IRA contribution limits for 2024 set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Understanding these limits is crucial for maximizing your retirement savings, as they dictate how much you can contribute to your IRA each year.

This guide delves into the intricacies of IRA contributions, exploring maximum contribution limits, income limitations, catch-up contributions, and various strategies for maximizing your retirement savings.

Whether you’re a seasoned investor or just starting your retirement journey, this comprehensive overview will equip you with the knowledge needed to navigate the complexities of IRA contributions and make informed decisions about your financial future.

Contents List

- 1 IRA Contribution Limits for 2024

- 2 IRA Contribution Strategies for 2024: Ira Contribution Limits For 2024

- 3 IRA Contribution Penalties

- 4 Outcome Summary

- 5 FAQ Insights

IRA Contribution Limits for 2024

Planning for retirement is crucial, and Individual Retirement Accounts (IRAs) offer valuable tax advantages. Understanding the contribution limits and income restrictions for 2024 can help you maximize your retirement savings.

IRA Contribution Limits for 2024

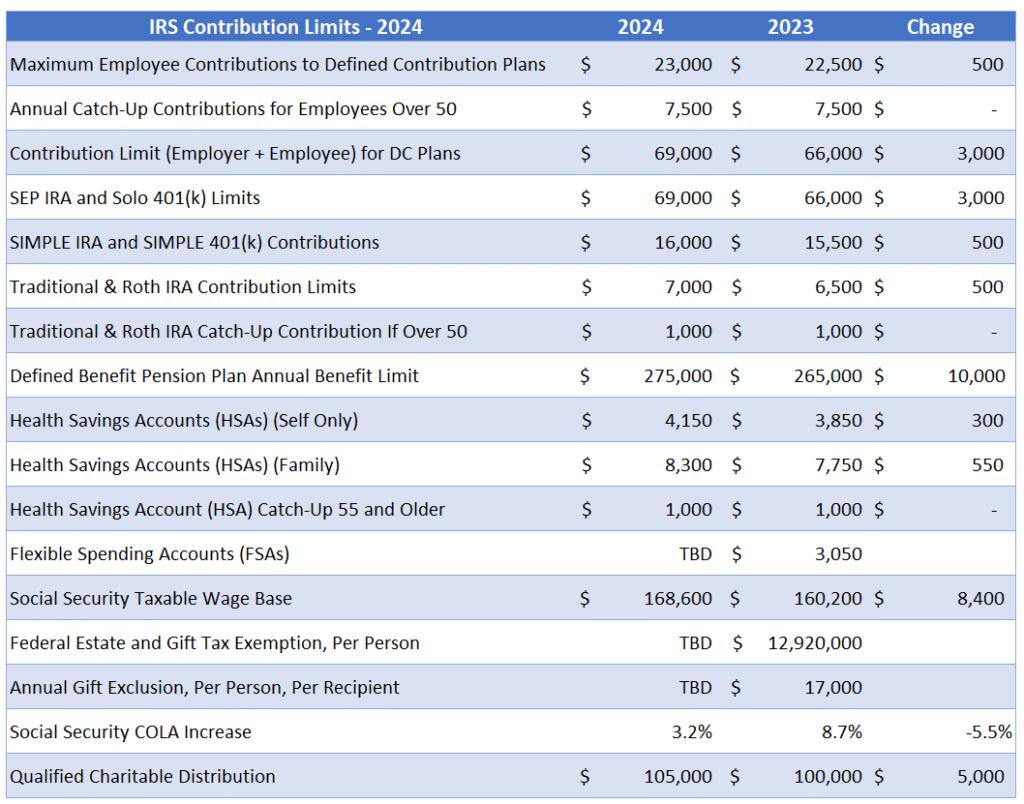

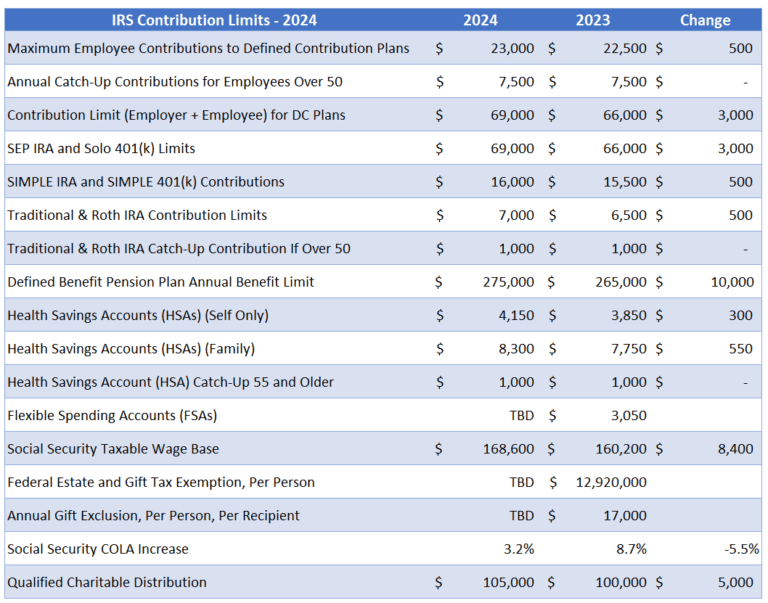

The maximum amount you can contribute to a traditional or Roth IRA in 2024 is $7,000. If you are 50 years old or older, you can contribute an additional $1,000 as a catch-up contribution, bringing your total contribution limit to $8,000.

While the October 2024 tax deadline is the same for many, there are some exceptions. For example, the October 2024 tax deadline for students might be different depending on their specific situation.

Income Limitations for Roth IRA Contributions in 2024

If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA or may face a reduced contribution amount. These thresholds are based on your filing status:

- Single filers: $153,000 – $168,000

- Married filing jointly: $228,000 – $248,000

- Head of household: $183,000 – $208,000

- Qualifying widow(er): $228,000 – $248,000

If your MAGI falls within these ranges, you can contribute a reduced amount to a Roth IRA. If your MAGI exceeds these ranges, you cannot contribute to a Roth IRA.

Comparing the tax bracket changes for 2024 vs 2023 can help you understand how your tax liability might change. Make sure to review the latest information to avoid surprises.

Differences Between Traditional and Roth IRA Contributions

Traditional and Roth IRAs offer distinct tax benefits.

- Traditional IRA:Contributions are tax-deductible in the year you make them, reducing your taxable income. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA:Contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free.

Consequences of Exceeding the IRA Contribution Limit

Exceeding the IRA contribution limit can result in penalties. The Internal Revenue Service (IRS) imposes a 6% penalty on the excess contribution amount. This penalty is applied each year until the excess contribution is removed from the IRA.

“For example, if you contribute $8,000 to your IRA in 2024, but the limit is $7,000, you will have a $1,000 excess contribution. You will be penalized 6% of $1,000, or $60, each year until you remove the excess contribution.”

IRA Contribution Strategies for 2024: Ira Contribution Limits For 2024

Choosing the right IRA contribution strategy can significantly impact your retirement savings and tax burden. This section will delve into various strategies, highlighting their suitability for different income levels and providing a sample plan for a young professional.

IRA Contribution Strategies for Different Income Levels

The choice of IRA contribution strategy depends heavily on an individual’s income level. Here’s a breakdown of the most common strategies and their suitability:

Traditional IRA

Individuals with lower incomes can benefit from a traditional IRA, where contributions are tax-deductible, reducing their current tax liability. The drawback is that withdrawals in retirement are taxed as ordinary income.

Roth IRA

For individuals with higher incomes, a Roth IRA may be more advantageous. Contributions are made after taxes, but withdrawals in retirement are tax-free. This strategy is particularly beneficial for those who anticipate being in a higher tax bracket in retirement.

If you use your vehicle for business purposes, you can deduct mileage expenses. The October 2024 mileage rate for business use is set by the IRS, and it’s important to stay updated on the current rate.

Backdoor Roth IRA

Individuals with higher incomes who are ineligible for direct Roth IRA contributions can use the backdoor Roth IRA strategy. This involves contributing to a traditional IRA and then converting it to a Roth IRA. While the conversion is subject to taxes, it allows individuals to access the benefits of a Roth IRA.

Mega Backdoor Roth IRA

This strategy is available to individuals with employer-sponsored retirement plans, such as 401(k)s. It allows individuals to contribute after-tax dollars to their 401(k) and then roll over those contributions to a Roth IRA, bypassing income limitations.

Figuring out your tax obligations for 2024? The tax bracket thresholds for 2024 can be a little confusing, but knowing how much you’ll owe can help you plan your finances throughout the year.

Sample IRA Contribution Plan for a Young Professional

For a young professional starting their career, a Roth IRA can be a strategic choice. This strategy allows them to accumulate tax-free retirement savings while their income is relatively low and their tax bracket is likely lower. Here’s a sample plan:

* Age 25:Contribute the maximum allowable amount to a Roth IRA, assuming they are eligible.

To make sure you’re ready for the October 2024 deadline, check out these tax preparation tips for the October 2024 deadline. From gathering your documents to understanding your deductions, these tips can help streamline the process.

Age 30

Continue contributing the maximum amount, increasing contributions as their income grows.

Age 35

Review their investment portfolio and adjust contributions based on their financial goals and risk tolerance.

Age 40

If you’re married filing separately, you’ll need to know the tax brackets for married filing separately in 2024. This information will help you calculate your tax liability accurately.

Consider diversifying their retirement savings by contributing to a 401(k) or other employer-sponsored plan, if available.

If you’re a single filer, understanding the tax brackets for single filers in 2024 is crucial for accurately calculating your tax liability.

Factors to Consider When Determining IRA Contribution Amounts

Several factors influence the decision on how much to contribute to an IRA.

The mileage rate for October 2024 can fluctuate, so it’s best to check with the IRS for the most up-to-date information.

Income Level

Individuals with higher incomes may have limited or no contribution options for Roth IRAs. They might need to explore alternative strategies like the backdoor Roth IRA.

It’s important to remember the October 2024 tax deadline for businesses – missing it can lead to penalties. The tax penalties for missing the October 2024 deadline can be hefty, so make sure you’re prepared.

Tax Bracket

Consider your current and projected tax brackets when choosing between traditional and Roth IRAs. Individuals who expect to be in a lower tax bracket in retirement may benefit from a traditional IRA.

Financial Goals

Your retirement goals, such as the desired lifestyle or income replacement, will influence your contribution amounts.

Taking advantage of available tax credits can help reduce your tax burden. Check out the tax credits for the October 2024 deadline and see if you qualify.

Risk Tolerance

Your investment risk tolerance will determine the asset allocation within your IRA.

The tax changes impacting the October 2024 deadline might require you to adjust your tax preparation strategy. Stay informed about these changes to ensure you’re filing correctly.

Emergency Fund

Ensure you have an adequate emergency fund before maximizing IRA contributions.

Tax Implications of IRA Contribution Strategies

Different IRA contribution strategies have varying tax implications.

The tax bracket changes for 2024 might affect how much you owe. It’s important to stay informed about these changes so you can plan accordingly.

Traditional IRA

Contributions are tax-deductible, reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

The understanding tax brackets for 2024 is a key step in filing your taxes correctly. Knowing how the tax brackets work can help you avoid surprises and ensure you’re paying the right amount.

Roth IRA

Contributions are made after taxes, but withdrawals in retirement are tax-free. This strategy is advantageous for those who anticipate being in a higher tax bracket in retirement.

Foreign nationals have specific deadlines to keep in mind. The October 2024 tax deadline for foreign nationals may differ based on their residency status and other factors.

Backdoor Roth IRA

While contributions to a traditional IRA are tax-deductible, the conversion to a Roth IRA is subject to taxes. This can be a strategic move for those with higher incomes who are ineligible for direct Roth IRA contributions.

Mega Backdoor Roth IRA

Contributions to a 401(k) are not tax-deductible, but withdrawals in retirement are tax-free. This strategy allows for higher contributions and tax-free growth, but it’s subject to income limitations.

IRA Contribution Penalties

Exceeding the IRA contribution limit or making an ineligible contribution can result in penalties. It’s essential to understand these penalties to avoid them and ensure your retirement savings are protected.

Penalties for Exceeding the IRA Contribution Limit

The penalty for exceeding the IRA contribution limit is a 6% excise tax on the excess contribution. This penalty is applied to the excess amount each year, and it is assessed on the amount of the excess contribution, not just the amount over the limit.

For example, if you contribute $7,000 to a traditional IRA in 2024, and the contribution limit is $6,500, you would be assessed a 6% penalty on the $500 excess contribution.

Consequences of Making an Ineligible IRA Contribution

An ineligible IRA contribution is a contribution that does not meet the requirements for an IRA. For example, if you contribute to a traditional IRA while you are covered by a retirement plan at work and your income exceeds the limit, your contribution may be ineligible.

The penalty for an ineligible IRA contribution is the same as the penalty for exceeding the contribution limit

a 6% excise tax.

Correcting an IRA Contribution Error

If you realize you have made an error in your IRA contribution, you can correct it by removing the excess contribution or the ineligible contribution. You have until the tax filing deadline for the year of the error to remove the excess contribution or the ineligible contribution.

If you remove the excess contribution or the ineligible contribution before the tax filing deadline, you will not have to pay the 6% excise tax penalty.

Common IRA Contribution Penalty Situations, Ira contribution limits for 2024

Here are some common situations that can lead to IRA contribution penalties:

- Contributing more than the annual limit. For example, contributing $7,000 to a traditional IRA in 2024, when the limit is $6,500.

- Contributing to a traditional IRA while covered by a retirement plan at work and exceeding the income limit.

- Contributing to a Roth IRA while exceeding the income limit.

- Contributing to an IRA after age 70 1/2.

Outcome Summary

As we conclude our exploration of IRA contribution limits for 2024, remember that understanding these regulations is vital for maximizing your retirement savings. By carefully considering your income level, age, and financial goals, you can develop a personalized IRA contribution strategy that aligns with your individual needs.

Don’t hesitate to consult with a financial advisor to ensure your strategy is optimal for your specific circumstances.

FAQ Insights

What happens if I exceed the IRA contribution limit?

If you exceed the IRA contribution limit, you will be subject to a penalty of 6% of the excess contribution. This penalty applies each year the excess contribution remains in your IRA. It’s important to avoid exceeding the limit to prevent financial penalties.

Can I contribute to both a traditional IRA and a Roth IRA in the same year?

Yes, you can contribute to both a traditional IRA and a Roth IRA in the same year, but the total amount you contribute to both accounts combined cannot exceed the annual contribution limit.

How do I know if I’m eligible for catch-up contributions?

Catch-up contributions are available to individuals aged 50 and older. If you meet this age requirement, you can contribute an additional amount to your IRA, allowing you to accelerate your retirement savings.

What are the tax implications of IRA rollovers?

IRA rollovers are generally tax-free, meaning you won’t have to pay taxes on the amount you roll over. However, it’s crucial to consult with a tax advisor to ensure you understand the specific tax implications for your situation.