How to fill out W9 Form for October 2024: A Comprehensive Guide Navigating the world of taxes can be daunting, especially when it comes to forms like the W9. This guide aims to simplify the process, providing clear instructions and helpful tips to ensure you complete your W9 form accurately and efficiently.

Whether you’re a freelancer, contractor, or business owner, understanding the W9 form is crucial for tax compliance and smooth financial transactions.

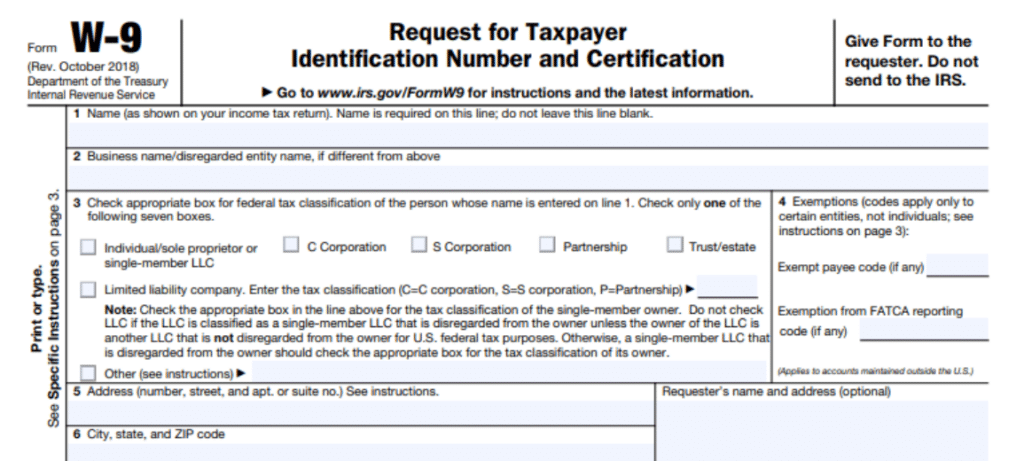

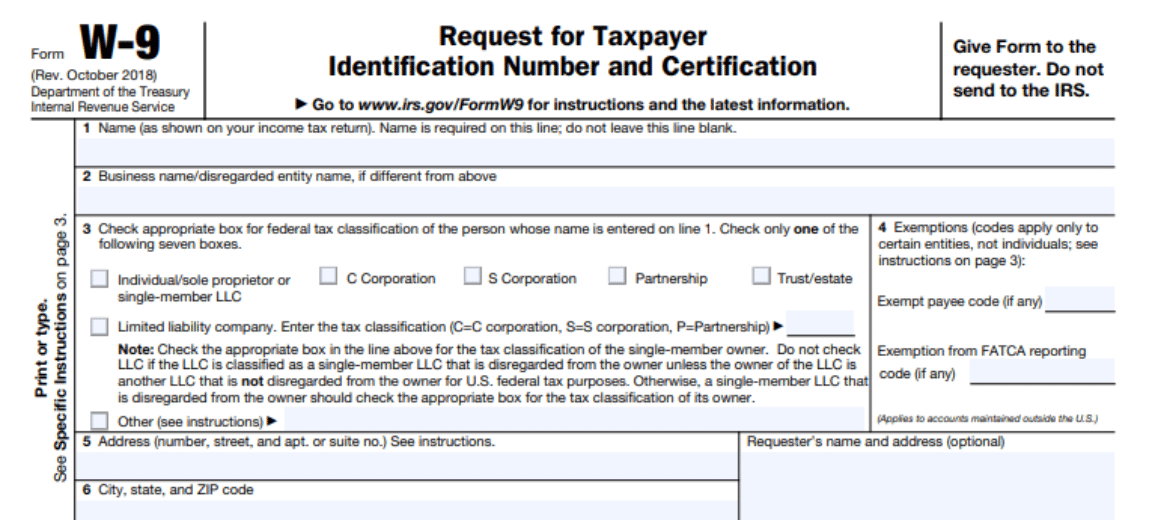

The W9 form, formally known as the “Request for Taxpayer Identification Number and Certification,” serves as a vital tool for businesses and individuals who need to report income earned from various sources. It provides essential information about your tax identification number (TIN), name, address, and other relevant details, enabling recipients to properly report payments made to you on their tax returns.

Contents List

Completing the W9 Form

The W9 form is a crucial document for anyone who receives payments from a business or organization. It provides the payer with your tax identification number (TIN) and other essential information required for tax reporting.

If you’re a small business owner, it’s important to understand your IRA contribution limits. Find out the IRA contribution limits for small business owners in 2024 and start planning your retirement savings.

Understanding the W9 Form Sections

The W9 form is divided into several sections, each requiring specific information. This section will guide you through each part, providing examples and clarifications.

The Seahawks had a tough loss in Week 5, but there’s always next week. Read the Rapid Reactions for a recap of the game and what’s ahead.

Section 1: Requestor’s Name, Address, and TIN

This section collects information about the person or entity requesting the W9 form.

Students have unique tax considerations. Learn about the October 2024 tax deadline for students and make sure you’re aware of any specific requirements.

- Requestor’s Name:This is the name of the person or entity requesting the W9 form. For example, if you are filling out the form for a company, enter the company’s full legal name.

- Requestor’s Address:Enter the full address of the person or entity requesting the W9 form. Include the street address, city, state, and zip code.

- Requestor’s TIN:This is the tax identification number of the person or entity requesting the W9 form. This is typically an Employer Identification Number (EIN) for businesses or a Social Security Number (SSN) for individuals.

Section 2: Payer’s Name, Address, and TIN

This section collects information about the person or entity who will be making the payment.

Understanding the tax rates for each bracket can help you plan your finances. Check out the tax rates for each tax bracket in 2024 and see where you fall.

- Payer’s Name:This is the name of the person or entity who will be making the payment. For example, if you are receiving a payment from a company, enter the company’s full legal name.

- Payer’s Address:Enter the full address of the person or entity making the payment. Include the street address, city, state, and zip code.

- Payer’s TIN:This is the tax identification number of the person or entity making the payment. This is typically an Employer Identification Number (EIN) for businesses or a Social Security Number (SSN) for individuals.

Section 3: Payee’s Name, Address, and TIN

This section collects information about the person or entity receiving the payment.

The standard mileage rate is a valuable deduction for business owners. Learn about the standard mileage rate for October 2024 and how it can benefit you.

- Payee’s Name:This is your name as it appears on your tax return. For example, if you are a sole proprietor, enter your full legal name. If you are a business, enter the business’s legal name.

- Payee’s Address:Enter your full address as it appears on your tax return. Include the street address, city, state, and zip code.

- Payee’s TIN:This is your tax identification number. If you are an individual, enter your Social Security Number (SSN). If you are a business, enter your Employer Identification Number (EIN).

Section 4: Exemption from Backup Withholding

This section asks if you are exempt from backup withholding. Backup withholding is a tax-withholding requirement that applies when a payer does not have enough information to properly report your income.

If you’re using your vehicle for business purposes, you might be eligible for mileage reimbursement. Find out the mileage reimbursement rate for October 2024 and see how much you could receive.

- Exemption from Backup Withholding:If you are exempt from backup withholding, check the box and provide the reason for exemption. You may be exempt if you are a U.S. citizen or resident alien, you have provided your TIN to the payer, and you have certified that you are not subject to backup withholding.

Wondering when the tax deadline is for October 2024? Find out the exact date so you can plan accordingly.

Section 5: Certification

This section requires you to certify that the information provided on the form is correct.

Planning for retirement? IRA contribution limits for October 2024 can help you make the most of your savings.

- Certification:Sign and date the form to certify that the information provided is accurate.

W9 Form Checklist

| Section | Information Required |

|---|---|

| Section 1: Requestor’s Name, Address, and TIN | Requestor’s Name, Requestor’s Address, Requestor’s TIN |

| Section 2: Payer’s Name, Address, and TIN | Payer’s Name, Payer’s Address, Payer’s TIN |

| Section 3: Payee’s Name, Address, and TIN | Payee’s Name, Payee’s Address, Payee’s TIN |

| Section 4: Exemption from Backup Withholding | Exemption from Backup Withholding (check box if applicable) and Reason for Exemption |

| Section 5: Certification | Signature and Date |

Common W9 Form Mistakes and Solutions

Filling out the W9 form correctly is crucial for receiving payments as an independent contractor or business. Mistakes on the form can lead to delays in payment or even penalties. This section will discuss common errors made when filling out the W9 form and provide solutions to avoid these mistakes.

Taking advantage of deductions can save you money on your taxes. Check out these tax deductions for the October 2024 deadline and see if you qualify.

Incorrect Taxpayer Identification Number (TIN)

Providing an incorrect TIN is one of the most common mistakes. This can be your Social Security Number (SSN) or Employer Identification Number (EIN). It is essential to double-check your TIN before submitting the form.

The tax code is always changing, so it’s important to stay informed. Learn about the new tax brackets for 2024 and make sure you’re prepared for filing season.

- Ensure you have the correct number and that it is entered accurately.

- Verify your TIN by checking your Social Security card or EIN letter.

- If you have recently changed your name or address, update your information with the IRS before filling out the W9 form.

Incorrect Name and Address

Another common mistake is providing an incorrect name or address. This can lead to payments being sent to the wrong place.

If you use your vehicle for business purposes, you can deduct mileage expenses. Find out the October 2024 mileage rate for business use and maximize your deductions.

- Use your legal name as it appears on your tax documents.

- Ensure your address is current and accurate.

- If you are using a business address, make sure it is the address where you receive mail and payments.

Missing or Incorrect Exemptions

The W9 form asks if you are exempt from backup withholding. If you are exempt, you must provide the correct exemption code.

Tax brackets can impact your tax liability. See the tax brackets for single filers in 2024 to get a better understanding of how your income will be taxed.

- Review the instructions on the form carefully to determine if you qualify for an exemption.

- If you are exempt, select the appropriate exemption code from the list on the form.

- Provide the correct documentation to support your exemption if required.

Incomplete or Missing Information

The W9 form requires specific information, such as your name, address, TIN, and exemption status.

- Complete all sections of the form carefully and accurately.

- Double-check that all required fields are filled in.

- Do not leave any sections blank unless you are exempt from providing that information.

Submitting the Form to the Wrong Payer

The W9 form is not submitted to the IRS; it is given to the payer.

If you’re looking to get your taxes in order before the October 2024 deadline, you’re in the right place. Check out these tips to help you prepare for filing and ensure you’re getting the most out of your deductions.

- Ensure you are providing the form to the correct payer.

- Contact the payer if you are unsure where to send the form.

- Keep a copy of the form for your records.

Correcting Errors on a Submitted W9 Form, How to fill out W9 Form for October 2024

If you discover an error on a W9 form that you have already submitted, you should contact the payer immediately.

- Provide them with a corrected W9 form.

- Explain the error and provide any necessary documentation.

- The payer may require you to complete a new W9 form.

Final Summary: How To Fill Out W9 Form For October 2024

Completing the W9 form correctly is essential for smooth financial transactions and accurate tax reporting. By understanding the purpose of each section and following the provided instructions, you can ensure that your information is accurate and compliant with IRS regulations.

Remember, accurate and timely submission of the W9 form is crucial for avoiding penalties and maintaining a positive financial standing.

Clarifying Questions

What happens if I submit an incomplete W9 form?

Submitting an incomplete W9 form may result in delays in receiving payments or even penalties. It’s crucial to complete all required sections accurately to ensure smooth transactions.

Can I fill out the W9 form online?

Yes, the IRS offers an online tool for filling out and submitting the W9 form electronically. However, it’s recommended to consult the official IRS website for the latest instructions and guidelines.

How long does it take for the IRS to process a W9 form?

The IRS does not process W9 forms. It’s the recipient of the form who uses the information for their tax reporting.

Where can I find the latest version of the W9 form?

The latest version of the W9 form is available on the official IRS website. It’s essential to use the most recent version to ensure accuracy and compliance.

Moving expenses can be tax deductible. Check out the October 2024 mileage rate for moving expenses and see if you qualify for this deduction.

If you’re donating your time or goods to charity, you might be able to deduct your mileage expenses. Learn about the October 2024 mileage rate for charitable donations and maximize your deductions.