IRA contribution limits for 2024 for part-time workers can be a confusing topic, especially if you’re not sure if you qualify or how much you can contribute. This guide will break down the essential information you need to know about IRA contributions, including eligibility requirements, tax advantages, and planning tips specifically tailored for part-time workers.

Understanding IRA contributions is crucial for anyone planning for retirement, but it can be particularly important for part-time workers who may not have access to employer-sponsored retirement plans. This guide will provide you with the information you need to make informed decisions about your retirement savings, regardless of your employment status.

Contents List

IRA Contribution Limits for 2024

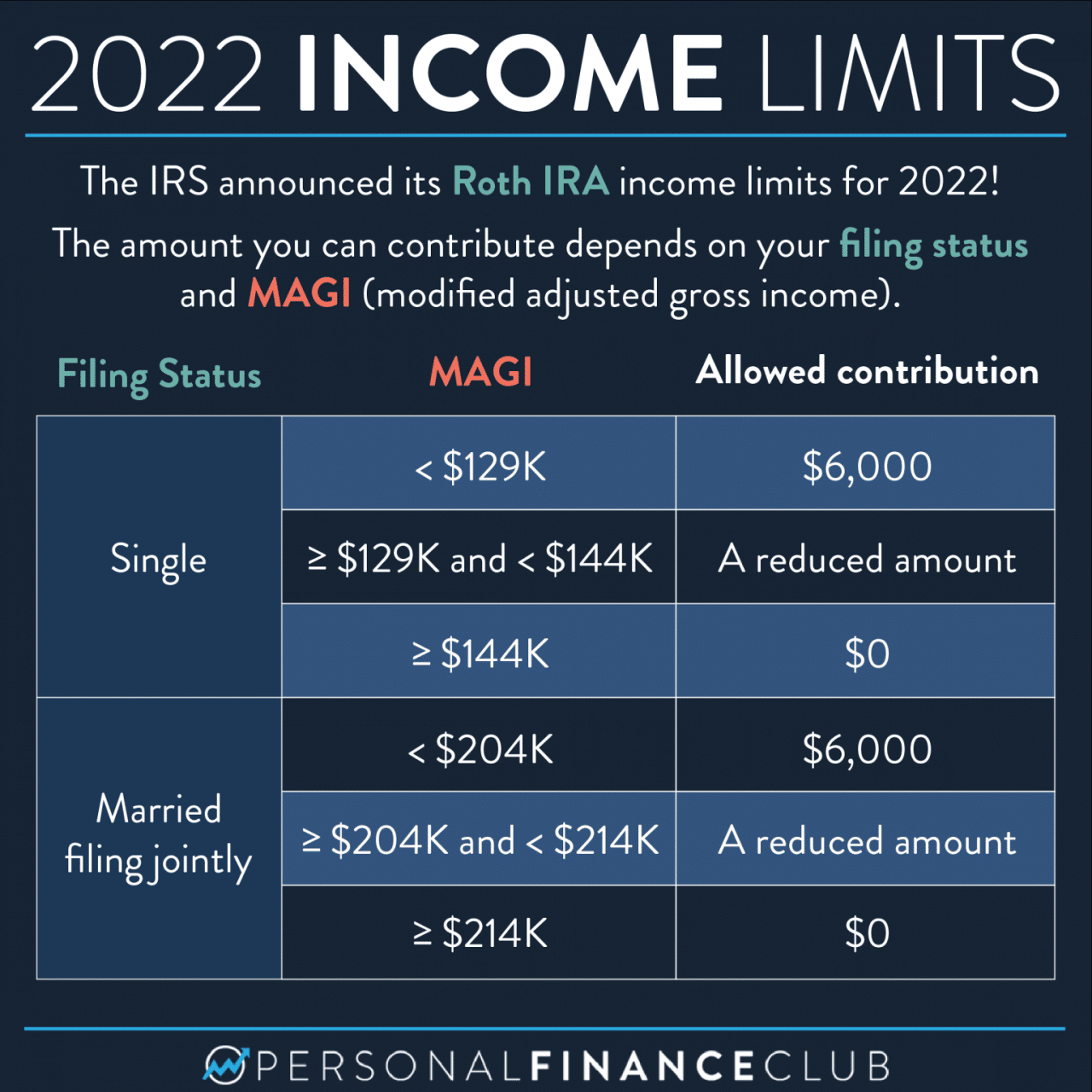

The annual contribution limits for traditional and Roth IRAs in 2024 are set by the IRS. The contribution limits for 2024 are the same as those in 2023, but may change in future years.

Understanding how the tax brackets work is crucial for planning your finances. You can find a breakdown of the tax rates for each bracket in 2024 in this article: Tax rates for each tax bracket in 2024. This information will help you make informed decisions about your income and deductions.

IRA Contribution Limits for 2024

The maximum amount you can contribute to a traditional or Roth IRA in 2024 is $6,500. If you are 50 or older, you can contribute an additional $1,000 as a “catch-up” contribution.

Understanding how tax brackets work is crucial for making informed financial decisions. This article provides a clear explanation of the different tax brackets and how they impact your income: Understanding tax brackets for 2024.

Traditional IRA vs. Roth IRA

Traditional and Roth IRAs have different tax treatment.

If you’re self-employed, the tax deadline for filing your return in October 2024 is different from the standard deadline. Make sure you’re aware of the specific date by checking out this helpful resource: October 2024 tax deadline for self-employed individuals.

- With a traditional IRA, you can deduct your contributions from your taxable income in the year you make them. This reduces your current tax liability. However, you will have to pay taxes on your withdrawals in retirement.

- With a Roth IRA, you don’t get a tax deduction for your contributions, but your withdrawals in retirement are tax-free. This means you pay taxes on your contributions now, but not when you withdraw the money in retirement.

IRA Contribution Limits for Different Types of IRAs in 2024

Here is a table that summarizes the contribution limits for different types of IRAs in 2024:

| IRA Type | Contribution Limit | Catch-up Contribution (Age 50+) |

|---|---|---|

| Traditional IRA | $6,500 | $1,000 |

| Roth IRA | $6,500 | $1,000 |

| SEP IRA | 25% of your net adjusted self-employed income | N/A |

| SIMPLE IRA | $15,500 | $3,500 |

Note:The contribution limits for IRAs are subject to change each year. It is important to consult with a financial advisor to determine the best type of IRA for your individual circumstances.

Married couples planning to contribute to an IRA in 2024 will find helpful information on the specific contribution limits for married couples in this article: IRA contribution limits for 2024 for married couples. This resource can help you make informed decisions about your retirement savings.

Tax Advantages of IRA Contributions

IRAs offer significant tax advantages that can help you save for retirement. These advantages vary depending on the type of IRA you choose, whether it’s a traditional IRA or a Roth IRA.

Want to maximize your retirement savings in 2024? If you’re 50 or older, you can contribute a bit more to your 401(k) through catch-up contributions. Learn more about the maximum contribution limits, including catch-up contributions, by visiting this page: How much can I contribute to my 401k in 2024 with catch-up contributions.

Tax Deductions for Traditional IRA Contributions

Traditional IRA contributions are generally tax-deductible. This means you can deduct the amount you contribute from your taxable income, reducing your tax liability for the current year.

Yes, the mileage rate for business travel is set to change in October 2024. This change can impact your tax deductions, so it’s essential to stay informed. You can find more details about the mileage rate adjustment in this article: Is the mileage rate changing in October 2024?

.

For example, if you contribute $6,500 to a traditional IRA and your taxable income is $50,000, your taxable income will be reduced to $43,500.

Knowing the tax bracket thresholds for 2024 can help you estimate your tax liability and make adjustments to your income or deductions. You can find a comprehensive list of these thresholds here: Tax bracket thresholds for 2024.

This can result in significant tax savings, especially if you’re in a higher tax bracket.

Wondering what the maximum amount you can contribute to your 401(k) in 2024? It’s a significant amount that can help you build a strong retirement nest egg. Check out this article for the details: What is the maximum 401k contribution for 2024.

Tax-Free Withdrawals for Roth IRA Contributions, IRA contribution limits for 2024 for part-time workers

Roth IRA contributions are made with after-tax dollars, but withdrawals in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, even if your income is much higher in retirement.

If you’re married and planning to contribute to an IRA in 2024, there are specific contribution limits for couples. To learn more about these limits and how they might impact your retirement planning, check out this helpful resource: Ira contribution limits for married couples in 2024.

For instance, if you contribute $6,500 to a Roth IRA and withdraw $100,000 in retirement, you won’t have to pay any taxes on that $100,000.

This can be a significant advantage, especially if you expect to be in a higher tax bracket in retirement.

The mileage rate for business travel is set to change in October 2024. If you’re self-employed or use your vehicle for business purposes, it’s important to stay updated on these changes. You can find the latest information on the mileage rate adjustment here: October 2024 mileage rate changes.

Comparing the Tax Benefits of Traditional and Roth IRAs for Part-Time Workers

The best type of IRA for you depends on your individual circumstances and financial goals.

- If you expect to be in a lower tax bracket in retirement, a traditional IRA may be more beneficial because you’ll get a tax deduction on your contributions now and pay taxes on withdrawals later when you’re in a lower tax bracket.

Looking to contribute to your Roth IRA in 2024? The contribution limit is set at a specific amount, and you can find out more about it by checking out this article: Ira contribution limits for Roth IRA in 2024.

This information can help you plan your retirement savings effectively.

- If you expect to be in a higher tax bracket in retirement, a Roth IRA may be more beneficial because your withdrawals will be tax-free.

Part-time workers should consider their current income and their anticipated income in retirement when making this decision.

Closing Summary: IRA Contribution Limits For 2024 For Part-time Workers

Navigating the world of IRA contributions can seem daunting, but with the right information and resources, you can confidently plan for a secure financial future. Remember, even as a part-time worker, taking advantage of IRA contributions can make a significant difference in your retirement savings.

By understanding the rules, maximizing your contributions, and seeking guidance from qualified professionals when needed, you can build a solid foundation for a comfortable retirement.

Query Resolution

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA allows you to deduct your contributions from your taxable income, reducing your current tax bill. However, withdrawals in retirement are taxed. A Roth IRA does not offer an immediate tax deduction, but withdrawals in retirement are tax-free.

The best option for you depends on your individual financial situation and tax bracket.

Can I contribute to an IRA if I have a 401(k)?

Yes, you can contribute to both an IRA and a 401(k), but your total contributions may be limited. It’s important to check the contribution limits for both types of accounts and ensure you’re not exceeding the annual maximum.

How do I find a financial advisor to help me with my retirement planning?

You can search for a financial advisor online, through professional organizations like the Certified Financial Planner Board of Standards, or by asking for referrals from trusted sources like friends, family, or colleagues. Make sure to choose a qualified and experienced advisor who can provide personalized advice tailored to your specific needs.

If you’re dealing with an estate, you’ll need to file a W9 Form. The October 2024 deadline for estates to file their W9 forms is important to remember. You can find more information about this form and the deadline in this article: W9 Form October 2024 for estates.

The tax brackets for qualifying widow(er)s in 2024 are different from those for other filing statuses. To learn more about these specific brackets and how they might impact your taxes, check out this article: Tax brackets for qualifying widow(er)s in 2024.

The IRA contribution limits for October 2024 are an important factor to consider when planning your retirement savings. You can find the latest information on these limits here: Ira limits for October 2024.

Non-profit organizations also need to file a W9 Form. The October 2024 deadline for non-profit organizations to file their W9 forms is approaching. You can find detailed information about the W9 Form for non-profit organizations here: W9 Form October 2024 for non-profit organizations.