What is the mileage reimbursement rate for October 2024? This question is crucial for individuals and businesses alike, as it impacts the financial aspects of travel and work-related expenses. Understanding the factors that influence mileage reimbursement rates, such as the IRS standard mileage rate, employer policies, and fluctuating market conditions, is essential for accurate calculations and financial planning.

This guide delves into the complexities of mileage reimbursement, exploring the IRS standard mileage rate for October 2024, employer policies, and the key factors that affect reimbursement rates. We’ll also provide step-by-step guidance on calculating mileage reimbursement, along with practical tips for keeping accurate records.

Contents List

Understanding Mileage Reimbursement Rates

Mileage reimbursement rates are the amounts paid to individuals or businesses for using their personal vehicles for work-related travel. They are often used to compensate employees for using their cars for business purposes, or for reimbursing individuals for travel expenses incurred for business trips.

The tax brackets for 2024 have changed, so it’s important to understand how they affect your income. This article will answer your questions about what are the new tax brackets for 2024 and what you need to know.

Factors Influencing Mileage Reimbursement Rates

The mileage reimbursement rate is not a fixed amount and can vary based on several factors.

Understanding the tax bracket thresholds is crucial for planning your finances. This article will guide you through the tax bracket thresholds for 2024 and how they affect your income.

- Location:The cost of driving varies depending on factors like gas prices, traffic congestion, and road conditions. Therefore, reimbursement rates may differ across regions.

- Vehicle Type:The size and fuel efficiency of a vehicle impact fuel consumption and maintenance costs. For instance, a large SUV will likely have a higher reimbursement rate than a compact car.

- Purpose of Travel:The reason for the travel can influence the reimbursement rate. For example, rates for business trips might be different from those for personal travel or charitable work.

Common Mileage Reimbursement Rate Sources, What is the mileage reimbursement rate for October 2024?

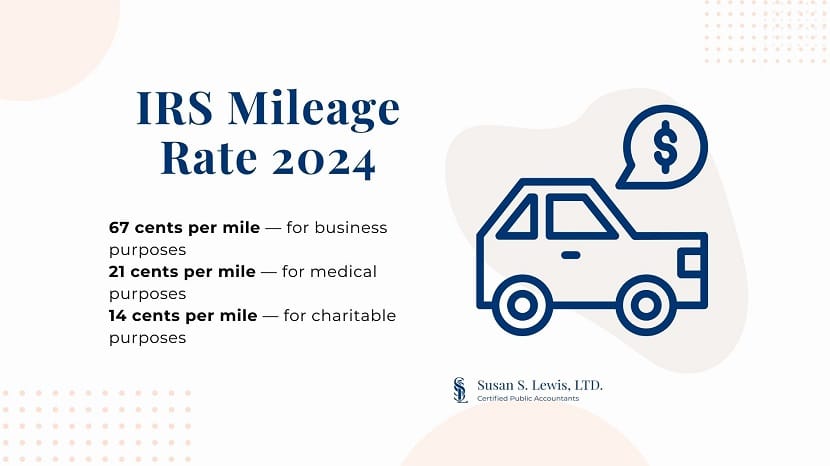

- IRS Standard Mileage Rate:The Internal Revenue Service (IRS) publishes annual standard mileage rates for business, medical, and charitable purposes. These rates are often used as a benchmark for reimbursement calculations.

- Employer Policies:Many employers have their own mileage reimbursement policies, which may differ from the IRS standard mileage rate. These policies often consider factors like vehicle type, employee position, and company budget.

IRS Standard Mileage Rate for October 2024

The IRS standard mileage rate is a predetermined amount that taxpayers can use to deduct vehicle expenses for business, medical, and moving purposes. The rate is adjusted periodically to reflect changes in fuel prices and other vehicle-related costs. For October 2024, the standard mileage rate for business use is 65.5 cents per mile.

The Seahawks had a tough loss in Week 5, despite a valiant comeback attempt. Read our analysis of the game and see why the Seahawks comeback fell short in Week 5 Loss.

This rate can be used to calculate deductions for travel expenses related to your job, such as driving to client meetings, attending conferences, or making deliveries.

The tax brackets for 2024 have changed, so it’s important to understand how they affect your income. This article will answer your questions about tax bracket changes for 2024 and what you need to know.

Differences Between Business and Medical/Moving Mileage Rates

The IRS standard mileage rate for business use is distinct from the rates for medical and moving expenses. The IRS sets separate mileage rates for these purposes. The rates for medical and moving expenses are typically lower than the business mileage rate.

Self-employed individuals have a different tax deadline than traditional employees. Make sure you’re aware of the October 2024 tax deadline for self-employed individuals to avoid any penalties.

Here’s a breakdown of the differences:

- Business Mileage Rate:Used to deduct vehicle expenses incurred for business purposes. This is the highest rate set by the IRS.

- Medical Mileage Rate:Used to deduct vehicle expenses incurred for medical purposes, such as traveling to and from doctor appointments or hospitals.

- Moving Mileage Rate:Used to deduct vehicle expenses incurred for moving household goods and personal effects to a new home.

Calculating Reimbursements Using the IRS Standard Mileage Rate

To calculate reimbursements using the IRS standard mileage rate, follow these steps:

- Determine the total number of miles driven for the relevant purpose.This could include business trips, medical appointments, or moving expenses.

- Multiply the total number of miles by the applicable IRS standard mileage rate.For business use, this would be 65.5 cents per mile in October 2024.

- The resulting amount is the deductible expense.This can be used to claim a deduction on your tax return or to calculate reimbursement amounts from your employer.

For example, if you drove 500 miles for business purposes in October 2024, your deductible expense would be 500 miles

With the new tax brackets for 2024, it’s natural to wonder how they will affect your income. This article will help you understand how tax brackets will affect your 2024 income.

$0.655/mile = $327.50.

Tax deductions can help you save money on your taxes. This article will help you understand tax deductions for the October 2024 deadline and how to maximize your savings.

Factors Affecting Mileage Reimbursement Rates

Mileage reimbursement rates are dynamic and subject to various influences. They are not static figures but rather respond to economic conditions and market fluctuations. Understanding these factors is crucial for both employers and employees to ensure fair compensation for business travel.

You might be wondering, “What is the tax deadline for October 2024?” Well, it’s October 15th for most individuals, but there are some exceptions. Check out this article to find out more about the tax deadline for October 2024.

Factors Influencing Mileage Reimbursement Rates

The IRS standard mileage rate is a key factor influencing mileage reimbursement rates. This rate is adjusted annually to reflect changes in fuel prices, vehicle maintenance costs, and inflation. Other factors that play a role include:

- Fuel Prices:Fuel prices are a major component of vehicle operating costs. As fuel prices fluctuate, so do mileage reimbursement rates. For example, a significant rise in fuel prices could lead to an increase in the standard mileage rate to compensate for higher driving expenses.

Freelancers have a little more time to file their taxes this year, with the deadline falling on October 15th. Learn more about the October 2024 tax deadline for freelancers and what deductions you can claim.

- Inflation:Inflation affects the overall cost of living, including vehicle maintenance and repairs. As inflation rises, the cost of these services increases, leading to a potential increase in mileage reimbursement rates to account for these rising expenses.

- Vehicle Maintenance Costs:Vehicle maintenance costs, including repairs, tires, and oil changes, also impact mileage reimbursement rates. These costs fluctuate based on factors like vehicle age, type, and driving conditions.

- Market Conditions:The overall economic climate and competition within a particular industry can also influence mileage reimbursement rates. Companies may adjust their rates to remain competitive and attract and retain employees.

Impact of Fluctuating Factors on Mileage Reimbursement Costs

Fluctuations in fuel prices, inflation, and vehicle maintenance costs can significantly impact the overall cost of mileage reimbursement for businesses.

For example, a 10% increase in fuel prices could lead to a corresponding increase in the standard mileage rate, resulting in higher reimbursement costs for employers.

Students have until October 15th to file their taxes, so make sure you’re prepared! Check out this article for a breakdown of the October 2024 tax deadline for students and what you need to know.

This underscores the importance of staying informed about these factors and adjusting reimbursement rates accordingly to ensure fairness and avoid potential financial burdens.

Figuring out how much you’ll owe in taxes can be confusing, especially with the new tax brackets for 2024. This guide will help you understand tax brackets for 2024 and how they affect your income.

Conclusive Thoughts

Navigating the world of mileage reimbursement can be intricate, but with a thorough understanding of the factors involved, you can ensure accurate and compliant calculations. Whether you’re an employee seeking reimbursement or an employer setting policies, staying informed about the latest rates and guidelines is crucial for financial clarity and peace of mind.

Essential FAQs: What Is The Mileage Reimbursement Rate For October 2024?

How often does the IRS standard mileage rate change?

The IRS standard mileage rate is typically adjusted on an annual basis, usually in January.

Is the IRS standard mileage rate the same for all types of travel?

No, the IRS offers separate rates for business use, medical/moving purposes, and charitable use.

Can I use the IRS standard mileage rate if my employer has a different policy?

You should follow your employer’s mileage reimbursement policy. If your employer’s policy is less than the IRS rate, you may be able to claim the difference as a deduction on your taxes.

What happens if I overestimate my mileage?

You may be required to repay any overpayment. It’s important to keep accurate records to avoid any potential issues.

Businesses have until October 15th to file their taxes, so it’s important to stay organized. This article will help you understand the October 2024 tax deadline for businesses and what you need to know.

It’s helpful to compare the tax brackets for 2024 to those of 2023 to see how things have changed. This article will give you a detailed breakdown of the tax bracket changes for 2024 vs 2023 and how they might affect you.

Tax credits can help you save money on your taxes. This article will guide you through the tax credits for the October 2024 deadline and how to claim them.

If you’re married filing separately, the tax brackets are different than for other filing statuses. This article will provide information on the tax brackets for married filing separately in 2024.