W9 Form October 2024 penalties for non-compliance – Navigating the complex world of tax reporting, the W9 Form plays a crucial role in ensuring accurate information is exchanged between individuals and businesses. However, failing to comply with the October 2024 deadline for W9 form submission can lead to significant penalties.

This article delves into the intricacies of W9 form compliance, exploring the potential consequences of non-compliance, common errors, and essential resources for staying informed.

Understanding the requirements and deadlines for W9 forms is essential for individuals and businesses alike. This information can help you avoid potential penalties and maintain a positive relationship with the IRS. From the basic definition of a W9 form to the specifics of the October 2024 deadline and the various penalties for non-compliance, this article provides a comprehensive overview of this important aspect of tax reporting.

Contents List

W9 Form Deadline for October 2024

The deadline for filing W9 forms in October 2024 is the same as it is for any other month of the year: upon request. This means that you should provide a completed W9 form to any payer who requests it, regardless of the specific month.

If you’re using your vehicle for business purposes, you might be eligible for a mileage deduction. Find out the current mileage rate on How much is the mileage rate for October 2024? to ensure you’re claiming the right amount.

W9 Form Deadline Explained

The IRS doesn’t specify a set deadline for filing W9 forms, as it is a form used by payers to gather your tax information for reporting purposes. It’s crucial to remember that failure to provide a W9 form when requested can result in delays in payments or withholding of taxes.

For married couples, there are specific contribution limits for IRAs. You can find more information about the Ira contribution limits for married couples in 2024 to make sure you’re within the allowed range.

The IRS requires payers to withhold taxes at the highest rate (backup withholding) if they don’t have a valid W9 form.

If you’re planning to contribute to a Roth IRA in 2024, make sure you’re aware of the contribution limits. You can find out more about the Ira contribution limits for Roth IRA in 2024 to ensure you’re maximizing your retirement savings.

If you are a contractor or freelancer, it’s essential to keep your W9 form updated and readily available to provide to your clients upon request.

There are some changes to tax brackets for 2024 compared to 2023. If you want to see the differences, you can check out the details on Tax bracket changes for 2024 vs 2023.

Penalties for Non-Compliance with W9 Form Requirements

Failing to comply with W9 form requirements can lead to a range of penalties, impacting both individuals and businesses. The IRS imposes these penalties to ensure accurate reporting of income and withholdings, and to prevent tax evasion.

The October 2024 tax deadline is approaching, so it’s a good time to start preparing. Check out these useful tips on Tax preparation tips for the October 2024 deadline to make the process smoother.

Financial Penalties

The IRS levies various financial penalties for W9 form non-compliance. These penalties aim to deter taxpayers from intentionally or unintentionally neglecting their filing obligations.

If you’re filing as head of household, you’ll have different tax brackets than other filing statuses. You can find the specific tax brackets for head of household on Tax brackets for head of household in 2024.

- Failure to File:The IRS may impose a penalty of up to $50 for each W9 form that is not filed on time. This penalty applies to both individuals and businesses that fail to provide the required information.

- Failure to Provide Accurate Information:If the information provided on the W9 form is inaccurate, the IRS may impose a penalty of up to $50 per form. This penalty applies to errors such as incorrect taxpayer identification numbers, incorrect names, or incorrect addresses.

- Failure to Withhold Taxes:When a payer fails to withhold taxes based on the information provided on the W9 form, the IRS may impose a penalty on the payer. The penalty can be up to 25% of the unpaid taxes.

Legal Repercussions

Beyond financial penalties, non-compliance with W9 form requirements can also lead to legal repercussions. These consequences can be significant, impacting the taxpayer’s reputation and future business dealings.

Tax brackets are changing for 2024. If you’re curious about the new tax brackets, you can find them on What are the new tax brackets for 2024? to see how they might affect your taxes.

- Civil Penalties:The IRS may pursue civil penalties for non-compliance with W9 form requirements. These penalties can include fines and back taxes. In some cases, the IRS may also file a lien against the taxpayer’s property.

- Criminal Penalties:In severe cases of intentional non-compliance, the IRS may pursue criminal penalties. These penalties can include fines, imprisonment, and other sanctions. For example, if a taxpayer knowingly provides false information on a W9 form to avoid paying taxes, they could face criminal charges.

Wondering where you fall in the tax bracket for 2024? A tax bracket calculator can help you figure it out. Use this helpful tool at Tax bracket calculator for 2024 to get an accurate estimate.

Other Consequences

Non-compliance with W9 form requirements can also lead to other consequences, impacting the taxpayer’s business operations and financial stability.

If you’re planning to contribute to a traditional IRA in 2024, you should be aware of the contribution limits. You can find out more about the Ira contribution limits for traditional IRA in 2024 to ensure you’re maximizing your retirement savings.

- Loss of Business Opportunities:Businesses that fail to comply with W9 form requirements may lose business opportunities. Payers may be hesitant to work with businesses that have a history of non-compliance, as it could indicate a lack of financial responsibility.

- Reputational Damage:Non-compliance with W9 form requirements can damage a taxpayer’s reputation. This can make it difficult to secure loans, financing, or other business opportunities in the future.

- Increased Scrutiny:The IRS may increase its scrutiny of taxpayers who have a history of non-compliance with W9 form requirements. This can lead to audits and other investigations.

Severity of Penalties for Different Types of W9 Form Errors, W9 Form October 2024 penalties for non-compliance

The severity of penalties for W9 form errors can vary depending on the type of error. For example, a simple typographical error on the form may result in a relatively minor penalty, while intentionally providing false information could lead to significant penalties.

The tax filing deadline for October 2024 is fast approaching. If you need more time to file, you can request an extension. Check out the details on Tax filing extensions for October 2024 to see if you qualify.

“The IRS generally takes a more lenient approach to unintentional errors, such as typographical mistakes. However, intentional errors or omissions can result in more severe penalties, including criminal charges.”

The IRA contribution limits are changing for 2024. If you want to compare the limits for 2024 and 2023, you can find the information on Ira contribution limits for 2024 vs 2023.

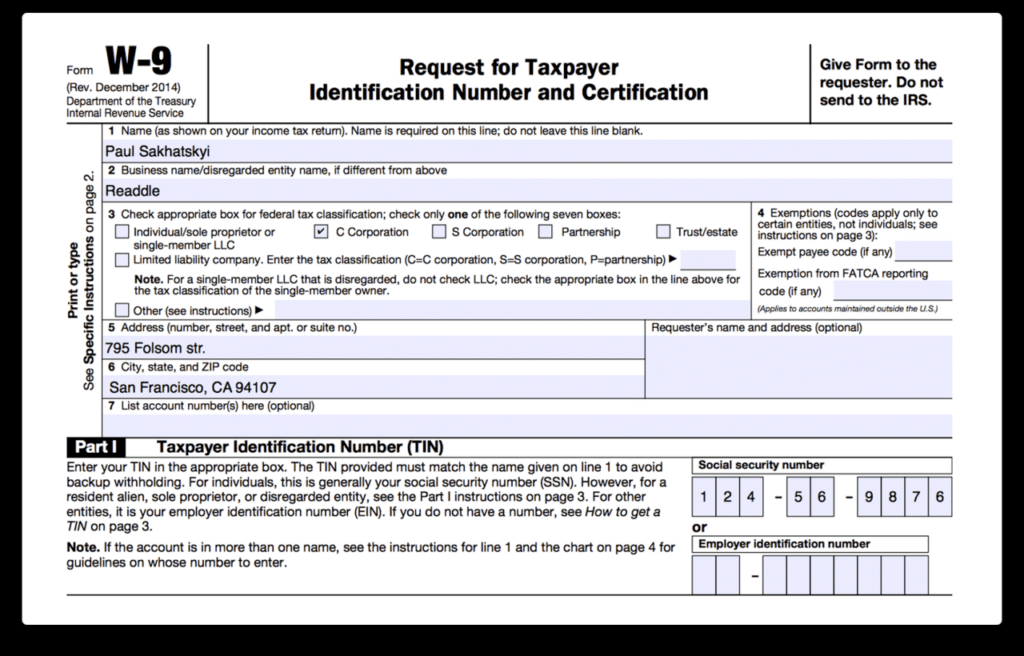

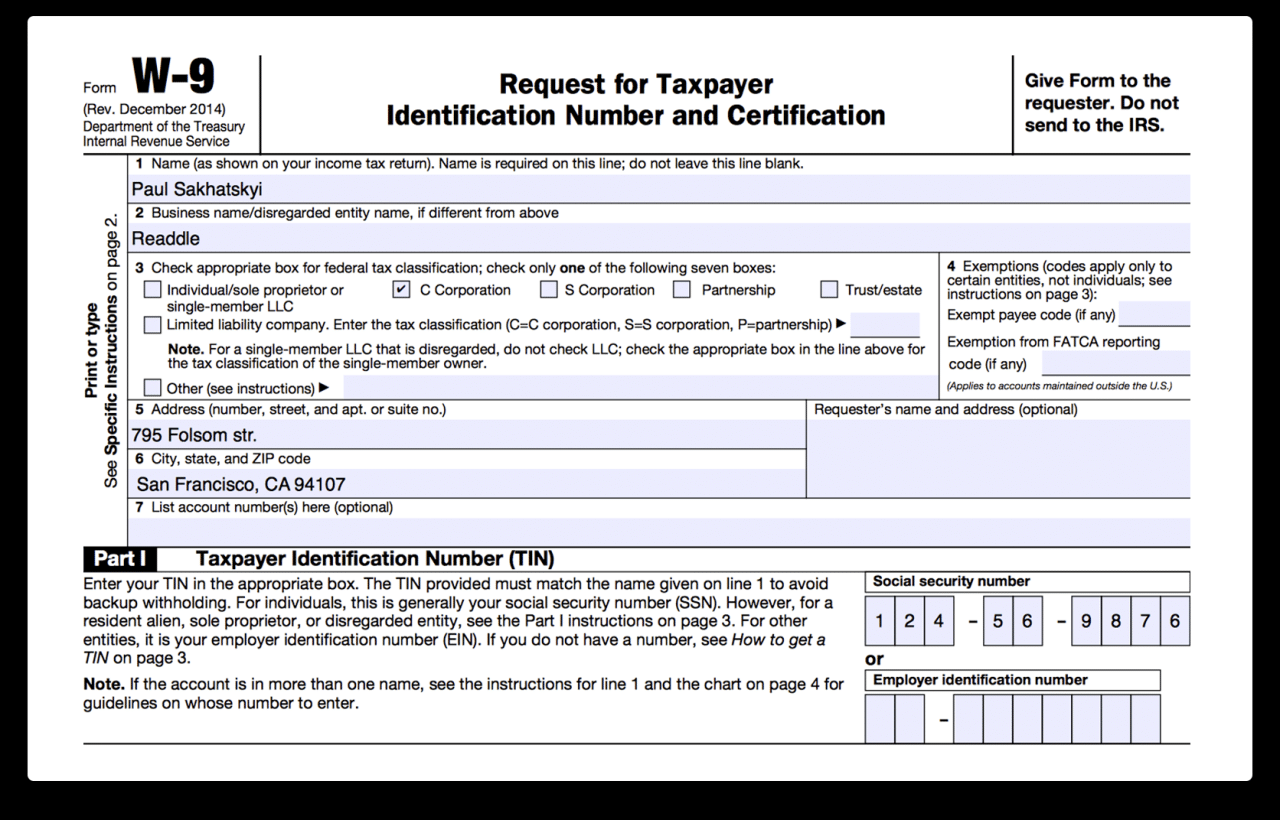

Understanding W9 Form Compliance

The W9 Form is a crucial document in the realm of tax reporting, serving as a cornerstone for accurate and timely tax filings. It provides essential information about the payee, enabling the payer to report income accurately and fulfill their tax obligations.

Understanding the importance of accurate and timely W9 form filing is vital for both the payer and the payee, ensuring smooth tax reporting and avoiding potential penalties.

Benefits of Complying with W9 Form Requirements

Compliance with W9 form requirements brings several benefits, fostering a smooth and efficient tax reporting process for both the payer and the payee.

- Accurate Tax Reporting:The W9 form provides accurate and up-to-date information about the payee, ensuring that the payer can correctly report income paid to them. This minimizes the risk of errors and facilitates efficient tax calculations.

- Reduced Risk of Penalties:Failure to provide a completed and accurate W9 form can result in penalties for both the payer and the payee. Timely and accurate completion ensures compliance with IRS regulations and avoids potential fines.

- Streamlined Tax Processes:Accurate W9 forms streamline the tax reporting process, minimizing delays and simplifying tax calculations. This benefits both the payer and the payee, facilitating efficient tax preparation and filing.

Potential Risks and Liabilities Associated with Non-Compliance

Non-compliance with W9 form requirements carries potential risks and liabilities for both the payer and the payee, emphasizing the importance of adherence to IRS regulations.

Retirees have a different tax deadline than others. If you’re retired, make sure you know when you need to file your taxes. You can find the specific deadline for retirees on October 2024 tax deadline for retirees.

- Penalties for the Payer:The payer may face penalties for failing to withhold taxes correctly or for reporting income inaccurately due to missing or incorrect W9 information.

- Penalties for the Payee:The payee may be subject to penalties for failing to provide a complete and accurate W9 form, potentially impacting their tax refund or leading to additional tax obligations.

- Audits and Investigations:Non-compliance with W9 form requirements can increase the likelihood of audits and investigations by the IRS, potentially leading to additional scrutiny and potential penalties.

- Reputational Damage:Failure to comply with tax regulations can damage the reputation of both the payer and the payee, potentially impacting their business relationships and future opportunities.

Outcome Summary: W9 Form October 2024 Penalties For Non-compliance

By adhering to the requirements of the W9 form and submitting it on time, individuals and businesses can avoid the potential consequences of non-compliance. Staying informed about the latest regulations and utilizing available resources can ensure a smooth and successful tax filing experience.

Remember, understanding the importance of W9 form compliance is crucial for maintaining financial stability and avoiding potential legal repercussions.

FAQ Guide

What are the most common errors made on W9 forms?

Some common errors include incorrect taxpayer identification numbers (TINs), missing or inaccurate addresses, and failing to update information after a change in circumstances. These errors can lead to delays in processing payments and potentially trigger penalties.

What are the benefits of complying with W9 form requirements?

Complying with W9 form requirements ensures accurate reporting of income and helps maintain a positive relationship with the IRS. It also simplifies the tax filing process and minimizes the risk of penalties or audits.

Where can I find additional information and assistance with W9 forms?

You can find comprehensive information on the IRS website, including official publications and FAQs. You can also contact the IRS directly for assistance or consult with a tax professional for personalized guidance.

If you’re self-employed, you can contribute to an IRA to save for retirement. You can find the contribution limits for self-employed individuals on Ira contribution limits for self-employed in 2024.

There are various tax credits available to help reduce your tax liability. You can find a list of tax credits and their eligibility requirements on Tax credits for the October 2024 deadline to see if you qualify.

If you’re using your vehicle for business purposes, you might be eligible for a mileage deduction. Find out the current IRS mileage rate on What is the IRS mileage rate for October 2024? to ensure you’re claiming the right amount.