Navigating the world of retirement savings as a small business owner can be a complex journey. IRA contribution limits for small business owners in 2024 offer a powerful tool to build a secure future. Understanding the various IRA options available, including traditional, Roth, and SEP IRAs, allows you to make informed decisions about your financial well-being.

Each type of IRA presents distinct tax advantages and drawbacks, making it essential to choose the one that aligns best with your individual circumstances and financial goals.

Beyond the contribution limits, exploring eligibility criteria and strategies for maximizing contributions is crucial. This guide delves into the specifics of IRA contributions for small business owners, covering everything from eligibility requirements to maximizing contributions and navigating the tax implications.

By understanding the intricacies of these regulations, you can confidently build a retirement plan that sets you up for success.

Contents List

- 1 Understanding IRA Contribution Limits

- 2 IRA Eligibility for Small Business Owners

- 3 Strategies for Maximizing IRA Contributions

- 4 IRA Contribution Strategies for Different Business Structures

- 5 Tax Implications of IRA Contributions: Ira Contribution Limits For Small Business Owners In 2024

- 6 Alternative Retirement Savings Options for Small Business Owners

- 7 Resources and Support for Small Business Owners

- 8 Epilogue

- 9 FAQ Guide

Understanding IRA Contribution Limits

Saving for retirement is crucial, especially for small business owners who may not have access to employer-sponsored retirement plans. Individual Retirement Accounts (IRAs) offer valuable tax advantages and flexibility for self-employed individuals. Understanding the different types of IRAs and their contribution limits is essential for maximizing retirement savings.

Businesses have a different tax deadline than individuals. Check the October 2024 tax deadline for businesses to ensure you meet the requirements and avoid penalties.

IRA Types for Small Business Owners

IRAs come in various forms, each offering distinct tax benefits and contribution limits. Here are the three main types of IRAs available to small business owners:

- Traditional IRA:This type of IRA allows pre-tax contributions to grow tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them in retirement. This can significantly reduce your current tax burden, but you’ll be taxed on withdrawals during retirement.

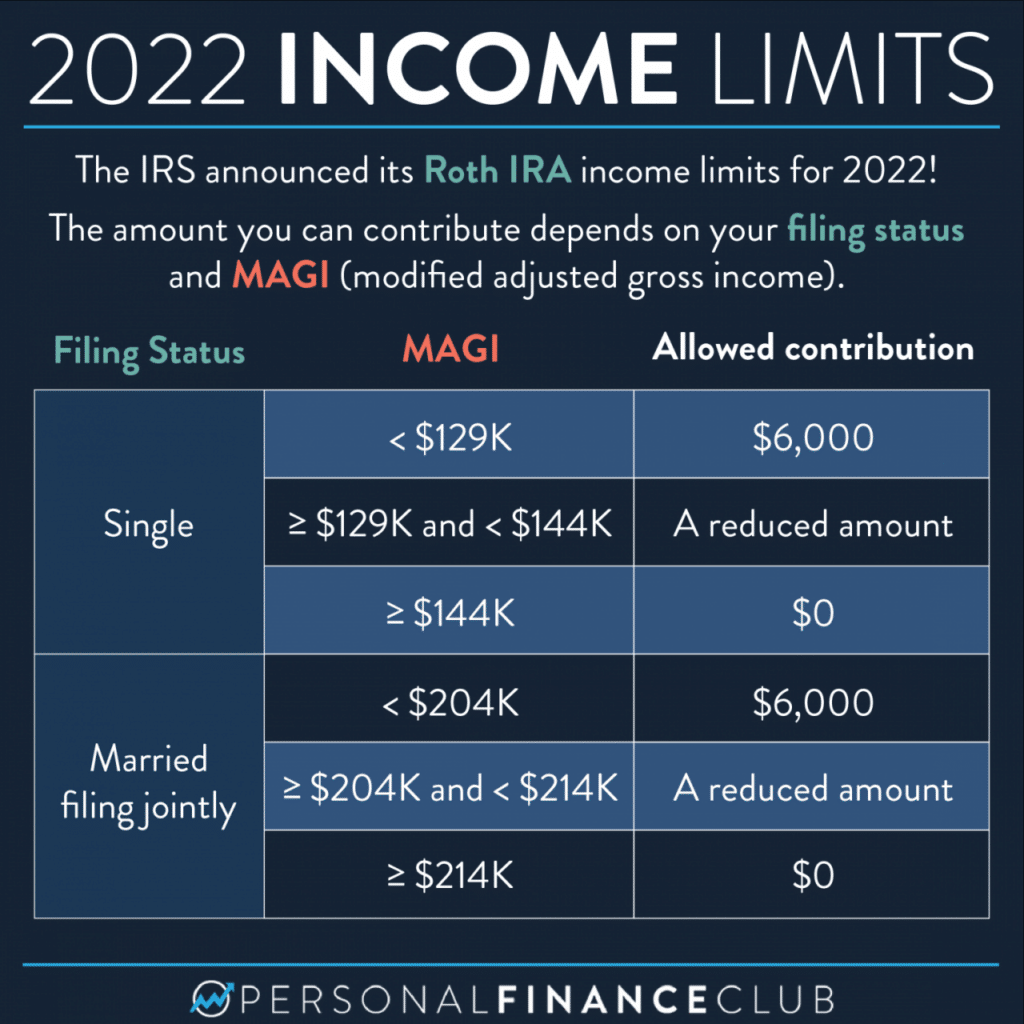

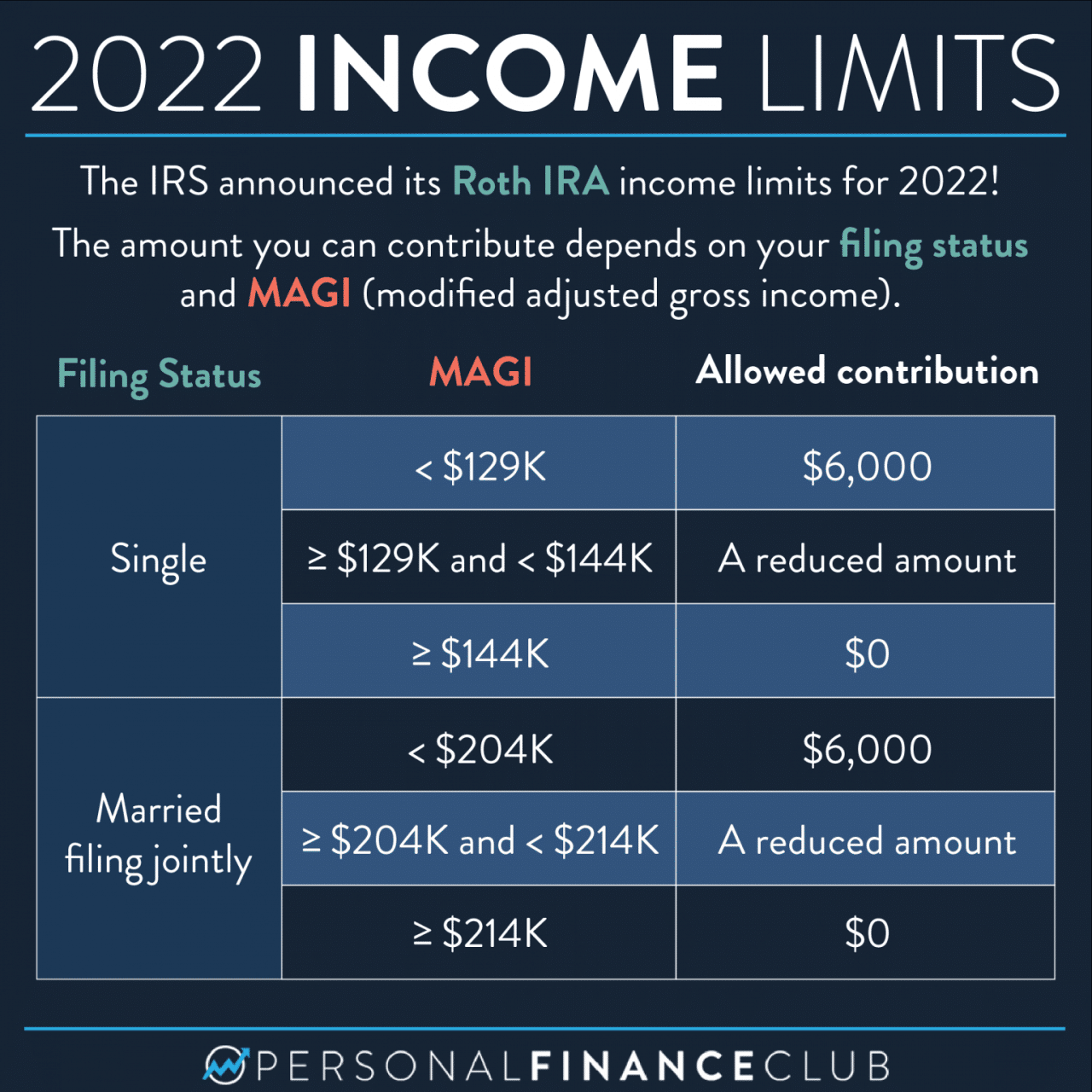

- Roth IRA:Unlike traditional IRAs, Roth IRAs allow after-tax contributions, meaning you’ve already paid taxes on the money you contribute. The earnings grow tax-free, and withdrawals in retirement are also tax-free. This makes Roth IRAs an attractive option for those who expect to be in a higher tax bracket during retirement.

Tax deductions can help lower your taxable income, ultimately reducing your tax bill. Review the tax deductions available for the October 2024 deadline to see if you qualify for any that could benefit you.

- SEP IRA (Simplified Employee Pension IRA):This is a retirement plan specifically designed for self-employed individuals and small business owners. It allows you to contribute both as an employee and an employer. With a SEP IRA, you can contribute up to 25% of your net adjusted self-employed income, with a maximum contribution limit for 2024 of $66,000.

The mileage rate for October 2024 is typically updated by the IRS in the early part of the year. It’s best to check the IRS website for the most current information, as it may change before the tax deadline.

2024 IRA Contribution Limits

The contribution limits for IRAs are subject to change annually. Here’s a breakdown of the contribution limits for 2024:

| IRA Type | Contribution Limit | Catch-Up Contribution (Age 50+) |

|---|---|---|

| Traditional IRA | $7,000 | $1,000 |

| Roth IRA | $7,000 | $1,000 |

| SEP IRA | $66,000 (25% of net adjusted self-employed income) | N/A |

Tax Benefits and Drawbacks of IRAs

The tax benefits and drawbacks of each IRA type are important considerations for small business owners:

- Traditional IRA:

- Tax Benefits:Contributions are tax-deductible, reducing your current tax liability.

- Drawbacks:Withdrawals in retirement are taxable. You may also face penalties for early withdrawals before age 59 1/2.

- Roth IRA:

- Tax Benefits:Withdrawals in retirement are tax-free.

- Drawbacks:Contributions are not tax-deductible.

- SEP IRA:

- Tax Benefits:Contributions are tax-deductible, reducing your current tax liability. You can also deduct the employer contributions as a business expense.

- Drawbacks:You can only contribute as both an employee and an employer, which can limit the amount you can contribute.

Note:It’s essential to consult with a qualified financial advisor to determine the most suitable IRA type for your specific circumstances and financial goals.

IRA Eligibility for Small Business Owners

Small business owners can contribute to an IRA, but there are specific eligibility criteria and regulations they must meet. These rules ensure that contributions are made appropriately and that the benefits of IRA tax advantages are accessible to a wide range of individuals.

Eligibility Criteria for Small Business Owners

Small business owners who are self-employed or work for a small business can contribute to an IRA, but they must meet certain eligibility criteria. These criteria are designed to ensure that the benefits of IRA tax advantages are available to those who genuinely need them.

The IRS mileage rate for October 2024 is a standard rate used to deduct business and moving expenses. It’s important to use the correct rate when filing your taxes to ensure accuracy.

- Self-Employed Individuals:If you are self-employed, you can contribute to a traditional or Roth IRA, regardless of your income level. This means that even if you have a high income, you can still make contributions to an IRA.

- Small Business Owners:If you own a small business, you can contribute to a traditional or Roth IRA, but your eligibility may depend on your business structure.

For example, sole proprietorships, partnerships, and S corporations have different eligibility rules.

IRA Eligibility for Different Business Structures

The eligibility for IRA contributions varies depending on the business structure. Here is a breakdown of the eligibility for each type of business:

- Sole Proprietorships:Sole proprietors are considered self-employed individuals, so they are eligible to contribute to a traditional or Roth IRA. Their income and expenses are reported on Schedule C of Form 1040.

- Partnerships:Partners in a partnership are also considered self-employed individuals, and they can contribute to a traditional or Roth IRA. Their income and expenses are reported on Schedule K-1 of Form 1065.

- S Corporations:Shareholders of an S corporation are considered employees of the corporation, and they can contribute to a traditional or Roth IRA. Their income and expenses are reported on Schedule K-1 of Form 1120-S.

Regulations and Limitations for Small Business Owners

While small business owners can contribute to an IRA, there are certain regulations and limitations that they must be aware of. These regulations are designed to ensure that the benefits of IRA tax advantages are not abused.

- Income Limits:For traditional IRAs, there are income limits that may affect your ability to deduct your contributions. If your income exceeds certain limits, you may not be able to deduct your contributions. This means that you will not be able to claim a tax deduction for your contributions.

- Contribution Limits:There are contribution limits for both traditional and Roth IRAs. For 2024, the maximum contribution limit for traditional and Roth IRAs is $7,000 for individuals under age 50, and $11,000 for individuals age 50 and older.

- Deductible Contributions:For traditional IRAs, the amount of your contribution that is deductible is limited by your adjusted gross income (AGI).

If you’re planning a move, you might be interested in the October 2024 mileage rate for moving expenses. This rate can help you deduct a portion of your moving costs on your taxes, potentially saving you some money.

If your AGI exceeds certain limits, you may not be able to deduct your contributions. This means that you will not be able to claim a tax deduction for your contributions.

Strategies for Maximizing IRA Contributions

Small business owners can maximize their IRA contributions within the 2024 limits by implementing a strategic approach that considers their financial goals, income level, and tax situation. This section explores various strategies and practical tips for incorporating IRA contributions into a comprehensive retirement savings plan.

Wondering what the highest tax bracket is in 2024? You can find the answer on the highest tax bracket in 2024 page. Understanding tax brackets is important for planning your finances and making informed decisions about your income and expenses.

Maximizing IRA Contributions

To maximize IRA contributions, small business owners can follow a strategic approach that involves understanding their eligibility, contribution limits, and tax advantages. Here are some key considerations:

- Determine Eligibility:Individuals who are self-employed or own a small business are eligible to contribute to a Solo 401(k) or SEP IRA. These plans allow for higher contribution limits than traditional IRAs.

- Maximize Contributions:The contribution limits for Solo 401(k) and SEP IRA plans are significantly higher than traditional IRAs. For 2024, the maximum contribution limit for Solo 401(k) is $66,000 for individuals aged 50 and older. This means that self-employed individuals can contribute up to $66,000 annually to their retirement savings.

- Take Advantage of Tax Benefits:Contributions to traditional IRAs and Solo 401(k) plans are tax-deductible, which can significantly reduce your tax liability in the current year. This means that you can potentially reduce your taxable income by the amount you contribute to your IRA, resulting in lower tax payments.

Incorporating IRA Contributions into a Comprehensive Retirement Savings Plan

Incorporating IRA contributions into a comprehensive retirement savings plan is crucial for long-term financial security. This involves:

- Setting Financial Goals:Determine your retirement income needs and create a plan to achieve those goals. This will help you determine the amount you need to save each year and the appropriate contribution level for your IRA.

- Reviewing Your Income and Expenses:Assess your current income and expenses to identify areas where you can potentially increase your savings. This may involve adjusting your spending habits, exploring additional income sources, or finding ways to reduce unnecessary expenses.

- Diversifying Your Investments:Invest your IRA contributions in a diversified portfolio of assets, such as stocks, bonds, and real estate. This helps to reduce risk and potentially increase your returns over time.

Benefits of Maximum IRA Contribution

Making the maximum IRA contribution can offer numerous benefits, including:

- Tax Savings:Contributions to traditional IRAs and Solo 401(k) plans are tax-deductible, resulting in immediate tax savings. This can be particularly advantageous for individuals in higher tax brackets.

- Long-Term Wealth Accumulation:By maximizing contributions, you can accelerate your wealth accumulation over time. The power of compounding returns can work in your favor, allowing your investments to grow significantly over the long term.

- Retirement Security:A substantial IRA balance can provide a significant source of income during retirement, helping to ensure financial security during your later years.

IRA Contribution Strategies for Different Business Structures

Understanding the specific rules and regulations for each business structure is crucial for maximizing your IRA contributions. This section will provide a detailed overview of IRA contribution strategies for different business structures, including sole proprietorships, partnerships, and S corporations.

IRA Contribution Strategies for Sole Proprietorships

Sole proprietors are considered self-employed individuals. As such, they can contribute to a traditional IRA or a Roth IRA as an employee. However, they can also make contributions as a self-employed individual through a SEP IRA or a SIMPLE IRA.

- Traditional IRA:Sole proprietors can contribute up to $7,000 in 2024, or $11,000 if they are age 50 or older. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- Roth IRA:Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. The contribution limit is the same as for a traditional IRA.

- SEP IRA:This plan allows self-employed individuals to contribute up to 25% of their net adjusted self-employment income, with a maximum contribution of $72,000 in 2024. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- SIMPLE IRA:This plan allows self-employed individuals to contribute up to $16,000 in 2024, or $23,000 if they are age 50 or older. The employer is also required to match contributions up to 3% of the employee’s salary. Contributions are tax-deductible, and withdrawals are taxed in retirement.

IRA Contribution Strategies for Partnerships

Partnerships are similar to sole proprietorships in terms of IRA contribution strategies. Each partner is considered self-employed and can contribute to a traditional IRA, Roth IRA, SEP IRA, or SIMPLE IRA.

- Traditional IRA:Partners can contribute up to $7,000 in 2024, or $11,000 if they are age 50 or older. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- Roth IRA:Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. The contribution limit is the same as for a traditional IRA.

- SEP IRA:Each partner can contribute up to 25% of their net adjusted self-employment income, with a maximum contribution of $72,000 in 2024. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- SIMPLE IRA:This plan allows partners to contribute up to $16,000 in 2024, or $23,000 if they are age 50 or older. The partnership is also required to match contributions up to 3% of the employee’s salary. Contributions are tax-deductible, and withdrawals are taxed in retirement.

IRA Contribution Strategies for S Corporations

S corporations are a unique business structure, and their IRA contribution strategies are slightly different from those of sole proprietorships and partnerships. Shareholders in an S corporation are considered employees, and they can contribute to a traditional IRA or a Roth IRA as an employee.

With tax season approaching, it’s crucial to be aware of any tax changes impacting the October 2024 deadline. These changes could affect your filing process, deductions, or even your overall tax liability. Staying informed about these changes can help you prepare and avoid any surprises.

However, they can also contribute as a self-employed individual through a SEP IRA or a SIMPLE IRA.

The mileage rate for October 2024 is calculated by the IRS based on factors like fuel costs and vehicle maintenance. It’s updated periodically, so it’s important to use the most current rate when filing your taxes.

- Traditional IRA:Shareholders can contribute up to $7,000 in 2024, or $11,000 if they are age 50 or older. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- Roth IRA:Contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. The contribution limit is the same as for a traditional IRA.

- SEP IRA:This plan allows shareholders to contribute up to 25% of their net adjusted self-employment income, with a maximum contribution of $72,000 in 2024. Contributions are tax-deductible, and withdrawals are taxed in retirement.

- SIMPLE IRA:This plan allows shareholders to contribute up to $16,000 in 2024, or $23,000 if they are age 50 or older. The S corporation is also required to match contributions up to 3% of the employee’s salary. Contributions are tax-deductible, and withdrawals are taxed in retirement.

Considerations for Choosing an IRA Contribution Strategy

Several factors should be considered when choosing an IRA contribution strategy, including:

- Tax bracket:If you are in a high tax bracket, a traditional IRA may be more beneficial because contributions are tax-deductible. However, if you are in a low tax bracket, a Roth IRA may be more advantageous because withdrawals in retirement are tax-free.

The October 2024 mileage rate may differ from previous years due to factors like fluctuations in fuel prices. Make sure to stay updated on any changes to ensure you’re using the correct rate when claiming business or moving expense deductions.

- Income:The income limits for contributing to a Roth IRA are $153,000 for single filers and $228,000 for married couples filing jointly in 2024. If your income exceeds these limits, you may not be eligible to contribute to a Roth IRA.

Looking for ways to reduce your tax burden? Check out the tax credits available for the October 2024 deadline. These credits can directly reduce the amount of taxes you owe, potentially putting more money back in your pocket.

- Retirement goals:If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial. However, if you expect to be in a lower tax bracket in retirement, a traditional IRA may be more advantageous.

- Flexibility:SEP IRAs and SIMPLE IRAs offer more flexibility for contributions, but they also have some restrictions. For example, SEP IRAs can only be used by self-employed individuals, and SIMPLE IRAs require employers to match contributions.

Important Considerations for Small Business Owners

Small business owners should consider the following factors when choosing an IRA contribution strategy:

- Business structure:The business structure will determine the specific IRA contribution options available to you.

- Financial situation:Your income, expenses, and retirement goals will influence your decision.

- Tax implications:Carefully consider the tax implications of each contribution option.

- Future plans:Consider how your IRA contribution strategy will impact your future financial plans.

Tax Implications of IRA Contributions: Ira Contribution Limits For Small Business Owners In 2024

One of the most attractive aspects of IRAs for small business owners is the potential tax benefits. By contributing to an IRA, you can potentially reduce your current tax liability, and in some cases, even receive a tax credit.

If you need more time to file your taxes, you can apply for a tax filing extension. This will give you additional time to gather your documents and complete your return, but it’s important to remember that it only extends the filing deadline, not the payment deadline.

Tax Deductions for IRA Contributions, Ira contribution limits for small business owners in 2024

Traditional IRA contributions are generally tax-deductible, meaning they can reduce your taxable income for the year. This can lead to a lower tax bill and potentially more money in your pocket. However, the deductibility of contributions can be affected by your income and whether you or your spouse are covered by a retirement plan at work.

Thinking about contributing to your IRA before the October 2024 deadline? You’ll want to be aware of the IRA limits for October 2024 to ensure you’re maximizing your savings and staying within the guidelines. These limits can change year to year, so it’s always best to stay informed.

Saver’s Credit

The Saver’s Credit is a nonrefundable tax credit that can help lower your tax bill if you contribute to a traditional or Roth IRA. This credit is available to individuals and couples who meet certain income limits and contribute to a retirement account.

The credit amount depends on your income and the amount you contribute.

Don’t wait until the last minute to file your taxes! Check out the guide on how to file taxes by the October 2024 deadline. It includes tips on gathering the necessary information, choosing the right filing method, and avoiding common mistakes.

Tax Consequences of Early Withdrawals

While IRAs offer tax advantages, withdrawing funds before age 59 1/2 typically comes with penalties. You’ll generally have to pay a 10% penalty on top of your usual income tax rate for early withdrawals. However, there are exceptions to this rule, such as for first-time home purchases, medical expenses, and certain disabilities.

Missing the October 2024 tax deadline can lead to tax penalties. The IRS takes deadlines seriously, so it’s best to be prepared and file on time. If you’re unable to file by the deadline, you may be able to apply for an extension.

Alternative Retirement Savings Options for Small Business Owners

While IRAs are a great option for retirement savings, they aren’t the only choice available to small business owners. Other retirement savings options offer unique advantages and may be more suitable depending on your specific circumstances and financial goals. Let’s explore some of these alternatives.

401(k) Plans

(k) plans are a popular retirement savings option for both employees and self-employed individuals. These plans allow you to contribute pre-tax dollars to an investment account that grows tax-deferred. The funds are not taxed until you withdraw them in retirement.

Benefits of 401(k) Plans

- Tax-deferred growth: Your investment earnings grow tax-free until retirement.

- Higher contribution limits: You can contribute significantly more to a 401(k) plan compared to an IRA.

- Potential for employer matching: Some employers offer matching contributions, essentially giving you free money for retirement.

- Flexibility in investment choices: You have a wide range of investment options within a 401(k) plan.

Drawbacks of 401(k) Plans

- Administrative costs: Setting up and managing a 401(k) plan can be more expensive than an IRA.

- Complexity: 401(k) plans have more complex rules and regulations than IRAs.

- Potential for early withdrawal penalties: Withdrawals before age 59 1/2 are generally subject to penalties.

Solo 401(k) Plans

Solo 401(k) plans are designed for self-employed individuals and small business owners with no employees or only a spouse working in the business. They combine the features of a traditional 401(k) plan with the flexibility of an IRA.

Benefits of Solo 401(k) Plans

- Higher contribution limits: You can contribute significantly more to a Solo 401(k) than to an IRA.

- Tax-deferred growth: Your investments grow tax-deferred until retirement.

- Flexibility: You can choose to contribute as both an employee and an employer, allowing for higher contributions.

Drawbacks of Solo 401(k) Plans

- Administrative costs: Setting up and managing a Solo 401(k) plan can be more expensive than an IRA.

- Potential for early withdrawal penalties: Withdrawals before age 59 1/2 are generally subject to penalties.

Keogh Plans (HR-10 Plans)

Keogh plans are specifically designed for self-employed individuals and small business owners with employees. They allow you to contribute a percentage of your net adjusted self-employment income to a retirement account.

Benefits of Keogh Plans

- Tax-deferred growth: Your investments grow tax-deferred until retirement.

- Higher contribution limits: You can contribute significantly more to a Keogh plan than to an IRA.

- Flexibility: You can choose between a defined contribution plan or a defined benefit plan.

Drawbacks of Keogh Plans

- Administrative costs: Setting up and managing a Keogh plan can be more expensive than an IRA.

- Complex rules and regulations: Keogh plans have more complex rules and regulations than IRAs.

- Potential for early withdrawal penalties: Withdrawals before age 59 1/2 are generally subject to penalties.

Resources and Support for Small Business Owners

Navigating IRA contributions and retirement planning as a small business owner can be complex. Fortunately, numerous resources and support organizations can provide valuable guidance and assistance.

Government Resources

Government agencies offer essential information and tools to help small business owners understand IRA contribution limits and retirement planning options.

- Internal Revenue Service (IRS):The IRS provides comprehensive information on IRA contributions, eligibility requirements, and tax implications. Visit the IRS website (www.irs.gov) or contact the IRS directly at 1-800-829-1040.

- Small Business Administration (SBA):The SBA offers resources and programs to help small business owners, including information on retirement planning. Visit the SBA website (www.sba.gov) or contact the SBA at 1-800-827-5622.

Financial Professionals

Consulting with a qualified financial professional can provide personalized guidance and tailored strategies for your retirement planning needs.

- Certified Financial Planner (CFP):CFP professionals specialize in financial planning, including retirement planning. They can help you develop a comprehensive retirement plan, choose the right IRA options, and manage your investments.

- Registered Investment Advisor (RIA):RIAs provide investment advice and manage investment portfolios. They can help you create a diversified investment strategy that aligns with your retirement goals.

- Retirement Planning Specialists:Many financial advisors specialize in retirement planning for small business owners. They can provide insights into specific IRA options, tax implications, and strategies for maximizing your retirement savings.

Other Resources

In addition to government agencies and financial professionals, other organizations offer valuable resources and support for small business owners.

Planning to contribute to your IRA in 2024? You’ll want to check out the IRA contribution limits for 2024 to ensure you’re maximizing your savings and staying within the guidelines. These limits can change year to year, so it’s always best to stay informed.

- National Association of Realtors (NAR):The NAR provides resources and guidance for real estate professionals, including information on retirement planning. Visit the NAR website (www.nar.realtor).

- National Federation of Independent Business (NFIB):The NFIB offers resources and advocacy for small business owners, including information on retirement planning. Visit the NFIB website (www.nfib.com).

Seeking Professional Advice

Seeking professional advice from a qualified financial professional is highly recommended. A financial advisor can provide personalized guidance based on your individual circumstances, financial goals, and risk tolerance. They can help you understand the complexities of IRA contributions, choose the best options for your situation, and develop a comprehensive retirement plan that aligns with your needs.

Epilogue

Taking control of your retirement savings as a small business owner is an empowering step. Understanding the IRA contribution limits for 2024 and exploring the various IRA options available to you can pave the way for a financially secure future.

Remember to carefully consider your business structure, tax implications, and individual financial goals to make informed decisions about your retirement savings strategy. Seeking professional advice from a qualified financial advisor can provide personalized guidance and ensure that you are maximizing your retirement savings potential.

FAQ Guide

What are the contribution limits for a traditional IRA in 2024?

For 2024, the maximum contribution limit for a traditional IRA is $6,500. Individuals aged 50 and older can contribute an additional $1,000 as a catch-up contribution, bringing their total contribution limit to $7,500.

Can I contribute to both a 401(k) and an IRA?

Yes, you can contribute to both a 401(k) and an IRA, but there may be income limitations that apply. The contribution limits for both plans are independent of each other.

What are the tax implications of withdrawing money from a Roth IRA before retirement?

Withdrawals of contributions from a Roth IRA are always tax-free and penalty-free. However, withdrawals of earnings before age 59 1/2 are generally subject to both taxes and a 10% penalty.

Are there any income limitations for contributing to a Roth IRA?

Yes, there are income limitations for contributing to a Roth IRA. For 2024, if your modified adjusted gross income (MAGI) is $153,000 or higher as a single filer, married filing separately, or head of household, you cannot contribute to a Roth IRA.

For married filing jointly or qualifying widow(er), the limit is $228,000.