Standard deduction changes for 2024 are impacting how taxpayers approach their annual filings. The standard deduction, a fixed amount that can be claimed instead of itemizing deductions, is increasing for the 2024 tax year, potentially affecting the tax liability of many individuals and families.

These changes are significant, and understanding their implications is crucial for navigating the tax landscape effectively.

This article delves into the details of these changes, examining the increased standard deduction amounts, their impact on itemized deductions, and considerations for taxpayers in planning their 2024 tax strategy. We’ll also explore potential implications for future tax years, offering insights into how these adjustments might shape tax policy and revenue collection in the long run.

Contents List

Overview of Standard Deduction Changes for 2024

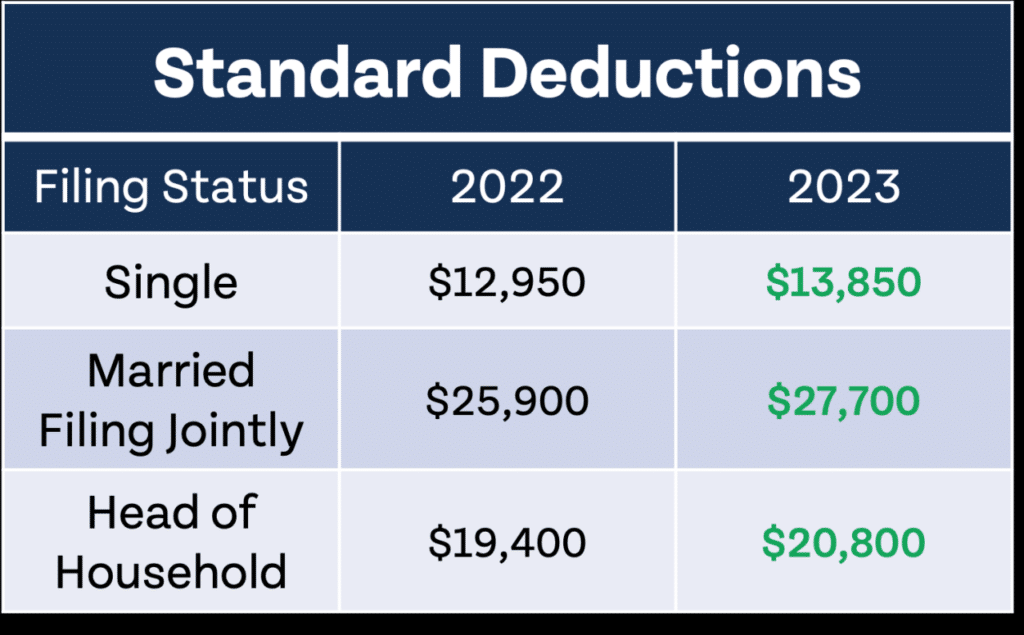

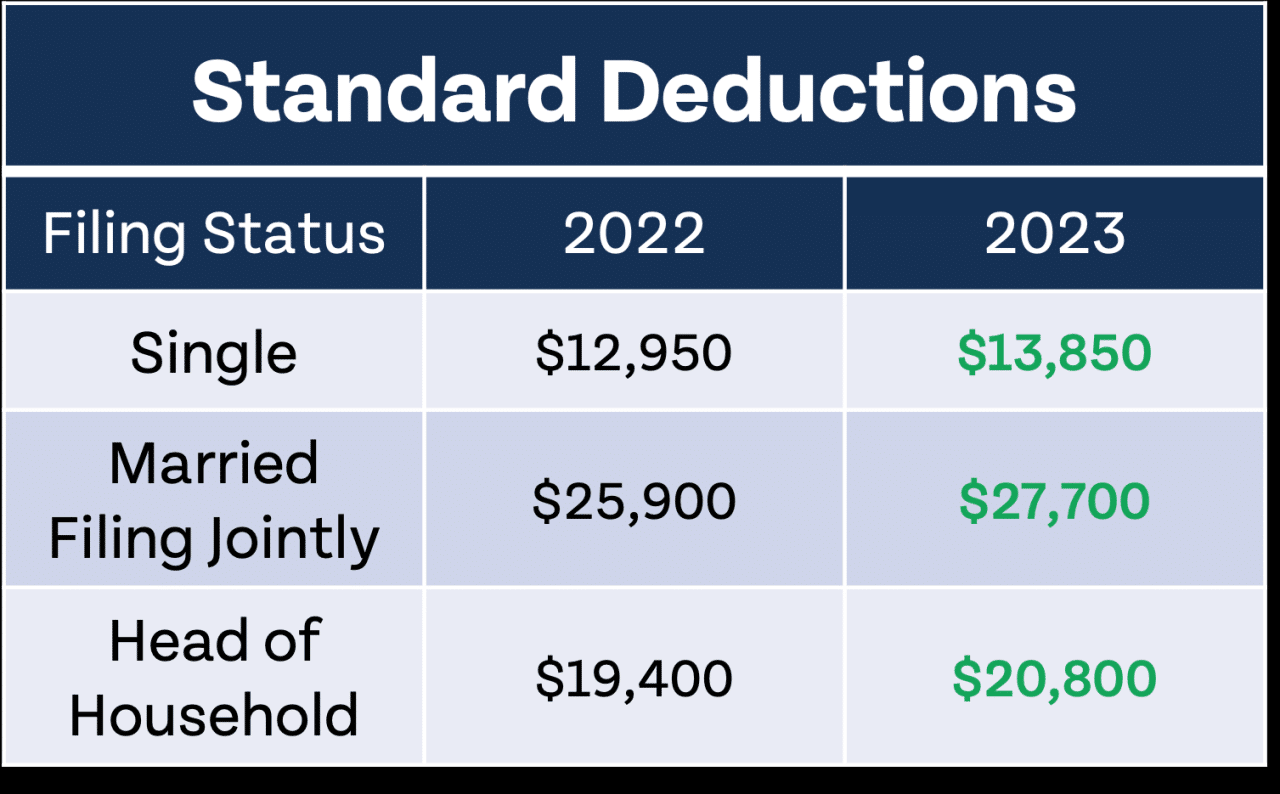

The standard deduction is a fixed amount that taxpayers can subtract from their taxable income. It’s a way for the government to provide tax relief to individuals and families. The standard deduction amount varies depending on your filing status, such as single, married filing jointly, or head of household.

The IRS mileage rate is updated quarterly, so you’ll need to wait until the official announcement to know the exact rate for October 2024. Check this link for the latest news and updates.

The standard deduction is adjusted annually for inflation, and for 2024, there are some changes to the amounts.The key changes to the standard deduction for 2024 are increased amounts for all filing statuses. These increases reflect the rising cost of living and are intended to provide more tax relief to taxpayers.

Tax laws are constantly changing, so it’s important to stay up-to-date. See if any tax changes are affecting the October 2024 deadline and make sure you’re prepared.

Impact of Standard Deduction Changes on Different Taxpayer Groups

The increased standard deduction amounts will benefit all taxpayers, but the impact will vary depending on their filing status and income level.

Partnerships need to complete a W9 Form to provide their tax information. Learn about the W9 Form requirements for partnerships in October 2024 to stay compliant with tax regulations.

- Single Filers: Single filers will see the largest percentage increase in their standard deduction. This means that more of their income will be tax-free.

- Married Couples Filing Jointly: Married couples filing jointly will also see a significant increase in their standard deduction. This can help reduce their tax liability and increase their disposable income.

- Seniors: Seniors may benefit from the increased standard deduction, as they often have lower incomes and may be more sensitive to tax changes.

It’s important to note that these are just the standard deduction amounts. The actual amount of tax relief you receive will depend on your individual circumstances, including your income, deductions, and credits.

Curious about your tax bracket in 2024? Use this tax bracket calculator to get a better understanding of your tax obligations.

Impact on Itemized Deductions

The increased standard deduction for 2024 will likely affect the decision of whether to itemize deductions. Itemizing is only advantageous if the total of your itemized deductions exceeds the standard deduction amount. With the standard deduction increasing, fewer taxpayers may find it beneficial to itemize.

Small businesses have their own unique 401k contribution limits. Find out the limits for small businesses in 2024 to make sure you’re maximizing your retirement savings.

Impact on Specific Itemized Deductions, Standard deduction changes for 2024

The higher standard deduction may make some itemized deductions less beneficial. These include:

- State and Local Taxes (SALT):The 2017 Tax Cuts and Jobs Act limited the deduction for state and local taxes (SALT) to $10,000 per household. The higher standard deduction may reduce the number of taxpayers who exceed this limit and benefit from the SALT deduction.

Whether you’re self-employed or just want to contribute to your retirement, learn about the IRA contribution limits for 2024. It’s a great way to build your nest egg.

- Medical Expenses:You can deduct medical expenses exceeding 7.5% of your adjusted gross income (AGI). The higher standard deduction may make this threshold harder to reach, reducing the benefit of this deduction for some taxpayers.

- Home Mortgage Interest:The interest deduction on mortgage debt is limited to the first $750,000 of debt. With the higher standard deduction, some taxpayers may find it more beneficial to take the standard deduction rather than itemize and claim this deduction.

- Charitable Contributions:You can deduct charitable contributions up to 60% of your AGI. While this deduction is generally unaffected by the standard deduction, the higher standard deduction may lead some taxpayers to choose the standard deduction instead of itemizing and claiming this deduction.

Moving can be expensive, but there are deductions available for moving expenses. Find out the mileage rate for moving expenses in October 2024 to make sure you’re claiming everything you’re entitled to.

Situations Where Itemizing May Still Be Advantageous

Even with the higher standard deduction, some taxpayers may still find it beneficial to itemize. These situations include:

- High Medical Expenses:If you have significant medical expenses, you may still find it advantageous to itemize, even with the higher standard deduction. The deduction for medical expenses exceeding 7.5% of your AGI can be substantial.

- High State and Local Taxes:If you live in a state with high state and local taxes, you may still find it beneficial to itemize, even if you exceed the $10,000 SALT limit. This is because you can deduct the portion of your state and local taxes that does not exceed the limit.

Wondering if the mileage rate is changing this October? Find out here if there are any updates to the IRS mileage rate for business and medical expenses.

- Significant Home Mortgage Interest:If you have a large mortgage, you may still find it beneficial to itemize, even with the higher standard deduction. The interest deduction on mortgage debt can be significant.

- Large Charitable Contributions:If you make significant charitable contributions, you may still find it beneficial to itemize, even with the higher standard deduction. The deduction for charitable contributions can be substantial.

Considerations for Taxpayers

The changes to the standard deduction for 2024 will have a significant impact on many taxpayers. It is important to consider these changes when planning for the upcoming tax year.

The IRS mileage rate is used for business and medical expenses, and it changes throughout the year. Get the latest mileage rate for October 2024 to ensure accurate record keeping.

Strategies for Maximizing Tax Benefits

Taxpayers should explore various strategies to maximize their tax benefits in light of the standard deduction changes.

Maximize your retirement savings with a Traditional IRA. Find out the contribution limits for single filers in 2024 to make sure you’re taking advantage of all the benefits.

- Review Itemized Deductions:While the standard deduction may be more beneficial for some, others might find itemizing deductions to be more advantageous. Carefully review your potential itemized deductions, such as mortgage interest, charitable contributions, and medical expenses, to determine if they exceed the standard deduction amount.

Planning for your retirement? See how the 401k contribution limits have changed for 2024 compared to last year. You might be able to save even more for your future!

- Consider Adjustments to Income:Explore strategies to reduce your adjusted gross income (AGI), which can affect your eligibility for certain tax credits and deductions. For example, you might consider making contributions to a traditional IRA or 401(k) plan, which can lower your AGI.

- Maximize Tax Credits:Tax credits directly reduce your tax liability. Explore available credits such as the Child Tax Credit, Earned Income Tax Credit, and American Opportunity Tax Credit.

- Seek Professional Advice:Consulting with a qualified tax professional can provide personalized guidance based on your specific circumstances and help you make informed decisions regarding your tax planning strategies.

Impact on Different Taxpayer Groups

The standard deduction changes are likely to affect different taxpayer groups in various ways.

| Taxpayer Group | Potential Impact | Example |

|---|---|---|

| Single Filers | Higher standard deduction may result in lower tax liability, especially for those with limited itemized deductions. | A single filer with modest income and no major itemized deductions may find the increased standard deduction to be advantageous. |

| Married Filing Jointly | Increased standard deduction may benefit couples with lower incomes and limited itemized deductions. | A married couple with combined income below a certain threshold and no significant itemized deductions might benefit from the higher standard deduction. |

| High-Income Earners | May experience a less significant impact from the standard deduction increase as they are more likely to itemize deductions. | A high-income earner with substantial itemized deductions, such as mortgage interest and charitable contributions, may find the standard deduction increase less impactful. |

Potential Implications for Future Tax Years

The changes to the standard deduction in 2024 could have far-reaching implications for tax policy and revenue collection in the years to come. Understanding these potential effects is crucial for both policymakers and taxpayers alike.

Impact on Tax Policy and Revenue Collection

The increase in the standard deduction could lead to a decrease in the number of taxpayers who itemize their deductions. This could, in turn, affect the government’s revenue collection. If fewer taxpayers itemize, the government might collect less revenue from income taxes.

This reduction in revenue could necessitate adjustments to other areas of the budget or potentially lead to increased deficits.

Last Point: Standard Deduction Changes For 2024

The standard deduction changes for 2024 present both opportunities and challenges for taxpayers. By understanding the updated amounts, their impact on itemized deductions, and the strategies available for maximizing tax benefits, individuals and families can navigate the tax landscape more effectively.

The increased standard deduction might lead to lower tax liability for some, while others may find that itemizing remains advantageous. Staying informed about these changes and their potential long-term implications is crucial for navigating the evolving tax landscape.

User Queries

Who benefits most from the increased standard deduction?

Taxpayers with relatively simple income and few itemized deductions are likely to benefit most from the increased standard deduction. This includes individuals with limited charitable contributions, medical expenses, or other deductible expenses.

Will the increased standard deduction affect everyone equally?

No, the impact of the increased standard deduction will vary based on individual circumstances, such as income level, filing status, and whether itemized deductions are claimed. Taxpayers with higher incomes and significant itemized deductions may see a smaller impact.

Should I itemize deductions even if the standard deduction is higher?

It depends on your individual situation. If your itemized deductions exceed the standard deduction amount, it’s generally advantageous to itemize. However, it’s best to consult with a tax professional to determine the most beneficial approach for your specific circumstances.

Need to know the mileage rate for October 2024? Find it on the IRS website or use a reliable online resource.

Want to contribute to your retirement savings this year? Learn about the IRA contribution limits for 2024 to make sure you’re taking advantage of all the benefits.

The IRS mileage rate is used for a variety of expenses, and it’s important to know the current rate. Find out how much the mileage rate is for October 2024 to ensure accurate record keeping.

Non-profit organizations also need to complete a W9 Form to provide their tax information. Learn about the W9 Form requirements for non-profit organizations in October 2024 to stay compliant with tax regulations.