What are the 401k limits for 2024 for over 50? This question is on the minds of many Americans as they plan for their retirement. The good news is that those aged 50 and over have the benefit of a “catch-up” contribution, allowing them to save even more for their golden years.

This guide will break down the 2024 contribution limits, explain the “catch-up” contribution, and provide insights into how these limits can help you reach your retirement goals.

Understanding the 401(k) contribution limits is crucial for anyone seeking to maximize their retirement savings. These limits, set by the IRS, determine the maximum amount of money you can contribute to your 401(k) plan each year. While these limits might seem like restrictions, they actually serve a valuable purpose.

They ensure that everyone, regardless of their income level, has the opportunity to save for retirement and enjoy a comfortable future.

Contents List

2024 401(k) Contribution Limits

The annual contribution limits for 401(k) plans in 2024 have been set by the IRS. These limits apply to both traditional and Roth 401(k) plans, and they are designed to help you save for retirement.

Understanding the mileage reimbursement rate can be important for budgeting. You can find out more about what is the mileage reimbursement rate for October 2024 to help with your planning.

Contribution Limits for 2024

The contribution limits for 401(k) plans in 2024 are as follows:

- Individuals under age 50: $22,500

- Individuals aged 50 and over: $30,000

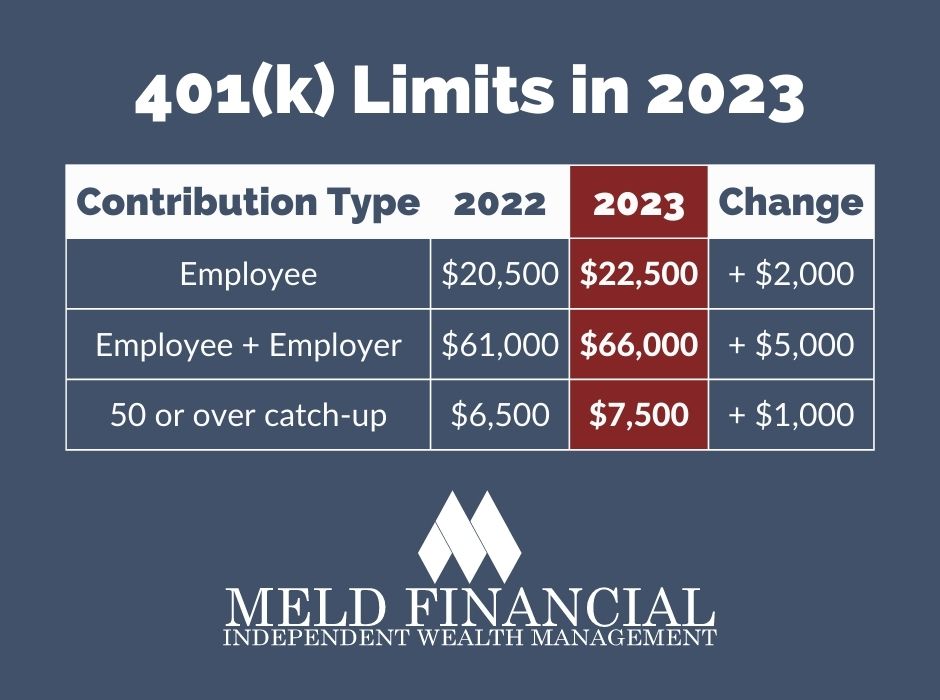

Comparison of Contribution Limits for 2023 and 2024

The following table compares the contribution limits for 2023 and 2024:

| Year | Contribution Limit (under age 50) | Contribution Limit (age 50 and over) |

|---|---|---|

| 2023 | $22,500 | $30,000 |

| 2024 | $22,500 | $30,000 |

Catch-up Contribution for Individuals Aged 50 and Over

Individuals aged 50 and over are eligible for a “catch-up” contribution. This allows them to contribute an additional amount to their 401(k) plan each year. The catch-up contribution limit for 2024 is $7,500. This means that individuals aged 50 and over can contribute a total of $30,000 ($22,500 regular contribution + $7,500 catch-up contribution) to their 401(k) plan in 2024.

Retirement planning is a big part of many people’s financial strategies. If you’re over 50, you might be curious about the IRA contribution limits for people over 50 in 2024.

The catch-up contribution is designed to help older workers make up for lost time in saving for retirement.

Roth IRAs are a popular retirement savings option. If you’re looking to contribute, you might be interested in knowing the IRA contribution limits for Roth IRA in 2024.

Understanding 401(k) Limits: What Are The 401k Limits For 2024 For Over 50

The 401(k) contribution limit is an important factor to consider when planning for retirement. Understanding these limits is crucial for maximizing your retirement savings and avoiding potential penalties.

The mileage rate can fluctuate throughout the year. If you’re curious about any changes, you can learn about October 2024 mileage rate changes to stay informed.

Purpose of 401(k) Contribution Limits

Contribution limits exist to ensure the long-term viability of retirement plans and to prevent individuals from contributing excessive amounts that could lead to unintended tax consequences. These limits also help ensure that retirement plans are accessible and affordable for a wide range of individuals.

Tax brackets can change from year to year. If you’re interested in understanding how they might affect you, you can find out about tax bracket changes for 2024.

Benefits of Maximizing 401(k) Contributions

Maximizing your 401(k) contributions offers several benefits:

- Tax advantages:Contributions to a 401(k) are made with pre-tax dollars, which reduces your taxable income and lowers your tax liability in the present. You only pay taxes on your withdrawals in retirement.

- Compounding growth:Your contributions grow tax-deferred, allowing them to compound faster than if they were subject to annual taxation. This can significantly boost your retirement savings over time.

- Employer matching:Many employers offer matching contributions to their employees’ 401(k) accounts. This essentially provides you with free money, further enhancing your retirement savings.

Consequences of Exceeding the 401(k) Contribution Limit

Exceeding the 401(k) contribution limit can result in penalties and taxes:

- Excess contributions:You may be subject to a 10% penalty on the excess contributions, plus additional taxes on the earnings generated by those contributions. This can significantly reduce your retirement savings.

- Taxable income:The excess contributions may be considered taxable income, potentially increasing your tax liability for the year.

- Disqualification:In extreme cases, exceeding the limit may lead to disqualification from the 401(k) plan, preventing you from contributing further.

Relationship to Other Retirement Savings Contributions

(k) limits are separate from the contribution limits for other retirement savings plans, such as traditional or Roth IRAs. You can contribute to both a 401(k) and an IRA, up to the respective contribution limits. However, it’s essential to consider the combined contribution limits when making your retirement savings decisions.

Non-profit organizations often require a W9 form for tax purposes. If you’re working with a non-profit, you might need to know about the W9 Form October 2024 for non-profit organizations deadline and requirements.

For example, if the 401(k) limit is $22,500 and the IRA limit is $6,500, you could contribute a total of $29,000 to retirement savings in 2024.

The highest tax bracket in 2024 is something many people are curious about. If you want to know more about what is the highest tax bracket in 2024 , it’s important to stay up-to-date on tax changes.

Factors Influencing 401(k) Contributions

Your 401(k) contribution strategy is a personal decision influenced by various factors. While the 401(k) contribution limits set by the IRS provide a framework, your individual circumstances play a significant role in determining your optimal contribution amount.

If you’re filing as head of household, knowing the tax brackets can be important. You can find out more about tax brackets for head of household in 2024 to help you plan.

Income’s Influence

Your income directly impacts how much you can contribute to your 401(k). The contribution limit is a maximum, and your actual contribution amount can’t exceed your earnings. For instance, if your annual income is $100,000 and the 401(k) contribution limit is $22,500, you can’t contribute more than $22,500 even if you want to.

The W9 form is an important part of tax filing. If you need to file a W9, you can find out about the W9 Form October 2024 deadline for filing to stay on track.

Your income also affects your tax bracket, influencing the tax benefits you receive from contributing to a 401(k).

Saving for retirement is a big part of financial planning. If you’re looking to maximize your contributions, you might be interested in knowing what is the maximum 401k contribution for 2024.

Age and Contribution Strategy, What are the 401k limits for 2024 for over 50

Age significantly influences your 401(k) contribution strategy. Younger individuals often prioritize building a solid foundation for their retirement savings, making larger contributions to maximize compound growth. As you get closer to retirement, you may adjust your strategy to focus on preserving your savings and generating income.

Tax deductions can help reduce your tax liability. You can find out more about tax deductions for the October 2024 deadline to see if you qualify.

The catch-up contribution provision for those aged 50 and above allows you to contribute more to your 401(k), potentially accelerating your retirement savings.

Tax preparation can be a bit overwhelming. If you’re looking for some tips to help you get organized, you can find out about tax preparation tips for the October 2024 deadline.

Financial Goals and Risk Tolerance

Your financial goals and risk tolerance are crucial factors in determining your 401(k) contributions. If you have specific retirement goals, like owning a vacation home or traveling extensively, you may need to contribute more to your 401(k) to reach those goals.

The IRS offers a variety of resources to help taxpayers. If you’re preparing for the October 2024 deadline, you might find the IRS resources for the October 2024 tax deadline helpful.

Your risk tolerance, or your willingness to accept potential losses in exchange for higher returns, can also affect your contributions. Those with a higher risk tolerance may be more inclined to invest in stocks, which historically offer higher returns but also come with greater volatility.

If you’re planning on donating to a charity, you might be wondering about the mileage rate for charitable donations. You can find out more about the October 2024 mileage rate for charitable donations to help you calculate your deductions.

401(k) Contribution Limits by Age

| Age | Contribution Limit | Catch-up Contribution |

|---|---|---|

| Under 50 | $22,500 | N/A |

| 50 and over | $22,500 | $7,500 |

Retirement Planning and 401(k) Limits

Your 401(k) is a powerful tool for achieving your retirement goals. It offers tax advantages and allows you to save consistently for the future. By understanding how 401(k) contributions work, you can plan for a comfortable retirement.

The Role of 401(k) Contributions in Retirement Planning

Your 401(k) contributions are essentially investments in your future. The money you contribute grows tax-deferred, meaning you won’t have to pay taxes on it until you withdraw it in retirement. This allows your savings to compound more quickly, potentially leading to a larger nest egg.

The Importance of Starting Early with Retirement Savings

Starting early with retirement savings is crucial due to the power of compound interest. Compound interest is the interest earned on both the principal amount and the accumulated interest. The earlier you start saving, the more time your money has to grow.

Tips for Maximizing 401(k) Contributions Throughout Your Career

Contribution Strategies

- Maximize Your Employer Match:If your employer offers a matching contribution, always contribute enough to receive the full match. It’s essentially free money that you’re leaving on the table if you don’t take advantage of it.

- Increase Contributions Gradually:Instead of making a significant jump in contributions, gradually increase them over time. This can make it easier to adjust to the lower take-home pay and helps you avoid feeling overwhelmed.

- Consider Catch-Up Contributions:If you’re over 50, you can contribute an additional amount to your 401(k) each year. This allows you to make up for lost time and accelerate your savings.

The Concept of Compound Interest and its Application to 401(k) Savings

Compound interest is often called the “eighth wonder of the world.” It’s a powerful force that can significantly increase your retirement savings over time. Let’s consider an example:

Imagine you invest $10,000 at an average annual return of 7% for 30 years. If the interest is compounded annually, your investment will grow to approximately $76,122. However, if you invest the same amount for 40 years, your investment will grow to a whopping $149,744.

This example demonstrates how compound interest can significantly amplify your savings over time. The longer your money is invested, the more it grows, leading to a larger retirement nest egg.

Last Recap

Navigating the world of 401(k) limits can seem daunting, but understanding the basics is crucial for achieving your retirement goals. By taking advantage of the “catch-up” contribution, you can significantly boost your savings and enjoy a more secure future. Remember to consult with a financial advisor to create a personalized retirement plan that aligns with your individual needs and aspirations.

Questions and Answers

What is the “catch-up” contribution?

The “catch-up” contribution allows individuals aged 50 and over to contribute an additional amount to their 401(k) beyond the regular limit. This extra contribution provides an opportunity to make up for lost savings time and potentially accelerate retirement savings.

How does the “catch-up” contribution work?

The “catch-up” contribution amount is added on top of the regular 401(k) contribution limit. For example, in 2024, the regular limit is $22,500, and the “catch-up” contribution is $7,500, allowing individuals aged 50 and over to contribute up to $30,000.

Can I contribute more than the 401(k) limit?

No, exceeding the 401(k) contribution limit can result in penalties and taxes. It’s crucial to stay within the designated limits to avoid any financial repercussions.

The mileage rate is important for many business expenses. If you need to calculate mileage for your business, you can find out about how much is the mileage rate for October 2024.