Ira contribution limits for SEP IRA in 2024 – SEP IRA contribution limits for 2024 offer a unique opportunity for self-employed individuals to save for retirement. This guide delves into the intricacies of SEP IRAs, exploring their structure, contribution limits, and tax advantages. Whether you’re a seasoned entrepreneur or just starting out, understanding SEP IRA contributions can significantly impact your financial future.

A SEP IRA, or Simplified Employee Pension IRA, is a retirement savings plan specifically designed for self-employed individuals and small business owners. It allows you to contribute a portion of your self-employment income, enjoying tax benefits on those contributions and their potential growth.

The maximum contribution limit for 2024 is 25% of your net earnings from self-employment, up to a maximum of $66,000. This means that the more you earn, the more you can contribute to your SEP IRA.

Contents List

SEP IRA Basics: Ira Contribution Limits For SEP IRA In 2024

A SEP IRA (Simplified Employee Pension IRA) is a retirement savings plan specifically designed for self-employed individuals and small business owners. It allows you to contribute a portion of your business income to a tax-deferred retirement account. This means that you don’t have to pay taxes on the money until you withdraw it in retirement.SEP IRAs offer a flexible and straightforward way to save for retirement, making them a popular choice for independent contractors, freelancers, and small business owners.

The mileage rate for October 2024 is a key factor for deducting business expenses. Find out what the mileage rate is for October 2024 to maximize your deductions.

SEP IRA Eligibility

To be eligible to contribute to a SEP IRA, you must be:

- Self-employed, including independent contractors, freelancers, and sole proprietors.

- A small business owner, which can include corporations, partnerships, and limited liability companies (LLCs).

- A part-time or full-time employee of a small business.

Definition of a Small Business Owner

In the context of SEP IRAs, a “small business owner” refers to anyone who operates a business, regardless of its size or revenue. This can include:

- Sole proprietorships: Businesses owned and operated by a single individual.

- Partnerships: Businesses owned and operated by two or more individuals.

- Corporations: Businesses that are legally separate entities from their owners.

- Limited Liability Companies (LLCs): Businesses that offer limited liability protection to their owners.

Contribution Limits for 2024

The maximum amount you can contribute to a SEP IRA in 2024 is 25% of your net earnings from self-employment. This limit applies to both contributions made by you and any contributions made by your employer. This limit is subject to change each year, so it is always a good idea to check the latest information before making a contribution.

If you’re filing as married filing separately, your tax brackets will differ from those who file jointly. Learn about the tax brackets for married filing separately in 2024 to understand your tax obligations.

Contribution Limit Calculation

The contribution limit is calculated based on your net earnings from self-employment. This is your gross income from self-employment minus your business expenses. For example, if your net earnings from self-employment are $100,000, the maximum contribution you can make to your SEP IRA is $25,000 (25% of $100,000).

The contribution limit for 2024 is 25% of your net earnings from self-employment, up to a maximum of $66,000.

Filing taxes by the October 2024 deadline can be a daunting task, but it’s important to stay organized and prepared. Here’s how to file taxes by the October 2024 deadline to avoid any penalties or complications.

Tax Advantages of Contributing to a SEP IRA

There are several tax advantages to contributing to a SEP IRA. These include:

- Tax-deferred growth:Your contributions grow tax-deferred, meaning you won’t have to pay taxes on the earnings until you withdraw them in retirement.

- Tax deduction:Your contributions are tax-deductible, which can lower your taxable income and reduce your tax bill.

- Potential for tax-free withdrawals:If you meet certain requirements, you may be able to withdraw your contributions and earnings tax-free in retirement.

Contribution Strategies

Understanding how much you can contribute to a SEP IRA is important, but it’s equally crucial to consider the most effective strategies for maximizing your contributions. This section will explore various strategies for maximizing your SEP IRA contributions, taking into account the limitations of self-employment income.

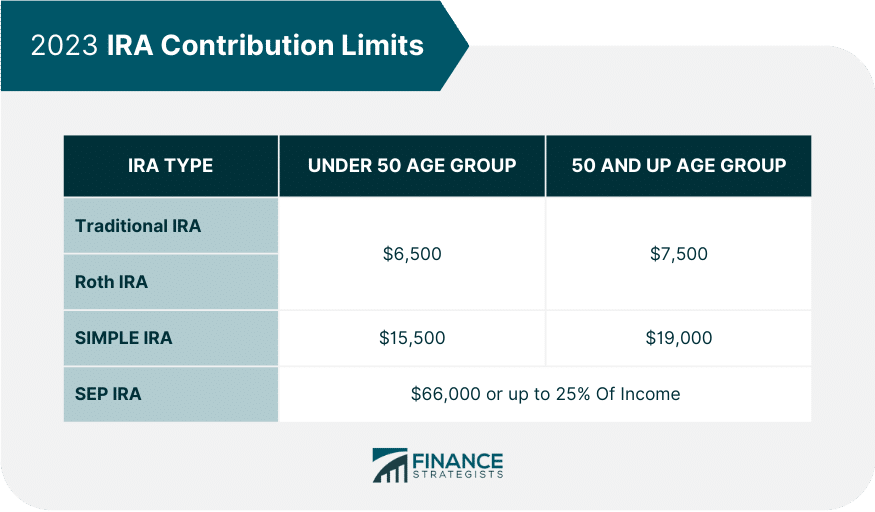

SEP IRA vs. Traditional IRA Contribution Limits, Ira contribution limits for SEP IRA in 2024

This table compares the contribution limits for SEP IRAs and traditional IRAs in 2024, providing a clear understanding of the maximum amounts you can contribute to each type of retirement account:

| IRA Type | Maximum Contribution Limit | Contribution Limit as a Percentage of Earnings |

|---|---|---|

| SEP IRA | $66,000 | 25% of net self-employment income |

| Traditional IRA | $7,500 (or $8,500 if age 50 or older) | N/A |

Benefits of Maximizing SEP IRA Contributions

Maximizing your SEP IRA contributions offers several potential benefits, including:

- Tax Deductions:SEP IRA contributions are tax-deductible, reducing your taxable income and potentially lowering your tax liability. This can result in significant tax savings over time.

- Tax-Deferred Growth:Earnings within a SEP IRA grow tax-deferred, meaning you won’t pay taxes on investment gains until you withdraw the funds in retirement.

- Potential for Higher Retirement Savings:By contributing the maximum amount allowed, you can significantly increase your retirement savings and potentially achieve a more comfortable retirement.

Strategies for Maximizing Contributions

Maximizing your SEP IRA contributions within the limitations of self-employment income can be challenging. However, here are some strategies you can consider:

- Plan Your Contributions:Determine a consistent contribution amount you can afford to set aside each year. This can help you stay on track and maximize your contributions over time.

- Adjust Your Income:If you’re self-employed, you can adjust your income to maximize your SEP IRA contributions. By reducing your net self-employment income, you can lower the required contribution amount while still taking advantage of the tax benefits.

- Consider a Roth SEP IRA:While less common, a Roth SEP IRA allows for tax-free withdrawals in retirement, which can be beneficial for individuals who anticipate being in a higher tax bracket during retirement. However, contributions are not tax-deductible.

Withdrawal Rules

SEP IRA withdrawals are subject to specific rules that determine when you can access your funds and the tax implications of doing so. These rules are designed to ensure that your retirement savings are used appropriately and that you pay the correct amount of taxes on your distributions.

The tax brackets for 2024 have changed compared to 2023, so it’s essential to be aware of the differences. Review the tax bracket changes for 2024 vs 2023 to ensure you’re accurately calculating your taxes.

Tax Implications of Withdrawals

The tax implications of SEP IRA withdrawals depend on whether you withdraw the funds before or after reaching retirement age. * Withdrawals Before Retirement Age:Withdrawals from a SEP IRA before age 59 1/2 are generally subject to a 10% early withdrawal penalty, in addition to your regular income tax rate.

This penalty can be avoided in certain situations, such as if you are permanently disabled, have a qualified medical expense, or are using the funds for a first-time home purchase.* Withdrawals After Retirement Age:Withdrawals after age 59 1/2 are generally taxed as ordinary income, at your current tax bracket.

The mileage rate for October 2024 is an important factor for those who use their vehicles for business purposes. Find out how the mileage rate is calculated for October 2024 to accurately deduct your expenses.

However, if you are taking distributions as part of a qualified retirement plan, such as a Roth IRA, the withdrawals may be tax-free.

There are some significant tax changes impacting the October 2024 deadline, so it’s crucial to stay informed. Check out these tax changes impacting the October 2024 deadline to ensure you’re prepared for filing.

Potential Penalties for Early Withdrawals

Early withdrawals from a SEP IRA can be subject to penalties, depending on the circumstances. The most common penalty is the 10% early withdrawal penalty, which is applied to withdrawals before age 59 1/2. * Exceptions to the 10% Early Withdrawal Penalty:

The mileage rate for October 2024 can significantly impact your tax refund or liability. Learn how much the mileage rate is for October 2024 to ensure you’re maximizing your deductions.

Permanent Disability

The tax rates for each tax bracket in 2024 can vary, so it’s important to know the specific rates that apply to your income. Find out the tax rates for each tax bracket in 2024 to ensure you’re paying the correct amount of taxes.

If you are permanently disabled, you can withdraw funds from your SEP IRA penalty-free.

Qualified Medical Expenses

You can withdraw funds penalty-free for qualified medical expenses that exceed 7.5% of your adjusted gross income (AGI).

If you’re filing as head of household, you’ll have a different set of tax brackets. See the tax brackets for head of household in 2024 to understand your tax obligations.

First-Time Home Purchase

Understanding tax brackets is essential for calculating your tax liability. Learn more about understanding tax brackets for 2024 to make sure you’re paying the right amount of taxes.

You can withdraw up to $10,000 penalty-free for a first-time home purchase.

Higher Education Expenses

Missing the October 2024 tax deadline can lead to penalties, so it’s important to stay organized and file on time. Learn more about the potential tax penalties for missing the October 2024 deadline to avoid any unexpected financial burdens.

You can withdraw funds penalty-free for qualified higher education expenses.

A tax bracket calculator can help you estimate your tax liability. Use a tax bracket calculator for 2024 to get a better idea of your tax obligations.

Death

Freelancers have a specific tax deadline to keep in mind. Learn about the October 2024 tax deadline for freelancers to avoid any late filing penalties.

If you die, your beneficiary can withdraw the funds from your SEP IRA without penalty.* Other Penalties:

Excess Contributions

If you contribute more than the annual limit to your SEP IRA, you may be subject to a 6% excise tax on the excess contribution.

Failure to Take Required Minimum Distributions (RMDs)

If you fail to take your required minimum distributions after age 72, you may be subject to a 50% penalty on the amount you should have withdrawn.

Businesses have their own unique tax deadlines. Find out the October 2024 tax deadline for businesses to ensure you’re meeting all your obligations.

Comparison with Other Retirement Plans

Choosing the right retirement plan is crucial for securing your financial future. While SEP IRAs offer valuable tax advantages and flexibility, they’re not the only option available. Understanding how SEP IRAs stack up against other popular retirement plans can help you make an informed decision.

Comparison of Retirement Plans

Here’s a table comparing SEP IRAs with other popular retirement plans, highlighting key features to help you understand their differences:

| Plan Type | Contribution Limits | Eligibility Requirements | Tax Advantages | Withdrawal Rules |

|---|---|---|---|---|

| SEP IRA | 25% of your net adjusted self-employed income, up to $66,000 in 2024 | Self-employed individuals or small business owners | Contributions are tax-deductible, and earnings grow tax-deferred | Withdrawals before age 59 1/2 are generally subject to a 10% penalty and ordinary income tax |

| 401(k) | $22,500 in 2024, or $30,000 if you’re 50 or older | Employees of companies that offer a 401(k) plan | Contributions are tax-deductible, and earnings grow tax-deferred | Withdrawals before age 59 1/2 are generally subject to a 10% penalty and ordinary income tax |

| Solo 401(k) | $66,000 in 2024, or $73,500 if you’re 50 or older | Self-employed individuals or small business owners with no employees | Contributions are tax-deductible, and earnings grow tax-deferred | Withdrawals before age 59 1/2 are generally subject to a 10% penalty and ordinary income tax |

The table above provides a general overview of the key features of each plan. However, it’s essential to consider your individual circumstances and consult with a financial advisor to determine the most suitable retirement plan for your needs.

Self-employed individuals have a different tax deadline than those who work for an employer. The October 2024 tax deadline for self-employed individuals is different , so make sure you’re aware of the specific requirements.

Factors to Consider When Choosing a Retirement Plan

Here are some factors to consider when choosing between different retirement plans:

- Your employment status:SEP IRAs are ideal for self-employed individuals and small business owners. 401(k)s are available to employees of companies that offer them. Solo 401(k)s are specifically designed for self-employed individuals and small business owners with no employees.

- Your income level:Contribution limits vary depending on the plan type and your income. SEP IRAs have higher contribution limits than 401(k)s, but the maximum contribution is capped at 25% of your net adjusted self-employed income.

- Your investment preferences:Each plan offers different investment options, allowing you to tailor your portfolio based on your risk tolerance and financial goals.

- Your tax situation:Contributions to all of these plans are tax-deductible, which can reduce your current tax liability. However, withdrawals are taxed as ordinary income in retirement.

- Your retirement goals:Consider how much you need to save for retirement and how long you have to save. The plan you choose should align with your overall retirement goals.

Conclusive Thoughts

By understanding the intricacies of SEP IRAs, you can leverage their potential to build a secure financial future. Whether you’re maximizing your contributions or carefully planning withdrawals, a well-informed approach can lead to a more comfortable retirement. Remember, this is just a starting point.

Consulting with a financial advisor can provide personalized guidance and help you develop a retirement plan tailored to your unique circumstances.

Detailed FAQs

What are the tax implications of contributing to a SEP IRA?

Contributions to a SEP IRA are tax-deductible, meaning they reduce your taxable income for the year. This can lead to lower tax liability and potentially more money in your pocket. However, remember that withdrawals from a SEP IRA are taxed as ordinary income in retirement.

Can I withdraw money from my SEP IRA before retirement?

You can withdraw money from your SEP IRA before retirement, but it may be subject to a 10% penalty, in addition to ordinary income tax. However, there are exceptions to this rule, such as for certain medical expenses, disability, or first-time home purchases.

It’s essential to consult with a financial advisor to understand the specific rules and implications of early withdrawals.

How does a SEP IRA compare to a traditional IRA?

SEP IRAs are designed specifically for self-employed individuals and small business owners, while traditional IRAs are available to anyone. SEP IRAs have higher contribution limits but are subject to more stringent withdrawal rules. The best choice for you depends on your individual circumstances and retirement goals.