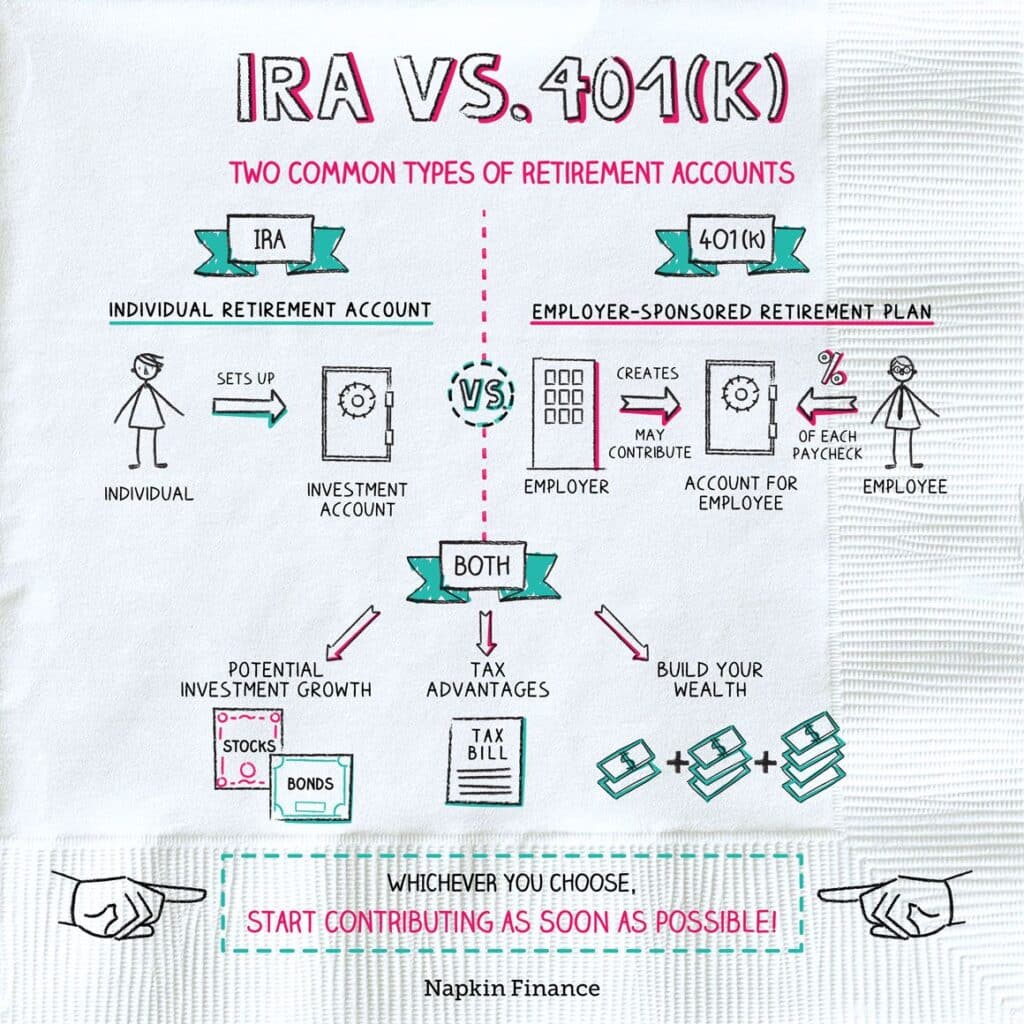

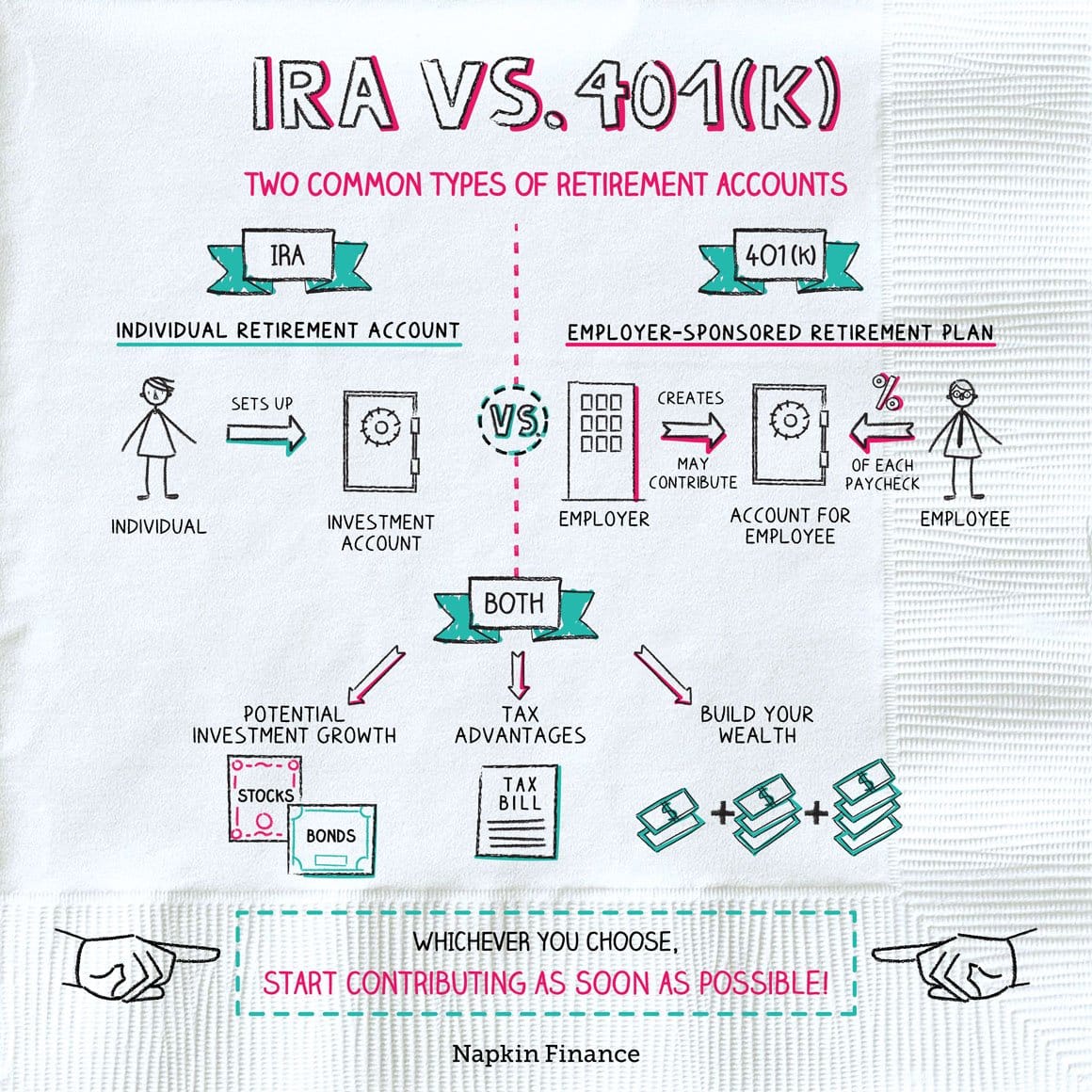

Can I contribute to an IRA if I have a 401k – Can I contribute to an IRA if I have a 401(k)? This is a common question for those navigating the world of retirement savings. Understanding the differences between IRAs and 401(k)s, their contribution limits, and tax benefits is crucial to making informed decisions about your retirement planning.

While both offer tax advantages, there are key distinctions that can impact your overall savings strategy.

For example, traditional IRAs allow pre-tax contributions, potentially lowering your current tax burden, while Roth IRAs offer tax-free withdrawals in retirement. 401(k)s often provide employer matching contributions, boosting your savings potential. The key is to determine which plan, or combination of plans, aligns best with your financial goals and current circumstances.

Contents List

Eligibility for IRA Contributions

IRA contributions are subject to specific eligibility requirements based on factors like income, age, and employment status. Understanding these guidelines is crucial for maximizing your retirement savings potential.

Looking for the latest mileage rate information? You can find the mileage rate for October 2024 by visiting the IRS website.

Income Limitations for Traditional IRA Contributions, Can I contribute to an IRA if I have a 401k

The amount you can contribute to a traditional IRA is not limited by your income, but your ability to deduct your contributions from your taxes may be. If your income exceeds certain thresholds, your deduction may be phased out or entirely eliminated.

Did you know that the mileage rate for business use can change throughout the year? Keep up-to-date with the October 2024 mileage rate changes to ensure you’re maximizing your tax benefits.

For 2023, the phase-out range for single filers is between $73,000 and $83,000. For married couples filing jointly, the range is between $146,000 and $156,000. If your income falls within these ranges, your deduction will be gradually reduced. If your income exceeds the upper limit, you will not be able to deduct your contributions.

If you’re a corporation, you’ll need to make sure you’re using the correct W9 form. Find out more about the W9 Form October 2024 for corporations and avoid any potential tax issues.

It’s important to note that even if you can’t deduct your contributions, you can still contribute to a traditional IRA.

Don’t miss the October 2024 tax deadline for foreign nationals. Make sure you’re prepared and have everything you need to file your taxes on time.

Eligibility Requirements for Roth IRA Contributions

Unlike traditional IRAs, Roth IRA contributions are not tax-deductible, but your distributions in retirement are tax-free. However, there are income limits for contributing to a Roth IRA. For 2023, if your modified adjusted gross income (MAGI) exceeds $153,000 for single filers or $228,000 for married couples filing jointly, you cannot contribute to a Roth IRA.

Thinking about boosting your retirement savings this year? Check out the IRA contribution limits for small business owners in 2024 to see how much you can contribute.

If your income falls within these ranges, your contribution may be limited.

If you’re a trust, make sure you’re using the correct W9 form. Get all the information you need about the W9 Form October 2024 for trusts to avoid any complications.

Employment Status and IRA Contribution Eligibility

Your employment status can impact your IRA contribution eligibility.

Planning on using your car for business purposes this October? You’ll want to know the October 2024 mileage rate for business use to ensure you’re claiming the right deductions on your taxes.

- If you are employed, you can contribute to both a traditional and Roth IRA, subject to the income limitations mentioned above.

- If you are self-employed, you can contribute to a SEP IRA or Solo 401(k), which are similar to traditional IRAs but offer higher contribution limits.

- If you are unemployed, you can still contribute to an IRA, as long as you have earned income. This income can be from sources such as part-time work, freelance gigs, or alimony.

Last Recap: Can I Contribute To An IRA If I Have A 401k

Ultimately, the decision of whether to contribute to an IRA, a 401(k), or both, depends on your individual financial situation, risk tolerance, and retirement goals. Carefully consider the pros and cons of each plan, consult with a financial advisor if needed, and create a retirement savings strategy that works for you.

By understanding the nuances of these retirement plans, you can make informed decisions to secure a comfortable financial future.

Question & Answer Hub

Can I contribute to both an IRA and a 401(k) at the same time?

Yes, you can generally contribute to both an IRA and a 401(k) simultaneously. However, your income may affect your eligibility for certain IRA contributions.

What if my employer doesn’t offer a 401(k)?

If your employer doesn’t offer a 401(k), you can still contribute to an IRA. This can be a valuable way to start building your retirement savings.

Should I choose a traditional IRA or a Roth IRA?

The choice between a traditional IRA and a Roth IRA depends on your current tax bracket and your anticipated tax bracket in retirement. If you expect to be in a lower tax bracket in retirement, a Roth IRA might be more beneficial.

If you expect to be in a higher tax bracket in retirement, a traditional IRA might be more advantageous.

Is there an age limit for contributing to an IRA?

There is no age limit for contributing to an IRA. You can continue to contribute even after you retire.

Want to maximize your retirement savings? Check out the contribution limits for your 401k in 2024, including catch-up contributions to see how much you can contribute.

The mileage rate for October 2024 is something you should be aware of if you’re using your car for business purposes.

Want to know where you fall in the tax bracket system? Check out the tax brackets for 2024 in the United States to get a better understanding of your tax obligations.

Are you self-employed and contributing to a solo 401k? Learn about the IRA contribution limits for solo 401ks in 2024 to make sure you’re maximizing your savings.

The October 2024 tax deadline is approaching fast. Get a head start on your tax preparation by learning about the tax deductions available to you.

Are you self-employed and looking to contribute to an IRA? Make sure you’re aware of the IRA contribution limits for self-employed individuals in 2024.

The amount you can contribute to your 401k can change depending on your age. Find out the 401k contribution limits for 2024 by age to make sure you’re taking advantage of all your savings options.

If you’re a freelancer, you’ll need to make sure you’re using the correct W9 form. Learn about the W9 Form October 2024 for freelancers and stay compliant with tax regulations.