W9 Form October 2024 for government agencies is an essential document for individuals and businesses who are seeking to conduct transactions with government entities. This form serves as a crucial tool for tax reporting and ensures compliance with federal regulations.

Understanding the intricacies of the W9 form, particularly its specific requirements for government agencies, is crucial for smooth and successful interactions with these entities. This guide aims to provide a comprehensive overview of the W9 form, focusing on its application within the context of government agencies.

The W9 form serves as a vital link between taxpayers and government agencies, enabling accurate reporting of income and ensuring the smooth flow of financial transactions. By providing accurate and complete information on the W9 form, individuals and businesses can avoid potential penalties and ensure compliance with relevant tax laws.

This guide delves into the intricacies of the W9 form, exploring its purpose, key requirements, and best practices for completion. It also sheds light on the specific considerations for submitting the W9 form to government agencies, highlighting the importance of compliance with agency regulations and procedures.

Contents List

W9 Form Basics: W9 Form October 2024 For Government Agencies

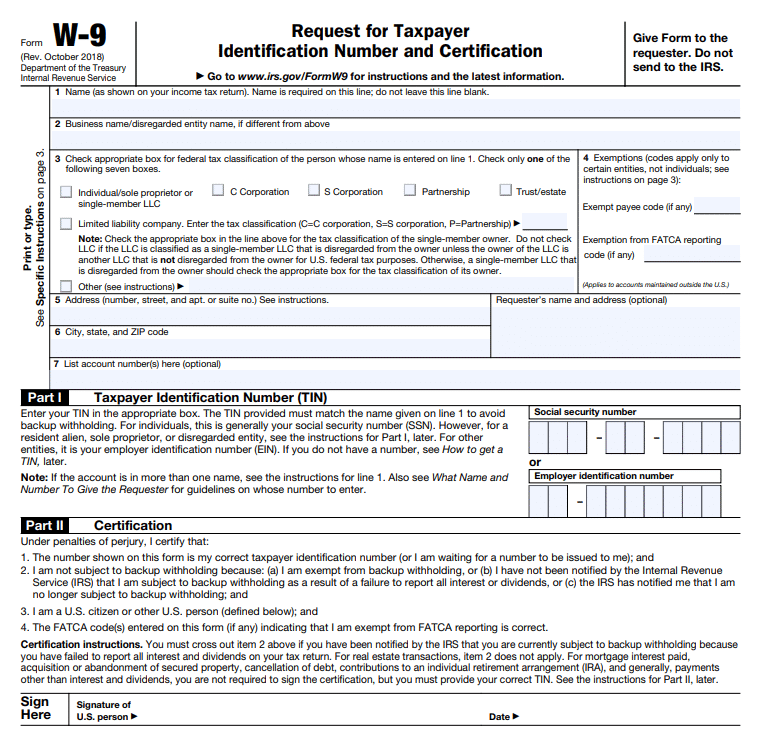

The W9 form is a vital document for anyone who provides services or goods to a government agency or other entities that require a taxpayer identification number (TIN). This form helps ensure that payments are made correctly and taxes are withheld appropriately.

The Seahawks had a tough loss in Week 5, despite a valiant comeback effort. Read the Rapid Reactions for a deeper dive into the Seahawks’ comeback attempt and what went wrong in the game.

Purpose and Significance

The W9 form serves as a crucial tool for reporting your taxpayer identification number (TIN) and other essential information to the recipient of your services or goods. This information allows the recipient to correctly report your payments on their tax returns, ensuring accurate tax withholding and reporting.

Freelancers, mark your calendars! The October 2024 tax deadline is fast approaching. Learn more about the October 2024 tax deadline for freelancers and get your paperwork in order to avoid any penalties.

Key Information Required

The W9 form requires several key pieces of information about you as the taxpayer. These include:

- Your full legal name

- Your TIN (either your Social Security Number or Employer Identification Number)

- Your address

- Your business name, if applicable

- Your tax classification (e.g., sole proprietor, corporation)

- Your exemption status (if applicable)

The W9 form is typically used when you:

- Provide services or goods to a government agency.

- Receive payments for work performed as an independent contractor.

- Open a bank account.

- Rent or lease property.

Filling Out the W9 Form

Completing the W9 form accurately is crucial. Here’s a step-by-step guide to ensure you provide the correct information:

- Fill in your Name:Provide your full legal name as it appears on your tax return.

- Enter your TIN:Choose either your Social Security Number (SSN) or Employer Identification Number (EIN) based on your tax classification.

If you are an individual, you’ll typically use your SSN. If you operate a business, you’ll need an EIN, which you can obtain from the IRS.

Partnerships need to be mindful of the W9 form for October 2024. The W9 form is crucial for partnerships and ensuring accurate tax reporting. Make sure you’re up-to-date on the latest requirements.

- Provide your Address:Include your current address where you receive mail.

- Indicate your Business Name:If you operate a business, include the name under which you conduct business activities.

- Select your Tax Classification:Choose the appropriate tax classification that best describes your business structure.

- Specify your Exemption Status:If you’re exempt from backup withholding, indicate your exemption status and the reason for exemption.

- Sign and Date:Sign and date the form to confirm the accuracy of the information provided.

Best Practices for Completing the W9 Form

Here are some essential best practices to ensure accuracy when completing the W9 form:

- Double-check all information:Review the form thoroughly to ensure that all details are accurate and consistent with your tax records.

- Use black ink:Use black ink to fill out the form for clarity and readability.

- Avoid using abbreviations:Write out your full name and address to avoid confusion.

- Keep a copy for your records:Retain a copy of the completed W9 form for your records.

Filing and Submission

Submitting your completed W9 form is a crucial step in ensuring you receive the correct tax treatment for payments you receive. You have several options for submitting your W9 form to government agencies.

If you’re a qualifying widow(er) in 2024, you’ll want to familiarize yourself with the tax brackets. This article outlines the tax brackets for qualifying widow(er)s in 2024 to help you understand how your income will be taxed.

Methods of Submission

The following table Artikels the different methods for submitting a W9 form to government agencies and their advantages:

| Method | Advantages |

|---|---|

| Easy, widely available, no technology required. | |

| Fax | Fast, secure, and can be used for immediate submission. |

| Convenient, efficient, and can be used for quick submission. | |

| Online Portal | Streamlined, secure, and often offers automated processing. |

Submission Checklist, W9 Form October 2024 for government agencies

To ensure a successful submission of your W9 form, consider the following checklist:

- Complete all required fields accurately.Ensure all information is correct and up-to-date. Double-check for any typos or errors.

- Sign and date the form.This is essential for validating your submission.

- Choose the appropriate submission method.Consider factors like time sensitivity, security, and your comfort level with technology.

- Send the form to the correct recipient.Verify the address or email address before sending.

- Keep a copy for your records.This is helpful for tracking your submission and for future reference.

Electronic Filing

Submitting your W9 form electronically offers a streamlined and efficient process. The process typically involves:

- Accessing the agency’s online portal.Locate the specific portal or website for the government agency you are submitting to.

- Completing the form electronically.Fill out the form fields using the online interface.

- Uploading any required documents.Some agencies may require additional documentation, such as a copy of your driver’s license or business license.

- Submitting the form.Review your information and submit the completed form.

- Receiving confirmation.You will typically receive an email or notification confirming your submission.

Summary

Successfully navigating the complexities of the W9 form for government agencies requires a thorough understanding of its purpose, requirements, and procedures. This guide has provided a comprehensive overview of the W9 form, encompassing its fundamental principles, specific considerations for government agencies, and essential filing procedures.

By adhering to the guidelines Artikeld in this guide, individuals and businesses can confidently submit accurate and compliant W9 forms, ensuring smooth transactions and avoiding potential complications with government agencies.

FAQ Compilation

What happens if I submit an inaccurate W9 form?

Submitting an inaccurate W9 form can result in delays in processing your payments, penalties, and even legal repercussions. It’s crucial to ensure that all information provided on the form is correct and up-to-date.

How often do I need to update my W9 form?

You should update your W9 form whenever there is a change in your tax identification number, name, address, or other relevant information. It’s best to keep your W9 form current to avoid any issues with payments and reporting.

Where can I find the latest W9 form?

The latest version of the W9 form is available on the official website of the Internal Revenue Service (IRS).

What are the penalties for non-compliance with W9 form requirements?

Penalties for non-compliance with W9 form requirements can vary depending on the specific circumstances and the severity of the violation. These penalties may include fines, interest charges, and even criminal prosecution in some cases.

Foreign nationals residing in the United States have a specific tax deadline to adhere to. The October 2024 tax deadline for foreign nationals might differ from the standard deadline, so it’s essential to stay informed.

Retirees need to be aware of the tax implications associated with their income. The October 2024 tax deadline for retirees is important for understanding how retirement income is taxed.

Planning for retirement? It’s crucial to understand IRA contribution limits. The IRA contribution limits for 2024 and 2025 can help you make informed decisions about your retirement savings.

Tax brackets can significantly impact your overall tax burden. This article explains how tax brackets affect your 2024 income and provides insights into tax planning.

The IRS provides valuable resources to assist taxpayers during tax season. Explore the IRS resources for the October 2024 tax deadline to find helpful information and tools.

If you’re using your vehicle for business purposes, the mileage rate is crucial for deducting expenses. Find out how much the mileage rate is for October 2024 to ensure you’re claiming the correct amount.

Understanding the tax rates for each bracket is essential for accurate tax calculations. This article provides a breakdown of tax rates for each tax bracket in 2024 to help you navigate the tax system.

The United States tax system utilizes a progressive tax structure. Learn about the tax brackets for 2024 in the United States to understand how your income is taxed.

Self-employed individuals have specific IRA contribution limits. Discover the IRA contribution limits for self-employed individuals in 2024 to maximize your retirement savings.

SEP IRA contributions offer a valuable tax-advantaged retirement savings option. Explore the IRA contribution limits for SEP IRA in 2024 to learn more about this retirement plan.

As the October 2024 tax deadline approaches, it’s crucial to prepare your taxes efficiently. Read these tax preparation tips for the October 2024 deadline to make the process smoother and avoid any errors.