What are the IRA contribution limits for 2024? This question is on the minds of many Americans as they plan for their financial future. Individual Retirement Accounts (IRAs) offer a powerful tool for saving for retirement, and understanding the contribution limits is crucial for maximizing your savings potential.

Whether you’re just starting your retirement journey or you’re a seasoned saver, knowing how much you can contribute to your IRA is essential for making informed decisions about your finances.

IRAs come in two main flavors: traditional and Roth. Traditional IRAs allow for pre-tax contributions, meaning you’ll save on taxes now but pay them later when you withdraw in retirement. Roth IRAs, on the other hand, offer tax-free withdrawals in retirement, but your contributions are made with after-tax dollars.

The choice between these two depends on your individual circumstances, such as your income level, tax bracket, and retirement goals.

Contents List

IRA Contribution Limits for 2024

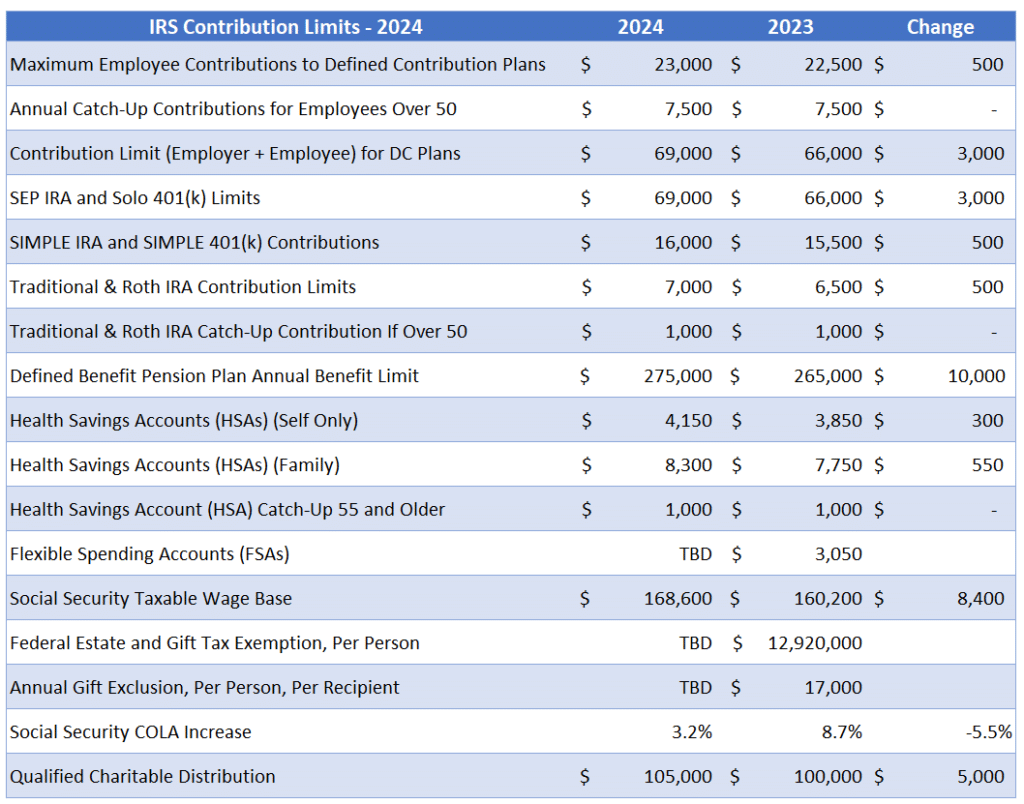

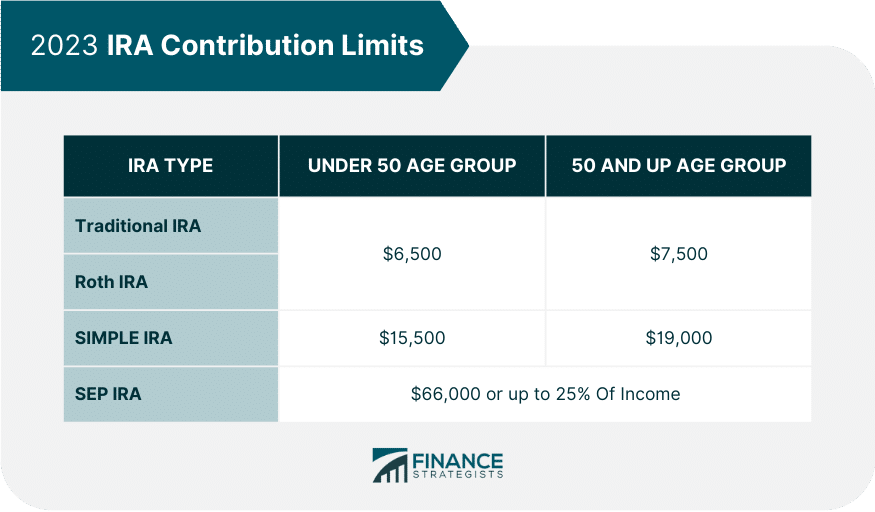

The maximum amount you can contribute to an IRA in 2024 depends on your age and whether you’re contributing to a traditional or Roth IRA. The contribution limits are set by the IRS and are adjusted periodically to account for inflation.

Married couples have specific IRA contribution limits. This article provides details on the contribution limits for married couples in 2024, so you can plan your retirement savings strategy effectively as a couple.

Traditional and Roth IRA Contribution Limits for 2024

Both traditional and Roth IRAs offer tax advantages, but they differ in how they are taxed. Here’s a breakdown:

- Traditional IRA: Contributions are tax-deductible, meaning you can deduct them from your taxable income, potentially reducing your tax bill. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, so you don’t get a tax deduction at the time of contribution. However, qualified withdrawals in retirement are tax-free.

The maximum contribution limit for both traditional and Roth IRAs in 2024 is $7,000.

Income Limitations for Roth IRA Contributions in 2024

While anyone can contribute to a traditional IRA, there are income limitations for contributing to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you can’t contribute to a Roth IRA, or your contributions may be phased out.For 2024, the income limits for Roth IRA contributions are as follows:

| Filing Status | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

| Phase-out Begins | $153,000 | $228,000 | $186,000 |

| Phase-out Ends | $168,000 | $246,000 | $206,000 |

If your MAGI falls within the phase-out range, you can only contribute a portion of the maximum contribution. For example, if your MAGI is $160,000 as a single filer, you can only contribute a portion of the $7,000 maximum.

Catch-Up Contributions for Those 50 or Older in 2024

Individuals who are 50 or older in 2024 can make additional “catch-up” contributions to their IRAs. This allows them to contribute an extra amount to make up for lost savings time.The catch-up contribution limit for 2024 is $1,000, bringing the total maximum contribution to $8,000for those 50 or older.

The IRS provides valuable resources to help you navigate the tax process. This article highlights key IRS resources that can assist you in filing your taxes accurately and on time, ensuring you meet all the necessary requirements.

Note:The contribution limits and income thresholds for Roth IRAs are subject to change each year. It’s always best to consult with a financial advisor or check with the IRS for the most up-to-date information.

If you’re considering a Roth 401k, it’s important to know the contribution limits for 2024. This article provides a detailed explanation of the limits for Roth 401ks, so you can make informed decisions about your retirement savings.

Factors Affecting Contribution Limits

While the annual contribution limits for traditional and Roth IRAs are generally the same, there are several factors that can affect how much you can contribute. These factors include your income level, age, and filing status.

Income Levels and Roth IRA Contribution Limits

Your income level can affect your ability to contribute to a Roth IRA. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be able to contribute to a Roth IRA, or your contributions may be phased out.

For 2024, the income limits for Roth IRA contributions are as follows:

For single filers: $153,000For married couples filing jointly: $228,000For heads of household: $189,000

Wondering how the tax brackets might affect your income in 2024? This article breaks down the different tax brackets and how they could impact your bottom line. It’s important to understand how these brackets work, as they can influence your overall tax liability.

If your MAGI exceeds these limits, you may still be able to contribute to a traditional IRA, but you will not be able to deduct your contributions on your tax return.

The standard mileage rate is a crucial factor for calculating deductions. This article provides the latest information on the standard mileage rate for October 2024, so you can ensure your deductions are accurate and compliant.

Contribution Limits for Different Age Groups

The contribution limits for traditional and Roth IRAs are the same for all age groups. For 2024, the annual contribution limit for both traditional and Roth IRAs is $7,000. However, if you are 50 years old or older, you can contribute an additional $1,000 as a “catch-up” contribution, bringing the total annual contribution limit to $8,000.

The October 2024 tax deadline is approaching, and you might be eligible for tax credits. This article provides a list of potential tax credits you could claim, helping you maximize your tax refund or minimize your tax liability.

Special Circumstances Affecting Contribution Limits

There are a few special circumstances that can affect your IRA contribution limits. For example, if you are a part-time worker or a student, you may still be eligible to contribute to an IRA. However, you may need to meet certain requirements, such as having earned income.

Curious about how the tax brackets have changed for 2024 compared to 2023? This article highlights the key differences, so you can see if there have been any significant adjustments that might affect your tax obligations.

Filing Status and Roth IRA Contribution Limits

Your filing status can also affect your Roth IRA contribution limits. As mentioned above, the income limits for Roth IRA contributions vary based on your filing status. For example, if you are single, your MAGI must be below $153,000 to contribute to a Roth IRA in 2024.

However, if you are married filing jointly, your MAGI must be below $228,000.

If you’re planning a move, you might need to know the mileage rate for moving expenses. This article explains the mileage rate specifically for moving expenses, helping you accurately calculate your deductions for your move.

Benefits of Contributing to an IRA: What Are The IRA Contribution Limits For 2024

Contributing to an IRA offers significant financial advantages, particularly for retirement planning. These benefits stem from the tax-advantaged nature of IRA contributions and the potential for long-term growth.

Want to know the exact mileage rate for October 2024? This article provides the latest information on the mileage rate, so you can accurately calculate your deductions for business or moving expenses.

Tax Benefits of Traditional IRAs

Traditional IRAs provide tax deductions for contributions, reducing your taxable income in the year you make the contribution. This can result in immediate tax savings. For example, if you contribute $6,500 to a traditional IRA and are in the 22% tax bracket, you would save $1,430 in taxes.

Self-employed individuals have specific 401k contribution limits. This article explains the limits for self-employed individuals, so you can maximize your retirement savings contributions while staying compliant with IRS regulations.

Advantages of Contributing to a Roth IRA

Roth IRAs offer tax-free withdrawals in retirement, meaning you won’t owe any taxes on the money you withdraw after age 59 1/2. This can be a significant advantage, especially if you expect to be in a higher tax bracket in retirement.

Knowing the specific tax rates for each bracket in 2024 can help you plan your finances more effectively. This resource provides a clear overview of the tax rates for each income level, allowing you to see how much you’ll owe based on your earnings.

For instance, if you withdraw $100,000 from a Roth IRA in retirement and are in the 24% tax bracket, you would avoid paying $24,000 in taxes.

Potential for Tax Savings and Long-Term Growth

IRA contributions offer the potential for both tax savings and long-term growth. Tax-deductible contributions to a traditional IRA can reduce your current tax liability, while tax-free withdrawals from a Roth IRA can save you taxes in retirement. Additionally, the money in your IRA grows tax-deferred, meaning you don’t pay taxes on investment earnings until you withdraw them.

This allows your money to compound more quickly, potentially leading to significant long-term wealth accumulation.

Planning for your retirement future involves knowing the contribution limits for IRAs. This article provides an overview of the contribution limits for both 2024 and 2025, so you can plan your savings strategy effectively.

Traditional vs. Roth IRA: Key Features

| Feature | Traditional IRA | Roth IRA |

|---|---|---|

| Contributions | Tax-deductible | Not tax-deductible |

| Withdrawals in Retirement | Taxable | Tax-free |

| Tax Implications | Taxes paid in retirement | Taxes paid upfront |

| Income Limits | None for contributions | Phase-out limits for contributions |

Strategies for Maximizing IRA Contributions

Maximizing your IRA contributions can significantly boost your retirement savings. By understanding the contribution limits, income restrictions, and various strategies, you can make the most of this valuable tax-advantaged savings tool.

Understanding how the mileage rate is calculated is essential for accurate deductions. This article provides a breakdown of how the mileage rate is determined, ensuring you understand the methodology behind the calculations.

Understanding Contribution Limits and Income Restrictions

Knowing the contribution limits and income restrictions is crucial for maximizing your IRA contributions. The annual contribution limit for traditional and Roth IRAs is the same, but your eligibility for certain deductions and tax benefits might differ.

If you’re driving to work, you might be interested in the October 2024 mileage rate. This article explains the current mileage rate and how it can be used to deduct your driving expenses for tax purposes. It’s a valuable tool for anyone who uses their personal vehicle for work-related travel.

- Contribution Limits:For 2024, the annual contribution limit for traditional and Roth IRAs is $7,000 for individuals under 50 and $11,000 for those 50 and over. These limits apply to both traditional and Roth IRAs.

- Income Restrictions:While there are no income restrictions for contributing to a Roth IRA, your ability to deduct contributions to a traditional IRA is limited based on your modified adjusted gross income (MAGI). For 2024, if your MAGI is $153,000 or higher as a single filer or $228,000 or higher as a married couple filing jointly, you can’t deduct contributions to a traditional IRA.

When it comes to retirement planning, understanding the 401k contribution limits is crucial. This resource provides a breakdown of the contribution limits for 2024, categorized by age, so you can see how much you can contribute to your retirement savings based on your current age.

Catch-Up Contributions

Individuals aged 50 and over can contribute an additional amount to their IRAs, known as catch-up contributions. This allows them to accelerate their retirement savings. For 2024, the catch-up contribution limit is $1,000, meaning you can contribute up to $11,000 if you are 50 or older.

Budgeting and Saving Strategies

Regularly contributing to your IRA requires a solid budget and disciplined saving habits. Here are some effective strategies:

- Automate Contributions:Set up automatic transfers from your checking account to your IRA. This eliminates the need for manual contributions and ensures you contribute consistently.

- Reduce Expenses:Identify areas where you can cut back on spending, such as dining out, entertainment, or subscriptions. Redirect these savings towards your IRA contributions.

- Increase Income:Explore ways to increase your income, such as taking on a side hustle, asking for a raise, or learning new skills that can lead to higher-paying jobs.

- Track Your Progress:Regularly monitor your IRA contributions and track your progress towards your retirement goals. This helps you stay motivated and make adjustments as needed.

Resources for Further Information

Several resources can provide you with more information on maximizing your IRA contributions:

- IRS Website:The IRS website offers comprehensive information on IRA contributions, including contribution limits, income restrictions, and tax implications.

- Financial Advisor:Consulting a financial advisor can help you develop a personalized retirement plan and maximize your IRA contributions based on your individual circumstances.

- Financial Books and Websites:Numerous books and websites offer valuable insights into retirement planning and IRA contributions.

Important Considerations for IRA Contributions

Before diving into the specifics of IRA contributions, it’s crucial to understand the implications and potential risks associated with these retirement savings vehicles. Understanding these factors will help you make informed decisions about your IRA contributions.

Early Withdrawals from an IRA

Withdrawing funds from your IRA before age 59 1/2 generally incurs a 10% penalty, in addition to your usual income tax rate. However, there are exceptions to this rule, such as for first-time home purchases, certain medical expenses, and paying for college tuition.

It’s important to be aware of these exceptions and consult with a financial advisor to determine if your withdrawal qualifies for an exemption.

Required Minimum Distributions (RMDs) for Traditional IRAs

Once you reach age 72, you are required to start taking minimum distributions from your traditional IRA. These distributions are subject to income tax, and failing to take them can result in substantial penalties. The amount of your RMD is calculated based on your age and the balance of your IRA.

There are no RMDs for Roth IRAs.

Potential Risks Associated with Investing in an IRA

While IRAs offer tax advantages, they also carry inherent risks. These include:

- Market Volatility:The value of your investments can fluctuate, and you may lose money if the market declines.

- Investment Fees:Some IRA accounts charge fees for management, trading, or other services. These fees can eat into your returns over time.

- Inflation:Inflation can erode the purchasing power of your savings, meaning your money may not buy as much in the future as it does today.

Opening and Contributing to an IRA, What are the IRA contribution limits for 2024

- Choose an IRA Provider:Select a reputable financial institution, such as a bank, brokerage firm, or mutual fund company, to manage your IRA.

- Choose an IRA Type:Decide between a traditional IRA or a Roth IRA, considering your tax situation and financial goals.

- Open an IRA Account:Complete the necessary paperwork and provide the required information to open your account.

- Make Contributions:Contribute to your IRA regularly, taking advantage of the annual contribution limit.

- Monitor Your Investments:Regularly review your investments and make adjustments as needed to align with your risk tolerance and financial goals.

Final Conclusion

Understanding the IRA contribution limits for 2024 is a key step in planning for a comfortable retirement. By maximizing your contributions, you can take advantage of tax benefits and build a substantial nest egg for your golden years. Whether you choose a traditional or Roth IRA, remember to consider your financial situation and retirement goals to make the most of this valuable savings tool.

Remember, the earlier you start saving, the more time your money has to grow, so don’t delay in making the most of your IRA contributions.

FAQ Corner

What happens if I contribute more than the IRA limit?

If you exceed the IRA contribution limit, you may be subject to a penalty. The IRS considers any excess contributions as non-deductible, meaning they won’t be tax-deductible and could lead to a penalty.

Can I contribute to both a traditional and Roth IRA in the same year?

Yes, you can contribute to both a traditional and Roth IRA in the same year, but there are income limitations for Roth IRA contributions. You may need to adjust your contributions based on your income level to avoid penalties.

What are the tax implications of withdrawing from an IRA before age 59 1/2?

Generally, withdrawing from an IRA before age 59 1/2 will result in a 10% penalty, plus taxes on the amount withdrawn. There are some exceptions, such as for certain medical expenses or for first-time home purchases.