When will the mileage rate be updated for October 2024? This question is on the minds of many individuals and businesses who rely on mileage reimbursements. The IRS mileage rate, used to calculate deductions for business, medical, and charitable travel, is adjusted periodically based on factors like fuel prices and inflation.

This article delves into the process of determining the mileage rate, explores the potential factors influencing the October 2024 update, and analyzes the impact this change could have on individuals and businesses.

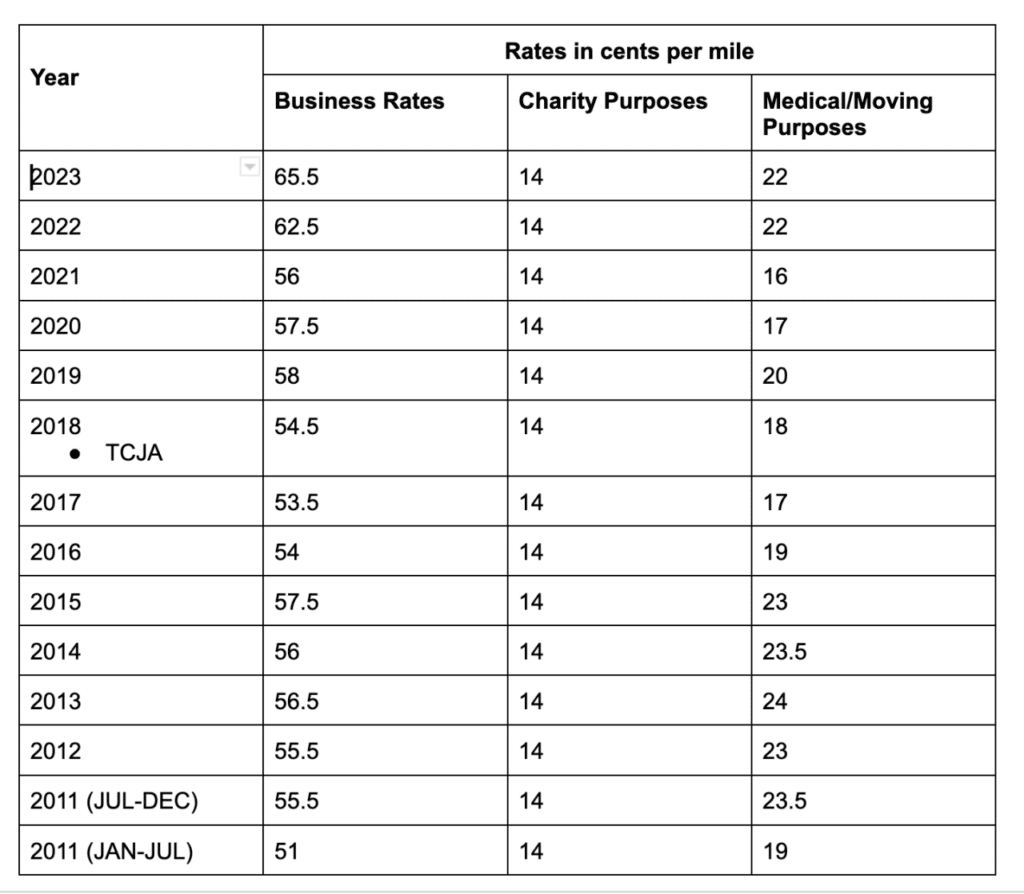

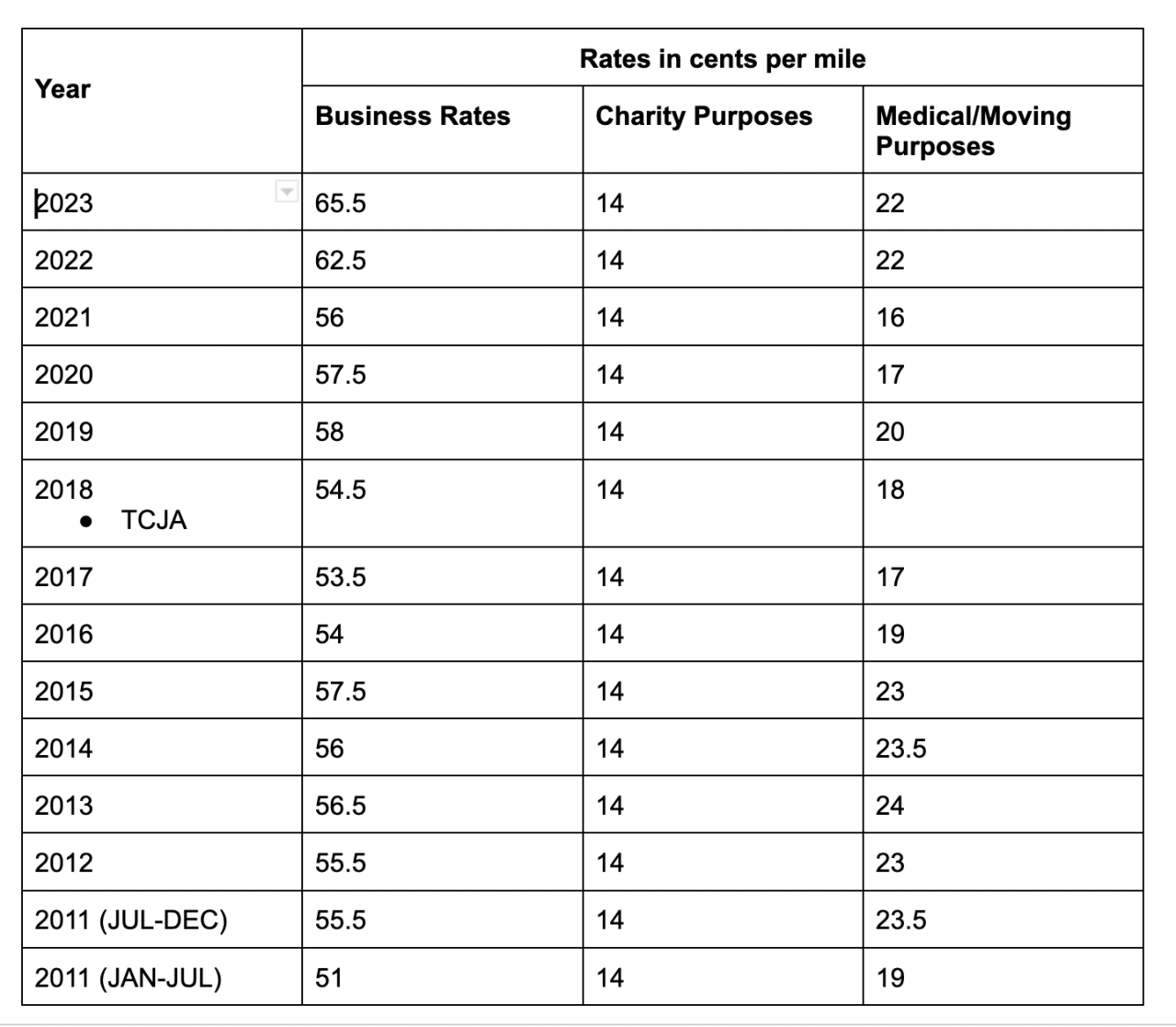

Understanding the IRS’s approach to setting mileage rates is crucial for accurate deductions. The IRS carefully considers factors like fuel costs, vehicle maintenance, and depreciation to determine the standard mileage rate. There are different mileage rates for various purposes, including business, medical, and charitable travel.

The IRS’s commitment to providing fair and accurate mileage rates ensures that individuals and businesses receive appropriate deductions for their travel expenses.

Contents List

Resources and Information: When Will The Mileage Rate Be Updated For October 2024?

Staying updated on the mileage rate is crucial for anyone who uses their vehicle for business purposes. Knowing the current rate helps ensure accurate expense tracking and tax deductions. Here are some resources and tips to help you stay informed.

Tax season is just around the corner, and it’s important to be aware of the tax bracket thresholds for 2024. Knowing where you fall in the tax bracket system can help you plan your finances and make informed decisions about your income and expenses.

Reliable Sources for Mileage Rate Information, When will the mileage rate be updated for October 2024?

The IRS is the primary source for mileage rates. You can find the most up-to-date information directly from their website and publications.

If you’re planning on driving for work, you might be curious about the mileage reimbursement rate for October 2024. You can find the latest information on the mileage reimbursement rate for October 2024 to make sure you’re getting paid fairly for your travel expenses.

- IRS Website:The IRS website is the official source for mileage rates. You can find the current standard mileage rates on the IRS website’s “Tax Information for Business” page.

- IRS Publication 529, Miscellaneous Deductions:This publication provides detailed information on the standard mileage rate, including how to use it and when it’s appropriate.

- IRS Publication 463, Travel, Entertainment, Gift, and Car Expenses:This publication offers a comprehensive guide to deducting travel expenses, including mileage.

Staying Informed About Future Updates

The IRS typically updates the mileage rate annually, usually in the early part of the year. To stay informed, consider the following:

- Subscribe to IRS Email Updates:The IRS offers email subscriptions for various tax-related topics, including business expenses. Sign up for updates to receive notifications about mileage rate changes.

- Check Tax News Websites:Several reputable tax news websites regularly report on IRS updates, including mileage rate changes.

- Follow Tax Professionals on Social Media:Many tax professionals share updates and insights on social media platforms like Twitter and LinkedIn.

Summary

As we approach October 2024, the anticipation for the mileage rate update continues to grow. Understanding the factors that influence the rate, such as fuel prices and historical trends, provides valuable insights into the potential changes. By staying informed about the update and utilizing the resources provided by the IRS, individuals and businesses can ensure they are prepared for the new mileage rate and make informed decisions about their travel expenses.

Answers to Common Questions

What is the current mileage rate?

The current mileage rate for business use is 65.5 cents per mile, while the rate for medical and charitable purposes is 22 cents per mile.

How often is the mileage rate updated?

The IRS typically updates the mileage rate annually, usually in January or February. However, adjustments can occur at other times if necessary.

What are the potential consequences of not using the updated mileage rate?

Using an outdated mileage rate can result in incorrect deductions and potential penalties from the IRS.

The tax landscape is constantly changing, and there may be some tax changes impacting the October 2024 deadline. It’s a good idea to stay updated on any new legislation that could affect your tax obligations.

If you’re self-employed, you’ll need to file your taxes by the October 2024 tax deadline for self-employed individuals. Make sure you’re aware of the specific deadline and requirements for your situation.

When it comes to driving for work, you’ll need to know the mileage rate for October 2024 to accurately track your expenses and get reimbursed properly.

Getting your taxes filed on time can be a bit of a challenge, but there are resources to help you navigate the process. You can find information on how to file taxes by the October 2024 deadline to ensure you meet all the requirements.

Understanding the tax rates for each tax bracket in 2024 is crucial for making informed financial decisions. Knowing how your income is taxed can help you plan for the future and manage your finances effectively.

The IRS offers a variety of resources to help you navigate the tax season. You can find information on IRS resources for the October 2024 tax deadline , including forms, publications, and tools to assist you with your tax filing.

If you need more time to file your taxes, you can request a tax filing extension for October 2024. This will give you additional time to gather all the necessary documents and complete your tax return.

The tax brackets for 2024 in the United States are determined by your income level and filing status. Knowing where you fall within the tax bracket system can help you understand how much tax you’ll owe.

If you’re a foreign national living in the US, you’ll need to file your taxes by the October 2024 tax deadline for foreign nationals. Make sure you’re aware of the specific requirements for your situation.

The tax brackets for qualifying widow(er)s in 2024 are designed to provide some tax relief for those who have lost a spouse. Understanding these brackets can help you plan your finances and minimize your tax burden.

If you’re filing as single, it’s important to know the tax brackets for single filers in 2024. This information can help you understand how your income is taxed and make informed financial decisions.

The tax bracket changes for 2024 may affect your tax liability. It’s a good idea to stay updated on any changes to the tax code so you can adjust your financial planning accordingly.

If you’re retired, you may be wondering about the October 2024 tax deadline for retirees. While the deadline is generally the same for everyone, there may be specific rules and regulations that apply to retirees.