Where can I find the mileage rate for October 2024? This question is crucial for anyone seeking reimbursement for business or personal travel expenses. Mileage rates, determined by government agencies, provide a standardized way to calculate reimbursement based on the distance traveled.

Understanding these rates is essential for accurate record-keeping and tax compliance.

Navigating the world of mileage rates can seem complex, but this guide will equip you with the knowledge you need. We’ll delve into the official sources for obtaining the latest mileage rates, exploring factors that influence their fluctuations, and demonstrating how to calculate reimbursements.

By the end, you’ll be confident in understanding and utilizing mileage rates for October 2024.

Contents List

Official Sources for Mileage Rates

The mileage rate used for business and tax purposes is determined by the Internal Revenue Service (IRS) in the United States. This rate fluctuates annually, reflecting changes in fuel prices and other relevant factors.

The IRS mileage rate is adjusted periodically, so it’s important to know the current rate. To find out what is the IRS mileage rate for October 2024 , you can visit the IRS website or consult with a tax professional.

IRS Publication

The IRS publishes official mileage rates for both business and medical purposes. These rates are typically updated annually, and the rates for October 2024 will be determined by the IRS in the months leading up to October. You can find the most up-to-date mileage rates on the IRS website or in IRS Publication 535, “Business Expenses.”

There are several tax credits available to help reduce your tax liability. You can find out more about tax credits for the October 2024 deadline by visiting the IRS website or speaking with a tax professional.

IRS Website, Where can I find the mileage rate for October 2024?

The IRS website is the primary source for obtaining official mileage rates. The IRS publishes the standard mileage rates on its website, usually under the “Tax Information for Businesses” section. This section often includes a dedicated page or a downloadable document containing the current mileage rates.

The mileage rate for October 2024 is used for various purposes, including business travel, medical expenses, and charitable donations. You can find out how much is the mileage rate for October 2024 by visiting the IRS website.

Format of Mileage Rate Information

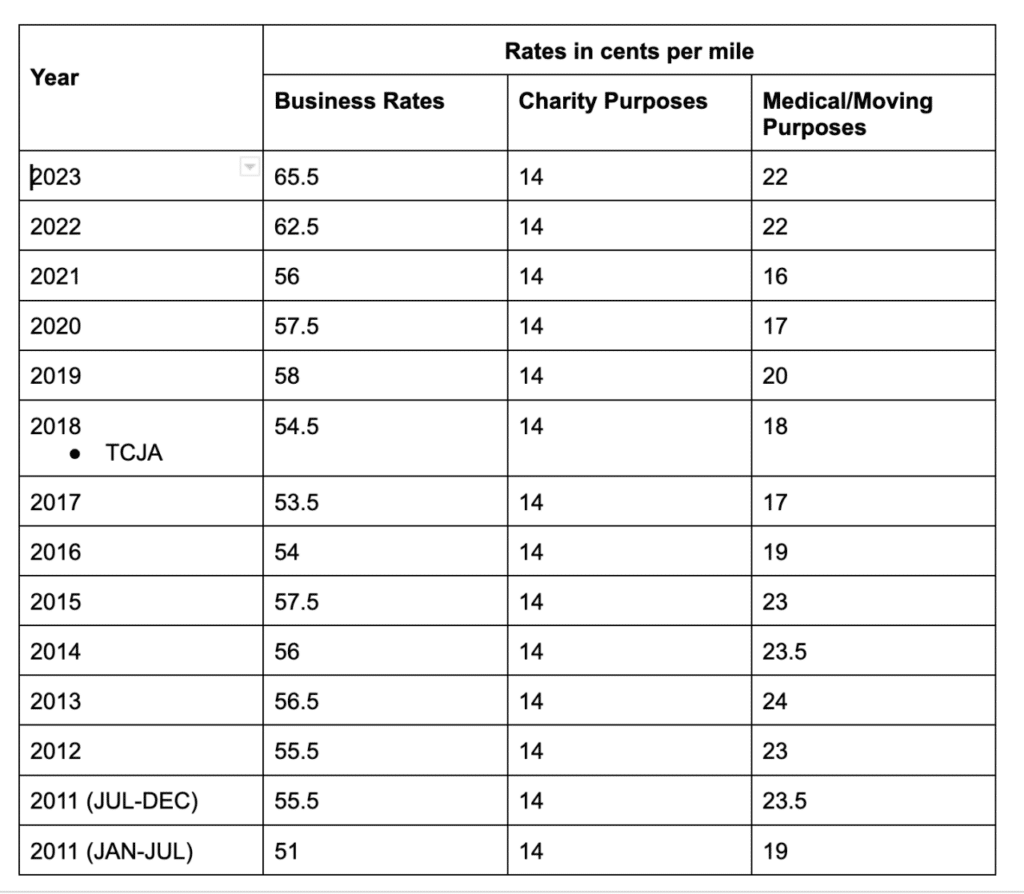

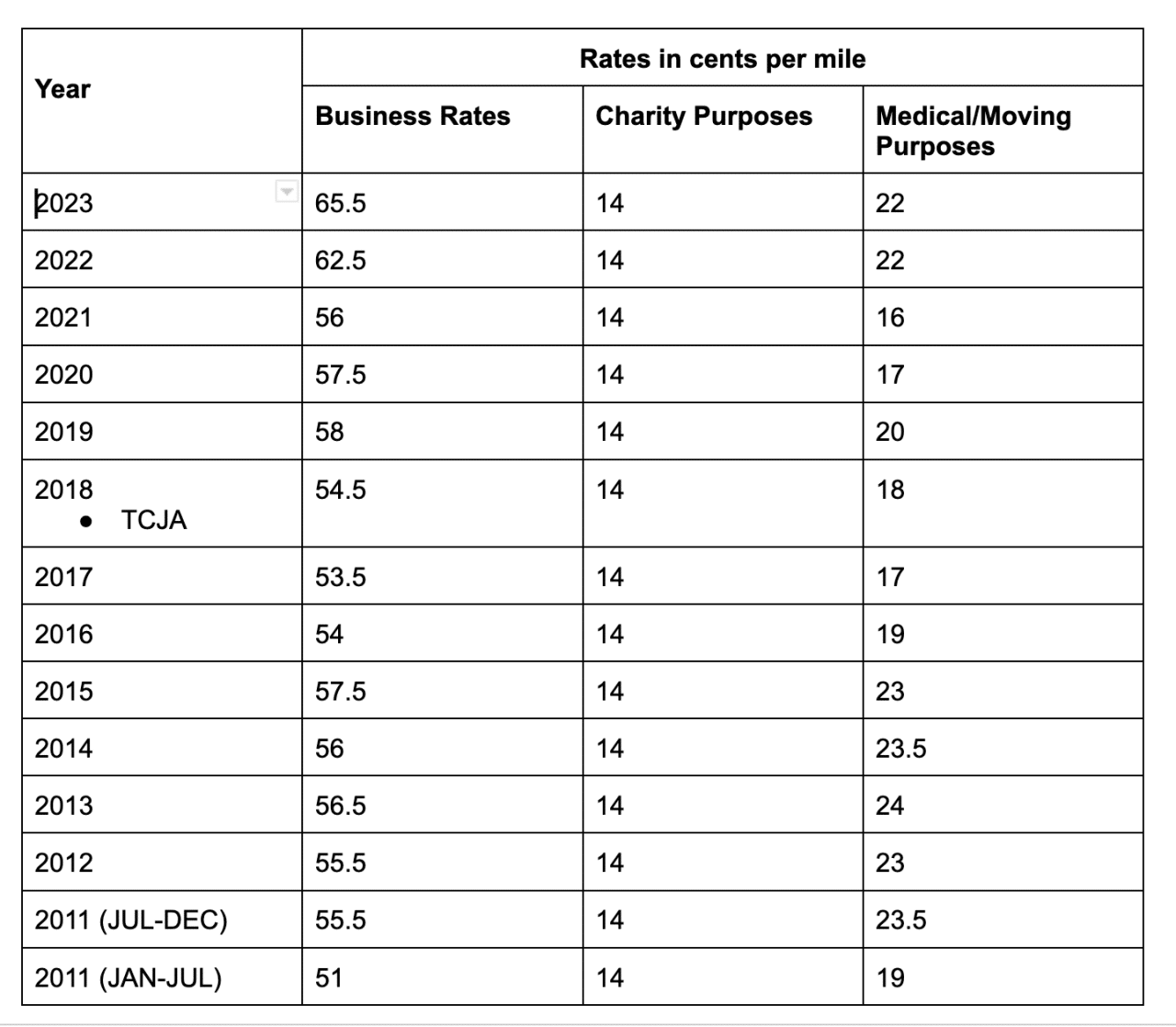

The IRS typically presents mileage rates in a clear and concise format. They usually provide a table that lists the rates for each category, such as business, medical, and charitable purposes. The table often includes the following information:

- Rate:The standard mileage rate for the specific purpose.

- Effective Date:The period during which the rate is applicable.

- Purpose:The intended use of the mileage rate, such as business, medical, or charitable.

Factors Affecting Mileage Rates

Mileage rates are dynamic and are influenced by various factors. Understanding these factors is crucial for individuals and businesses who rely on mileage reimbursement.

Students may be eligible for certain tax deductions and credits, so it’s important to file your taxes by the October 15th deadline. To find out more about the October 2024 tax deadline for students , you can visit the IRS website or speak with a tax professional.

Inflation’s Impact on Mileage Rates

Inflation directly affects mileage rates by increasing the cost of operating a vehicle. As prices for fuel, maintenance, and vehicle parts rise, the cost per mile driven also increases. For instance, a significant increase in fuel prices can lead to a corresponding increase in the mileage rate to compensate for the higher fuel costs.

If you’re filing as single, the tax brackets for 2024 will affect how much you owe in taxes. To find out more about tax brackets for single filers in 2024 , you can visit the IRS website or speak with a tax professional.

Fuel Price Influence

Fuel prices are a major factor in mileage rate adjustments. Fluctuations in fuel prices directly impact the cost of driving. When fuel prices rise, the mileage rate typically increases to reflect the higher cost of gasoline or diesel. Conversely, when fuel prices decline, the mileage rate may be adjusted downward.

The October 2024 tax deadline for foreign nationals is the same as for US citizens, which is October 15th. However, there are some specific rules that apply to foreign nationals, so it’s important to check the October 2024 tax deadline for foreign nationals website for more information.

This dynamic relationship between fuel prices and mileage rates ensures that individuals and businesses are fairly compensated for their driving expenses.

The new tax brackets for 2024 are based on your income level. To find out what are the new tax brackets for 2024 , you can visit the IRS website or consult with a tax professional.

Other Economic and Environmental Factors

Beyond inflation and fuel prices, other economic and environmental factors can influence mileage rates. These factors include:

- Changes in vehicle technology:Advances in fuel efficiency and hybrid or electric vehicles can impact mileage rates. More efficient vehicles may result in lower mileage rates, as the cost per mile driven decreases.

- Government policies:Government policies, such as fuel taxes or incentives for electric vehicles, can influence mileage rates. For example, a tax on gasoline would likely lead to an increase in mileage rates to account for the additional expense.

- Environmental regulations:Environmental regulations related to emissions and fuel efficiency can impact mileage rates. For instance, stricter emission standards may require more expensive fuel or vehicle modifications, potentially leading to higher mileage rates.

Keeping Track of Mileage: Where Can I Find The Mileage Rate For October 2024?

Keeping accurate mileage records is crucial for receiving reimbursement for business travel expenses. You need to document every mile driven for business purposes to ensure you receive the correct amount of reimbursement. There are several methods you can use to track your mileage, and some are more effective than others.

The tax brackets for 2024 in the United States are based on your income level. You can find out more about tax brackets for 2024 in the United States by visiting the IRS website or consulting with a tax professional.

Methods for Tracking Mileage

There are many different ways to track mileage. Some are more effective than others, but ultimately the best method for you will depend on your individual needs and preferences. Here are some popular methods:

- Mileage Tracking Apps:Mileage tracking apps are designed specifically to track mileage. They use your phone’s GPS to automatically record your trips, making it easy to track your mileage. Some popular apps include MileIQ, Hurdlr, and TripLog.

- Spreadsheet:A simple spreadsheet can be used to manually track your mileage. You can create a spreadsheet in Google Sheets or Microsoft Excel to record your starting and ending mileage for each trip, the date, and the purpose of the trip.

If you’re planning on driving for medical reasons, you might want to check out the October 2024 mileage rate for medical expenses. This rate is used to calculate the deductible expenses you can claim on your taxes.

- Mileage Log:A mileage log is a physical notebook where you can manually record your mileage. You can use a pre-printed mileage log or create your own. This method requires you to manually enter your mileage information, which can be time-consuming, but it can be helpful if you prefer a physical record.

Maintaining Accurate Mileage Records

Accurate mileage records are essential for receiving reimbursement. Here are some tips for maintaining accurate records:

- Record Mileage Immediately:Record your mileage as soon as you complete a trip to avoid forgetting any details.

- Include Trip Details:When recording your mileage, be sure to include all relevant details, such as the date, starting and ending mileage, the purpose of the trip, and any other important information.

- Use a Consistent Method:Choose a method for tracking your mileage and stick with it. This will help to ensure that your records are consistent and accurate.

- Keep Your Records Organized:Organize your mileage records in a way that makes them easy to find and review.

Sample Mileage Log Template

Here is a sample mileage log template that you can use to record your travel data:

| Date | Starting Mileage | Ending Mileage | Total Miles | Purpose of Trip | Notes |

|---|---|---|---|---|---|

| 2024-10-25 | 12,345 | 12,456 | 111 | Meeting with Client | |

| 2024-10-26 | 12,456 | 12,567 | 111 | Business Supplies |

Final Conclusion

As we’ve seen, finding the correct mileage rate for October 2024 is essential for accurate reimbursement and tax reporting. By utilizing the official sources and understanding the factors that affect these rates, you can ensure your travel expenses are properly documented and accounted for.

Remember to keep detailed mileage logs and stay informed about any changes in mileage rate regulations.

Essential FAQs

What is the purpose of mileage rates?

Mileage rates are used to reimburse individuals for the costs associated with using their personal vehicles for business or work-related travel. They are a standardized way to calculate these costs, making it fair and transparent for both the individual and the employer or organization.

How are mileage rates determined?

Mileage rates are typically determined by government agencies based on factors like fuel costs, vehicle maintenance, and depreciation. They are updated periodically to reflect changes in these factors.

Where can I find the mileage rate for October 2024?

You can find the mileage rate for October 2024 on the official websites of the IRS or other relevant government agencies. These websites will usually provide a table with mileage rates for different purposes, such as business use, medical expenses, or charitable work.

The tax brackets for 2024 will determine how much of your income is taxed at each rate. To understand how will tax brackets affect my 2024 income , you can visit the IRS website or consult with a tax professional.

There are a few different ways to file your taxes by the October 2024 deadline. You can file online, by mail, or through a tax professional. To find out more about how to file taxes by the October 2024 deadline , you can visit the IRS website or consult with a tax professional.

The mileage rate for October 2024 is used for various purposes, including business travel, medical expenses, and charitable donations. You can find out what is the mileage rate for October 2024 by visiting the IRS website.

A tax bracket calculator can help you estimate how much you’ll owe in taxes for 2024. To use a tax bracket calculator for 2024 , you can visit the IRS website or search for a calculator online.

If you need more time to file your taxes, you can request a tax filing extension. To learn more about tax filing extensions for October 2024 , you can visit the IRS website or consult with a tax professional.

Understanding how tax brackets work can help you plan your finances for 2024. To learn more about understanding tax brackets for 2024 , you can visit the IRS website or consult with a tax professional.