401k contribution limits for 2024 for small businesses – Navigating the world of retirement savings can be complex, especially for small business owners. Understanding 401k contribution limits for 2024 is crucial for maximizing your retirement savings and ensuring a comfortable future. This guide delves into the intricacies of 401k contributions, offering insights into both employee and small business owner limits, catch-up contributions, and strategic planning for a successful retirement.

From understanding the basics of contribution limits to exploring various strategies for maximizing your savings, this guide provides valuable information to help you make informed decisions about your retirement plan. We’ll cover the tax implications of 401k contributions, explore different contribution strategies, and provide resources for further learning.

Contents List

Catch-Up Contributions for 2024

Catch-up contributions allow employees and small business owners aged 50 and older to contribute extra money to their 401(k) accounts each year. These contributions can help individuals save more for retirement and potentially increase their retirement income.

Don’t miss out on potential tax deductions! Learn about the tax deductions you can claim before the October 2024 deadline here and save on your tax bill.

Catch-Up Contribution Rules for Employees

Employees aged 50 and older can contribute an additional amount to their 401(k) plans in 2024. This extra contribution, known as the catch-up contribution, allows individuals to increase their retirement savings and potentially reach their retirement goals faster.

The tax brackets for 2024 in the United States have been updated. Stay informed about the latest changes here to understand your tax liability.

The catch-up contribution limit for employees aged 50 and older in 2024 is $7,500.

Planning to contribute to your IRA for 2024? Check out the latest contribution limits here and get a head start on your retirement savings.

This means that in addition to the regular 401(k) contribution limit of $22,500, employees aged 50 and older can contribute an extra $7,500, bringing their total annual contribution limit to $30,000.

Are you self-employed? You have specific IRA contribution limits for 2024. Check out the latest guidelines here to make the most of your retirement savings.

Catch-Up Contribution Rules for Small Business Owners

Small business owners who are also participants in their own 401(k) plans can also take advantage of catch-up contributions. This allows them to save more for retirement and potentially reach their financial goals sooner.

Need to know the mileage rate for October 2024? You can find the latest information here for both business and medical expenses.

The catch-up contribution limit for small business owners aged 50 and older in 2024 is $7,500.

Foreign entities working in the US need to be aware of the specific requirements for filling out the W9 form. You can find the details for October 2024 here to avoid any complications.

This means that in addition to the regular 401(k) contribution limit of $66,000, small business owners aged 50 and older can contribute an extra $7,500, bringing their total annual contribution limit to $73,500.

If you’re considering a Roth IRA for 2024, make sure you understand the contribution limits. You can find the latest information here to plan your contributions effectively.

Catch-Up Contribution Limits for 2024

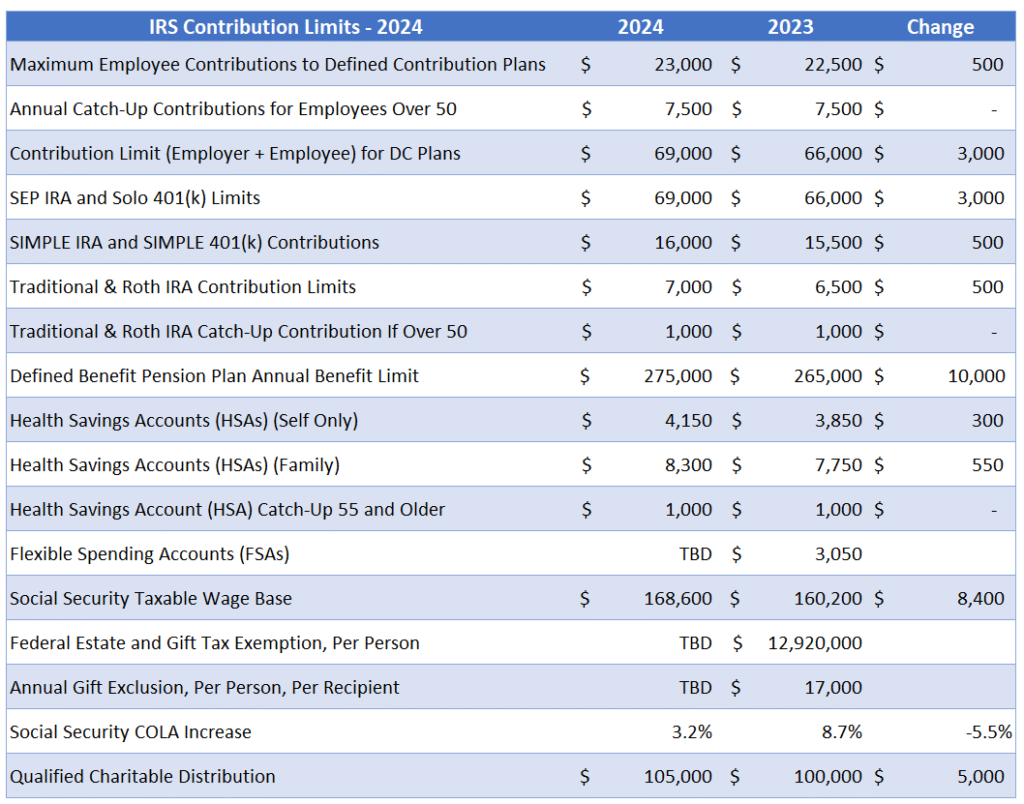

The following table summarizes the catch-up contribution limits for employees and small business owners in 2024:

| Participant Type | Catch-Up Contribution Limit | Total Annual Contribution Limit |

|---|---|---|

| Employees aged 50 and older | $7,500 | $30,000 |

| Small business owners aged 50 and older | $7,500 | $73,500 |

Financial Planning for Small Business Owners

Small business owners often wear many hats, juggling the responsibilities of running their business with their own personal financial planning. A well-designed financial plan, especially one that considers the 401(k) contribution limits available to them, can help them secure their future and build a solid foundation for retirement.

Are you driving for work? The mileage rates for October 2024 have changed. Stay informed about the latest rates here to maximize your deductions.

401(k) Contribution Limits and Financial Planning

A 401(k) plan is a valuable tool for small business owners to save for retirement. The contribution limits for 2024 are set at $22,500 for employees under age 50, and $30,000 for those age 50 and older. This allows for significant contributions to be made each year, potentially accelerating retirement savings.

If you’re a contractor or freelancer, you’ll need to fill out a W9 form for your clients. Learn how to correctly complete the form for October 2024 here and ensure smooth payments.

Here are some key aspects of financial planning that small business owners should consider:

- Contribution Strategy:Determining the optimal contribution level is crucial. Business owners should consider their current financial situation, income, and retirement goals. A financial advisor can help create a customized plan that balances current needs with long-term savings objectives.

- Matching Contributions:As a business owner, you have the option to match employee contributions. This is a powerful incentive to attract and retain employees while also boosting your own retirement savings. The match can be a percentage of the employee’s contribution or a flat dollar amount.

Thinking about maxing out your 401k contributions? Find out the maximum amount you can contribute in 2024 here and take advantage of tax-advantaged savings.

- Investment Allocation:Choosing the right investment options within the 401(k) is essential. The investment strategy should align with your risk tolerance, time horizon, and retirement goals. A diversified portfolio that includes stocks, bonds, and other assets can help mitigate risk and potentially generate higher returns over time.

Did you know that you can deduct medical expenses on your taxes? The mileage rate for medical expenses in October 2024 has been updated. Check out the latest information here.

- Tax Advantages:Contributions to a 401(k) are made pre-tax, meaning you won’t pay taxes on the money until you withdraw it in retirement. This can significantly reduce your tax liability in the present and allow your savings to grow tax-deferred.

- Rollover Options:If you leave your business or change your 401(k) plan, you can typically roll over your existing savings to another retirement account without incurring taxes or penalties.

Financial Planning Checklist for Small Business Owners, 401k contribution limits for 2024 for small businesses

Creating a comprehensive financial plan is vital for small business owners. This checklist can serve as a starting point:

- Review Existing Financial Situation:Assess your current income, expenses, assets, and liabilities. This will provide a clear picture of your financial health and help identify areas for improvement.

- Set Realistic Financial Goals:Define your short-term and long-term financial goals, including retirement savings, debt reduction, and asset accumulation. Having specific goals will help you stay focused and motivated.

- Develop a Budget:Create a detailed budget that tracks your income and expenses. This will help you understand where your money is going and identify areas where you can cut back or save more.

- Plan for Retirement:Determine your desired retirement age and lifestyle. Calculate how much you need to save to reach your retirement goals, taking into account factors such as inflation and investment returns.

- Consider Life Insurance:Life insurance can provide financial security for your family and business in the event of your death. Evaluate your coverage needs and explore different types of policies.

- Protect Your Business:Ensure you have adequate insurance coverage for your business, including property, liability, and workers’ compensation. This will help mitigate risks and protect your assets.

- Seek Professional Advice:Consult with a financial advisor or accountant to develop a personalized financial plan that addresses your unique needs and goals. They can provide expert guidance and support throughout the process.

Resources and Tools for Small Business Owners

There are numerous resources available to help small business owners navigate the complexities of financial planning and 401(k) plans:

- Small Business Administration (SBA):The SBA provides valuable information and resources for small business owners, including guidance on retirement planning and 401(k) plans. https://www.sba.gov/

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on 401(k) plans, including contribution limits, tax implications, and eligibility requirements. https://www.irs.gov/

- Financial Planning Websites:Many reputable financial planning websites offer articles, calculators, and tools to help you create a budget, plan for retirement, and manage your finances. Some popular options include:

- Investopedia: https://www.investopedia.com/

- Bankrate: https://www.bankrate.com/

- NerdWallet: https://www.nerdwallet.com/

- Financial Advisors:Consider working with a qualified financial advisor who specializes in small business retirement planning. They can provide personalized advice and guidance based on your specific needs and goals.

End of Discussion

As a small business owner, your retirement plan is a critical component of your overall financial well-being. By understanding the 401k contribution limits for 2024, exploring different contribution strategies, and seeking professional guidance when needed, you can confidently plan for a secure and comfortable retirement.

Remember, every contribution you make today is an investment in your future.

Questions and Answers: 401k Contribution Limits For 2024 For Small Businesses

What are the consequences of exceeding the 401k contribution limit?

Exceeding the 401k contribution limit can result in penalties. You may be required to pay taxes on the excess contributions, as well as a 10% penalty if you’re under 59 1/2 years old.

Can I contribute to both a 401k and a Roth IRA?

Yes, you can contribute to both a 401k and a Roth IRA, but your contributions to both may be subject to income limitations. It’s essential to consult with a financial advisor to determine the best strategy for your individual situation.

What are the tax implications of withdrawing funds from a 401k before retirement?

Withdrawals from a 401k before age 59 1/2 are typically subject to a 10% penalty, in addition to ordinary income tax. However, there are some exceptions, such as for hardship withdrawals or first-time home purchases. It’s crucial to understand the rules and potential penalties before making any withdrawals.

Curious about the tax bracket changes for 2024 compared to 2023? You can find a breakdown of the differences here to understand how your taxes might be impacted.

Wondering how much the mileage rate is for October 2024? Check out the latest rates here to ensure you’re getting the right deductions.

If you’re working with government agencies, you’ll need to fill out a W9 form. Make sure you’re using the correct form for October 2024 by checking the guidelines here.

Get ahead of your tax preparation and save yourself some stress! Find helpful tips for the October 2024 deadline here to make the process smoother.