Tax brackets for qualifying widow(er)s in 2024 offer a unique tax filing status designed for individuals who have lost their spouse within the past two years and are still raising a dependent child. This status allows for lower tax rates compared to other filing options, offering financial relief during a challenging time.

Understanding the tax brackets for this status is crucial for accurately calculating tax obligations and maximizing deductions and credits. This guide provides a detailed overview of the tax brackets, standard deduction, and other relevant information to help qualifying widow(er)s navigate their tax responsibilities effectively.

Contents List

Introduction to Qualifying Widow(er) Filing Status

The Qualifying Widow(er) filing status is a special tax status available to surviving spouses who have lost their spouse in the previous year. It allows individuals to file their taxes at a lower rate for a limited period, providing financial relief during a difficult time.This filing status offers significant tax advantages, including lower tax rates and a larger standard deduction.

These benefits are designed to help surviving spouses navigate the financial complexities of losing a loved one.

Eligibility Criteria for Qualifying Widow(er) Status

To qualify for the Qualifying Widow(er) filing status in 2024, individuals must meet the following criteria:

- They must have been married to the deceased spouse at the time of their death.

- They must have paid more than half the costs of maintaining a home for a qualifying child for the entire tax year.

- They must not have remarried during the tax year.

- They must be claiming a qualifying child as a dependent.

Benefits and Advantages of Filing as a Qualifying Widow(er)

Filing as a Qualifying Widow(er) offers several benefits, including:

- Lower Tax Rates:This filing status allows individuals to use the tax rates applicable to married couples filing jointly, which are generally lower than the rates for single filers.

- Larger Standard Deduction:Qualifying Widow(ers) can claim a larger standard deduction compared to single filers, reducing their taxable income and potential tax liability.

- Access to Tax Credits and Deductions:Individuals can claim various tax credits and deductions, including the child tax credit and the earned income tax credit, depending on their specific circumstances.

Duration of Qualifying Widow(er) Status

The Qualifying Widow(er) filing status is available for two years following the year of the spouse’s death. After this period, individuals must file as either single or head of household, depending on their circumstances.

The world is mourning the loss of TikTok star Taylor Rousseau Grigg, who tragically passed away at the age of 25. You can read more about her life and legacy in the TikTok star Taylor Rousseau Grigg dead at 25.

She will be deeply missed by her fans and loved ones.

Tax Brackets for Qualifying Widow(er)s in 2024

The Qualifying Widow(er) filing status is available for two years after the death of a spouse if the surviving spouse remains unmarried and maintains a home for a dependent child. This status allows the surviving spouse to receive the same tax benefits as a married couple filing jointly.

Tax Brackets for Qualifying Widow(er)s in 2024

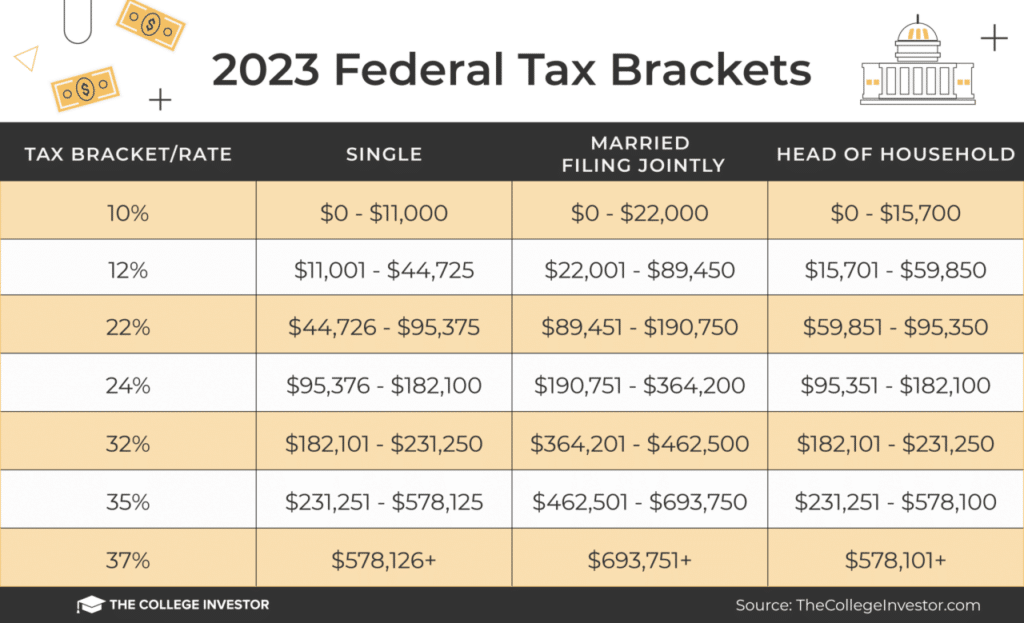

The following table shows the tax brackets for Qualifying Widow(er)s in 2024.

| Tax Rate | Taxable Income |

|---|---|

| 10% | $0

The Bills suffered a surprising loss to the Texans, and there were some key takeaways from the game. You can read about the Top 3 things we learned from Bills at Texans | Week 5 and what it means for both teams moving forward.

|

| 12% | $10,951

|

| 22% | $46,276

|

| 24% | $101,751

The Cardinals pulled off a huge upset against the 49ers, rallying to win in a thrilling game. Check out the Cardinals vs. 49ers highlights, analysis: Arizona rallies to stun S.F. for a full recap of the game. It was a shocking and exciting win for Arizona.

|

| 32% | $192,151

The Packers got a big win over the Rams thanks to some key turnovers. Check out the Recap: Turnovers help Packers defeat Rams, 24-19 for a full recap of the game. It was a great performance for Green Bay.

|

| 35% | $287,251

The Texans pulled off a big upset against the Bills, winning 23-20. You can find the final score, stats, and highlights in the Texans 23, Bills 20 | Final score, stats to know + game highlights. It was a huge win for Houston.

|

| 37% | $574,501+ |

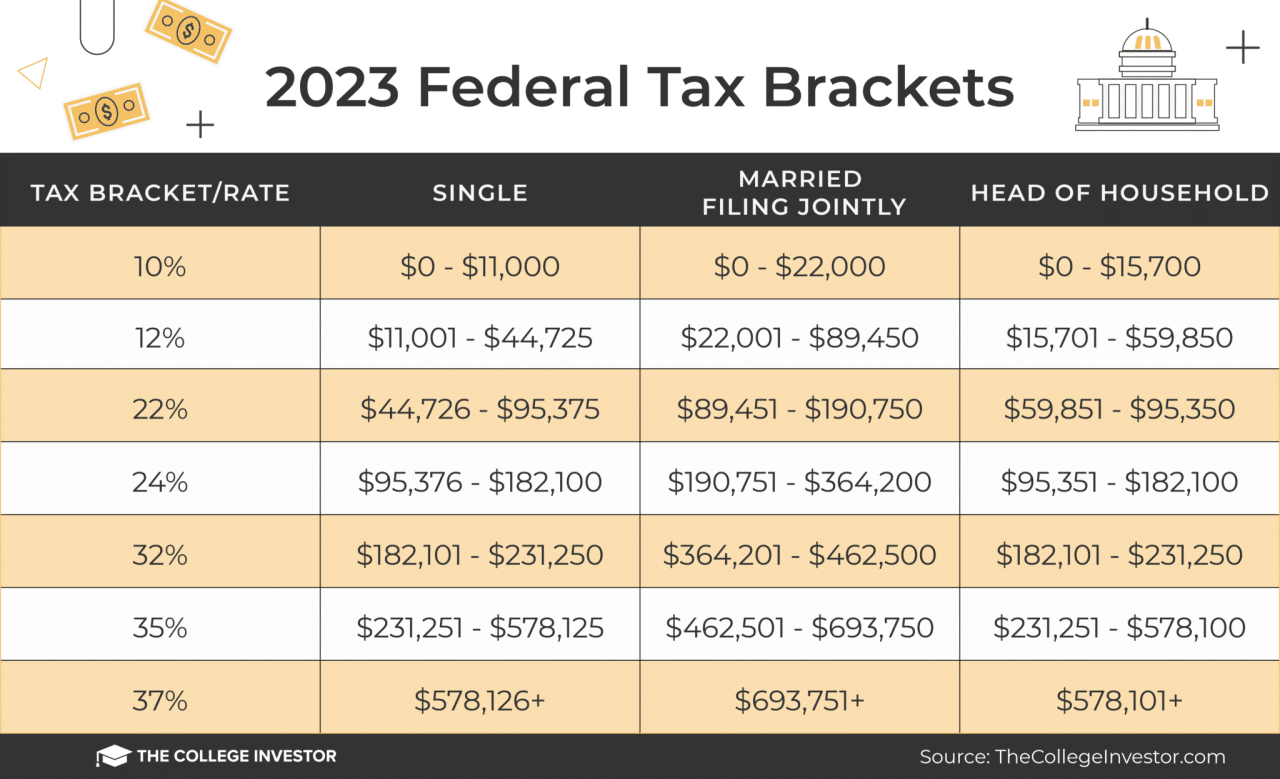

Comparison of Tax Brackets for Qualifying Widow(er)s with Other Filing Statuses

This section compares the tax brackets for Qualifying Widow(er)s with other filing statuses, including Single, Married Filing Separately, and Head of Household.

Comparison Table

The following table provides a comparison of the tax brackets for each filing status in 2024.

| Filing Status | Tax Rate | Taxable Income |

|---|---|---|

| Single | 10% | $0

If you’re a fan of the Raiders or Broncos, you won’t want to miss this game. Find out how to watch the Las Vegas Raiders vs. Denver Broncos NFL game so you don’t miss any of the action. It’s sure to be an exciting matchup.

|

| 12% | $10,951

The Ravens and Bengals had a heated matchup, and you can find all the post-game notes and quotes in the Postgame Notes and Quotes: Ravens at Bengals. It was a hard-fought game with plenty of drama.

|

|

| 22% | $46,276

The Giants came out on top in a close game against the Seahawks, winning 29-20. You can find a detailed analysis of the game in the Instant Analysis: Giants defeat Seahawks, 29-20. It was a great win for New York.

|

|

| 24% | $101,751

An early morning earthquake shook parts of Southern California, with the epicenter near Ontario. You can read more about the Early morning Ontario earthquake shakes parts of Southern California and its impact. Thankfully, there were no major injuries reported.

|

|

| 32% | $192,151

The Miami Dolphins are coming off a tough loss, and you can read what the players and coaches had to say about it in the Miami Dolphins Postgame Quotes 10/6. They’ll need to regroup quickly if they want to turn things around this season.

|

|

| 35% | $287,251

The Commanders dominated the Browns in a convincing win, with a final score of 34-13. Check out the Commanders 34, Browns 13 | Final Score, Stats & Game Recap for a full breakdown of the game. It was a strong performance from Washington.

|

|

| 37% | $574,501+ | |

| Married Filing Separately | 10% | $0

The Bears are on a roll, winning their third game of the season with a decisive victory over the Panthers. You can find all the details and highlights in the Rapid Recap: Bears improve to 3-2 with rout of Panthers. It’s a great start to the season for Chicago.

|

| 12% | $5,476

|

|

| 22% | $23,138.50

|

|

| 24% | $50,876

|

|

| 32% | $96,076

The Seahawks fought hard, but ultimately fell short in their Week 5 matchup. Read all about the comeback that wasn’t in the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss. They’ll need to regroup and come back stronger next week.

|

|

| 35% | $143,626

Lewandowski was on fire for Barcelona, scoring a hat trick in the first half. It was a dominant performance for the Catalan side, and you can read all about it in the First-half hat trick for Lewandowski as Barcelona top ahead of. The team is looking strong this season.

|

|

| 37% | $287,251+ | |

| Head of Household | 10% | $0

|

| 12% | $18,201

|

|

| 22% | $85,576

|

|

| 24% | $178,251

The Jaguars pulled off a thrilling victory against the Colts, scoring a last-minute field goal to seal the win. You can find all the details and stats in the Game Report, 2024 Week 5: Jaguars 37, Colts 34. It was a nail-biter that went down to the wire.

|

|

| 32% | $342,001

|

|

| 35% | $513,001

|

|

| 37% | $574,501+ | |

| Qualifying Widow(er) | 10% | $0

|

| 12% | $10,951

|

|

| 22% | $46,276

|

|

| 24% | $101,751

|

|

| 32% | $192,151

|

|

| 35% | $287,251

|

|

| 37% | $574,501+ |

Key Differences and Similarities

The Qualifying Widow(er) filing status has the same tax brackets as Married Filing Jointly, which means the tax rates and income thresholds are identical. This is a significant benefit for surviving spouses, as it allows them to pay the same amount of tax as a married couple filing jointly.

However, the Qualifying Widow(er) status is only available for a limited time, so it’s important to understand the eligibility requirements.

Standard Deduction and Personal Exemptions: Tax Brackets For Qualifying Widow(er)s In 2024

Qualifying widow(er)s, like other taxpayers, can take advantage of the standard deduction and personal exemptions to reduce their taxable income. These deductions and exemptions are designed to provide tax relief to individuals and families.

Standard Deduction for Qualifying Widow(er)s in 2024

The standard deduction amount for Qualifying Widow(er)s in 2024 is $20,800. This means that Qualifying Widow(er)s can reduce their taxable income by $20,800 before calculating their tax liability.

Personal Exemptions for Qualifying Widow(er)s in 2024, Tax brackets for qualifying widow(er)s in 2024

Personal exemptions were suspended in 2018 and have not been reinstated. This means that Qualifying Widow(er)s, like all other taxpayers, cannot claim personal exemptions for themselves or their dependents.

Impact of Deductions and Exemptions on Taxable Income

The standard deduction and personal exemptions (or the lack thereof) significantly impact a Qualifying Widow(er)’s taxable income. The standard deduction directly reduces the amount of income subject to taxation.

For example, if a Qualifying Widow(er) has a gross income of $100,000 and takes the standard deduction, their taxable income will be reduced to $79,200 ($100,000

$20,800).

The absence of personal exemptions further increases the amount of taxable income. This means that Qualifying Widow(er)s will pay taxes on a larger portion of their income.

Conclusion

Navigating the tax system as a qualifying widow(er) can be complex, but understanding the unique benefits and considerations associated with this filing status can provide significant financial advantages. By utilizing the information provided in this guide, qualifying widow(er)s can ensure they are taking full advantage of the tax benefits available to them and minimize their tax liability.

Q&A

What is the difference between Qualifying Widow(er) and Surviving Spouse?

Qualifying Widow(er) status is available for two years following the death of a spouse, while Surviving Spouse status is available for the year of the spouse’s death and the following year. After the two-year period, individuals can no longer claim Qualifying Widow(er) status and may need to file as Single or Head of Household.

Can I claim Qualifying Widow(er) status if I remarried before the two-year period?

No, if you remarry before the two-year period, you are no longer eligible to claim Qualifying Widow(er) status. You will need to file as Single or Head of Household, depending on your circumstances.

What if I have a dependent child but did not live with them in 2024?

You can still claim Qualifying Widow(er) status if you paid more than half of the child’s living expenses, even if you did not live with them. However, you must have been legally entitled to claim the child as a dependent.

Can I claim Qualifying Widow(er) status if my spouse died before 2022?

No, the Qualifying Widow(er) status is only available for the two years following the death of a spouse. If your spouse died before 2022, you are not eligible for this status.