Average Mortgage Rates Today 2024: A Guide for Homebuyers Navigating the ever-changing landscape of mortgage rates can feel overwhelming, especially in today’s economic climate. Understanding current trends, key factors influencing rates, and available resources is crucial for making informed decisions about homeownership.

The “Help to Buy” scheme in the UK offers assistance for first-time buyers. Explore Help to Buy mortgages to see if you qualify.

This guide will explore the average mortgage rates in 2024, delve into the factors affecting individual rates, and provide insights on how to navigate this dynamic market.

Choosing the right lender can make a big difference in your home buying experience. Researching best home loan lenders can help you find the best rates and terms for your needs.

The current average mortgage rates for various loan types in 2024 are influenced by a complex interplay of economic factors, including the Federal Reserve’s monetary policy, inflation, and the overall economic outlook. Understanding these factors is essential for predicting future rate movements and making informed decisions about home financing.

If you’re planning to buy an investment property, you’ll need to understand investment property mortgages. These loans have different requirements compared to primary residence mortgages.

Contents List

Current Mortgage Rate Trends

Mortgage rates, the interest rates charged on home loans, are a crucial factor influencing the affordability and accessibility of homeownership. Understanding current mortgage rate trends is essential for both prospective homebuyers and existing homeowners. This article will delve into the current mortgage rate landscape, exploring factors influencing their fluctuations and how they impact the housing market.

Average Mortgage Rates in 2024

As of [Tanggal saat ini], average mortgage rates for various loan types in 2024 are as follows:

- Fixed-Rate Mortgages:[Rata-rata suku bunga untuk hipotek suku bunga tetap, contoh: 7.00%]. Fixed-rate mortgages provide borrowers with predictable monthly payments throughout the loan term, offering stability and financial planning certainty.

- Adjustable-Rate Mortgages (ARMs):[Rata-rata suku bunga untuk hipotek suku bunga variabel, contoh: 6.50%]. ARMs offer lower initial interest rates compared to fixed-rate mortgages, but the rates can adjust periodically based on market conditions, potentially leading to higher payments in the future.

- FHA Loans:[Rata-rata suku bunga untuk pinjaman FHA, contoh: 6.75%]. FHA loans are government-insured mortgages designed for borrowers with lower credit scores or smaller down payments. They often have lower interest rates compared to conventional loans.

- VA Loans:[Rata-rata suku bunga untuk pinjaman VA, contoh: 6.25%]. VA loans are backed by the Department of Veterans Affairs and are available to eligible veterans, active-duty military personnel, and surviving spouses. They typically offer competitive interest rates and no down payment requirement.

If you’re looking to buy a home in 2024, understanding mortgage rates is crucial. They fluctuate based on economic factors, so staying informed is key.

Historical Mortgage Rate Fluctuations

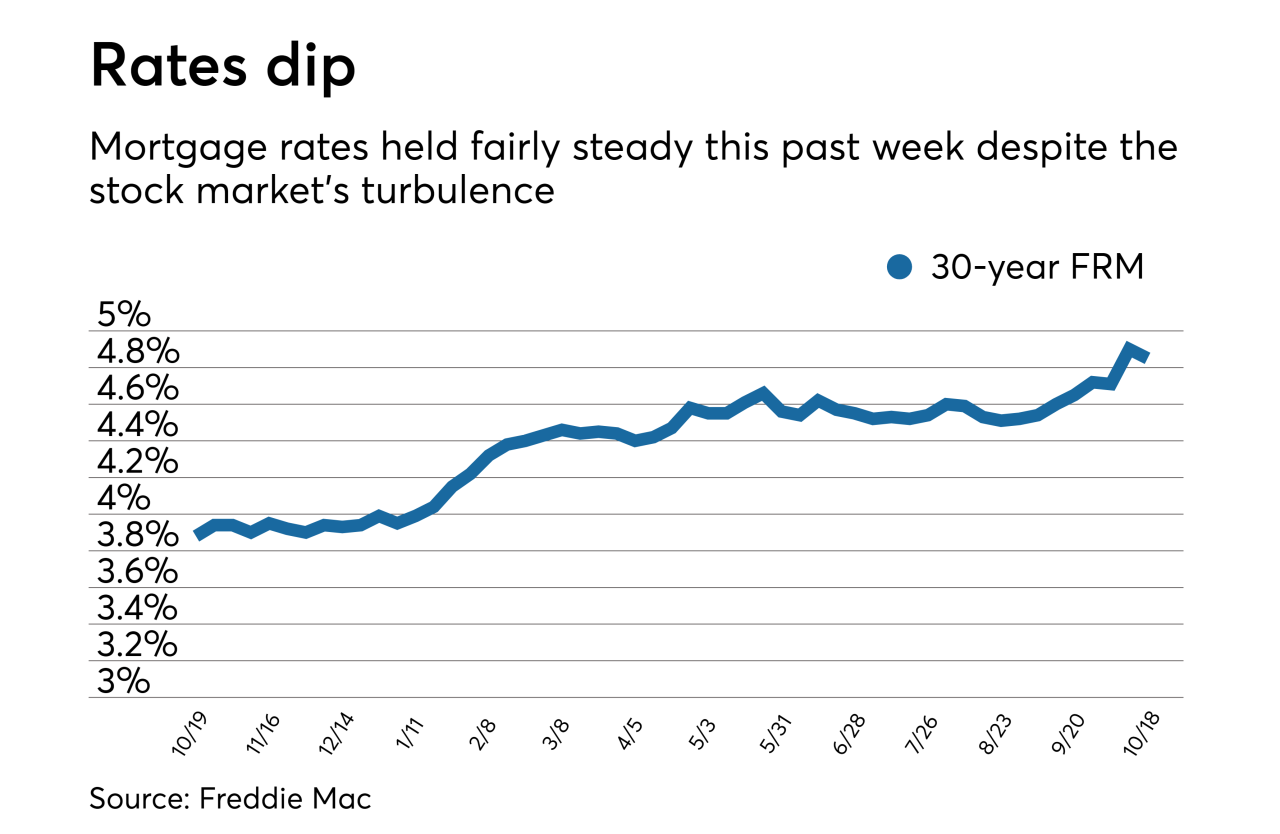

Mortgage rates have historically fluctuated in response to various economic factors. In recent years, we have witnessed a period of historically low mortgage rates following the 2008 financial crisis. However, rates have been on an upward trajectory since the beginning of 2022, driven by factors such as inflation and the Federal Reserve’s monetary policy.

Factors Influencing Mortgage Rate Trends

Several key factors influence current mortgage rate trends, including:

- Federal Reserve Policy:The Federal Reserve’s monetary policy, including interest rate adjustments, plays a significant role in shaping mortgage rates. When the Fed raises interest rates, it generally leads to higher mortgage rates, and vice versa.

- Inflation:High inflation erodes purchasing power and can lead to increased borrowing costs, including higher mortgage rates. The Federal Reserve often raises interest rates to combat inflation, which further contributes to rising mortgage rates.

- Economic Outlook:The overall economic outlook, including factors such as GDP growth, unemployment rates, and consumer confidence, can influence mortgage rates. A strong economy typically supports lower mortgage rates, while economic uncertainty or recessionary fears can lead to higher rates.

Understanding Mortgage Rates: Average Mortgage Rates Today 2024

Mortgage rates are the interest rates charged on home loans, representing the cost of borrowing money to purchase a property. They are expressed as an annual percentage rate (APR) and play a crucial role in determining the affordability and overall cost of homeownership.

Zero-down mortgages can be appealing, but they often come with higher interest rates. Learn more about zero-down mortgages and weigh the pros and cons.

Fixed-Rate vs. Adjustable-Rate Mortgages

The two primary types of mortgages are fixed-rate and adjustable-rate mortgages (ARMs). Understanding the differences between these mortgage types is essential for making an informed decision:

- Fixed-Rate Mortgages:With a fixed-rate mortgage, the interest rate remains constant throughout the loan term, providing predictable monthly payments. This offers financial stability and allows for long-term budgeting.

- Adjustable-Rate Mortgages (ARMs):ARMs have an initial interest rate that is typically lower than fixed-rate mortgages, but the rate can adjust periodically based on a specific index, such as the London Interbank Offered Rate (LIBOR). While ARMs can offer lower initial payments, they carry the risk of higher payments in the future if interest rates rise.

Keybank is a well-established financial institution that offers mortgage services. Get an idea of their current rates by checking out Keybank mortgage rates.

Common Mortgage Terms

Here are some common mortgage terms you should be familiar with:

- Interest Rate:The annual percentage rate (APR) charged on the mortgage loan. It determines the cost of borrowing money.

- Loan Term:The length of time over which the mortgage loan is repaid, typically 15 or 30 years.

- Amortization Schedule:A table outlining the monthly payments, principal and interest allocation, and remaining loan balance over the loan term.

Factors Affecting Individual Mortgage Rates

While average mortgage rates provide a general indication of market conditions, individual mortgage rates can vary based on several factors. Understanding these factors can help borrowers negotiate better rates and make informed financing decisions.

Finding the lowest interest rate home loan can save you money over the life of your mortgage. Compare rates from different lenders to get the best deal.

Credit Score

A borrower’s credit score is one of the most significant factors influencing their mortgage rate. A higher credit score generally translates to lower interest rates, as lenders perceive borrowers with good credit history as less risky.

FHA loans are known for their flexible requirements, making them a good option for first-time homebuyers. Check out FHA loans to see if they’re right for you.

Down Payment

The amount of down payment a borrower makes can also impact their mortgage rate. A larger down payment typically leads to a lower interest rate, as it reduces the loan-to-value ratio (LTV) and makes the loan less risky for the lender.

Loan-to-Value Ratio (LTV)

The loan-to-value ratio (LTV) is the percentage of the property’s value that is financed by the mortgage loan. A lower LTV, indicating a larger down payment, typically results in lower interest rates.

Getting pre-approved for a mortgage can strengthen your offer when buying a home. Understanding the mortgage approval process in 2024 is essential.

Loan Programs

Different loan programs, such as FHA, VA, and USDA loans, can offer varying interest rates. These programs are designed to meet the needs of specific borrower demographics and may have different eligibility requirements and lending guidelines.

Rates for investment property mortgages can differ from those for primary residences. Check out investment property mortgage rates to get a better understanding.

Loan Fees and Points

Loan fees, such as origination fees, appraisal fees, and closing costs, can impact the overall cost of a mortgage. Points are prepaid interest that can reduce the interest rate on a mortgage. Borrowers should carefully consider the impact of these fees and points on their overall mortgage costs.

For veterans, VA cash-out refinance can be a great way to access equity in your home. It’s important to understand the terms and eligibility requirements before proceeding.

Resources for Finding Current Mortgage Rates

Obtaining current mortgage rates from reputable sources is crucial for making informed financing decisions. Here are some resources to help you find the latest rates:

Financial Websites

- Bankrate.com

- NerdWallet.com

- MortgageNewsDaily.com

Mortgage Lenders

- Wells Fargo

- Chase

- Bank of America

Table of Average Mortgage Rates

| Loan Type | Average Rate | Date | Source |

|---|---|---|---|

| Fixed-Rate (30-year) | [Rata-rata suku bunga] | [Tanggal] | [Sumber] |

| Fixed-Rate (15-year) | [Rata-rata suku bunga] | [Tanggal] | [Sumber] |

| Adjustable-Rate (5/1 ARM) | [Rata-rata suku bunga] | [Tanggal] | [Sumber] |

| FHA Loan | [Rata-rata suku bunga] | [Tanggal] | [Sumber] |

| VA Loan | [Rata-rata suku bunga] | [Tanggal] | [Sumber] |

Comparing Mortgage Rates

When comparing mortgage rates from different lenders, it is essential to consider factors beyond just the interest rate. Other important factors include loan fees, points, closing costs, and the lender’s reputation and customer service.

The prime rate is a benchmark interest rate that influences mortgage rates. Keep an eye on the prime mortgage rate to get an idea of overall trends.

Impact of Mortgage Rates on Homebuyers

Mortgage rates have a significant impact on homebuyers’ affordability and purchasing decisions. Fluctuations in rates can influence the amount of home a buyer can afford, the monthly payments they can manage, and the overall cost of homeownership.

Rising Mortgage Rates

Rising mortgage rates make it more expensive to borrow money for a home purchase. This can lead to reduced affordability, as buyers can qualify for smaller loans or face higher monthly payments. Rising rates can also slow down home sales activity, as buyers become more cautious and price-sensitive.

Falling Mortgage Rates, Average Mortgage Rates Today 2024

Falling mortgage rates make it less expensive to borrow money, leading to increased affordability. This can stimulate home buying activity, as buyers can qualify for larger loans and enjoy lower monthly payments. However, falling rates can also contribute to rising home prices, as increased demand puts upward pressure on property values.

A 30-year fixed-rate mortgage is a common choice for homebuyers. See what 30-year fixed rates look like in 2024.

Here are some strategies for homebuyers navigating fluctuating mortgage rates:

- Lock in a Rate:If rates are expected to rise, consider locking in a rate with a lender to secure a fixed interest rate for a specific period.

- Shop Around:Compare rates from multiple lenders to find the best terms and fees.

- Consider an ARM:If rates are high, an adjustable-rate mortgage (ARM) with a lower initial interest rate may be an option, but be mindful of the potential for higher payments in the future.

- Increase Your Down Payment:A larger down payment can reduce your LTV and potentially qualify you for a lower interest rate.

Ending Remarks

In conclusion, navigating the mortgage market requires staying informed about current rates, understanding the factors influencing them, and exploring available resources. Whether you’re a first-time buyer or a seasoned homeowner, staying informed about average mortgage rates today in 2024 is crucial for making informed decisions that align with your financial goals and homeownership aspirations.

Commonly Asked Questions

What are the current average mortgage rates for fixed-rate mortgages?

Sofi is a popular online lender that offers various financial products, including loans. Learn more about Sofi loans and see if they meet your needs.

The current average mortgage rates for fixed-rate mortgages vary depending on the loan term. For example, a 30-year fixed-rate mortgage may have an average rate of around 6.5%, while a 15-year fixed-rate mortgage might have an average rate of 5.5%.

Adjustable-rate mortgages (ARMs) can offer lower initial rates. If you’re considering an ARM, explore 7/1 ARM rates to see how they compare to fixed-rate options.

What is the difference between a fixed-rate and an adjustable-rate mortgage?

A fixed-rate mortgage has an interest rate that remains the same for the entire loan term, providing predictable monthly payments. An adjustable-rate mortgage (ARM) has an interest rate that can change periodically based on a specific index, making monthly payments potentially more volatile.

How can I find the best mortgage rates?

To find the best mortgage rates, it’s essential to shop around and compare offers from multiple lenders. Use online mortgage calculators, financial websites, and contact reputable mortgage brokers to obtain quotes and compare rates.