Ira contribution limits for solo 401k in 2024 – Solo 401(k) contribution limits for 2024 offer self-employed individuals and small business owners a powerful tool to save for retirement. This unique retirement plan combines the benefits of both traditional and Roth 401(k)s, allowing individuals to contribute as both an employee and an employer.

By understanding the contribution limits, investment options, and tax advantages of Solo 401(k)s, you can make informed decisions about your retirement savings strategy.

The Solo 401(k) plan is designed to provide retirement savings opportunities for self-employed individuals, independent contractors, and small business owners who may not have access to traditional employer-sponsored retirement plans. It allows individuals to contribute both as an employee and an employer, maximizing their contributions and potential for tax-deferred growth.

Contents List

Considerations for Solo 401(k) Participants

A Solo 401(k) plan can be a valuable retirement savings tool for self-employed individuals and small business owners. However, it’s essential to carefully consider the advantages and disadvantages of this plan before deciding if it’s the right fit for your specific circumstances.

Freelancers, don’t forget! The October 2024 tax deadline for freelancers is approaching. Make sure you’re prepared.

Advantages of a Solo 401(k)

The Solo 401(k) offers several benefits that make it an attractive option for self-employed individuals.

Wondering how much you can deduct for driving your car for business purposes? The October 2024 mileage rate for business use has been announced, so you can calculate your deductions accurately.

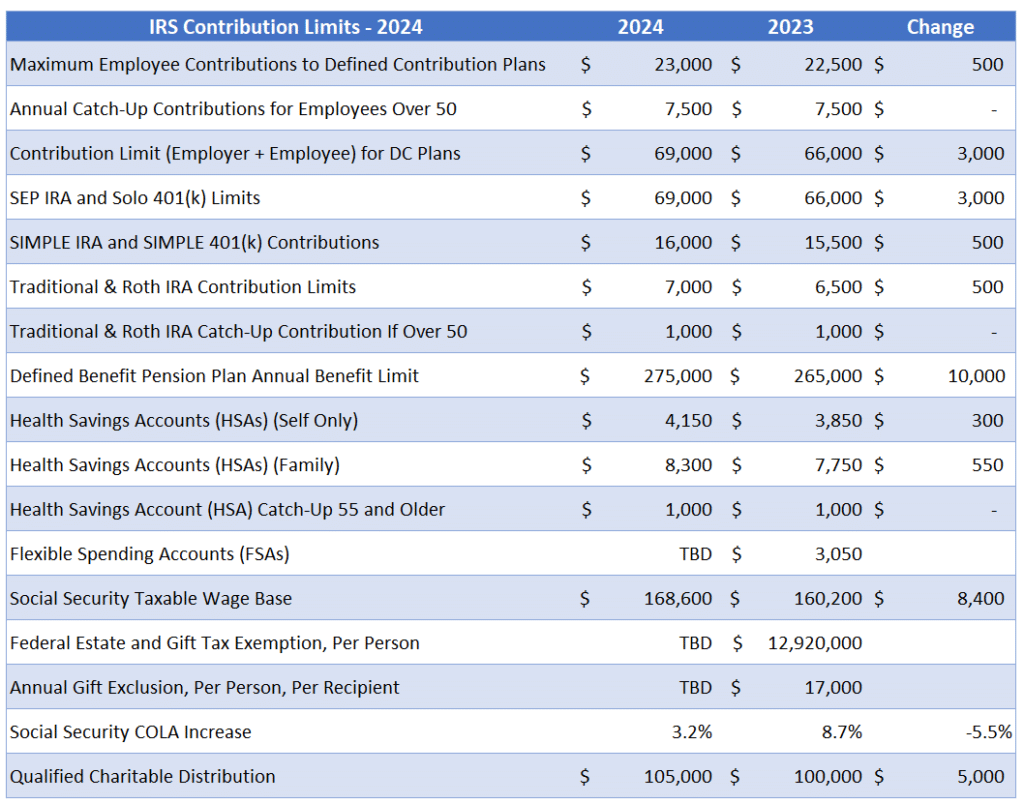

- Higher Contribution Limits:Solo 401(k) plans allow for significantly higher contributions compared to traditional IRAs. In 2024, you can contribute up to $66,000 or $73,500 if you are 50 or older. This higher contribution limit can significantly boost your retirement savings.

- Tax-Deferred Growth:Your investments grow tax-deferred within the Solo 401(k) account, meaning you won’t owe taxes on the earnings until you withdraw them in retirement. This allows your savings to compound faster than in a taxable account.

- Flexibility:Solo 401(k) plans offer flexibility in terms of investment options. You can choose from a wide range of investments, including stocks, bonds, mutual funds, and real estate.

- Potential for Roth Contributions:You can choose to make Roth contributions to your Solo 401(k), which allows you to withdraw your contributions and earnings tax-free in retirement.

Disadvantages of a Solo 401(k)

While the Solo 401(k) offers many advantages, it also has some drawbacks to consider.

Need more time to file your taxes? You might be eligible for an extension! Check out the Tax filing extensions for October 2024 to see if you qualify.

- Administrative Burden:Setting up and managing a Solo 401(k) can be more complex than traditional IRAs. You are responsible for all administrative tasks, including recordkeeping, investment management, and filing tax forms.

- Limited Investment Options:While Solo 401(k) plans offer a wide range of investment options, they may not be as extensive as traditional 401(k) plans offered by larger employers.

- Potential for Early Withdrawal Penalties:Withdrawing funds from a Solo 401(k) before age 59 1/2 can result in significant penalties and taxes.

Suitability of a Solo 401(k), Ira contribution limits for solo 401k in 2024

The suitability of a Solo 401(k) depends on several factors, including your income, financial situation, and retirement goals.

The October 2024 mileage rate changes are a big deal for anyone who uses their car for work. Stay informed about the latest rates.

- High-Income Earners:Solo 401(k) plans can be particularly beneficial for high-income earners who want to maximize their retirement contributions. The higher contribution limits allow them to save more for retirement.

- Self-Employed Individuals:Solo 401(k) plans are specifically designed for self-employed individuals and small business owners. If you work for yourself, a Solo 401(k) can be an excellent way to save for retirement.

- Individuals with a Long-Term Investment Horizon:Solo 401(k) plans are best suited for individuals with a long-term investment horizon, as the tax-deferred growth benefits can significantly increase your retirement savings over time.

Comparison with Other Retirement Savings Options

When considering a Solo 401(k), it’s essential to compare it with other retirement savings options available for self-employed individuals.

Curious about what tax bracket you’ll fall into? The Tax bracket calculator for 2024 can help you estimate your tax liability.

- Traditional IRA:Traditional IRAs offer tax-deductible contributions, but they have lower contribution limits than Solo 401(k) plans. Traditional IRAs may be a better option for individuals with lower incomes who want to maximize their tax deductions.

- SEP IRA:SEP IRAs are simpler to administer than Solo 401(k) plans, but they have lower contribution limits. SEP IRAs may be a good choice for self-employed individuals who want a straightforward retirement savings option.

- Simple IRA:Simple IRAs are a simplified retirement plan option for small businesses with 100 or fewer employees. They have lower contribution limits than Solo 401(k) plans but offer a straightforward way to save for retirement.

Ultimate Conclusion

Navigating the world of Solo 401(k)s can be complex, but understanding the contribution limits, investment options, and tax advantages is crucial for maximizing your retirement savings. By taking the time to explore the details of this unique retirement plan, you can position yourself for a comfortable and secure financial future.

Remember to consult with a financial advisor to determine if a Solo 401(k) is the right fit for your individual needs and circumstances.

FAQ Insights: Ira Contribution Limits For Solo 401k In 2024

What are the penalties for early withdrawals from a Solo 401(k)?

Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus your usual income tax rate.

Can I roll over a traditional IRA into a Solo 401(k)?

Yes, you can roll over funds from a traditional IRA into a Solo 401(k) without incurring any tax penalties.

Is there a minimum amount I need to contribute to a Solo 401(k)?

There is no minimum contribution requirement for Solo 401(k)s. You can contribute as much or as little as you want, up to the annual limits.

What are some examples of investment options available within a Solo 401(k)?

Common investment options include mutual funds, index funds, ETFs, and individual stocks. You can also invest in real estate, precious metals, and other alternative assets, depending on the custodian’s rules.

The Tax brackets for 2024 in the United States have been updated. Understanding these brackets is essential for accurate tax planning.

The IRS offers a wealth of resources to help you navigate the tax season. The IRS resources for the October 2024 tax deadline can provide valuable guidance.

Yes, the mileage rate is changing in October 2024. It’s important to be aware of these changes to ensure accurate deductions.

Wondering what the highest earners will be paying in taxes? The highest tax bracket in 2024 is set at a specific rate.

If you’re filing as head of household, the tax brackets for head of household in 2024 are different from those for single or married filers.

The tax deadline for October 2024 is a crucial date for everyone. Don’t miss it!

The new tax brackets for 2024 have been announced, impacting how much you’ll pay in taxes.

Self-employed individuals have a different deadline than those who work for an employer. The October 2024 tax deadline for self-employed individuals is important to keep in mind.

There are some tax changes impacting the October 2024 deadline. Stay updated on these changes to ensure accurate filing.

Don’t forget to explore the tax credits for the October 2024 deadline. These credits can help reduce your tax liability.