting obligations. The form provides the vendor’s tax identification number (TIN), which is essential for accurate tax reporting.

- Payroll:The W9 form helps businesses accurately withhold taxes from payments to contractors. It provides the contractor’s TIN, which is used to report payments to the IRS.

Compliance with Tax Regulations

The W9 form plays a critical role in ensuring businesses comply with IRS regulations. It allows businesses to accurately report payments made to vendors and contractors, preventing potential penalties for non-compliance.

The IRS requires businesses to obtain a W9 form from any vendor or contractor who is paid $600 or more during a calendar year. Failure to do so can result in penalties.

Best Practices for Managing and Storing W9 Forms

Businesses should implement best practices for managing and storing W9 forms to ensure compliance and prevent potential issues.

- Secure Storage:Businesses should store W9 forms securely, preferably in a dedicated system or folder. This helps protect sensitive information and prevents unauthorized access.

- Regular Updates:Businesses should request updated W9 forms from vendors and contractors periodically, especially when there are changes in their tax status or TIN.

- Data Protection:Businesses should implement appropriate data protection measures to safeguard the confidentiality of W9 forms. This includes access control measures and encryption of sensitive information.

W9 Forms in Different Industries and Sectors

The W9 form is widely used across various industries and sectors, including:

- Construction:Businesses in the construction industry often use W9 forms to pay subcontractors and suppliers.

- Healthcare:Healthcare providers use W9 forms to pay physicians, nurses, and other healthcare professionals.

- Technology:Technology companies use W9 forms to pay freelance developers, designers, and other contractors.

- Finance:Financial institutions use W9 forms to pay independent financial advisors and other contractors.

8. W9 Form and Tax Professionals

Navigating the complexities of the W9 form can be daunting, especially for individuals and businesses with unique tax situations. This is where tax professionals come in, offering invaluable assistance and guidance to ensure accurate and timely completion.

Role of Tax Professionals

Tax professionals play a crucial role in helping individuals and businesses understand and complete the W9 form correctly. They possess specialized knowledge and expertise in tax laws and regulations, enabling them to provide accurate guidance and support.

- Task Undertaken by Tax Professionals:Tax professionals handle various tasks related to the W9 form, including:

- Explaining the purpose and requirements of the W9 form

- Assisting with accurate completion of all sections, including taxpayer identification numbers (TIN), name, address, and other relevant information

- Reviewing the completed form for accuracy and compliance with IRS regulations

- Advising on specific tax situations and providing tailored guidance

- Helping with electronic filing or paper submission

- Addressing any questions or concerns related to the W9 form

- Streamlining the W9 Form Process:Tax professionals can streamline the W9 form process by:

- Providing clear and concise explanations of the form’s requirements

- Offering templates and resources to simplify form completion

- Helping individuals and businesses understand their tax obligations and how the W9 form fits into their overall tax strategy

- Expertise and Knowledge:Tax professionals bring a wealth of knowledge and expertise to the table regarding the W9 form:

- Understanding the latest IRS regulations and updates

- Staying informed about changes to the W9 form and its requirements

- Possessing in-depth knowledge of different tax situations, including those involving foreign income, trusts, and complex business structures

Benefits of Professional Guidance

Seeking professional assistance for W9 form preparation offers numerous advantages, ensuring accuracy, compliance, and potential tax benefits.

- Accuracy and Compliance:Tax professionals ensure the W9 form is filled out correctly, minimizing the risk of errors and penalties. They are familiar with IRS regulations and can help individuals and businesses comply with all requirements.

- Avoiding Common Errors:Tax professionals can identify and correct common W9 form errors, such as incorrect TINs, inaccurate addresses, or missing information. This helps avoid delays in processing and potential penalties.

- Tax Benefits:Tax professionals can provide guidance on how to maximize tax benefits by correctly completing the W9 form. For example, they can advise on the proper reporting of income and deductions to ensure individuals and businesses receive the appropriate tax treatment.

- Timely Submission:Tax professionals ensure the W9 form is submitted on time, avoiding late filing penalties. They understand the deadlines and requirements for different situations.

Complex Tax Situations

Certain tax situations require specialized knowledge and expertise, making consulting a tax professional crucial for accurate W9 form completion.

- Foreign Income:Individuals and businesses with foreign income may have specific requirements for completing the W9 form. Tax professionals can provide guidance on the proper reporting of foreign income and ensure compliance with relevant tax treaties.

- Trusts:Trusts are complex legal entities with unique tax implications. Tax professionals can help with completing the W9 form for trusts, ensuring accurate reporting of income and distributions.

- Complex Business Structures:Businesses with complex structures, such as partnerships, LLCs, or corporations, may have specific requirements for completing the W9 form. Tax professionals can provide tailored advice and guidance to ensure accurate reporting.

Choosing a Qualified Tax Professional

Selecting a qualified tax professional is crucial for receiving accurate and reliable assistance with the W9 form.

- Key Qualifications:Consider the following qualifications when choosing a tax professional:

- Credentials:Look for tax professionals with relevant credentials, such as Certified Public Accountant (CPA), Enrolled Agent (EA), or Certified Financial Planner (CFP). These credentials indicate a high level of expertise and professionalism.

- Experience:Choose a tax professional with experience in handling W9 forms and assisting individuals and businesses with their tax obligations.

- Expertise:Ensure the tax professional has expertise in relevant tax laws and regulations, including those related to the W9 form.

- Reputation:Check the tax professional’s reputation by looking for client reviews and testimonials.

- Research and Vetting:Take the time to research and vet potential tax professionals:

- Professional Organizations:Check the tax professional’s membership in professional organizations, such as the American Institute of Certified Public Accountants (AICPA) or the National Association of Enrolled Agents (NAEA).

- Online Reviews:Read online reviews and testimonials from previous clients to gauge the tax professional’s expertise, professionalism, and customer satisfaction.

- Referrals:Ask for referrals from trusted sources, such as friends, family, or colleagues.

W9 Form and International Transactions

The W9 form is primarily used for domestic transactions within the United States. However, it can also play a role in certain international transactions, particularly when dealing with US-based entities or individuals. While the W9 form is not a primary requirement for international transactions, understanding its relevance in specific scenarios is crucial.

W9 Form in International Transactions

The W9 form is used to collect taxpayer identification information (TIN) from individuals and entities, facilitating proper tax reporting. In international transactions, the W9 form may be relevant when:* US-based entities or individuals are involved:If a foreign entity or individual is making payments to a US-based entity or individual, the US recipient may require a W9 form to report the income received on their US tax return.

US tax treaties

Certain US tax treaties may require the exchange of taxpayer information, including TINs, which could necessitate the use of the W9 form.

US tax regulations

US tax regulations may require the reporting of certain international transactions, and the W9 form may be needed to provide the necessary taxpayer information.

Examples of W9 Form Use in International Transactions

Here are some examples of how the W9 form might be used in international transactions:* Foreign investment in US securities:A foreign investor purchasing US stocks or bonds may need to provide a W9 form to the brokerage firm to report the income earned from the investment.

International trade

A US importer receiving goods from a foreign supplier may need to provide a W9 form to the supplier to report the payments made.

Cross-border payments

A US-based company making payments to a foreign entity for services or goods may require the foreign entity to provide a W9 form to comply with US tax reporting requirements.

Navigating international tax regulations related to the W9 form can be complex. It’s essential to:* Understand the specific tax treaty provisions:Consult with a tax professional to determine if any relevant tax treaties apply to the transaction.

Stay informed about US tax regulations

Keep up-to-date on the latest US tax regulations regarding international transactions.

Seek guidance from qualified professionals

Engage a tax professional experienced in international tax matters for advice and assistance.

W9 Form and Data Security

Protecting your business from data breaches is crucial, especially when handling sensitive information like W9 forms. These forms contain critical financial details, including your taxpayer identification number (TIN) and Social Security number. Unauthorized access to this information can lead to serious consequences, including identity theft, fraudulent tax filings, and financial losses.

Data Breach Risks and Consequences

A data breach can occur through various means, such as hacking, malware attacks, employee negligence, or physical theft. The consequences of a data breach can be severe for businesses, including:* Financial losses:Data breaches can lead to direct financial losses from stolen funds, fraud, and legal expenses.

Reputational damage

A data breach can damage your business’s reputation, leading to loss of customer trust and potential business decline.

Legal penalties

Businesses can face significant fines and penalties from regulatory agencies for data breaches, especially if they fail to comply with data security regulations.

Identity theft

Unauthorized access to W9 form information can lead to identity theft, which can have long-term consequences for individuals and businesses.

The EV tax credit is significantly impacting the auto industry in 2024. Learn how this incentive is driving the transition to electric vehicles and shaping the future of transportation here.

Best Practices for Protecting W9 Form Data

Protecting W9 form data requires a multi-layered approach. Here’s a summary of best practices:

| Category | Best Practice | Explanation |

|---|---|---|

| Secure Storage | Store W9 forms in a secure location, such as a locked filing cabinet or a password-protected digital folder. | This prevents unauthorized physical access to the forms. |

| Access Controls | Limit access to W9 forms to authorized personnel only. Implement strong passwords and multi-factor authentication for digital access. | This ensures only authorized individuals can view and modify W9 form information. |

| Encryption | Encrypt all digital W9 forms using strong encryption algorithms. | Encryption makes it difficult for unauthorized individuals to access the data even if they gain access to the device or network. |

| Employee Training | Train employees on data security best practices, including handling sensitive information like W9 forms. | Educating employees on data security procedures can help prevent accidental or intentional data breaches. |

| Regular Audits | Regularly audit your data security practices to identify and address any vulnerabilities. | Regular audits help ensure that your data security measures are effective and up-to-date. |

Employee Training Video Script, W9 Form 2024

Here’s a sample script for an employee training video on W9 form data security: Introduction“Hi everyone, this video is about protecting sensitive data, specifically W9 forms. These forms contain important information like your Social Security number and taxpayer identification number.

It’s crucial to keep this information secure to prevent identity theft, fraud, and legal issues. Data Security Best Practices“Let’s go over some key practices:* Secure Storage:Always store W9 forms in a locked filing cabinet or a password-protected digital folder. Never leave them unattended or accessible to unauthorized individuals.

Access Controls

Only authorized personnel should have access to W9 forms. Use strong passwords and multi-factor authentication for digital access.

Encryption

If you’re storing W9 forms digitally, make sure to encrypt them using strong encryption algorithms. This ensures that even if someone gains access to the file, they won’t be able to read the information.

Employee Training

We’ll be conducting regular training sessions on data security best practices. It’s important to stay informed and follow these guidelines. Common Mistakes to Avoid“Here are some common mistakes to avoid:* Sharing W9 forms over unsecured channels:Never share W9 forms over email or other unsecured channels. Always use secure methods like encrypted email or a secure file-sharing service.

Leaving W9 forms unattended

Never leave W9 forms unattended on your desk or in an unlocked drawer. Always store them in a secure location.

Using weak passwords

Use strong passwords for digital access to W9 forms. Avoid using easily guessable passwords like your birthdate or pet’s name.

Ignoring security warnings

If you receive a security warning on your computer, don’t ignore it. It could be a sign of a potential data breach. Conclusion“By following these best practices, we can help protect our business from data breaches and ensure the security of our employees’ and customers’ information.

Remember, data security is everyone’s responsibility. If you have any questions or concerns, please don’t hesitate to reach out to your supervisor or the IT department.”

Data Security Regulations and Resources

Here are some resources for understanding data security regulations related to W9 forms:* IRS Publication 17:This publication provides detailed information about the IRS’s data security requirements. [Link to IRS Publication 17]

HIPAA Privacy Rule

If you handle healthcare information, you must comply with the HIPAA Privacy Rule, which includes data security provisions. [Link to HIPAA Privacy Rule]

GDPR

The General Data Protection Regulation (GDPR) is a comprehensive data protection law that applies to businesses that process personal data of individuals in the European Union. [Link to GDPR]

Data Security Best Practices for Small Businesses

This article from the National Institute of Standards and Technology (NIST) provides valuable guidance on data security for small businesses. [Link to NIST Data Security Best Practices]

W9 Form and Common Errors

The W9 form is a crucial document for tax reporting, and even small errors can lead to significant tax issues. It’s important to understand common mistakes and how to avoid them to ensure accurate reporting.

Consequences of Errors

Mistakes on the W9 form can have serious consequences for both the payer and the payee. For example, if a payee’s TIN is incorrect, the payer may be subject to penalties for failing to withhold taxes. Similarly, if the payee’s name or address is incorrect, the payer may not be able to send tax documents to the correct recipient.

Common Errors

- Incorrect TIN: This is the most common error, and it can lead to penalties for both the payer and the payee. Make sure you enter your correct Social Security number or Employer Identification Number (EIN).

- Incorrect Name: This can lead to confusion about who the payee is and can result in tax documents being sent to the wrong person. Double-check that your name is spelled correctly and matches your tax records.

- Incorrect Address: This can prevent the payer from sending tax documents to the correct address, leading to delays and potential penalties. Ensure your address is current and accurate.

- Missing or Incorrect Exemptions: If you are exempt from backup withholding, make sure you fill out the exemption section correctly. This can help you avoid unnecessary tax withholding.

- Incorrect Business Structure: If you are a business, it is essential to select the correct business structure. This ensures the payer correctly reports your income and withholding.

- Incomplete Information: Failing to provide all the required information on the W9 form can lead to delays and penalties. Ensure you complete all sections accurately and provide all necessary information.

Correcting Errors

If you discover an error on a submitted W9 form, it’s important to correct it as soon as possible. You should contact the payer and inform them of the error. They may require you to submit a corrected W9 form.

Examples of Real-World Cases

- A freelancer provided an incorrect Social Security number on their W9 form. As a result, the payer withheld taxes from their payments but sent the tax documents to the wrong person. This caused significant delays and complications for the freelancer in filing their taxes.

- A small business owner mistakenly selected the wrong business structure on their W9 form. This resulted in the payer reporting their income incorrectly, leading to penalties for the business owner.

W9 Form and IRS Resources

The IRS provides a wealth of resources for taxpayers seeking information about the W9 form. These resources can help you understand the form’s purpose, complete it accurately, and address any questions or concerns you may have.

The IRS website is a comprehensive resource for tax-related information, including guidance on the W9 form. To find specific information about the W9 form, follow these steps:

- Visit the IRS website: www.irs.gov

- In the search bar, enter “Form W9”

- Click on the relevant search result, which should lead you to the official IRS page for Form W9.

IRS Resources for W9 Form

The IRS website offers a variety of resources to assist taxpayers with the W9 form. These resources include:

- Form W9 Instructions:This document provides detailed instructions on completing the W9 form, including explanations of each section and examples of how to fill it out correctly.

- Frequently Asked Questions (FAQs):The IRS website includes a dedicated FAQ section for Form W9, addressing common questions and concerns.

- Online Tutorials:The IRS website may offer online tutorials or videos explaining how to complete the W9 form. These tutorials can be helpful for visual learners or those who prefer step-by-step instructions.

- Taxpayer Assistance Centers (TACs):The IRS operates Taxpayer Assistance Centers nationwide, where taxpayers can receive in-person assistance with tax-related matters, including the W9 form.

- Publication 1220, “Taxpayer Guide to Identity Theft”:This publication provides information on protecting your identity and what to do if you believe you have been a victim of identity theft. This information is relevant to the W9 form, as it can help you prevent fraud and ensure the accuracy of your information.

Key IRS Resources

The following table summarizes the key IRS resources for taxpayers seeking information about the W9 form:

| Resource | Description |

|---|---|

| Form W9 Instructions | Provides detailed instructions on completing the W9 form. |

| FAQs | Addresses common questions and concerns about the W9 form. |

| Online Tutorials | Offers step-by-step instructions on completing the W9 form. |

| Taxpayer Assistance Centers (TACs) | Provides in-person assistance with tax-related matters, including the W9 form. |

| Publication 1220, “Taxpayer Guide to Identity Theft” | Provides information on protecting your identity and what to do if you believe you have been a victim of identity theft. |

W9 Form and Future Developments

The W9 form, while a staple of tax reporting, is not static. As the tax landscape evolves, the IRS may adjust the form to reflect changes in tax policy, technological advancements, or emerging compliance needs. This section explores potential changes to the W9 form in the future, outlining the driving forces behind these updates and their implications for taxpayers.

Factors Influencing W9 Form Changes

The IRS continually assesses the effectiveness of tax reporting processes and seeks to streamline compliance while ensuring accurate tax collection. This ongoing evaluation can lead to adjustments in the W9 form. Several factors could influence future updates, including:

- Technological Advancements:The increasing adoption of digital platforms and electronic filing systems may lead to changes in the W9 form’s format or submission methods. For instance, the IRS might integrate the W9 form into online tax filing systems or develop a dedicated electronic filing platform for W9 forms.

This could potentially simplify the process and reduce the risk of errors.

- Tax Policy Revisions:Changes in tax laws, such as new reporting requirements or modifications to tax classifications, could necessitate updates to the W9 form. For example, if the IRS introduces new categories for reporting income or changes the way certain entities are classified, the W9 form may need to be revised to accommodate these changes.

- Fraud Prevention:The IRS is constantly working to combat tax fraud. Updates to the W9 form may include enhanced security measures, such as improved verification processes or digital signatures, to deter fraudulent activity. This could involve incorporating features like two-factor authentication or requiring electronic signatures to validate the identity of the payer and payee.

- Compliance Improvements:The IRS may update the W9 form to enhance compliance and simplify reporting processes. For example, the form could be redesigned to improve clarity and reduce the potential for errors. The IRS might also explore options for pre-filling certain fields on the form based on data available in its systems, further streamlining the process for taxpayers.

Impact of W9 Form Changes

Updates to the W9 form can impact both payers and payees. Payers need to stay informed about any changes to the form to ensure they are collecting the correct information and reporting it accurately. Payees must also stay up-to-date to ensure their tax reporting complies with the latest requirements.

For example, if the IRS introduces a new electronic filing system for W9 forms, payers will need to adopt this system to collect and transmit the information electronically. Payees will need to adapt their systems and processes to comply with the new electronic filing requirements.

Staying Informed about W9 Form Updates

It is crucial for taxpayers to stay informed about any updates or changes to the W9 form. The IRS website is the primary source for information about tax forms and regulations. Taxpayers can subscribe to email alerts from the IRS to receive notifications about changes to forms or tax policies.

Additionally, consulting with a tax professional can help taxpayers understand the latest requirements and ensure their compliance.

14. W9 Form and Real-World Examples

The W9 form is a crucial document for tax compliance in various real-world scenarios. Understanding its purpose and proper completion can ensure accurate reporting and avoid potential penalties. This section explores how the W9 form is used in different situations and highlights its importance in tax compliance.

1. Freelance Writer Receiving Payment

In this scenario, a freelance writer provides content creation services to a small business. The business requires a W9 form to correctly report payments made to the writer for tax purposes.

- The writer would complete the W9 form, providing their name, address, Taxpayer Identification Number (TIN), and other relevant information.

- The business would then use the information from the W9 form to prepare tax forms, such as Form 1099-NEC, to report the payments made to the writer.

- The writer would then use the information from the 1099-NEC form to report their income on their own tax return.

- The writer can submit the W9 form to the business via mail, email, or online platforms depending on the business’s preferred method.

- Submitting an incomplete or inaccurate W9 form could result in delays in payment, incorrect tax reporting, and potential penalties from the IRS.

2. Renting a Property

When renting a property, the landlord requires a W9 form from the tenant to report rent payments made to the tenant for tax purposes.

- The landlord would use the W9 form to obtain the tenant’s name, address, and TIN to accurately report the rent payments on their tax return.

- The tenant would provide their name, address, and TIN on the W9 form.

- The landlord would then use the information from the W9 form to prepare Form 1099-MISC to report the rent payments to the tenant.

- The tenant would then use the information from the 1099-MISC form to report their income on their own tax return.

- This process ensures both the landlord and tenant comply with tax regulations by accurately reporting the rent payments.

3. Real-World Applications of the W9 Form

The W9 form has various applications beyond freelance writing and renting property. Here’s a table summarizing several real-world scenarios where the W9 form is used:| Scenario | Purpose of W9 Form | Information Required | Submission Method | |—|—|—|—|| Receiving payment for freelance work | To report payments made to the freelancer for tax purposes | Name, address, TIN, business name (if applicable) | Mail, email, online platforms || Renting property | To report rent payments made to the tenant for tax purposes | Name, address, TIN | Mail, email, online platforms || Selling items on an online marketplace | To report payments made to the seller for tax purposes | Name, address, TIN, business name (if applicable) | Online platform, mail, email || Participating in a paid survey | To report payments made to the survey participant for tax purposes | Name, address, TIN | Online platform, mail, email || Receiving a scholarship or grant | To report payments made to the recipient for tax purposes | Name, address, TIN | Mail, email, online platforms |

4. Case Studies on W9 Form Importance

- A freelance graphic designer failed to provide a W9 form to a client, resulting in the client not being able to accurately report the payments made to the designer. This led to the client receiving a penalty from the IRS for failing to report the income correctly.

The designer also faced potential penalties for failing to provide their tax information.

- A landlord did not obtain a W9 form from a tenant, leading to incorrect reporting of rent payments on the landlord’s tax return. The landlord was penalized by the IRS for inaccurate reporting. This also affected the tenant’s tax reporting, as they did not receive a 1099-MISC form to report their income.

- A small business owner failed to collect W9 forms from their contractors, resulting in inaccurate reporting of payments made to the contractors. The business owner faced penalties for failing to comply with tax reporting requirements. The contractors also faced potential penalties for not reporting their income correctly.

5. Importance of Obtaining W9 Forms for Small Businesses

Small business owners should understand the importance of obtaining W9 forms from their contractors and vendors.

- The W9 form provides the necessary information to accurately report payments made to contractors and vendors for tax purposes.

- This ensures tax compliance and avoids potential penalties from the IRS.

- Small business owners can collect W9 forms from contractors and vendors by requesting them directly, including them in contracts, or using online platforms.

- Failing to obtain a W9 form can lead to inaccurate tax reporting, potential penalties, and legal issues.

W9 Form and Legal Considerations

The W9 form plays a crucial role in the legal framework of tax reporting and compliance. It is essential to understand the legal implications of the W9 form and its relationship to tax law to ensure accurate reporting and avoid potential legal consequences.

Legal Implications of the W9 Form

The W9 form is a legal document that serves as a foundation for tax reporting and compliance. It enables the IRS to track and collect taxes from individuals and businesses. Failure to comply with W9 form requirements can result in legal consequences, including penalties and fines.

Legal Consequences of Non-Compliance

Non-compliance with W9 form requirements can have significant legal consequences.

- Penalties and Fines:The IRS can impose penalties for failing to provide a complete and accurate W9 form. These penalties can vary depending on the severity of the violation.

- Back Taxes and Interest:If a taxpayer fails to report income correctly due to inaccurate or incomplete W9 information, they may be liable for back taxes and interest.

- Criminal Charges:In some cases, intentional misrepresentation or fraudulent use of a W9 form can lead to criminal charges.

Resources for Understanding Legal Framework

Several resources can help you understand the legal framework surrounding the W9 form.

- IRS Publication 1220:This publication provides comprehensive guidance on the W9 form and its requirements.

- IRS Website:The IRS website offers a wealth of information on tax forms, including the W9 form, and related legal issues.

- Tax Professionals:Consulting with a tax professional can provide valuable insights and guidance on legal matters related to the W9 form.

Seeking Legal Advice

If you have complex legal questions related to the W9 form, seeking legal advice from a qualified tax attorney is highly recommended. A tax attorney can provide personalized guidance and ensure compliance with all applicable laws and regulations.

Closure

The W9 form is a cornerstone of tax compliance, ensuring accurate reporting and facilitating smooth financial transactions. By understanding the requirements, adhering to best practices, and staying informed about any updates, you can streamline the tax reporting process and avoid potential complications.

Remember, accuracy and timely submission are crucial, so consult this guide and utilize the provided resources to ensure your W9 forms are handled correctly.

FAQ Resource

What is the purpose of the W9 form?

The W9 form is used to provide the payer with your tax identification number (TIN), name, and address, allowing them to correctly report payments made to you on their tax returns and withhold the appropriate amount of taxes.

Who is required to complete a W9 form?

Individuals and entities who receive payments for services, rent, or other transactions from businesses or individuals are typically required to complete a W9 form.

What are the penalties for submitting an inaccurate or incomplete W9 form?

Penalties for inaccurate or incomplete W9 forms can include fines, interest, and potential audits. In some cases, the payer may be required to withhold additional taxes.

Where can I find the latest version of the W9 form?

The latest version of the W9 form is available on the IRS website. You can access it by searching for “W9 Form” on the IRS website.

What are some common errors to avoid when completing a W9 form?

Common errors include providing incorrect or incomplete information, using the wrong TIN, and failing to sign the form.