Tax Deadline 2024 is fast approaching, and it’s crucial to be prepared. Whether you’re an individual or a business, understanding the latest tax laws and filing requirements is essential to avoid penalties and ensure a smooth filing process.

This year, several tax law changes have been implemented, potentially affecting your tax liability. It’s important to stay informed about these changes and how they might impact your tax filing strategy. This guide will provide a comprehensive overview of the 2024 tax deadline, including key filing requirements, recent tax law changes, and helpful tips for navigating the tax season.

Contents List

- 1 Tax Deadline 2024 Overview

- 2 Filing Options and Methods

- 3 Key Tax Forms and Documents

- 4 Common Tax Filing Mistakes

- 5 Tax Extensions and Payment Options

- 6 Tax Assistance and Resources

- 7 9. Tax Planning for the Future

- 8 Tax Implications of Life Events: Tax Deadline 2024

- 9 Tax Audits and Disputes

- 10 Tax Reform and Future Trends

- 11 Last Word

- 12 FAQ Compilation

Tax Deadline 2024 Overview

The 2024 tax deadline is approaching, and it’s crucial to be prepared. This overview will provide you with essential information regarding the filing requirements and potential changes in tax laws.

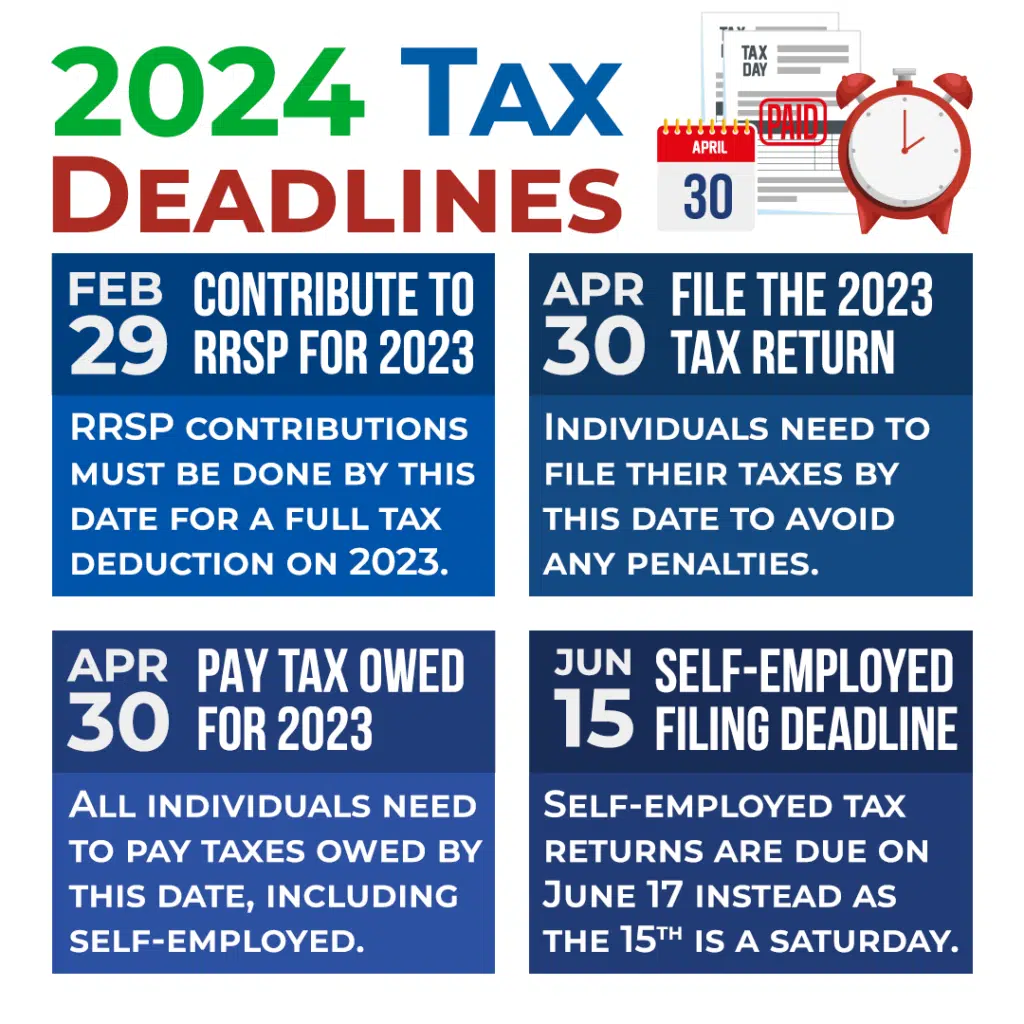

Mark your calendars! The 2024 Tax Deadline is approaching, so make sure you file your taxes on time to avoid any penalties.

Tax Deadline

The official tax deadline for filing federal income tax returns in 2024 is April 15, 2024. This date applies to most individuals and businesses. However, certain states may have different deadlines, and specific filers, such as partnerships and corporations, may have extended deadlines.

It’s important to check with the relevant authorities for specific state or filer-specific deadlines.

Tax Law Changes

While the 2024 tax deadline remains consistent, several tax law changes enacted in 2023 and early 2024 could significantly impact your filing requirements. Here are some key changes to consider:

- Increased Standard Deduction:The standard deduction for individuals and families has been increased for 2024. This could impact your taxable income and the amount of taxes you owe.

- Modified Child Tax Credit:The Child Tax Credit has been modified for 2024, with changes to eligibility criteria and the maximum amount of credit available. This could impact families with children.

- Changes to Capital Gains Tax Rates:The capital gains tax rates have been adjusted for 2024. This could affect your tax liability on the sale of assets, such as stocks or real estate.

Filing Requirements

The filing requirements for individuals and businesses in 2024 are Artikeld below.

Individuals

- Income Reporting:You are required to report all sources of income, including wages, salaries, interest, dividends, and self-employment income.

- Deductions:You can deduct eligible expenses, such as medical expenses, charitable contributions, and home mortgage interest.

- Credits:You may be eligible for tax credits, such as the Earned Income Tax Credit or the Child Tax Credit, which can reduce your tax liability.

- Forms to File:The most common tax form for individuals is Form 1040, which includes several schedules for reporting specific income and deductions.

Businesses

- Tax Forms:Different tax forms are required for corporations, partnerships, and sole proprietorships. For example, corporations typically file Form 1120, while partnerships file Form 1065.

- Estimated Payments:Businesses are generally required to make estimated tax payments throughout the year. These payments help avoid penalties for underpayment.

- Corporate Tax Rates:The corporate tax rates for 2024 remain unchanged. However, there are specific rules and deductions applicable to corporations.

- Reporting Requirements:Businesses must comply with various reporting requirements, including filing information returns for employees, contractors, and other stakeholders.

Filing Options and Methods

When it comes to filing your taxes, you have several options, each with its own advantages and disadvantages. Choosing the right method depends on your individual circumstances, including your comfort level with technology, budget, and the complexity of your tax situation.

E-filing

E-filing is the most popular method for filing taxes, offering convenience, speed, and accuracy. You can file your taxes online using tax software or through a tax preparation website.

Stay on top of your tax obligations by understanding the 2024 federal tax brackets. The 2024 Federal Tax Brackets guide provides a comprehensive overview of the current rates.

- Tax Software:Popular options include TurboTax, H&R Block, and TaxAct. These software programs guide you through the filing process, offer tax deductions and credits, and allow you to file electronically.

- Tax Preparation Websites:Websites like FreeTaxUSA and TaxSlayer offer free or low-cost filing options, particularly for simple tax situations. These websites often have basic features and may not offer the same level of support as tax software programs.

Advantages of E-filing

- Convenience:E-filing allows you to file your taxes from the comfort of your home, at your own pace.

- Speed:E-filed returns are typically processed much faster than paper returns, meaning you receive your refund quicker.

- Accuracy:Tax software and websites often have built-in error-checking features to help prevent mistakes.

- Security:E-filing is generally secure, as most reputable software programs and websites use encryption to protect your personal information.

Disadvantages of E-filing

- Cost:While some free options exist, most tax software programs and websites charge a fee, which can vary depending on the complexity of your return.

- Technical Issues:E-filing requires a computer and internet access, which can be a barrier for some individuals.

- Limited Support:While some software programs offer customer support, it may not be as comprehensive as in-person assistance.

Steps Involved in E-filing

- Choose a Tax Software or Website:Consider your budget, tax situation, and the level of support you require.

- Gather Necessary Documents:This includes your Social Security number, W-2 forms, 1099 forms, and any other relevant documentation.

- Enter Your Information:Carefully enter your personal and financial information into the software or website.

- Review and File:Review your return carefully for any errors before submitting it electronically.

Key Tax Forms and Documents

Understanding the required tax forms and documents is crucial for accurate and timely filing. Knowing which forms to use and the supporting documents needed ensures you meet all the requirements and avoid potential penalties.

Common Tax Forms

A variety of tax forms are used by individuals and businesses to report income, deductions, and credits. Here are some of the most common forms:

| Form | Description | Purpose |

|---|---|---|

| Form 1040 | U.S. Individual Income Tax Return | Used by individuals to report their income, deductions, and credits and calculate their tax liability. |

| Form W-2 | Wage and Tax Statement | Issued by employers to employees, reporting wages, salaries, and withholdings for the year. |

| Form 1099-NEC | Nonemployee Compensation | Used to report payments made to independent contractors and other non-employees for services rendered. |

| Form 1099-INT | Interest Income | Reports interest income earned from sources such as savings accounts, bonds, and certificates of deposit. |

| Form 1099-DIV | Dividend Income | Reports dividends received from stocks and mutual funds. |

| Form 1040-SR | U.S. Tax Form for Seniors | Simplified version of Form 1040 designed for taxpayers aged 65 or older. |

| Form 1040-EZ | U.S. Individual Income Tax Return (EZ) | Simplified version of Form 1040 for taxpayers with simple income situations. |

Essential Documents

Along with the tax forms, several documents are needed to complete your tax return accurately. These documents provide the necessary information to calculate your income, deductions, and credits.

- W-2 Forms:Issued by employers, these forms report wages, salaries, and withholdings for the tax year. You should receive a W-2 for each employer you worked for during the year.

- 1099 Forms:These forms report income from sources other than employment, such as interest, dividends, and payments to independent contractors. There are various 1099 forms, depending on the type of income.

- Tax Receipts:Keep all receipts for deductible expenses, such as medical expenses, charitable donations, and home office expenses. These receipts provide documentation for claiming these deductions on your tax return.

- Other Supporting Documents:Depending on your specific situation, you may need additional documents, such as mortgage interest statements, property tax statements, or student loan interest statements.

Resources for Tax Forms and Information

The IRS website and state tax agency websites are valuable resources for obtaining tax forms and information.

- IRS Website:The IRS website (www.irs.gov) provides access to a wide range of tax forms, publications, and other resources. You can download tax forms, view instructions, and find answers to frequently asked questions.

- State Tax Agency Websites:Each state has its own tax agency website, which provides information on state income taxes, forms, and deadlines. For example, the California Franchise Tax Board website (www.ftb.ca.gov) offers resources for California taxpayers.

Common Tax Filing Mistakes

Even the most diligent taxpayers can make mistakes when filing their taxes. These errors can lead to delays, penalties, and even audits. Here’s a breakdown of some common tax filing mistakes and how to avoid them.

Recent news about Geico has been concerning for some employees. The Geico Layoffs 2024 article provides insights into the current situation and potential impacts.

Incorrect Income Reporting

It’s crucial to report all income accurately, including wages, salaries, tips, interest, dividends, and capital gains.

- Missing Income Sources:Make sure you’ve included all income sources, including those from freelance work, side hustles, or investments. Even small amounts of income should be reported.

- Incorrectly Reporting Income:Ensure you’re using the right forms and reporting income in the correct categories. For instance, if you’re a freelancer, you might need to use Schedule C to report your self-employment income.

- Failing to Report All Tips:If you received tips, you must report them on your tax return. This includes tips from waitressing, bartending, or any other service industry job.

To avoid these mistakes, keep detailed records of all your income throughout the year, including pay stubs, invoices, and investment statements. Carefully review your tax forms and consult with a tax professional if you’re unsure about any income reporting requirements.

Missing Deductions and Credits

Tax deductions and credits can reduce your tax liability, but many taxpayers miss out on these valuable benefits.

Maximize your retirement savings by contributing the maximum amount allowed. The 401k Contribution Limits 2024 article provides the latest information on contribution limits.

- Not Claiming All Eligible Deductions:Familiarize yourself with common deductions, such as the standard deduction, itemized deductions (like mortgage interest or charitable contributions), and deductions for business expenses. You may be eligible for deductions you’re not aware of.

- Missing Out on Tax Credits:Tax credits directly reduce the amount of taxes you owe. Research available tax credits, like the Earned Income Tax Credit (EITC) or the Child Tax Credit, to see if you qualify.

Organize your receipts, documents, and tax forms to identify all potential deductions and credits. Consider using tax preparation software or consulting a tax professional to help you find all eligible deductions and credits.

Looking for the best credit cards available in 2024? The Best Credit Cards 2024 list features a variety of options, from travel rewards to cash back, to help you find the perfect fit.

Inaccurate Calculations

Mathematical errors can lead to incorrect tax liabilities, resulting in underpayment or overpayment.

- Mistakes in Calculating Income:Double-check your income calculations to ensure they’re accurate. Mistakes can occur when adding up various income sources, such as wages, interest, and dividends.

- Incorrectly Calculating Deductions and Credits:Use the correct formulas and guidelines when calculating deductions and credits. For instance, if you’re claiming the standard deduction, make sure you’re using the correct amount based on your filing status.

- Errors in Calculating Tax Liability:Carefully review your tax calculations to avoid errors in determining your tax liability. Use tax preparation software or a tax professional to help with these calculations, especially if you have complex financial situations.

Review your tax return carefully before filing. Use a tax calculator or seek assistance from a tax professional to ensure your calculations are accurate.

Failing to File on Time

The IRS has specific deadlines for filing taxes. Failing to meet these deadlines can result in penalties.

- Missing the Filing Deadline:The tax filing deadline is typically April 15th. If you miss the deadline, you may face penalties. There are extensions available, but you still need to file your return by the extended deadline to avoid penalties.

- Not Filing an Extension:If you need more time to file your taxes, you can request an extension. However, remember that an extension only gives you more time to file, not more time to pay. You still need to pay any taxes owed by the original deadline.

Mark the tax deadline on your calendar and plan ahead to avoid last-minute rush. If you need more time, file for an extension well before the deadline.

Not Keeping Adequate Records

Maintaining accurate and organized records is crucial for accurate tax filing.

- Missing or Incomplete Records:Keep detailed records of all your income, expenses, deductions, and credits. This includes pay stubs, receipts, invoices, bank statements, and investment statements.

- Disorganized Records:Organize your records in a system that’s easy to access and maintain. Consider using a filing system, digital folders, or tax preparation software.

Organize your records throughout the year, not just during tax season. Keep records for at least three years to ensure you can support your tax return if you’re audited.

Consequences of Filing Inaccurate Tax Returns

Filing inaccurate tax returns can lead to various consequences, including:

- Penalties:The IRS can impose penalties for late filing, underpayment, or inaccurate reporting. These penalties can be significant, depending on the severity of the error and the taxpayer’s circumstances.

- Interest Charges:If you owe taxes and don’t pay them on time, you’ll be charged interest on the unpaid amount. Interest rates can vary, but they can add up quickly.

- Audits:An inaccurate tax return can increase your chances of being audited. An audit involves the IRS reviewing your tax records and may lead to adjustments to your tax liability.

It’s essential to take the time to file your taxes accurately and avoid these potential consequences. Seek professional advice if you’re unsure about any aspect of your tax return.

If you’re considering a Roth IRA, make sure you’re aware of the contribution limits for 2024. The Roth IRA Limits 2024 article provides a comprehensive overview of the current rules and regulations.

Tax Extensions and Payment Options

Sometimes, you might need more time to file your taxes or pay what you owe. The IRS offers options to help, including extensions and various payment methods.

Tax Extensions

Tax extensions provide additional time to file your tax return, but not to pay your taxes. If you need more time to gather the necessary information or complete your tax return, you can request an extension using Form 4868, Application for Automatic Extension of Time to File U.S.

Individual Income Tax Return. The deadline for requesting an extension is typically the same as the original tax filing deadline, which is April 15th for most taxpayers. However, if the 15th falls on a weekend or holiday, the deadline is extended to the next business day.

You can request an extension online, by mail, or by fax.

Payment Options

The IRS offers several payment options for taxes, including:* Direct Debit:You can set up direct debit from your bank account through the IRS website or through your tax preparation software.

Credit Card

Tennis fans, get ready for the exciting Erste Bank Open! Check out the Erste Bank Open 2024 page for all the latest news, schedules, and player updates.

You can pay your taxes using a credit card through third-party payment processors.

Debit Card

Want to estimate your tax liability for 2024? Use the Tax Calculator 2024 to get a personalized estimate based on your income and deductions.

You can pay your taxes using a debit card through the IRS website or through your tax preparation software.

Check or Money Order

You can send a check or money order payable to the U.S. Treasury.

Cash

You can pay your taxes in cash at one of the IRS’s authorized payment locations.

It’s important to stay informed about tax changes, especially when it comes to tax brackets. The Tax Brackets 2024 article provides a detailed breakdown of the current income tax rates.

Installment Agreement

If you cannot afford to pay your taxes in full, you can request an installment agreement. This allows you to pay your taxes in monthly installments.

Note that payment options may have fees associated with them.

Penalties for Late Filing or Late Payment

If you file your taxes late, you may be subject to penalties. The penalty for late filing is typically 5% of the unpaid taxes for each month or part of a month that your return is late.

The penalty for late payment is 0.5% of the unpaid taxes for each month or part of a month that the taxes are late.

The penalty for late filing and late payment can be reduced or waived if you have a reasonable cause for the delay.

Tax Assistance and Resources

Navigating the complexities of tax filing can be challenging, even for experienced taxpayers. Fortunately, various resources are available to assist individuals and families in understanding their tax obligations and ensuring accurate filing.

IRS Website and Publications

The IRS website, IRS.gov, is an invaluable resource for taxpayers. It provides access to a wealth of information, including:

- Tax forms and instructions

- Tax publications and guides

- Tax law updates and changes

- Tools and calculators for estimating tax liability

- Contact information for IRS offices and customer service

Tax Preparation Services

Tax preparation services offer professional assistance in completing tax returns. These services can range from basic assistance with simple returns to comprehensive guidance for complex financial situations.

- Tax Preparers:These individuals are typically trained in tax preparation and can assist with various aspects of tax filing, including gathering necessary documents, completing forms, and filing electronically.

- Enrolled Agents (EAs):EAs are licensed by the IRS to represent taxpayers before the agency. They have expertise in tax law and can provide comprehensive tax advice and assistance.

- Certified Public Accountants (CPAs):CPAs are licensed professionals who specialize in accounting and financial matters. They can provide tax preparation services, financial planning advice, and representation before the IRS.

- Tax Attorneys:Tax attorneys are legal professionals who specialize in tax law. They can provide legal advice on tax matters, represent taxpayers in audits, and assist with tax litigation.

Free Tax Preparation Programs

For low-income individuals and families, several free tax preparation programs are available. These programs are often run by community organizations, non-profits, or government agencies.

It’s crucial to understand the contribution limits for your 401k plan. The 401k Limits 2024 guide provides detailed information on the maximum amount you can contribute this year.

- Volunteer Income Tax Assistance (VITA):VITA is a free tax preparation program offered by IRS-certified volunteers. This program is available to low- and moderate-income taxpayers, particularly those who are elderly, disabled, or speak limited English.

- Tax Counseling for the Elderly (TCE):TCE is a free tax preparation program specifically for taxpayers age 60 and older. The program is run by IRS-certified volunteers who are trained to provide specialized tax advice to seniors.

- AARP Foundation Tax-Aide:AARP Foundation Tax-Aide is a free tax preparation program offered by the AARP Foundation. This program is available to taxpayers of all ages, with a focus on low- and moderate-income individuals and families.

9. Tax Planning for the Future

Proactive tax planning is essential for maximizing your financial well-being and minimizing your tax burden over the long term. By strategically managing your income, investments, and retirement savings, you can potentially save thousands of dollars in taxes throughout your life.

Amex Member Week is back! Discover exclusive offers and deals for Amex cardholders. Check out the Amex Member Week 2024 page for all the details.

Understanding Your Tax Situation

Understanding your current tax situation is crucial for developing an effective tax plan. This involves analyzing your income, expenses, and investment portfolio to determine your current tax bracket and potential tax liabilities. A detailed breakdown of your income sources, deductions, and credits can help you identify areas where you might be able to reduce your tax burden.

Retirement Planning

Retirement planning is an integral part of tax planning, as it involves making decisions that can significantly impact your future tax obligations. There are several retirement savings options available, each with its own tax implications.

- Traditional IRA: Pre-tax contributions to a traditional IRA are tax-deductible, reducing your current tax liability. However, you will be taxed on your withdrawals in retirement.

- Roth IRA: Roth IRA contributions are made with after-tax dollars, meaning you won’t receive a tax deduction at the time of contribution. However, qualified withdrawals in retirement are tax-free.

- 401(k): Employer-sponsored retirement plans allow you to contribute pre-tax dollars, which reduces your current taxable income. The earnings in your 401(k) grow tax-deferred, and you will be taxed on your withdrawals in retirement.

Investment Strategies

Strategic investment planning can help you minimize your tax burden while growing your wealth.

- Tax-advantaged accounts, such as 529 plans and Health Savings Accounts (HSAs), offer tax benefits that can reduce your overall tax liability.

- Different investment vehicles, such as stocks, bonds, and real estate, have varying tax implications. Understanding these implications can help you make informed investment decisions.

Income Management

Managing your income throughout your career is essential for minimizing your future tax obligations.

- Structuring your income to take advantage of tax deductions and credits can significantly reduce your tax liability.

- Different types of income, such as wages, salaries, dividends, and capital gains, are taxed differently. Understanding these tax implications can help you make informed financial decisions.

Staying Informed, Tax Deadline 2024

Staying informed about tax changes and updates is essential for ensuring you are taking advantage of all available tax deductions and credits.

- Reliable sources of tax information include the IRS website, reputable financial publications, and tax professionals.

Additional Considerations

Tax planning extends beyond income and investments.

- Estate planning, including wills, trusts, and inheritances, has significant tax implications.

- Preparing for potential tax audits and minimizing your risk of penalties is essential for protecting your financial well-being.

Tax Implications of Life Events: Tax Deadline 2024

Life events can significantly impact your tax obligations and financial planning. Whether you’re getting married, starting a family, or entering retirement, understanding the tax implications of these events can help you make informed decisions and potentially save money.

If you’re self-employed or have other retirement savings, make sure you’re aware of the contribution limits for 2024. The Ira Limits 2024 article provides the latest information.

Marriage

Marriage can bring about various tax changes, both positive and negative. It’s essential to consider these changes when filing your taxes as a married couple.

Planning for retirement? Find out how much you can contribute to your 401k in 2024 with the Max 401k Contribution 2024 guide. This information will help you maximize your savings and reach your financial goals.

- Filing Status:You’ll need to choose a new filing status, such as “married filing jointly” or “married filing separately,” which can affect your tax bracket and deductions.

- Standard Deduction:The standard deduction for married couples is higher than for single filers, potentially resulting in lower taxes.

- Tax Credits:Some tax credits, such as the Child Tax Credit, are available to married couples, while others may be restricted based on income thresholds.

- Deductions:You may be able to claim deductions for medical expenses, charitable contributions, and other expenses that are higher for married couples.

- Retirement Planning:You may need to adjust your retirement planning strategies as a married couple, considering factors such as spousal benefits and estate planning.

Divorce

Divorce can also significantly impact your tax obligations. Understanding the tax implications of divorce can help you navigate this complex process.

- Filing Status:You’ll need to choose a new filing status, such as “single” or “head of household,” which can affect your tax bracket and deductions.

- Alimony Payments:Alimony payments are generally deductible by the payer and taxable to the recipient. This can impact your tax liability and income.

- Child Tax Credit:The custodial parent typically claims the Child Tax Credit, but this can be shared or divided based on custody arrangements.

- Property Division:The division of assets during a divorce can impact your tax liability. Capital gains or losses may be realized, depending on the type of assets and their value.

- Retirement Accounts:You may need to adjust your retirement planning strategies following a divorce, considering factors such as rollovers and distributions.

Childbirth

The arrival of a new child can bring about significant tax changes and financial planning adjustments.

- Child Tax Credit:You may be eligible for the Child Tax Credit, which provides a tax credit for each qualifying child. This credit can reduce your tax liability.

- Dependent Care Credit:If you pay for childcare expenses, you may be eligible for the Dependent Care Credit, which can help offset the cost of childcare.

- Other Deductions:You may be able to claim deductions for medical expenses related to childbirth, such as hospital bills and doctor visits.

- Retirement Savings:You may need to adjust your retirement planning strategies to account for the financial needs of your child.

- Education Savings:You may consider opening a 529 plan to save for your child’s future education expenses.

Retirement

Retirement is a significant life event that brings about various tax implications. Understanding these implications can help you make informed decisions about your finances and retirement planning.

- Income Tax:Your retirement income, such as Social Security benefits and distributions from retirement accounts, may be subject to income tax.

- Tax Deductions:You may be eligible for tax deductions for medical expenses, charitable contributions, and other expenses related to retirement.

- Tax Credits:You may be eligible for tax credits, such as the Retirement Savings Contributions Credit, which can help offset the cost of saving for retirement.

- Estate Planning:It’s essential to consider estate planning in retirement, including the tax implications of transferring assets to heirs.

- Tax-Advantaged Accounts:You may need to adjust your retirement savings strategies to take advantage of tax-advantaged accounts, such as Roth IRAs and traditional IRAs.

Tax Audits and Disputes

Tax audits are a reality for many taxpayers, and understanding the process can help you navigate it effectively. This section will guide you through the intricacies of tax audits, from understanding different audit types to resolving disputes and appealing findings.

Understanding the federal tax brackets is essential for financial planning. The 2024 Income Tax Brackets guide provides a clear overview of the current rates.

Understanding Tax Audits

The IRS conducts tax audits to ensure taxpayers are accurately reporting their income and paying the correct amount of taxes. Audits can range from simple correspondence reviews to in-depth field examinations.

- Correspondence Audit:This is the most common type of audit, conducted via mail. The IRS will typically request specific documentation to verify a particular item on your tax return.

- Office Audit:This type of audit requires you to visit an IRS office to discuss your tax return with an auditor. You will need to bring supporting documentation to support your claims.

- Field Audit:This is the most extensive type of audit, involving an IRS agent visiting your home or business to examine your records and financial transactions.

The steps involved in a typical tax audit are as follows:

- Initial Contact:The IRS will send you a notification letter outlining the reason for the audit and the specific items under review.

- Document Requests:The IRS will request supporting documentation to verify the information on your tax return. This may include bank statements, receipts, invoices, and other relevant records.

- Interview Process:You may be required to meet with an IRS auditor to discuss your tax return and provide further clarification. It is crucial to be prepared and have all necessary documentation readily available.

- Final Determination:After reviewing your documentation and completing the interview process, the IRS will issue a notice of determination, which Artikels the audit findings and any proposed adjustments to your tax liability.

Several factors can trigger an IRS audit. Some common reasons include:

- Discrepancies in Tax Returns:Inconsistent information between your tax return and other IRS records can raise red flags.

- Unusual Deductions:Claims for unusual or questionable deductions may prompt an audit. It is essential to ensure all deductions are legitimate and supported by proper documentation.

- High-Income Earners:Taxpayers with high incomes are more likely to be audited, as the IRS may want to verify the accuracy of their reporting.

- Random Selection:The IRS conducts random audits to ensure compliance across all income levels.

| Audit Triggers | Examples |

|---|---|

| Discrepancies in Tax Returns | Reporting different income amounts on your tax return compared to your W-2 or 1099 forms. |

| Unusual Deductions | Claiming a home office deduction without meeting all IRS requirements. |

| High-Income Earners | Individuals earning over $200,000 in annual income. |

| Random Selection | The IRS selects a random sample of tax returns for audit each year. |

Taxpayer Rights During an Audit

As a taxpayer, you have certain rights during an audit. Understanding these rights is essential for protecting your interests and ensuring a fair process.

- Right to Representation:You have the right to be represented by a tax professional, such as an attorney, certified public accountant (CPA), or enrolled agent (EA), during an audit. They can assist you in understanding the audit process, negotiating with the IRS, and protecting your rights.

- Right to Appeal:If you disagree with the IRS’s audit findings, you have the right to appeal the decision. You can appeal to the IRS’s Office of Appeals or file a case in the U.S. Tax Court.

- Right to Privacy:The IRS is required to protect your privacy and confidentiality during an audit. They cannot disclose information about your tax return to unauthorized individuals.

Effective communication with the IRS is crucial during an audit. Be polite and respectful, but also assertive in defending your position. It is essential to keep accurate records and documentation to support your claims.

Preparing for a Tax Audit

Being prepared for a tax audit can significantly reduce stress and improve your chances of a favorable outcome. Here’s a step-by-step guide to help you prepare:

- Gather Necessary Documents:Assemble all relevant documentation, including bank statements, receipts, invoices, W-2 forms, 1099 forms, and any other supporting documents that relate to the items under review.

- Understand the Audit Process:Familiarize yourself with the different types of audits, the steps involved, and your rights as a taxpayer. You can find comprehensive information on the IRS website or consult with a tax professional.

- Choose a Tax Professional:If you are not comfortable handling the audit yourself, consider hiring a tax professional to represent you. They can provide expert guidance and ensure your rights are protected.

Here is a checklist of documents you should have readily available for an audit:

- Tax returns for the years under review

- W-2 forms and 1099 forms

- Bank statements and credit card statements

- Receipts and invoices for expenses and deductions

- Business records, if applicable

- Any other documentation relevant to your tax return

If you receive an initial audit notification from the IRS, here is a sample script you can use to respond:

“Dear IRS,Thank you for your letter regarding the audit of my tax return for [year]. I am aware of the audit and am prepared to cooperate fully. I have already begun gathering the necessary documentation to support my tax return.I would like to request a meeting with an auditor to discuss the audit process and the items under review. Please let me know your availability for a meeting.Sincerely,[Your Name]”

Resolving Tax Disputes and Appeals

If you disagree with the IRS’s audit findings, you have several options for resolving the dispute:

- Negotiation:You can attempt to negotiate with the IRS auditor to reach a mutually acceptable resolution.

- Settlement:The IRS may offer a settlement, which is a compromise that reduces your tax liability. However, you may need to make concessions to reach a settlement.

- Litigation:If you cannot reach a resolution through negotiation or settlement, you can file a case in the U.S. Tax Court.

If you decide to appeal the audit findings, you must follow the IRS’s appeal process. This involves filing a formal appeal within a specific timeframe and providing supporting documentation. There are three levels of appeal:

- Appeals Officer:This is the first level of appeal, where you can present your case to an IRS appeals officer.

- Appeals Conference:If you are not satisfied with the appeals officer’s decision, you can request an appeals conference. This involves a meeting with a higher-level appeals official.

- U.S. Tax Court:If you are still not satisfied with the IRS’s decision, you can file a case in the U.S. Tax Court. This is a formal legal proceeding where a judge will hear your case and issue a ruling.

The IRS’s Office of Appeals plays a critical role in resolving tax disputes. It is an independent organization within the IRS that reviews audit findings and attempts to reach a fair resolution. The Office of Appeals has the authority to settle disputes without going to court.The difference between an appeal and a tax court case is that an appeal is a review of the IRS’s decision, while a tax court case is a formal legal proceeding.

Appeals are typically less formal and can be resolved more quickly than tax court cases.

Tax Reform and Future Trends

Tax reform is a constant process, driven by evolving economic landscapes, technological advancements, and societal priorities. Governments worldwide are continually assessing and adjusting their tax systems to address these changes, aiming to create a more efficient, equitable, and sustainable tax environment.

This section delves into the current state of tax reform, explores emerging trends, and predicts future developments in tax legislation and policy.

Current Tax Reforms

Tax reforms aim to simplify tax systems, improve fairness, boost economic growth, and address specific societal needs. Recent tax reforms in various countries have focused on areas like corporate tax rates, individual income tax brackets, and tax incentives for specific industries.

- Analyzing recent tax reform legislation: For instance, the Tax Cuts and Jobs Act (TCJA) of 2017 in the United States lowered corporate tax rates from 35% to 21%, reduced individual income tax rates, and made changes to the deductibility of certain expenses. This reform aimed to stimulate economic growth by encouraging businesses to invest and create jobs.

Similarly, the Goods and Services Tax (GST) introduced in India in 2017 simplified the tax system by replacing multiple indirect taxes with a single nationwide tax. This reform aimed to improve tax compliance and reduce tax evasion.

- Comparing and contrasting tax reform proposals: Comparing the tax reform proposals in different countries reveals varying approaches to achieving desired outcomes. For example, the tax reform proposals in France and Germany have focused on increasing taxes on high-income earners and corporations to fund social welfare programs, while the tax reform proposals in the United States have focused on reducing taxes for businesses and individuals to stimulate economic growth.

- Impact of tax reforms on small businesses: Tax reforms can have a significant impact on small businesses, affecting their profitability and investment decisions. For example, the TCJA in the United States provided tax breaks for small businesses, including a lower corporate tax rate and increased expensing deductions.

However, the reform also eliminated certain deductions that were previously available to small businesses, which could potentially offset some of the benefits.

Proposed Tax Reforms

Tax reform proposals are often driven by the need to address emerging economic and social challenges. These proposals often focus on specific areas, such as environmental sustainability, the digital economy, or wealth inequality.

- Tax reforms related to carbon emissions: Several countries have proposed carbon taxes or emissions trading schemes to incentivize businesses and individuals to reduce their carbon footprint. For instance, the European Union’s Emissions Trading System (EU ETS) puts a price on carbon emissions from power plants and industrial facilities, creating a market for carbon allowances that can be traded among companies.

- Tax reforms related to the digital economy: The rise of the digital economy has presented challenges for traditional tax systems, as multinational corporations can shift profits to low-tax jurisdictions. Proposed tax reforms related to the digital economy aim to ensure that these companies pay their fair share of taxes.

For example, the Organisation for Economic Co-operation and Development (OECD) has proposed a global minimum corporate tax rate to prevent tax avoidance by multinational corporations.

- Feasibility and drawbacks of implementing specific tax reform proposals: Implementing certain tax reform proposals, such as a wealth tax or a carbon tax, can face challenges in terms of feasibility and potential drawbacks. For example, a wealth tax could discourage investment and economic growth, while a carbon tax could disproportionately impact low-income households.

Emerging Trends in Tax Legislation and Policy

The tax landscape is constantly evolving, influenced by technological advancements, globalization, and changing societal priorities. Emerging trends in tax legislation and policy are shaping the future of tax systems.

Need to track your mileage for business purposes? The 2024 Mileage Rate has been updated, so check out the latest information to ensure you’re claiming the correct deductions.

- Tax avoidance by multinational corporations: The growing trend of tax avoidance by multinational corporations has raised concerns about fairness and equity in the global tax system. Governments are working together to combat tax avoidance through initiatives like the OECD’s Base Erosion and Profit Shifting (BEPS) project, which aims to close loopholes that allow corporations to shift profits to low-tax jurisdictions.

- Use of AI in tax audits: Artificial intelligence (AI) is increasingly being used by tax authorities to automate tasks, detect fraud, and improve tax compliance. For example, AI can analyze large datasets of taxpayer information to identify potential tax evasion or errors.

- International cooperation in combating tax evasion: International cooperation is crucial to combating tax evasion and promoting a more equitable global tax system. The OECD and other international organizations are working to share information and coordinate tax policies to prevent tax avoidance and promote transparency.

- Impact of technological advancements on tax regulations: Technological advancements, such as blockchain and cryptocurrency, are presenting new challenges and opportunities for tax regulations and compliance. For example, blockchain technology can potentially improve the transparency and security of tax records, while cryptocurrency transactions require new regulations to address tax compliance issues.

Predictions about the Future of Tax Filing and Tax Regulations

The future of tax filing and tax regulations is likely to be shaped by the increasing adoption of online platforms and digital technologies.

- Future of tax filing methods: Tax filing is expected to become increasingly digital, with more taxpayers using online platforms to file their taxes. This trend is likely to continue as technology improves and more people become comfortable using digital services.

- Impact of automation and artificial intelligence on tax regulations: Automation and artificial intelligence (AI) are likely to have a significant impact on tax regulations and compliance in the future. For example, AI-powered tax software can help taxpayers file their taxes more efficiently and accurately, while AI-powered audit systems can help tax authorities detect fraud and improve compliance.

- Challenges and opportunities for tax authorities: Tax authorities face challenges and opportunities in adapting to a rapidly changing technological landscape. They need to invest in new technologies and develop new strategies to ensure that they can effectively administer tax systems in the digital age.

Last Word

Filing your taxes on time and accurately is crucial to avoid penalties and ensure compliance with tax regulations. With a clear understanding of the tax deadline, filing requirements, and available deductions and credits, you can approach tax season with confidence.

Remember, seeking professional advice from a qualified tax professional can provide valuable guidance and ensure you maximize your tax benefits.

FAQ Compilation

What is the tax deadline for 2024?

The official tax deadline for filing federal income tax returns in 2024 is April 15th. However, this deadline may vary for certain states or specific types of filers. It’s important to consult the IRS website or your state tax agency for the most up-to-date information.

What if I can’t file my taxes by the deadline?

You can request a tax extension, which will give you additional time to file your return. However, it’s important to note that an extension only extends the filing deadline, not the payment deadline. You’ll still need to pay any taxes owed by the original deadline.

Where can I find the necessary tax forms?

You can find tax forms and publications on the IRS website, or you can obtain them from your local IRS office. You can also access these forms through tax preparation software or through your tax professional.