October 2024 mileage rate for charitable donations takes center stage, offering valuable insights into tax deductions for individuals and organizations. This guide delves into the intricacies of mileage rates, providing a comprehensive overview of the official IRS guidelines, historical context, and practical applications for maximizing your deductions.

The Internal Revenue Service (IRS) annually sets mileage rates for charitable donations, reflecting the cost of operating a vehicle. These rates fluctuate based on factors like fuel prices and inflation. Understanding these rates is crucial for individuals and organizations who donate their time and resources to charitable causes, as it allows them to claim legitimate tax deductions.

Contents List

Understanding Mileage Rates

Donating your time and resources to charitable causes is commendable. However, you might not realize that even the miles you drive for these organizations can be tax-deductible. The Internal Revenue Service (IRS) provides mileage rates specifically for charitable donations, allowing you to claim a deduction for the expenses incurred while volunteering or transporting donated goods.

Navigating the tax system can be complex. You can find a comprehensive guide to the tax brackets for 2024 in the United States here.

Understanding these rates is crucial for maximizing your tax benefits and supporting your favorite charities effectively.

Mileage Rates for Charitable Donations: A Historical Perspective

The IRS has a long history of providing mileage rates for various purposes, including charitable donations. The concept of mileage rates originated in the early 20th century, as a way to simplify the process of deducting transportation expenses. Initially, these rates were based on the average cost of operating a vehicle, taking into account factors like fuel, maintenance, and depreciation.Over time, the IRS has adjusted the mileage rates to reflect changes in vehicle costs and other relevant factors.

The mileage rates for charitable donations have evolved alongside these adjustments, ensuring that they remain fair and accurate.

Wondering what the highest tax bracket is for 2024? You can find that information, along with the other tax brackets, here. Understanding these brackets is crucial for accurately calculating your tax liability.

Defining Mileage Rates and Their Application in Tax Deductions

Mileage rates are standardized amounts that the IRS allows taxpayers to use to calculate the cost of driving their vehicles for specific purposes. These rates are based on a combination of factors, including the average cost of operating a vehicle, fuel prices, and depreciation.For charitable donations, the IRS provides two separate mileage rates:* Standard Mileage Rate:This rate is used for calculating the cost of driving your vehicle for volunteer services or transporting donated goods to a charitable organization.

The tax landscape is always evolving, and there are some changes impacting the October 2024 deadline. To stay informed about these updates, you can check out this article here to ensure you’re prepared.

The standard mileage rate is typically higher than the rate for business use.

Tax brackets play a significant role in determining your tax liability. To see how these brackets will affect your 2024 income, you can find detailed information here.

Actual Expenses

The October 2024 tax deadline is fast approaching. To ensure a smooth filing process, check out these tax preparation tips here.

You can also choose to deduct the actual expenses you incurred for driving your vehicle for charitable purposes. This option allows you to claim deductions for specific costs, such as fuel, repairs, and insurance. However, this method requires meticulous record-keeping and can be more complex than using the standard mileage rate.The mileage rate you choose to use will affect the amount of your tax deduction.

The standard mileage rate is generally easier to calculate and provides a more straightforward deduction. However, if you have significant actual expenses, using the actual expense method might result in a larger deduction.

The October 2024 tax deadline for self-employed individuals is different from the standard deadline. For specific details on this deadline, check out this resource here.

The standard mileage rate for charitable donations in 2024 is [Insert Mileage Rate Here] per mile.

If you’re filing as head of household, the tax brackets will differ from other filing statuses. You can find the specific brackets for this status here.

October 2024 Mileage Rate for Charitable Donations

The Internal Revenue Service (IRS) sets the standard mileage rate for charitable donations, allowing individuals to deduct expenses incurred while volunteering for qualifying organizations. This rate is adjusted periodically to reflect changes in fuel prices and other driving costs. This rate is updated annually, with the October 2024 rate being the most current for this period.

October 2024 Mileage Rate

The official mileage rate for charitable donations in October 2024 is 58 cents per mile. This rate applies to all miles driven for charitable purposes, including travel to and from volunteer activities, picking up donated items, and delivering items to the charity.

The tax rate for each bracket can vary significantly, so it’s essential to know the rates that apply to your income. You can find the tax rates for each bracket in 2024 here.

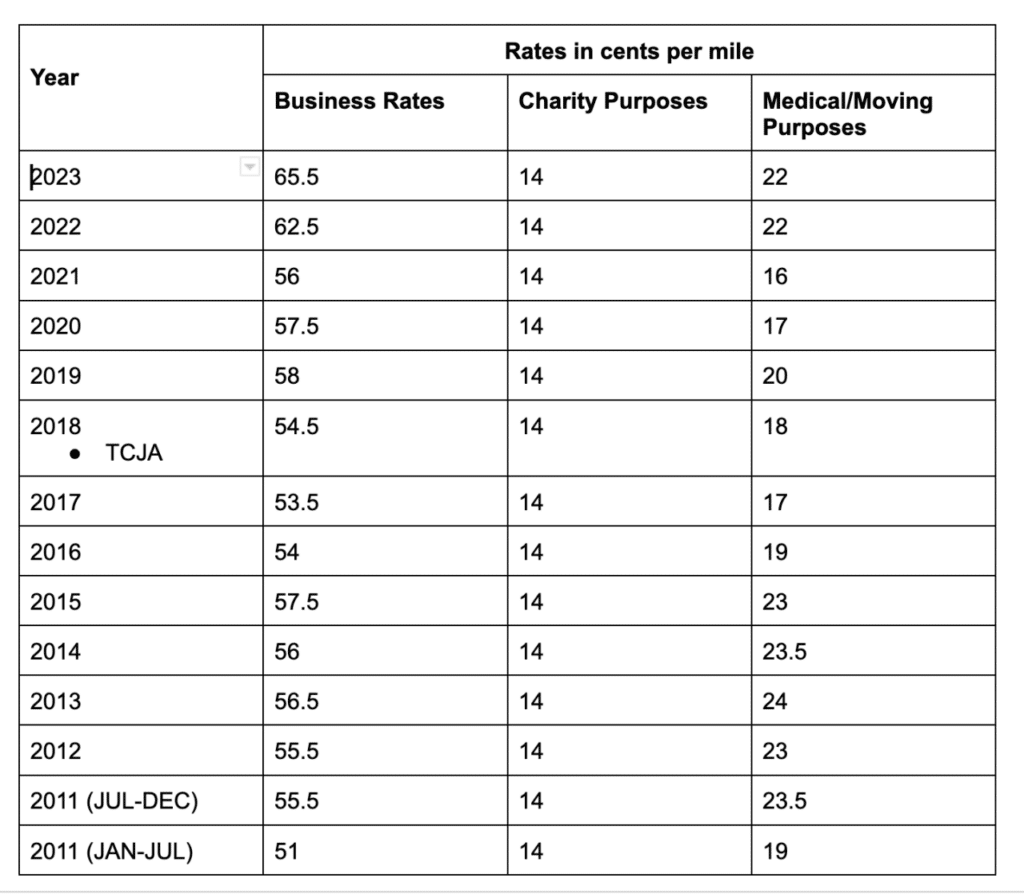

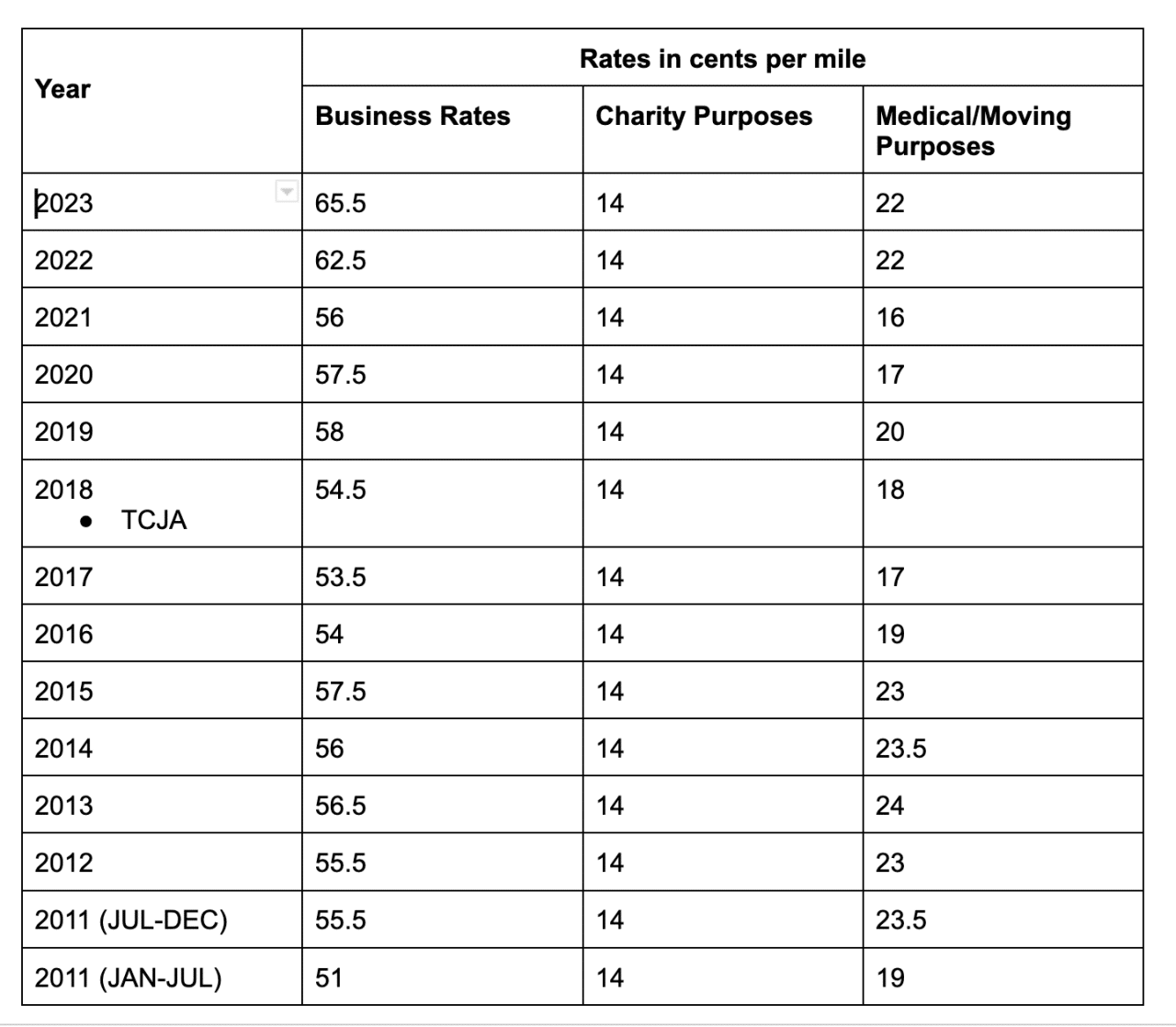

Comparison to Previous Rates, October 2024 mileage rate for charitable donations

The October 2024 mileage rate represents a slight increase from the previous year’s rate. The mileage rate for charitable donations in October 2023 was 58 cents per mile.

Understanding the thresholds for each tax bracket is crucial for accurate tax calculations. You can find a clear explanation of these thresholds for 2024 here.

- October 2024:58 cents per mile

- October 2023:58 cents per mile

- October 2022:58.5 cents per mile

- October 2021:56 cents per mile

- October 2020:14 cents per mile

The rate has generally trended upwards over the past few years, reflecting the rising cost of fuel and vehicle maintenance.

Tax brackets are subject to change, so it’s important to stay updated. You can learn about the tax bracket changes for 2024 here.

Factors Influencing Mileage Rate Determination

The IRS considers several factors when determining the standard mileage rate, including:

- Fuel prices:Fluctuations in gasoline prices significantly impact driving costs.

- Vehicle maintenance:Costs associated with repairs, tire replacements, and other maintenance expenses are factored in.

- Depreciation:The value of a vehicle depreciates over time, and this depreciation is considered in the mileage rate.

- Insurance:Vehicle insurance costs are also factored into the rate.

The IRS analyzes data from various sources, including the Bureau of Labor Statistics and the American Automobile Association, to determine the appropriate mileage rate. The goal is to ensure that the rate accurately reflects the average cost of driving.

To avoid any surprises, it’s always best to use a tax bracket calculator. You can find a reliable one for 2024 here. This tool can help you estimate your tax burden and make informed financial decisions.

Using the Mileage Rate for Deductions

The IRS allows you to deduct a certain amount for each mile you drive for charitable purposes. This deduction can help you save money on your taxes.To calculate your mileage deduction, you need to know the standard mileage rate for the year, the number of miles you drove, and the type of charitable activity.

The IRS sets the standard mileage rate each year.

If you’re a qualifying widow(er), you’ll want to familiarize yourself with the specific tax brackets that apply to your filing status. You can find that information here.

Calculating Mileage Deductions

You can calculate your mileage deduction by multiplying the standard mileage rate by the number of miles you drove. For example, if the standard mileage rate is 14 cents per mile, and you drove 100 miles for a charitable purpose, you can deduct $14.

If you’re filing as single, you’ll need to know the tax brackets that apply to your filing status. You can find those brackets here.

To calculate your mileage deduction, multiply the standard mileage rate by the number of miles you drove for the charitable purpose.

Scenarios for Mileage Deductions

The mileage deduction can be used for various charitable activities, including:

- Driving to volunteer at a non-profit organization

- Delivering donated goods to a charity

- Driving to a fundraising event

- Picking up donated items for a charity

Mileage Deduction Table

The following table summarizes key information for mileage deductions:

| Category | Mileage Rate | Deduction Limit | Example |

|---|---|---|---|

| Volunteer Work | Standard Rate | 50 miles per trip | Driving 10 miles to volunteer = $14 deduction (assuming a $0.14 standard mileage rate) |

| Donation Delivery | Standard Rate | 50 miles per trip | Driving 20 miles to deliver donated goods = $28 deduction (assuming a $0.14 standard mileage rate) |

Additional Considerations for Mileage Deductions

The IRS requires accurate documentation to support mileage deductions. This means you need to keep detailed records of your mileage for charitable purposes, which can be a bit of a hassle, but it’s essential to avoid any potential issues with the IRS.

The Seahawks put up a valiant fight in Week 5, but ultimately fell short. You can read about the game and the team’s performance here.

Maintaining Accurate Records

Properly documenting your mileage for charitable donations is crucial. The IRS can request this documentation at any time, so having it readily available is essential.

It’s natural to want to know what the new tax brackets look like for 2024. You can find a breakdown of those brackets here.

- Date: The date of each trip is essential for tracking your mileage.

- Starting and Ending Locations: Clearly identify where each trip began and ended. For example, “Home to [Charity Name]” or “[Charity Name] to [Event Location].”

- Purpose of the Trip: Briefly explain the reason for each trip, such as “Dropping off donations” or “Volunteering at the event.”

- Mileage: Record the total miles driven for each trip.

Mileage Tracking Methods

Several methods can help you accurately track your mileage for charitable purposes.

- Mileage Tracking Apps: Many apps are available that automatically track your mileage, often using GPS. Popular options include MileIQ, Hurdlr, and Everlance. These apps usually categorize your trips and allow you to easily export your mileage data for tax purposes.

- Logbook: A traditional paper logbook can be a simple and effective method for recording mileage. A basic logbook should include the date, starting and ending locations, purpose of the trip, and mileage. You can find free logbook templates online or purchase a pre-printed logbook.

Consequences of Inaccurate Records

Failing to maintain accurate mileage records can lead to several consequences:

- Disallowance of Deduction: The IRS may disallow your mileage deduction if you cannot provide sufficient documentation. This could result in a higher tax liability.

- Audits: The IRS may audit your tax return if they suspect inaccuracies in your mileage deductions. An audit can be a time-consuming and stressful process.

- Penalties: In some cases, the IRS may impose penalties for failing to maintain accurate records or for intentionally claiming inaccurate deductions.

Summary: October 2024 Mileage Rate For Charitable Donations

Navigating the intricacies of mileage deductions for charitable donations can be challenging, but by understanding the official IRS guidelines and adhering to proper record-keeping practices, you can maximize your tax benefits while supporting worthy causes. Remember to consult with a qualified tax professional for personalized advice and ensure accurate reporting.

Quick FAQs

What if I don’t have a logbook or mileage tracking app?

You can still claim mileage deductions by keeping detailed records of your trips, including dates, starting and ending locations, and the purpose of each trip. However, using a mileage tracking app or logbook is recommended for accurate and organized record-keeping.

Can I claim mileage deductions for personal trips that involve charitable activities?

No, mileage deductions are only applicable for trips solely related to charitable donations. If your trip has a personal component, you cannot claim a deduction for the entire trip. You can only deduct the mileage directly associated with the charitable activity.

Is there a limit on the number of trips I can claim mileage deductions for?

There is no limit on the number of trips you can claim deductions for, but each trip must be documented and related to charitable donations.

What happens if I claim mileage deductions for trips I didn’t actually take?

Claiming deductions for fraudulent trips can result in serious penalties, including fines and even criminal charges. It’s crucial to maintain accurate and honest records for all mileage deductions.