What are the new tax brackets for 2024? Understanding these brackets is crucial for navigating the complexities of the US tax system. This article will analyze the updated tax brackets for 2024, providing insights into how they might impact taxpayers in different income ranges.

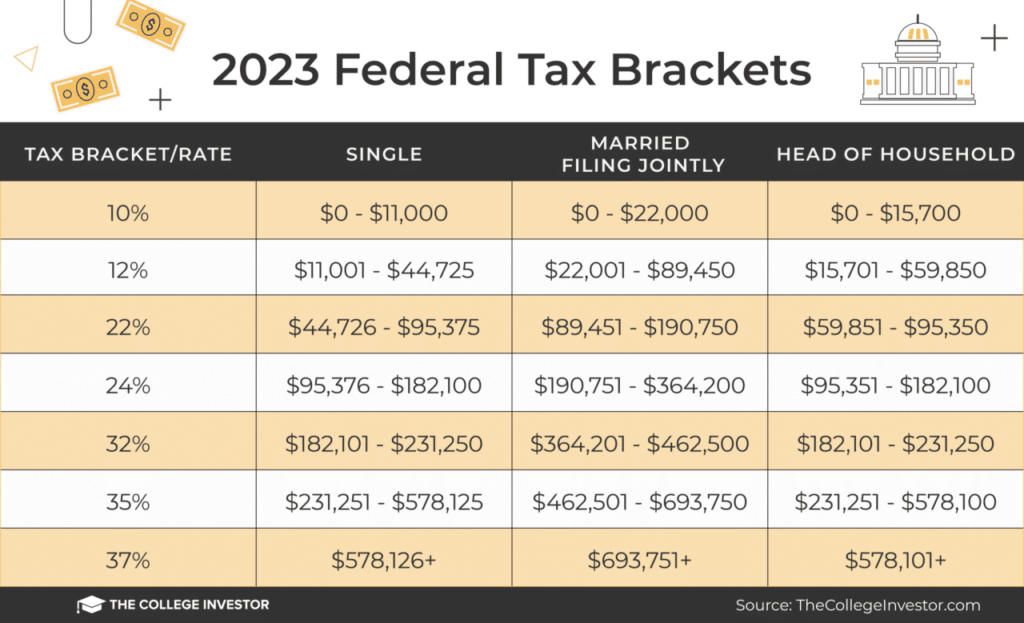

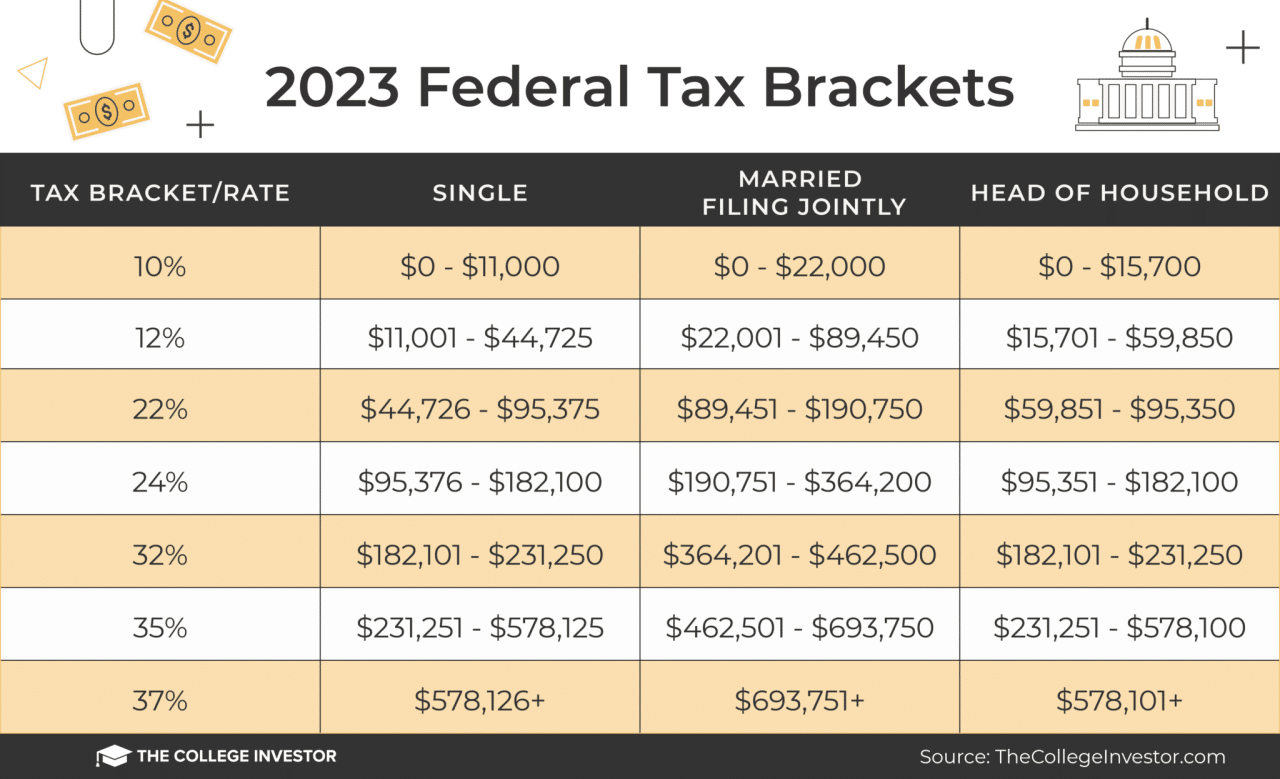

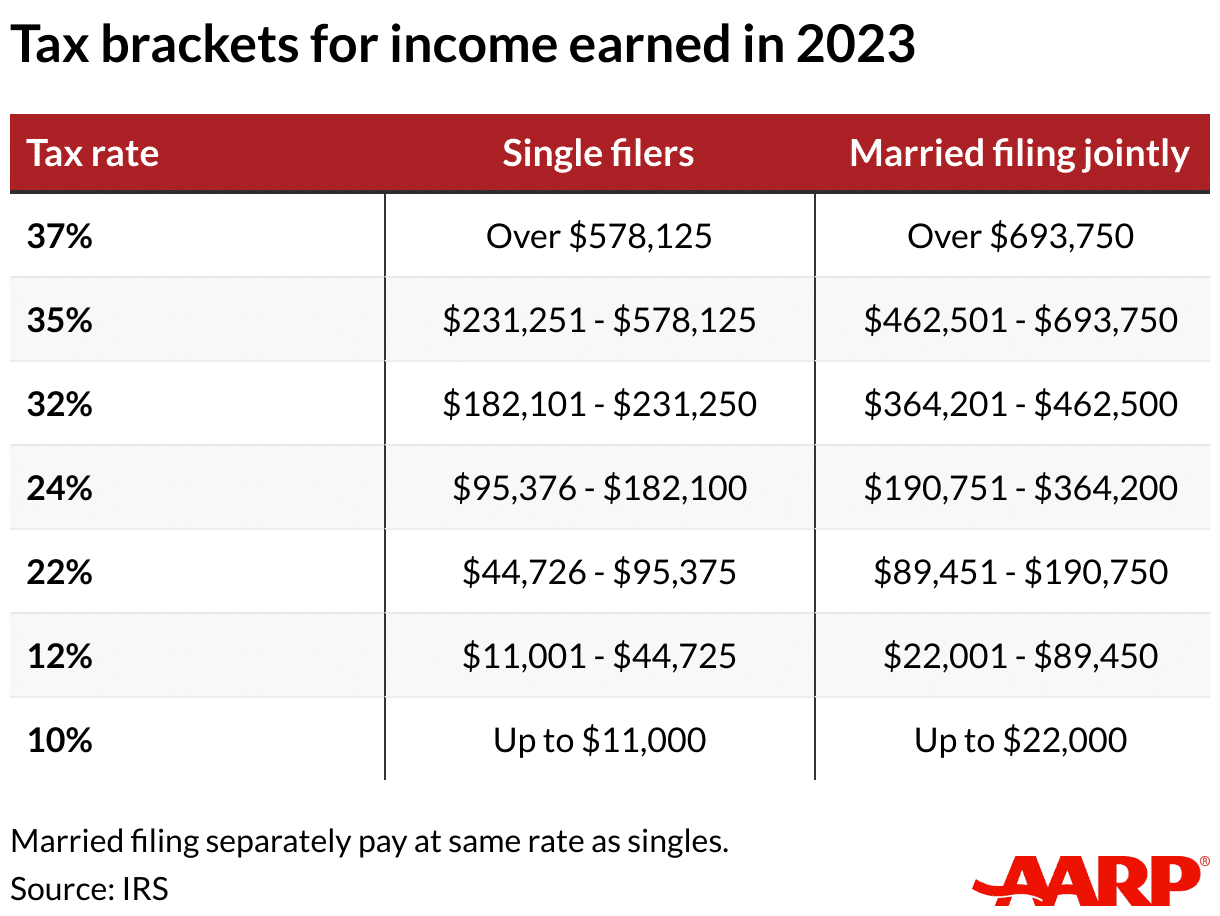

The US tax system relies on a progressive tax structure, where individuals pay a higher percentage of their income in taxes as their income increases. This system is divided into various tax brackets, each with a specific tax rate.

The new tax brackets for 2024 are expected to reflect adjustments to the tax code, potentially impacting taxpayers in various ways.

Contents List

2024 Tax Brackets Overview

The Internal Revenue Service (IRS) adjusts tax brackets annually to account for inflation. These adjustments are based on the Consumer Price Index (CPI), which measures the average change in prices paid by urban consumers for a basket of consumer goods and services.

The Seahawks came up short in a close game, but they still showed a lot of fight. Get the full breakdown in the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss article.

The 2024 tax brackets reflect these adjustments and will impact the amount of federal income tax you owe.

Want to hear what the Miami Dolphins had to say after their game? The Miami Dolphins Postgame Quotes 10/6 article has you covered.

2024 Tax Brackets

The 2024 tax brackets for single filers are Artikeld below.

Michigan football had a big win over Washington, and there’s a lot to take away from the game. Check out the Michigan football: What we learned vs. Washington: ‘Don’t let this article for a deeper analysis.

| Tax Bracket | Income Range | Tax Rate | Example Calculation |

|---|---|---|---|

| 10% | $0

An earthquake struck early in the morning in Ontario, shaking parts of Southern California. For more details about the event, check out the Early morning Ontario earthquake shakes parts of Southern California article.

|

10% | $5,000 x 10% = $500 |

| 12% | $10,951

The Jets fell short in their game against the Vikings, despite a valiant effort. Read the Jets-Vikings Game Recap | Green & White Fall Short in London article for a full recap.

|

12% | $20,000 x 12% = $2,400 |

| 22% | $46,276

The Chicago Bears are starting to find their groove, improving to 3-2 after a dominant win over the Carolina Panthers. You can read all about it in the Rapid Recap: Bears improve to 3-2 with rout of Panthers article.

|

22% | $50,000 x 22% = $11,000 |

| 24% | $101,751

The Cardinals pulled off a stunning upset against the 49ers, showcasing their resilience and determination. If you missed the action, check out the Cardinals vs. 49ers highlights, analysis: Arizona rallies to stun S.F. article for a recap.

|

24% | $75,000 x 24% = $18,000 |

| 32% | $192,151

The Jaguars pulled off a thrilling victory against the Colts, with a final score of 37-34. For a complete recap of the game, check out the Game Report, 2024 Week 5: Jaguars 37, Colts 34 article.

|

32% | $150,000 x 32% = $48,000 |

| 35% | $578,126

The Cowboys are taking on the Steelers, and you won’t want to miss a minute of the action. Get all the live updates and information on how to watch in the Cowboys vs. Steelers score today: Live updates, how to watch article.

|

35% | $300,000 x 35% = $105,000 |

| 37% | $1,000,001+ | 37% | $500,000 x 37% = $185,000 |

Note: These are just examples and your actual tax liability will depend on your individual circumstances, such as deductions and credits.

The Giants defeated the Seahawks in a hard-fought victory. Get the inside scoop on the game with the Instant Analysis: Giants defeat Seahawks, 29-20 article.

Considerations for Tax Planning: What Are The New Tax Brackets For 2024?

The 2024 tax brackets are designed to help taxpayers manage their tax liability. The new tax brackets, along with other tax changes, may present opportunities for individuals and businesses to adjust their financial planning strategies to potentially minimize their tax burden.

The world is mourning the loss of TikTok star Taylor Rousseau Grigg. You can read more about her life and legacy in the TikTok star Taylor Rousseau Grigg dead at 25 article.

Strategies for Optimizing Tax Liability

Taxpayers can explore various strategies to optimize their tax liability in 2024. This may involve adjusting income, deductions, and credits.

The Packers emerged victorious against the Rams, thanks in part to some crucial turnovers. Read the Recap: Turnovers help Packers defeat Rams, 24-19 article to get the full rundown.

- Income Shifting:Consider shifting income to lower tax brackets. This can be done through strategies like income splitting or taking advantage of tax-advantaged retirement accounts. For example, a business owner could choose to receive a lower salary and increase their contributions to a 401(k) plan, thereby lowering their taxable income.

Looking for a way to catch the Raiders and Broncos matchup? The How to watch the Las Vegas Raiders vs. Denver Broncos NFL game article has all the details you need.

- Maximize Deductions:Explore all eligible deductions. These can include deductions for mortgage interest, charitable contributions, state and local taxes, and medical expenses. It’s essential to review tax laws and regulations to ensure you’re taking advantage of all applicable deductions.

- Tax Credits:Utilize available tax credits to reduce your tax liability directly. These can include credits for education, child tax credit, and energy-efficient home improvements. Taxpayers should be aware of the eligibility requirements for these credits and ensure they meet the necessary criteria.

Maximizing Deductions and Credits, What are the new tax brackets for 2024?

Deductions and credits can significantly reduce your tax burden. It’s crucial to understand the different types of deductions and credits available and how to maximize their benefits.

The Commanders dominated the Browns in a decisive victory. For a complete breakdown of the final score, stats, and game recap, check out the Commanders 34, Browns 13 | Final Score, Stats & Game Recap article.

- Standard vs. Itemized Deductions:Determine whether taking the standard deduction or itemizing deductions is more advantageous. Itemized deductions are specific expenses that can be deducted, such as mortgage interest, property taxes, and charitable contributions. The standard deduction is a fixed amount based on filing status.

College football is in full swing, and the Big Ten teams are making their presence known. Alabama fell in the rankings, but the Big Ten is stacking the top. You can check out the full rankings in the College Football Rankings: Alabama falls, Big Ten teams stack top article.

- Retirement Contributions:Maximize contributions to retirement accounts like 401(k)s and IRAs. These contributions are typically tax-deductible, reducing your taxable income.

- Education Credits:Explore education credits if you’re paying for college or graduate school. The American Opportunity Tax Credit and the Lifetime Learning Credit can provide significant tax savings.

- Child Tax Credit:If you have qualifying children, you may be eligible for the Child Tax Credit. This credit can reduce your tax liability by up to $2,000 per child.

Resources and Further Information

It is essential to consult official sources and reputable tax resources for the most up-to-date and accurate information regarding tax brackets and filing requirements. The Internal Revenue Service (IRS) is the primary source of information about federal taxes in the United States.

Their website provides comprehensive guidance and resources for taxpayers.

Official Government Websites

- Internal Revenue Service (IRS):The IRS website is the definitive source for tax information in the United States. It provides details on tax brackets, filing requirements, deductions, credits, and other relevant information. You can access the IRS website at https://www.irs.gov/ .

- United States Department of the Treasury:The Treasury Department oversees the IRS and plays a vital role in formulating tax policy. Their website provides access to publications, regulations, and other relevant information. You can access the Treasury Department website at https://www.treasury.gov/ .

Reputable Tax Resources

- Tax Foundation:The Tax Foundation is a non-profit organization that provides research and analysis on tax policy. Their website offers in-depth information on tax brackets, tax rates, and other tax-related topics. You can access the Tax Foundation website at https://taxfoundation.org/ .

- Tax Policy Center:The Tax Policy Center is a non-partisan research organization that provides analysis of tax policy. Their website offers data, research, and analysis on tax brackets, tax rates, and other tax-related issues. You can access the Tax Policy Center website at https://www.taxpolicycenter.org/ .

Conclusion

The new tax brackets for 2024 offer a glimpse into the evolving landscape of US tax policy. By understanding these changes and their potential impact, taxpayers can make informed decisions about their financial planning and optimize their tax liability. Stay informed about these updates and consider seeking professional advice to ensure you are maximizing your tax benefits.

FAQ

What is the difference between a tax bracket and a tax rate?

A tax bracket refers to the income range that is subject to a specific tax rate. The tax rate is the percentage of income that is paid in taxes within that bracket.

How do I know which tax bracket I fall into?

Your tax bracket is determined by your taxable income, which is your gross income minus deductions and exemptions. You can find your tax bracket using IRS resources or consulting a tax professional.

What are some common deductions and credits that can reduce my tax liability?

Common deductions include mortgage interest, charitable contributions, and state and local taxes. Credits can include the Earned Income Tax Credit, the Child Tax Credit, and the American Opportunity Tax Credit.