W9 Form October 2024 for estates is a critical document for estate administrators and executors, serving as a crucial link between the estate and those seeking financial information. It Artikels the necessary steps for reporting an estate’s tax identification number, address, and other vital details.

This guide delves into the intricacies of the W9 form, offering a clear roadmap for navigating its requirements and ensuring compliance.

Understanding the purpose and significance of the W9 form for estates is essential for smooth estate administration. This form acts as a vital communication tool, enabling entities like banks, financial institutions, and businesses to accurately identify the estate and its tax status.

The W9 form for estates differs slightly from the individual version, reflecting the unique characteristics of estates and their financial dealings.

Contents List

Understanding the W9 Form

The W9 form is a crucial document for estates, serving as a vital link between the estate and entities required to report income paid to the estate. It’s an essential component in ensuring accurate tax reporting and compliance with IRS regulations.

Planning for retirement? It’s good to know the IRA contribution limits for 2024. These limits can help you understand how much you can contribute to your retirement savings this year.

Key Information on the W9 Form for Estates

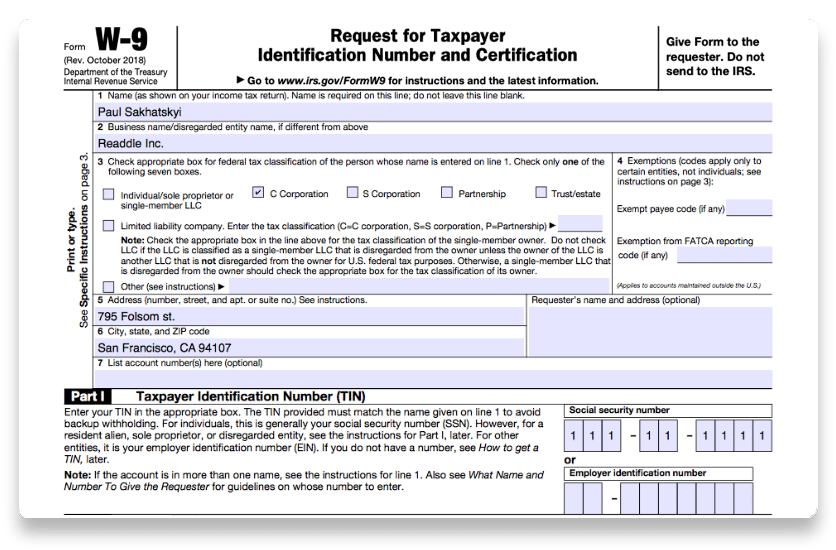

The W9 form requires specific information about the estate, including:

- Estate’s Name:The legal name of the estate, as established in the will or trust documents.

- Tax Identification Number (TIN):The estate’s unique TIN, typically an Employer Identification Number (EIN) obtained from the IRS.

- Estate’s Address:The physical address where the estate’s legal representative or executor resides.

Differences between W9 Forms for Estates and Individuals

The W9 form for estates differs significantly from the W9 form for individuals. Key differences include:

- Tax Identification Number:Individuals use their Social Security Number (SSN) on the W9 form, while estates use an EIN.

- Name and Address:The W9 form for estates requires the estate’s legal name and address, while the individual form uses the individual’s name and address.

- Exemption from Backup Withholding:Estates may be exempt from backup withholding under certain circumstances, requiring specific documentation to be provided.

Legal and Financial Considerations

Filing a W9 form for an estate can have significant legal and financial implications. It’s crucial to understand the associated responsibilities and navigate the complexities of managing estate finances and tax obligations.

Wondering how the tax brackets have changed? You can check out the tax bracket changes for 2024 vs 2023 to see what’s different this year.

Estate Tax Obligations

The W9 form serves as a vital document for reporting the estate’s tax identification number (TIN) to the IRS. This number is essential for the estate to file tax returns and comply with relevant tax laws. The executor or trustee is responsible for managing the estate’s assets, including paying any outstanding debts and taxes.

Filing as head of household? You’ll want to be aware of the tax brackets for head of household in 2024. This can help you estimate your tax liability for the year.

The IRS may impose penalties for failing to file the W9 form or for non-compliance with tax regulations.

Sole proprietorships need to be aware of the W9 Form October 2024 for sole proprietorships. This form is used to provide your tax identification number to payers.

It’s essential to consult with a tax professional to understand the specific tax implications of the estate and ensure compliance with all applicable regulations.

Curious about the highest tax bracket? You can find out more about what is the highest tax bracket in 2024 to understand the top tax rate.

Financial Management, W9 Form October 2024 for estates

The executor or trustee plays a critical role in managing the estate’s finances, including collecting assets, paying debts, and distributing assets to beneficiaries. Proper financial management ensures that the estate’s assets are protected and distributed according to the deceased’s wishes.

If you’re using your car for business, you’ll want to know the mileage rate for October 2024. This rate can be used to calculate deductions for your business expenses.

- The executor or trustee must maintain accurate records of all estate transactions, including income, expenses, and asset distributions. This helps ensure transparency and accountability in managing the estate.

- The executor or trustee must also ensure that all estate taxes are paid on time. Failure to do so can result in penalties and interest charges.

- It’s important to establish a clear budget for the estate to manage expenses and ensure that sufficient funds are available for paying taxes and distributing assets to beneficiaries.

Executor or Trustee’s Role

The executor or trustee is responsible for filing the W9 form on behalf of the estate. They must provide accurate information about the estate’s TIN and contact information. The executor or trustee must also ensure that the estate complies with all tax regulations and requirements.

If you’re self-employed, it’s important to understand the IRA contribution limits for self-employed in 2024. These limits can help you maximize your retirement savings.

- The executor or trustee should consult with a tax professional to ensure that they understand their responsibilities and comply with all applicable tax laws.

- They should also keep beneficiaries informed about the estate’s progress and any relevant financial information.

- The executor or trustee should maintain clear and accurate records of all estate transactions to ensure transparency and accountability.

Closing Summary

Navigating the complexities of estate tax and legal matters can be daunting, but with the right resources and understanding, the process can be simplified. This guide provides a clear framework for comprehending the W9 form for estates, its impact on estate tax obligations, and the best practices for ensuring compliance.

Remember, seeking professional guidance from legal and financial experts is crucial for navigating the intricacies of estate administration.

Essential FAQs: W9 Form October 2024 For Estates

What happens if I fail to file the W9 form on time?

Failing to file the W9 form on time can lead to penalties and delays in receiving payments due to the estate. It’s crucial to adhere to the deadlines to avoid complications.

Can I file the W9 form electronically?

While the IRS does not have a dedicated online platform for filing the W9 form, you can download the form and fill it out electronically before printing and submitting it.

Where can I find additional resources about the W9 form for estates?

The IRS website is an excellent source of information about the W9 form, including detailed instructions and guidance. You can also consult with legal and financial professionals specializing in estate planning and tax matters.

The October 2024 deadline is approaching, so you’ll want to look into potential tax deductions for the October 2024 deadline to potentially reduce your tax liability.

It’s important to be aware of any tax changes impacting the October 2024 deadline that could affect your filing.

Students may have a different deadline for filing their taxes. You can find out more about the October 2024 tax deadline for students to make sure you file on time.

Use a tax bracket calculator for 2024 to estimate your tax liability based on your income.

You can find information about tax bracket changes for 2024 to understand how the tax brackets have been adjusted this year.

Wondering when the mileage rate will be updated? You can find out more about when will the mileage rate be updated for October 2024 to stay informed.

Looking ahead to retirement? Check out the IRA contribution limits for 2024 and beyond to plan for your long-term savings.

Knowing the tax rates for each tax bracket in 2024 can help you understand how your income will be taxed this year.