Tax brackets for 2024 in the United States are a crucial aspect of financial planning, dictating the amount of income tax individuals and households owe to the federal government. The tax bracket system, characterized by tiered income ranges and corresponding tax rates, is designed to distribute the tax burden progressively, with higher earners paying a larger proportion of their income in taxes.

Understanding how these brackets work is essential for making informed financial decisions, from investment strategies to retirement planning.

The Internal Revenue Service (IRS) sets these tax brackets annually, and while the 2024 brackets are yet to be finalized, they are expected to reflect adjustments for inflation. These adjustments ensure that the tax burden remains consistent over time, even as wages and income levels rise.

It’s important to note that the tax brackets only determine the marginal tax rate, which is the rate applied to each additional dollar of income earned. The overall tax liability is calculated by applying the appropriate rate to each income bracket.

Contents List

2024 Tax Brackets for Married Filing Jointly

The tax brackets for married couples filing jointly in 2024 will determine the amount of federal income tax they owe based on their taxable income. The brackets are designed to tax higher earners at a higher rate.

2024 Tax Brackets for Married Filing Jointly

The following table shows the 2024 tax brackets for married couples filing jointly:

| Income Range | Tax Rate | Marginal Tax Rate | Total Tax Liability |

|---|---|---|---|

| $0

The Seahawks mounted a comeback but ultimately fell short in their Week 5 loss. Get a quick summary of the game, including key moments and player performances, on Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss. It’s a great way to catch up on the action if you missed the game.

|

10% | 10% | 10% of taxable income |

| $20,801

Lewandowski put on a show with a first-half hat trick as Barcelona dominated their opponent. Find out more about the game, including key moments and highlights, on First-half hat trick for Lewandowski as Barcelona top ahead of. It’s a great read for soccer fans who want to catch up on the action.

|

12% | 12% | $2,080 + 12% of income over $20,800 |

| $86,351

Want to know what’s happening in the world of college football recruiting? Check out the latest report from Otis Kirk on Arkansas Football Recruiting Report with Otis Kirk (10-6-24). Kirk provides insights and analysis on the latest news and developments in the Razorbacks’ recruiting efforts.

|

22% | 22% | $9,539.20 + 22% of income over $86,350 |

$178,751

|

24% | 24% | $32,197.20 + 24% of income over $178,750 |

| $340,001

Want to hear what the Ravens and Bengals had to say after their game? You can find postgame notes and quotes from players and coaches on Postgame Notes and Quotes: Ravens at Bengals. It’s a great way to get insights into the teams’ perspectives after the game.

|

32% | 32% | $72,597.20 + 32% of income over $340,000 |

$640,001

|

35% | 35% | $175,597.20 + 35% of income over $640,000 |

| $1,040,001 or more | 37% | 37% | $312,597.20 + 37% of income over $1,040,000 |

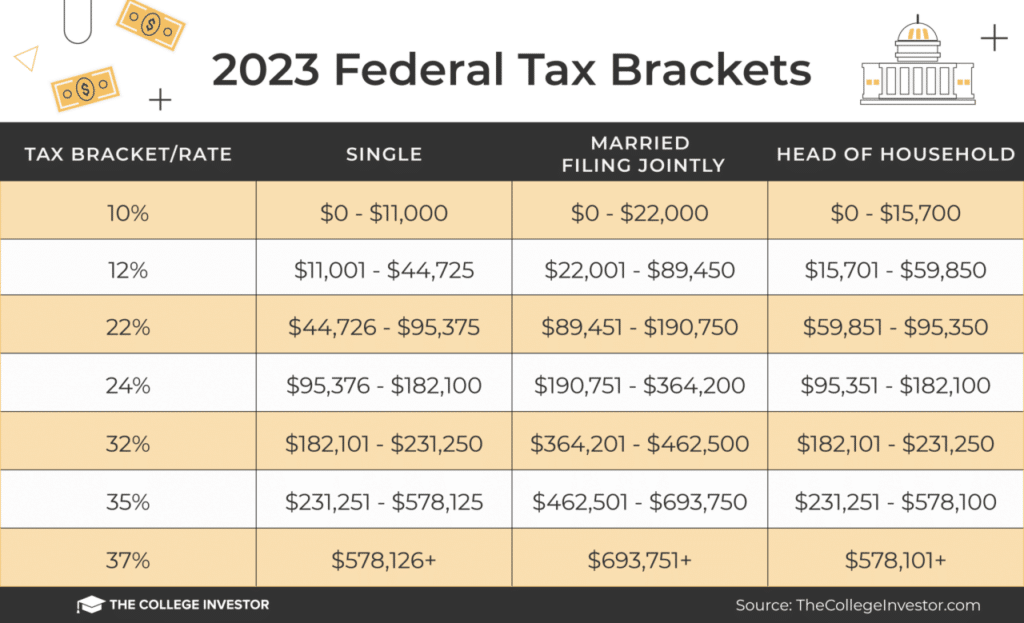

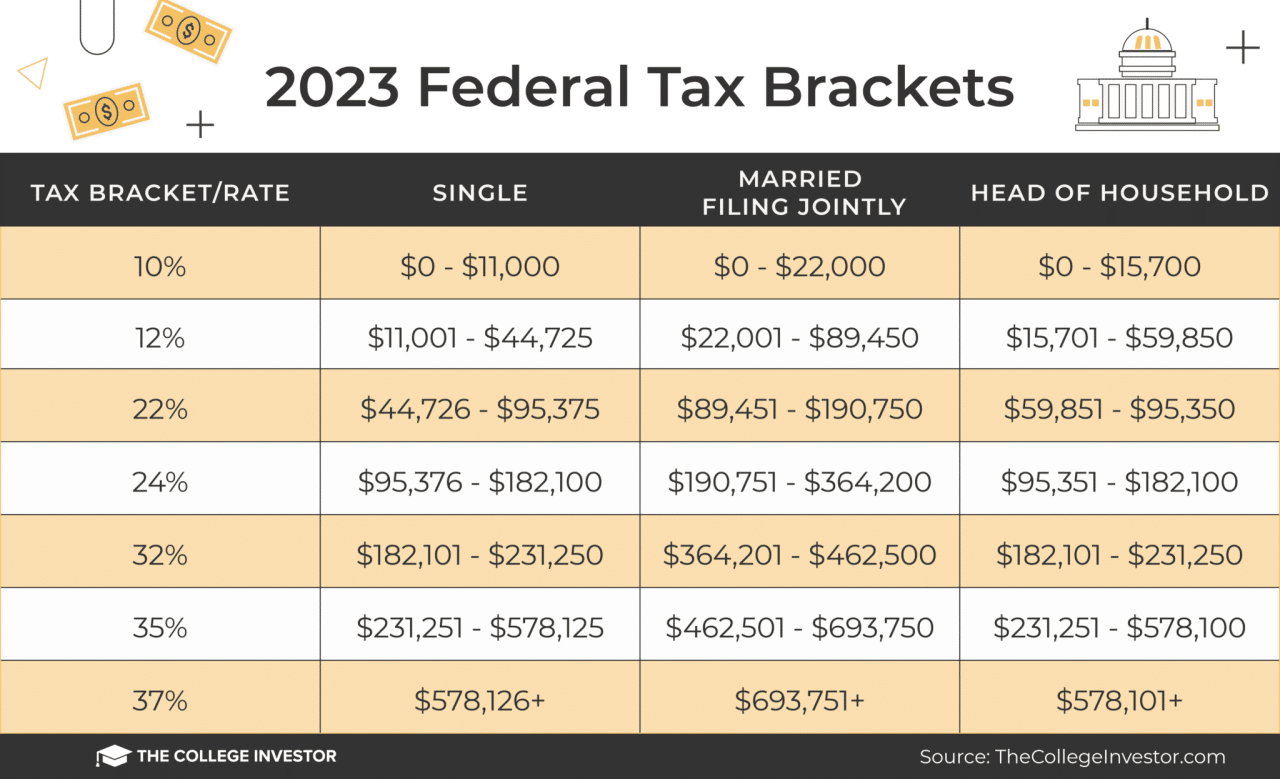

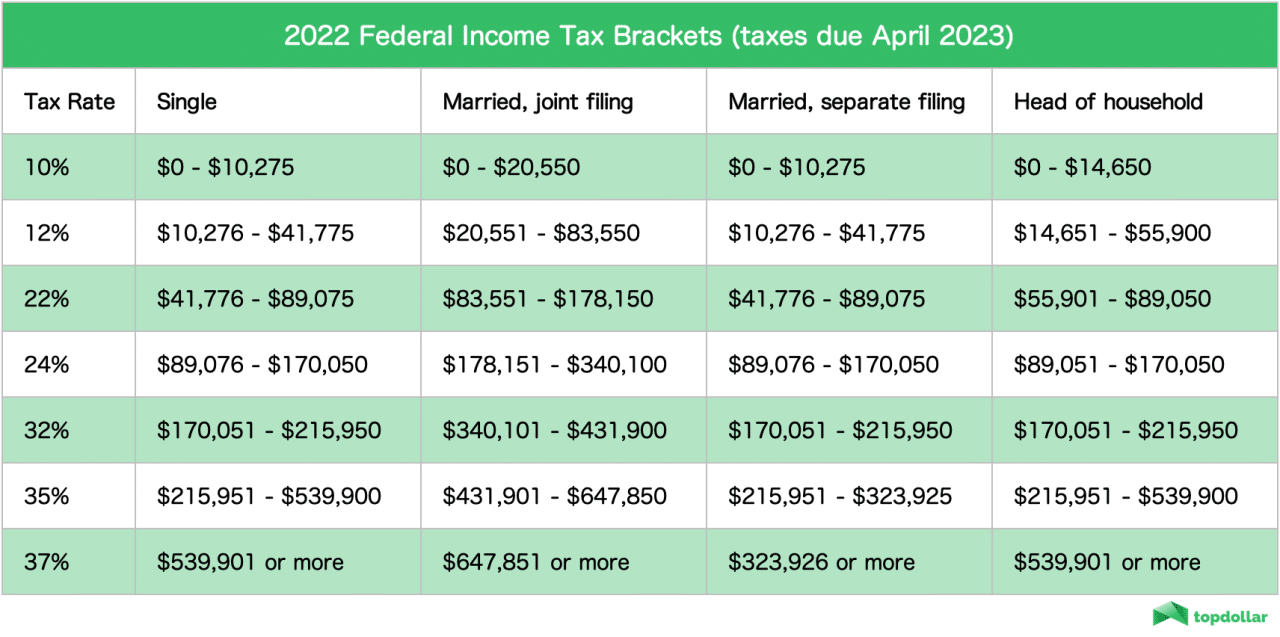

Comparison to 2023 Tax Brackets

The 2024 tax brackets for married filing jointly are largely similar to the 2023 brackets. However, there are some notable differences:* Higher Income Thresholds:The income thresholds for each bracket have been adjusted for inflation, meaning that taxpayers will need to earn more money in 2024 to reach the next tax bracket.

Standard Deduction Increase

The Cowboys are facing off against the Steelers! Find live updates, scores, and how to watch the game on Cowboys vs. Steelers score today: Live updates, how to watch. It’s your one-stop shop for all things Cowboys-Steelers.

The standard deduction for married couples filing jointly in 2024 has been increased to $28,700, which is higher than the 2023 standard deduction of $27,700. This means that more taxpayers will be able to take advantage of the standard deduction and potentially pay less in taxes.

No Major Changes in Tax Rates

Michigan football had a big win against Washington, but there are always lessons to be learned. Find out what insights the team gained from the game on Michigan football: What we learned vs. Washington: ‘Don’t let this. It’s a look behind the scenes at the Wolverines’ approach to improvement.

The tax rates for each bracket remain the same in 2024 compared to 2023.

The world is mourning the loss of TikTok star Taylor Rousseau Grigg, who tragically passed away at the age of 25. You can read more about her life and impact on TikTok star Taylor Rousseau Grigg dead at 25.

It’s a touching tribute to a young life cut short.

Note:The tax brackets and standard deduction amounts are subject to change based on legislative action. It’s important to consult with a tax professional for personalized advice.

2024 Tax Brackets for Head of Household

The tax brackets for head of household filers in 2024 are determined by the amount of taxable income earned during the year. The tax rates for each bracket are progressive, meaning that the higher the income, the higher the tax rate.

2024 Tax Brackets for Head of Household

The following table shows the 2024 tax brackets for head of household filers, along with the corresponding tax rates, marginal tax rates, and total tax liability:

| Income Range | Tax Rate | Marginal Tax Rate | Total Tax Liability |

|---|---|---|---|

$0

|

10% | 10% | $0

|

$10,951

|

12% | 12% | $1,095

|

$46,276

|

22% | 22% | $5,433

|

$101,751

|

24% | 24% | $19,413

|

$192,151

|

32% | 32% | $38,473

|

| $578,126

An earthquake shook parts of Southern California early this morning, with the epicenter near Ontario. Get the latest information on the earthquake’s magnitude and impact on Early morning Ontario earthquake shakes parts of Southern California. It’s a valuable resource for those in the affected area.

|

35% | 35% | $156,753

|

| $1,000,001+ | 37% | 37% | $291,753+ |

Comparison of 2024 and 2023 Tax Brackets for Head of Household

The 2024 tax brackets for head of household filers are generally similar to the 2023 brackets. However, there are a few key differences:* Income Thresholds:The income thresholds for each bracket have been adjusted slightly upwards to account for inflation.

Standard Deduction

Want to hear what the Dolphins had to say after their game on October 6th? You can find postgame quotes from players and coaches on Miami Dolphins Postgame Quotes 10/6. It’s a great way to get insights into the team’s mindset after the game.

The standard deduction for head of household filers has increased to $20,800 in 2024, up from $19,400 in 2023.

The Cardinals pulled off an impressive upset against the 49ers! See highlights and analysis of the game, including how Arizona rallied to stun San Francisco, on Cardinals vs. 49ers highlights, analysis: Arizona rallies to stun S.F.. It’s a must-watch for any NFL fan.

Personal Exemption

Looking to watch the Raiders take on the Broncos? You can find all the information you need, including how to watch the game on TV and streaming services, on How to watch the Las Vegas Raiders vs. Denver Broncos NFL game.

Don’t miss out on this exciting matchup!

The personal exemption is no longer in effect for tax years 2018 and beyond.

Tax Rates

The tax rates themselves have remained unchanged from 2023 to 2024.It is important to note that these are just the basic tax brackets. There are many other factors that can affect a taxpayer’s overall tax liability, such as deductions, credits, and other tax breaks.

Factors Affecting Tax Liability

Your income isn’t the only factor that determines your tax liability. Several other elements, such as deductions and credits, can significantly impact your tax bill. Understanding these factors can help you minimize your tax burden and maximize your tax savings.

Dependents

Having dependents can reduce your tax liability through various tax credits and deductions. The most common deduction for dependents is the Child Tax Credit, which can provide a substantial tax break for families with children.

The Bears are rolling! They improved to 3-2 with a decisive victory over the Panthers. Get a quick recap of the game, including key plays and highlights, on Rapid Recap: Bears improve to 3-2 with rout of Panthers. It’s a concise summary for those who want the highlights without a long read.

The Child Tax Credit is a tax credit that can reduce your tax liability by up to $2,000 per qualifying child.

The credit amount can be fully refundable, meaning you can receive a refund even if you don’t owe any taxes. Other tax credits and deductions available for dependents include:

- The Dependent Care Credit

- The Adoption Tax Credit

- The Earned Income Tax Credit

Charitable Contributions

Donating to charitable organizations can reduce your tax liability by allowing you to deduct a portion of your contribution from your taxable income. The amount you can deduct depends on the type of charity and the type of contribution.

College football rankings are in flux! Alabama dropped while Big Ten teams are climbing the ranks. See the latest rankings and find out why these changes happened on College Football Rankings: Alabama falls, Big Ten teams stack top. It’s a great resource for staying up-to-date on the college football landscape.

You can deduct up to 60% of your Adjusted Gross Income (AGI) for cash contributions to public charities and up to 30% of your AGI for contributions to private foundations.

The Commanders dominated the Browns in their Week 5 matchup, securing a 34-13 victory. You can find all the details, including final scores, stats, and a game recap, on Commanders 34, Browns 13 | Final Score, Stats & Game Recap.

It’s a comprehensive overview of the game for any football fan.

State and Local Taxes

State and local taxes can also impact your federal tax liability. The Tax Cuts and Jobs Act of 2017 limited the deductibility of state and local taxes to $10,000 per household. This limit can significantly impact taxpayers in states with high state and local taxes.

The Jets fell short in their London matchup against the Vikings. Get the full recap of the game, including key moments and player performances, on Jets-Vikings Game Recap | Green & White Fall Short in London. It’s a must-read for any Jets fan wanting to understand the team’s performance.

Flowchart Illustrating Tax Liability Determination

The flowchart illustrates how various factors interact to determine a taxpayer’s final tax liability. Starting with gross income, the process involves subtracting deductions and credits to arrive at taxable income. This taxable income is then subject to the applicable tax rates, resulting in the final tax liability.

Impact of Tax Brackets on Financial Planning

Understanding tax brackets is crucial for making informed financial decisions. Tax brackets determine the percentage of your income that goes towards federal income tax, and they can significantly influence your overall financial planning strategies. By strategically planning your income and expenses, you can potentially reduce your tax liability and maximize your after-tax income.

Retirement Savings, Tax brackets for 2024 in the United States

Tax brackets play a significant role in retirement planning. Understanding how your income will be taxed in retirement can help you make better decisions about how to save for your future.

- Traditional IRA:Contributions to a traditional IRA are typically tax-deductible, which means you can reduce your taxable income in the present. However, you’ll pay taxes on withdrawals in retirement. This strategy can be beneficial if you expect to be in a lower tax bracket in retirement.

- Roth IRA:Contributions to a Roth IRA are made with after-tax dollars, so you won’t receive a tax deduction in the present. However, withdrawals in retirement are tax-free. This option can be advantageous if you expect to be in a higher tax bracket in retirement.

- 401(k) and 403(b):These employer-sponsored retirement plans offer tax advantages similar to traditional and Roth IRAs. The specific tax treatment depends on the plan’s design.

Closing Summary

Navigating the complex world of tax brackets can seem daunting, but armed with a clear understanding of how they work, you can make informed decisions about your finances. Remember that tax planning is a continuous process, and it’s always wise to seek professional advice to optimize your tax liability and ensure compliance with the latest IRS regulations.

By staying informed and proactively managing your financial affairs, you can make the most of your income and achieve your financial goals.

FAQ Section: Tax Brackets For 2024 In The United States

What are the standard deductions for 2024?

The standard deductions for 2024 are yet to be announced by the IRS. They are usually adjusted annually for inflation. It’s recommended to consult the IRS website or a tax professional for the most up-to-date information.

How often are tax brackets adjusted?

Tax brackets are typically adjusted annually for inflation, usually based on the Consumer Price Index (CPI). This ensures that the tax burden remains consistent despite rising income levels.

Are there any tax credits available for 2024?

Yes, there are various tax credits available, including the Earned Income Tax Credit (EITC), Child Tax Credit, and others. The availability and eligibility criteria for these credits may vary depending on your individual circumstances. Consult the IRS website or a tax professional for detailed information.