How much is the mileage rate for October 2024? This question is crucial for businesses and individuals who rely on vehicle use for work or travel. Understanding the mileage rate is essential for accurate expense tracking, tax deductions, and overall financial planning.

Mileage rates fluctuate based on factors like fuel prices, inflation, and government regulations. Keeping abreast of these changes is vital for maximizing financial benefits and avoiding potential penalties. This guide delves into the intricacies of mileage rates, providing insights into how they are determined, where to find accurate information, and the impact they have on your finances.

Contents List

Sources for Mileage Rate Information: How Much Is The Mileage Rate For October 2024?

Obtaining accurate mileage rates is crucial for various purposes, including tax deductions, business expense tracking, and reimbursement calculations. Several reliable sources provide up-to-date information on mileage rates.

There have been some changes to the tax brackets for 2024 compared to 2023. Tax bracket changes for 2024 vs 2023 If you’re filing as head of household, make sure to familiarize yourself with the specific tax brackets for this filing status.

Tax brackets for head of household in 2024

Mileage Rate Sources

The following table Artikels some reputable sources for mileage rates:

| Source Name | URL | Contact Information | Update Frequency |

|---|---|---|---|

| Internal Revenue Service (IRS) | https://www.irs.gov/ | (800) 829-1040 | Annually |

| American Automobile Association (AAA) | https://www.aaa.com/ | (800) 222-4357 | Annually |

| National Association of Realtors (NAR) | https://www.realtor.org/ | (800) 874-6500 | Annually |

| National Federation of Independent Business (NFIB) | https://www.nfib.com/ | (800) 343-5775 | Annually |

The IRS is the primary source for mileage rates for tax purposes. The rates published by the IRS are used to calculate deductions for business use of a vehicle. AAA, NAR, and NFIB provide mileage rate information for their members, often based on IRS guidelines.

A tax bracket calculator can help you estimate your tax liability for 2024. Tax bracket calculator for 2024 Understanding how tax brackets affect your income is important for making informed financial decisions. How will tax brackets affect my 2024 income?

These organizations may offer additional resources and guidance related to mileage tracking and expense reporting.

When it comes to filing taxes, understanding your tax bracket is crucial. If you’re married filing separately in 2024, you’ll need to know how the tax brackets work. Tax brackets for married filing separately in 2024 Remember, you can always apply for a tax filing extension if you need more time to gather your information.

Tax filing extensions for October 2024

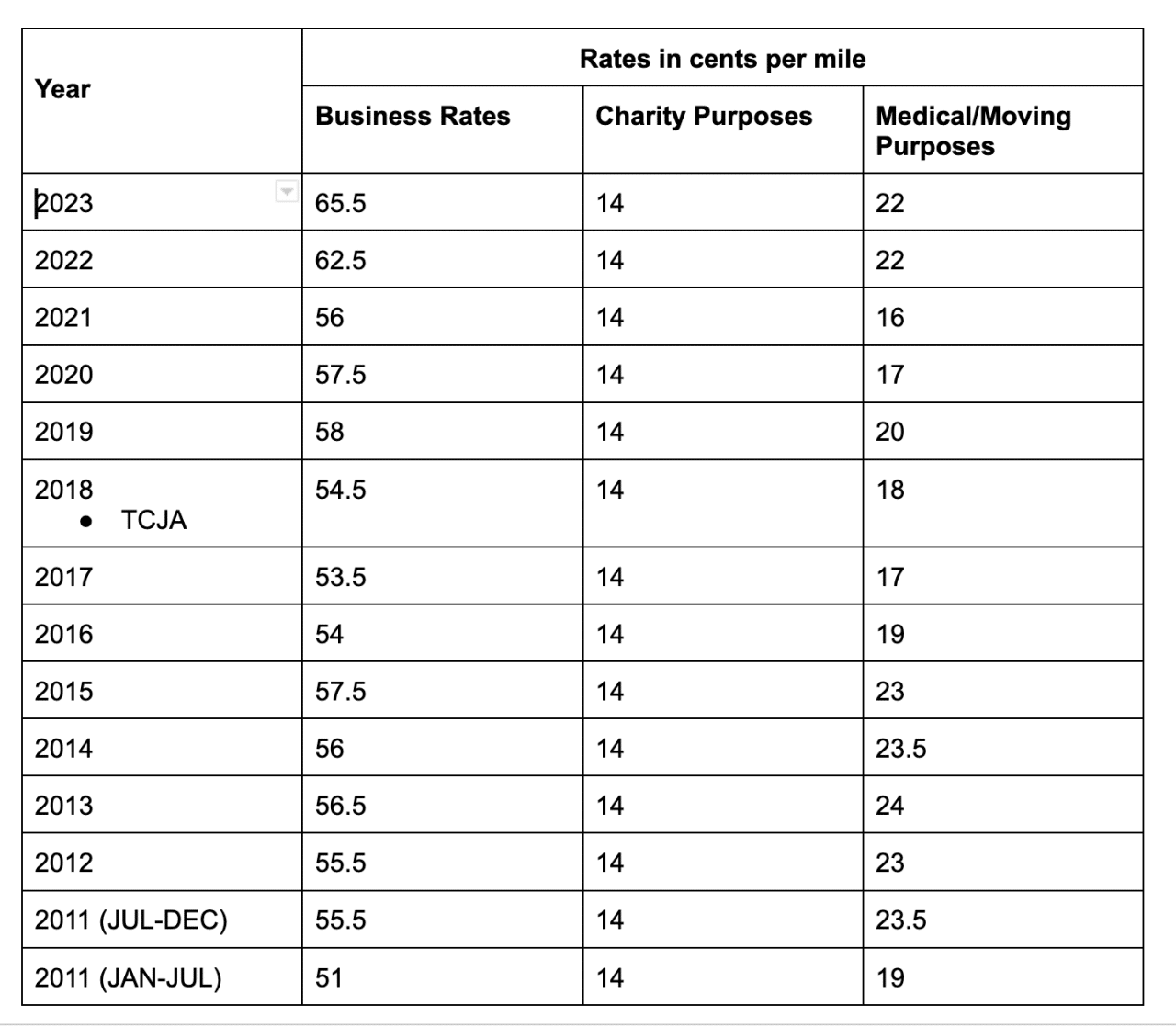

Mileage Rate for October 2024

The standard mileage rate for business use in October 2024 is not yet available. The Internal Revenue Service (IRS) typically announces the standard mileage rates for the upcoming year in late December or early January. The rates are based on factors such as fuel costs, inflation, and other economic indicators.

Standard Mileage Rate Changes, How much is the mileage rate for October 2024?

The standard mileage rate is adjusted annually to reflect changes in the cost of operating a vehicle. It is important to note that the standard mileage rate for October 2024 will be based on the rates announced by the IRS for the entire year.

The standard mileage rate is often subject to change due to fluctuating fuel prices, inflation, and economic conditions.

The October 2024 tax deadline for students is approaching, and it’s important to be aware of your filing obligations. October 2024 tax deadline for students If you’re a freelancer, the deadline also applies to you, so make sure to gather all your income and expense records.

October 2024 tax deadline for freelancers

Wrap-Up

Navigating the complexities of mileage rates requires staying informed about current regulations and utilizing reliable resources. By understanding the factors that influence mileage rates and employing effective tracking methods, individuals and businesses can optimize their financial outcomes and ensure compliance.

Whether you’re a self-employed professional, a business owner, or simply a frequent traveler, mastering the intricacies of mileage rates empowers you to make informed decisions and maximize your financial well-being.

FAQ Insights

How often are mileage rates updated?

Mileage rates are typically updated on a quarterly basis, but the specific frequency can vary depending on the source and the government agency responsible for setting the rates.

Can I use the standard mileage rate for personal travel?

No, the standard mileage rate is only applicable for business or work-related travel. Personal travel expenses are not eligible for deductions using the standard mileage rate.

Are there any exceptions to the standard mileage rate?

Yes, there may be exceptions for specific situations, such as using a vehicle for charitable purposes or for medical travel. It’s important to consult with a tax professional to determine if you qualify for any exceptions.

Each tax bracket in 2024 has a corresponding tax rate. Tax rates for each tax bracket in 2024 As the October 2024 tax deadline approaches, the IRS offers resources to help taxpayers navigate the process. IRS resources for the October 2024 tax deadline

The tax brackets for qualifying widow(er)s in 2024 are different from other filing statuses. Tax brackets for qualifying widow(er)s in 2024 There have been some tax changes that may impact the October 2024 tax deadline, so it’s important to stay informed.

Tax changes impacting the October 2024 deadline

With the new year comes new tax brackets. What are the new tax brackets for 2024? It’s crucial to understand the potential penalties for missing the October 2024 deadline. Tax penalties for missing the October 2024 deadline

The tax brackets for 2024 in the United States are based on your income level and filing status. Tax brackets for 2024 in the United States Understanding these brackets can help you plan your finances and minimize your tax liability.