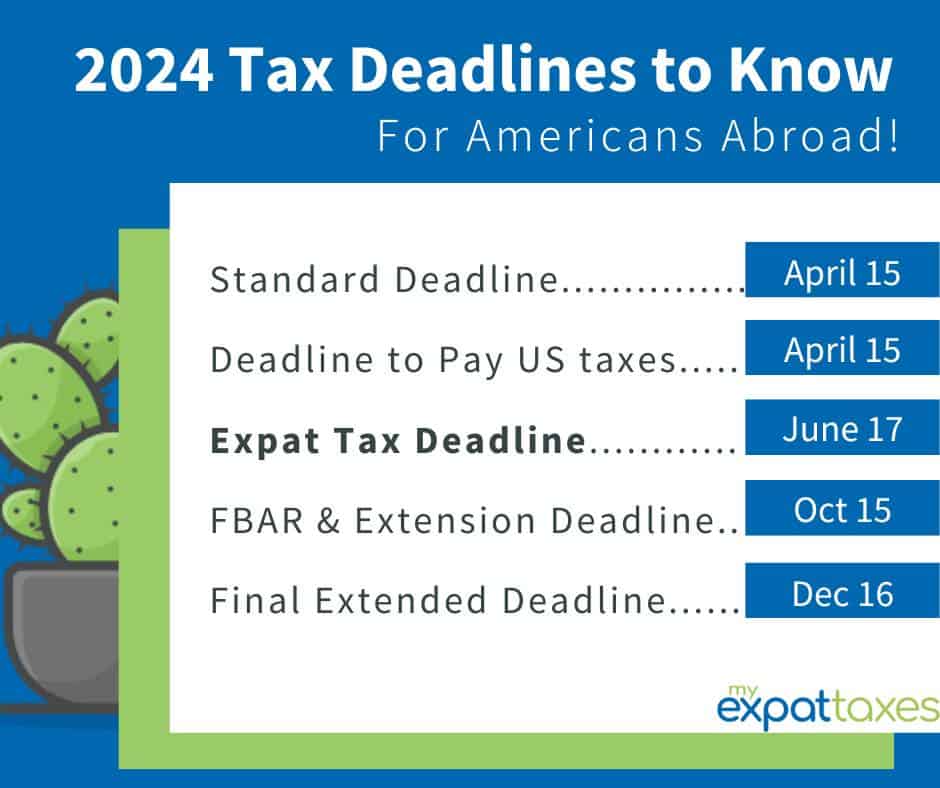

October 2024 tax deadline for foreign nationals in the US presents a unique set of challenges and opportunities. While the standard US tax filing deadline is typically in April, foreign nationals often have an extended deadline falling in October. This article delves into the intricacies of this deadline, exploring the tax obligations, resources, and common challenges faced by foreign nationals living and working in the United States.

Navigating the US tax system can be complex, especially for those unfamiliar with its nuances. Foreign nationals may encounter specific requirements and regulations that differ from those applicable to US citizens. Understanding the October 2024 deadline and its implications is crucial for ensuring compliance and avoiding potential penalties.

Contents List

Common Tax-Related Challenges for Foreign Nationals: October 2024 Tax Deadline For Foreign Nationals

Navigating the US tax system can be complex for anyone, but it presents unique challenges for foreign nationals. Understanding these challenges and implementing appropriate strategies can help foreign individuals minimize their tax burden and ensure compliance with US tax laws.

Married couples filing separately in 2024 might want to take a look at the specific tax brackets that apply to them. Get the details on tax brackets for married filing separately in 2024 to make sure you’re filing correctly.

Understanding Residency Status

Foreign nationals in the US face a crucial initial step: determining their residency status. This status dictates their tax obligations and the specific tax forms they need to file.

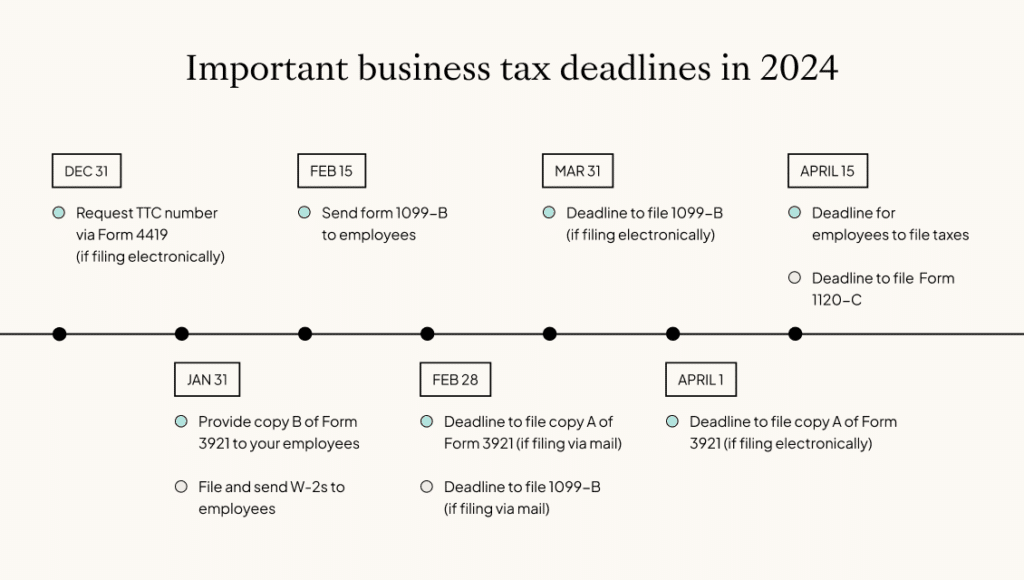

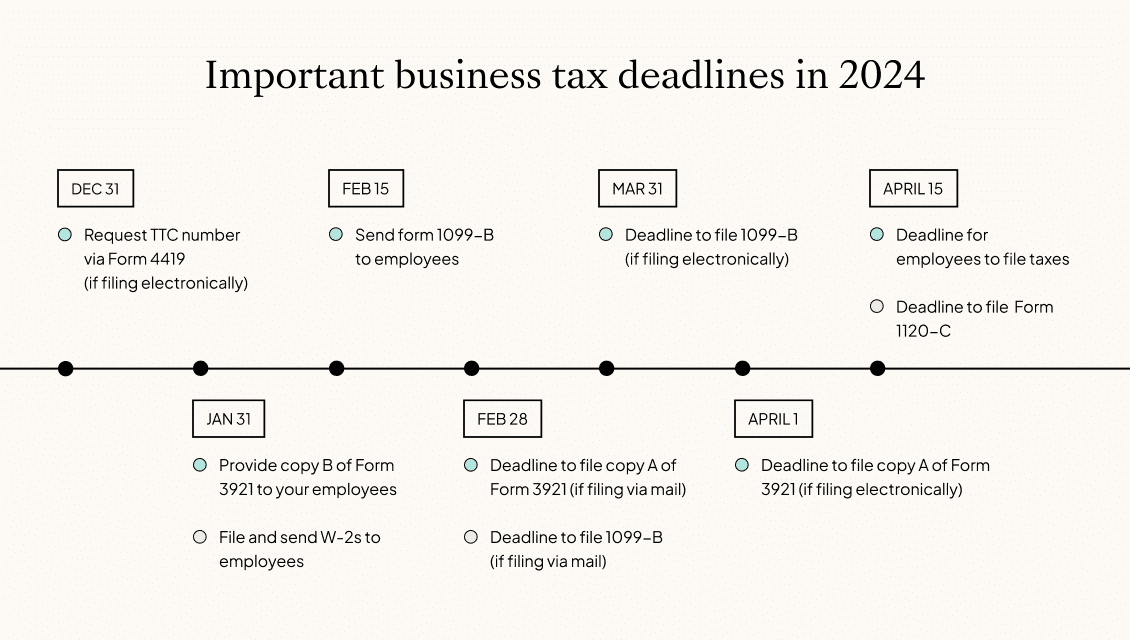

The October 2024 tax deadline for businesses is just around the corner! Find out more about the deadline and get your ducks in a row to avoid any penalties.

- Nonresident Alien:Individuals who are not US citizens or permanent residents and do not meet the “substantial presence test” are considered nonresident aliens. They are generally taxed only on US-source income.

- Resident Alien:Individuals who meet the “substantial presence test” or who hold a green card are considered resident aliens. They are generally taxed on their worldwide income, similar to US citizens.

The “substantial presence test” involves calculating the number of days spent in the US during the current year and the two preceding years. If the total exceeds a certain threshold, the individual is considered a resident alien.

If you’re a qualifying widow(er) in 2024, you might be wondering about the tax brackets that apply to you. Check out the tax brackets for qualifying widow(er)s in 2024 to see where you fall.

Filing Requirements and Tax Forms, October 2024 tax deadline for foreign nationals

The tax forms and filing requirements for foreign nationals vary based on their residency status and the type of income they receive.

Curious about the highest tax bracket in 2024? Find out what the highest tax bracket is in 2024 and see if you’ll be affected.

- Nonresident Aliens:Nonresident aliens typically file Form 1040-NR, “U.S. Nonresident Alien Income Tax Return,” to report their US-source income. They may also need to file other forms, such as Form 1040-ES, “Estimated Tax for Individuals,” to pay estimated taxes.

- Resident Aliens:Resident aliens typically file Form 1040, “U.S. Individual Income Tax Return,” similar to US citizens. They may also need to file additional forms, such as Form 8854, “Initial and Annual Expatriation Information Statement,” if they are considering renouncing their US citizenship.

The tax brackets for 2024 have changed! Learn about the new tax brackets for 2024 and see how they might affect your tax bill.

Foreign nationals should consult with a qualified tax advisor to determine the appropriate forms and filing requirements for their specific situation.

Freelancers, take note! The October 2024 tax deadline is approaching. Get the scoop on the October 2024 tax deadline for freelancers and get your paperwork in order.

Tax Treaties and Double Taxation

The US has tax treaties with many countries to prevent double taxation, which occurs when income is taxed twice in different jurisdictions. These treaties can help reduce the tax burden on foreign nationals by providing exemptions or credits for certain types of income.

Need a little extra time to file your taxes? Learn about tax filing extensions for October 2024 and see if you qualify for an extension.

- Example:A Canadian citizen working in the US may be eligible for a treaty exemption for certain types of income, such as dividends from US corporations, under the US-Canada tax treaty.

However, the specific provisions of each treaty vary, and foreign nationals should carefully review the applicable treaty to determine their eligibility for tax relief.

Filing as single in 2024? Check out the tax brackets for single filers in 2024 to get a better understanding of how your taxes will be calculated.

Understanding US Tax Laws and Regulations

US tax laws and regulations can be complex and challenging to navigate, especially for foreign nationals unfamiliar with the system.

- Example:The US tax code includes numerous deductions and credits that can reduce a taxpayer’s tax liability. However, these deductions and credits may have specific requirements and limitations that foreign nationals may not be aware of.

Foreign nationals should consult with a qualified tax advisor to ensure they are taking advantage of all available deductions and credits and are complying with all applicable tax laws and regulations.

Tax Reporting and Compliance

Foreign nationals are required to report their US-source income and comply with US tax laws, even if they are not residents. Failure to do so can result in penalties and fines.

- Example:A foreign national who receives interest income from a US bank account is required to report this income on their tax return, even if they are a nonresident alien.

Foreign nationals should keep accurate records of their income and expenses and seek professional advice to ensure they are meeting their tax reporting and compliance obligations.

Concluding Remarks

Filing taxes as a foreign national in the US can seem daunting, but with proper preparation and guidance, it can be a smooth process. By understanding the specific deadlines, tax obligations, and available resources, foreign nationals can confidently navigate their tax responsibilities and ensure compliance with US tax laws.

This article has provided a comprehensive overview of the key aspects related to the October 2024 tax deadline, equipping foreign nationals with the knowledge they need to approach their tax obligations with ease and clarity.

Essential FAQs

What types of income are subject to US taxation for foreign nationals?

Foreign nationals are generally taxed on income earned within the US, regardless of their residency status. This includes wages, salaries, business income, and investment income.

Are there any tax treaties between the US and other countries that affect foreign nationals’ tax obligations?

Yes, the US has tax treaties with many countries. These treaties can help reduce double taxation by providing exemptions or credits for taxes paid in the foreign country. The specific implications of these treaties vary depending on the individual’s circumstances and the country of origin.

What resources are available to help foreign nationals with their tax obligations?

The Internal Revenue Service (IRS) provides a wealth of information and resources specifically for foreign nationals. The IRS website offers publications, guides, and online tools to assist with tax filing. Additionally, many tax professionals specialize in assisting foreign nationals with their tax obligations.

What are some common tax challenges foreign nationals face in the US?

Foreign nationals may face challenges related to understanding complex tax rules, obtaining necessary documentation, and navigating language barriers. Additionally, they may encounter difficulties in claiming certain deductions or credits due to their non-resident status.

It can be a bit confusing trying to understand tax brackets, especially for 2024. Get a better understanding of tax brackets for 2024 to make filing easier.

The Seahawks had a tough loss in Week 5. Read the Rapid Reactions to the Seahawks comeback that fell short in Week 5 and see what fans are saying.

Wondering how your income will be taxed in 2024? Try out the tax bracket calculator for 2024 to get a personalized estimate.

Want to see how the tax brackets have changed from 2023 to 2024? Compare the tax bracket changes for 2024 vs 2023 to see what’s different.

Self-employed individuals have a specific deadline for their taxes in October 2024. Check out the October 2024 tax deadline for self-employed individuals to make sure you’re on track.

Want to know the exact tax rate for each tax bracket in 2024? Find out the tax rates for each tax bracket in 2024 to get a clear picture of how your income will be taxed.

Retirees have a specific tax deadline in October 2024. Get the details on the October 2024 tax deadline for retirees to ensure you file on time.