USDA Mortgage Rates 2024 are a hot topic for prospective homeowners, especially those seeking affordable financing options in rural areas. The USDA loan program, backed by the United States Department of Agriculture, offers unique benefits and potential savings compared to conventional mortgages.

If you’re a Coast Capital member, discover the latest Coast Capital Mortgage Rates 2024 and see if they can help you secure a great mortgage deal.

This guide will delve into the intricacies of USDA mortgage rates in 2024, exploring current trends, influencing factors, and providing insights into qualifying for this valuable program.

Looking to finance a commercial property? Learn more about Commercial Mortgage 2024 and explore your options.

Understanding USDA mortgage rates is crucial for making informed financial decisions. This comprehensive guide will equip you with the knowledge to navigate the USDA loan process, from assessing your eligibility to securing the best possible rate. Whether you’re a first-time homebuyer or looking to refinance, this information will empower you to make confident choices about your future homeownership journey.

Looking to purchase a home in a rural area? Explore the benefits of a Usda Mortgage 2024 to achieve your homeownership goals.

Contents List

USDA Mortgage Program Overview

The USDA mortgage program, officially known as the Rural Housing Service (RHS) loan program, offers a unique opportunity for eligible borrowers to achieve homeownership in rural areas. It’s a government-backed loan program designed to make homeownership more accessible in specific geographic locations.

Investing in real estate? You’ll want to keep an eye on Investment Property Interest Rates 2024 to find the best financing options for your rental property.

Purpose and Eligibility Criteria

The USDA loan program aims to promote affordable housing options in rural communities. To be eligible for a USDA loan, you must meet specific criteria, including:

- Location:The property must be located in a designated rural area, which can be verified through the USDA’s property eligibility tool.

- Income:Your household income must fall within the USDA’s income limits, which vary by location and family size. These limits are designed to ensure that the program primarily serves low- to moderate-income households.

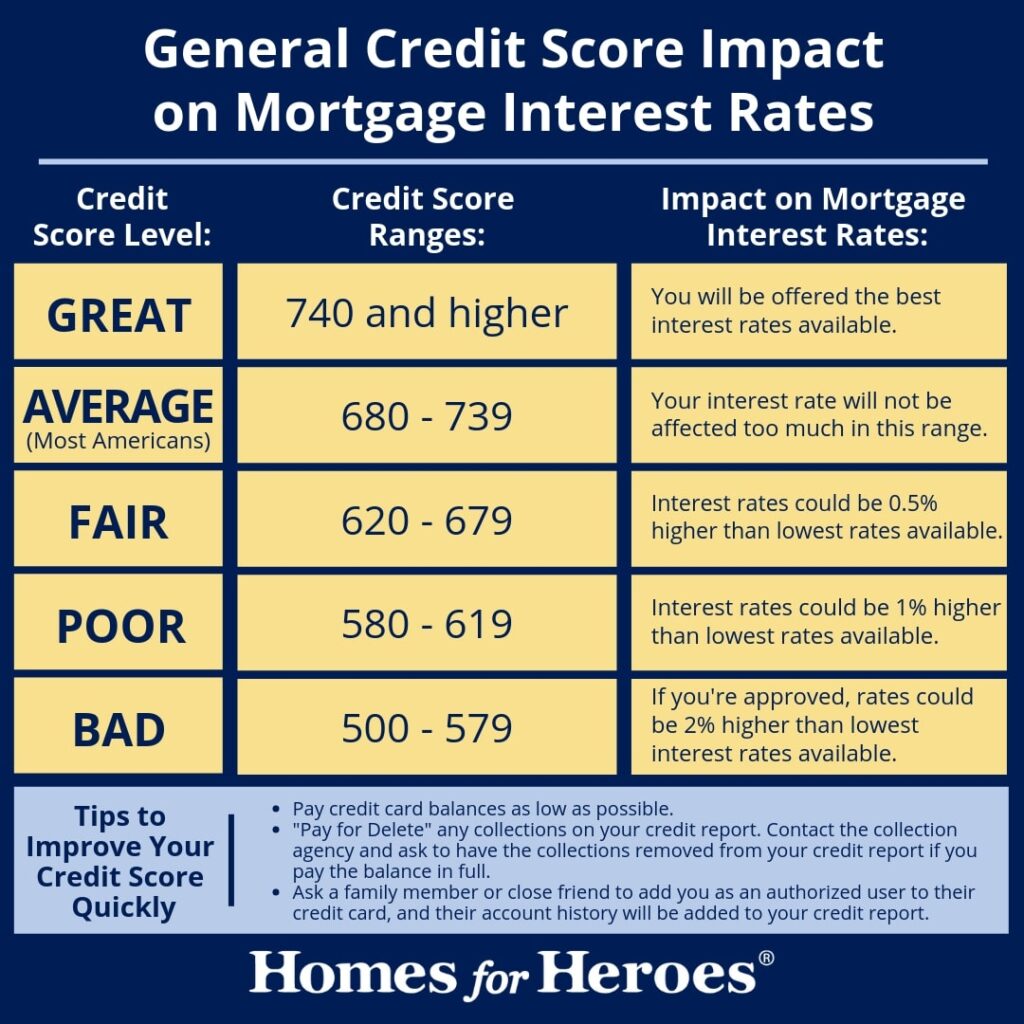

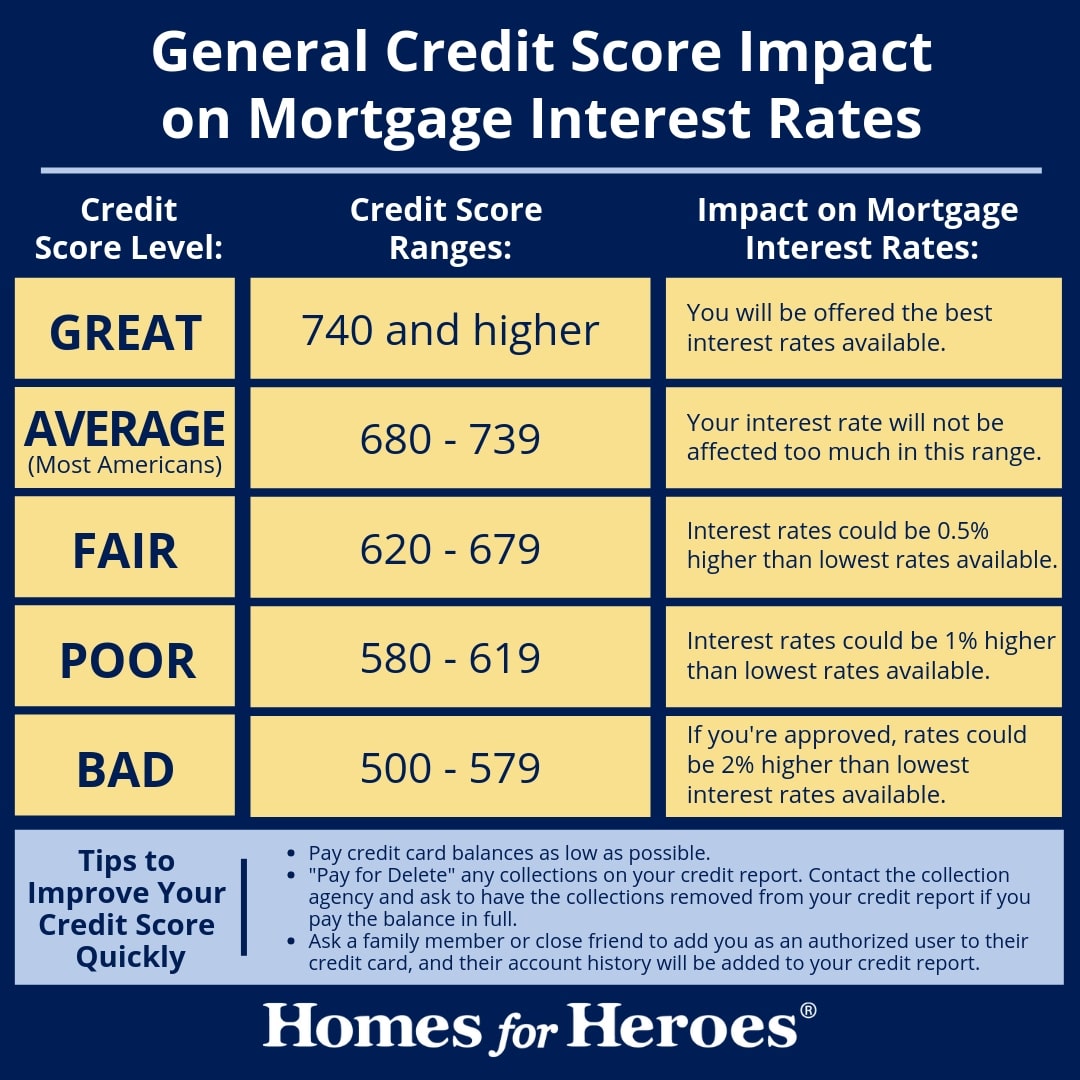

- Credit Score:While the minimum credit score requirement varies, a score of at least 640 is generally recommended for better loan terms. However, some lenders may accept borrowers with lower scores.

- Debt-to-Income Ratio (DTI):Your DTI, which measures your monthly debt payments relative to your gross monthly income, should be within the lender’s guidelines, usually around 43% or less.

- Property Type:The loan is typically used to purchase single-family homes, but it can also be used for manufactured homes, townhouses, and condominiums in eligible locations.

Benefits and Drawbacks

USDA mortgages offer several benefits to eligible borrowers, but they also come with some drawbacks to consider:

Benefits:

- Lower Down Payment:USDA loans typically require a 0% down payment, making homeownership more attainable for borrowers with limited savings.

- Competitive Interest Rates:USDA loan rates are often competitive with conventional mortgages, especially for borrowers with good credit scores.

- Limited Closing Costs:USDA loans generally have lower closing costs compared to other mortgage types.

- No Private Mortgage Insurance (PMI):Unlike conventional loans, USDA loans don’t require PMI, which can save borrowers significant money over the life of the loan.

Drawbacks:

- Rural Location Requirement:The most significant drawback is the property location restriction. You must purchase a home in a designated rural area to qualify for a USDA loan.

- Income Limits:The income limits can be restrictive, particularly for higher-income households, limiting eligibility for the program.

- Property Size and Value Limitations:USDA loans have limits on the size and value of the property you can purchase. These limits are designed to ensure affordability and may not be suitable for larger or more expensive homes.

- Limited Lender Availability:Not all lenders participate in the USDA loan program, so you may need to shop around to find a lender that offers these loans.

USDA Loan Rates vs. Conventional Mortgages

USDA mortgage rates are typically competitive with conventional mortgages, especially for borrowers with good credit. However, factors like the current market conditions, your credit score, and the loan term can influence the rates you qualify for.

Here’s a general comparison of USDA loan rates with conventional mortgage rates:

| Loan Type | Typical Interest Rate Range |

|---|---|

| USDA Mortgage | 4.5%

Thinking about tapping into your home’s equity? Discover the possibilities of Taking Equity Out Of Home 2024 and learn about the different options available.

|

| Conventional Mortgage | 4.0%

Credit unions often offer competitive mortgage rates. Explore Credit Union Mortgage Rates 2024 to see if they can help you get a great deal.

|

It’s important to note that these rates are just estimates and can vary based on individual circumstances. To get an accurate idea of the rates you qualify for, you should consult with a mortgage lender.

USDA Mortgage Rates in 2024

USDA mortgage rates, like all mortgage rates, are subject to fluctuations influenced by a range of economic factors. Understanding the current trends and potential influences on USDA mortgage rates in 2024 is crucial for borrowers seeking to utilize this program.

Current Trends in USDA Mortgage Rates

As of the first quarter of 2024, USDA mortgage rates are generally hovering within the 4.5% to 6.5% range for 30-year fixed-rate loans. This represents a slight increase from the historically low rates experienced in recent years. The increase is attributed to factors such as the Federal Reserve’s monetary policy, inflation, and economic uncertainty.

Understanding your mortgage affordability is crucial. Use Mortgage Affordability 2024 to calculate your budget and find a loan that fits your financial situation.

Factors Influencing Rate Fluctuations

Several factors can influence USDA mortgage rate fluctuations throughout 2024:

- Federal Reserve Interest Rate Policy:The Federal Reserve’s actions to control inflation through interest rate adjustments directly impact mortgage rates. Increased interest rates generally lead to higher mortgage rates.

- Inflation:High inflation can lead to increased borrowing costs, putting upward pressure on mortgage rates. The Fed’s efforts to curb inflation will play a significant role in determining rate movements.

- Economic Growth:Strong economic growth can lead to increased demand for loans, which can push mortgage rates higher. However, economic uncertainty can also create volatility in the market.

- Government Policies:Government policies, such as those related to housing affordability or mortgage lending, can also influence USDA mortgage rates.

Projected Rate Ranges for Different Loan Terms

Here’s a table displaying projected rate ranges for different loan terms in 2024, based on current trends and anticipated market conditions:

| Loan Term | Projected Rate Range |

|---|---|

| 15-Year Fixed-Rate | 4.0%

|

| 30-Year Fixed-Rate | 4.5%

Looking for the best interest rates on a 5-year fixed mortgage in 2024? Check out Best Mortgage Rates 5 Year Fixed 2024 for a comprehensive guide to the current market and tips on securing a competitive rate.

|

| Adjustable-Rate Mortgage (ARM) | 3.5%

For a longer fixed-rate period, consider a 10-year ARM. See 10 Year Arm Mortgage Rates 2024 for current rates and information.

|

It’s important to remember that these projections are based on current market conditions and can change rapidly. To get the most up-to-date information on USDA mortgage rates, consult with a mortgage lender or visit reputable online resources.

Ready to buy your dream home? Find out about the Lowest Interest Rate Home Loan 2024 and make your homeownership dreams a reality.

Qualifying for a USDA Mortgage

Before applying for a USDA mortgage, it’s crucial to understand the eligibility requirements to determine if you qualify for this program.

Considering an adjustable-rate mortgage? Learn more about Arm Mortgage 2024 and weigh the pros and cons before making a decision.

Income Limits and Property Location

To qualify for a USDA loan, your household income must fall within the USDA’s income limits, which vary based on location and family size. You can find the income limits for your area using the USDA’s property eligibility tool. Additionally, the property you wish to purchase must be located in a designated rural area, which can also be verified through the USDA tool.

Credit Score and Debt-to-Income Ratio

While the minimum credit score requirement can vary, a score of at least 640 is generally recommended for better loan terms. However, some lenders may accept borrowers with lower scores. Your debt-to-income ratio (DTI), which measures your monthly debt payments relative to your gross monthly income, should be within the lender’s guidelines, usually around 43% or less.

Eligibility Checklist, Usda Mortgage Rates 2024

Here’s a checklist to help potential borrowers assess their eligibility for a USDA mortgage:

- Property Location:Is the property located in a designated rural area?

- Income Limits:Does your household income fall within the USDA’s income limits for your area and family size?

- Credit Score:Do you have a credit score of at least 640 or meet the lender’s minimum credit score requirements?

- Debt-to-Income Ratio:Is your DTI within the lender’s guidelines, typically around 43% or less?

- Property Type:Does the property meet the USDA’s requirements for eligible property types (e.g., single-family homes, manufactured homes, townhouses)?

If you meet all the eligibility criteria, you can proceed with the USDA loan application process.

USDA Loan Process

Applying for a USDA mortgage involves a series of steps that can take several weeks or months to complete. Understanding the process and required documentation can help you navigate the application process smoothly.

Ally Bank offers competitive mortgage rates. Check out Ally Mortgage Rates 2024 to see if they have a loan that meets your needs.

Steps Involved in Applying

The typical USDA loan application process includes the following steps:

- Pre-Approval:Get pre-approved for a USDA loan by providing your financial information to a lender. This will give you an idea of the loan amount you qualify for and help you make an offer on a property.

- Property Selection:Find a property that meets the USDA’s eligibility requirements and fits your needs and budget.

- Loan Application:Complete the USDA loan application and provide the required documentation, such as your income verification, credit history, and employment information.

- Property Appraisal:The lender will order an appraisal to determine the property’s fair market value. The appraised value must be equal to or greater than the purchase price.

- Loan Underwriting:The lender will review your application and documentation to assess your creditworthiness and ensure you meet the loan requirements.

- Loan Closing:Once the loan is approved, you will sign the loan documents and complete the closing process. This typically involves meeting with a closing agent to finalize the transaction.

Required Documentation

To complete the USDA loan application, you will need to provide the following documentation:

- Proof of Income:Pay stubs, W-2 forms, tax returns, and other documents verifying your income.

- Credit History:Credit report and credit score from a credit bureau.

- Employment Information:Employment verification letter or pay stubs.

- Bank Statements:Recent bank statements showing your assets and liabilities.

- Property Information:Purchase agreement, property tax information, and insurance quotes.

Loan Closing Timeframe

The typical USDA loan closing timeframe can vary depending on factors such as the lender, the property, and the borrower’s financial situation. However, the entire process can take anywhere from 30 to 60 days.

USDA Mortgage Refinance Options

Refinancing your USDA mortgage can be a smart financial move if it allows you to lower your interest rate, shorten your loan term, or access cash for other needs. However, it’s essential to weigh the benefits and drawbacks before deciding to refinance.

USAA members can access a range of financial products, including HELOCs. See Usaa Heloc 2024 for details and current rates.

Benefits of Refinancing

Refinancing a USDA mortgage can offer several benefits, including:

- Lower Monthly Payments:Refinancing to a lower interest rate can significantly reduce your monthly mortgage payments, freeing up cash flow for other expenses.

- Shorter Loan Term:Refinancing to a shorter loan term, such as a 15-year mortgage, can help you pay off your loan faster and save on interest charges.

- Cash-Out Refinance:A cash-out refinance allows you to borrow against your home’s equity, giving you access to cash for home improvements, debt consolidation, or other financial needs.

Drawbacks of Refinancing

While refinancing can offer benefits, it’s essential to consider the potential drawbacks:

- Closing Costs:Refinancing involves closing costs, such as appraisal fees, lender fees, and title insurance, which can offset some of the savings from a lower interest rate.

- Interest Rate Risk:If interest rates rise after you refinance, you may end up paying more in interest over the life of the loan.

- Loan Term Extension:Refinancing to a longer loan term can lower your monthly payments but may result in paying more interest overall.

Refinance Scenarios and Outcomes

Here are some common refinance scenarios and their potential outcomes:

- Rate-and-Term Refinance:Refinancing to a lower interest rate and a shorter loan term can significantly reduce your monthly payments and help you pay off your loan faster.

- Cash-Out Refinance:Accessing cash from your home’s equity can provide funds for home improvements, debt consolidation, or other financial needs. However, this option increases your loan amount and interest charges.

- Streamline Refinance:This type of refinance is typically faster and less expensive than a traditional refinance, but it may not offer as much savings on your interest rate.

Determining the Best Refinance Strategy

The best refinance strategy depends on your individual financial situation and goals. Consider factors such as your current interest rate, your remaining loan term, your credit score, and your financial needs when deciding whether to refinance.

Ready to start your homebuying journey? Get pre-approved for a mortgage with Get Home Loan 2024 and take the first step towards homeownership.

Consulting with a mortgage lender can help you determine the best refinance option for your circumstances.

USDA Mortgage Resources: Usda Mortgage Rates 2024

Several resources are available to provide information and assistance regarding USDA loans. These resources can help you navigate the application process, understand the program’s requirements, and find a lender that offers USDA mortgages.

Reputable Websites and Organizations

- USDA Rural Development:The official website of the USDA Rural Development program provides comprehensive information about USDA loans, including eligibility requirements, program guidelines, and loan application procedures. (https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-direct-loans-and-loan-guarantees)

- National Rural Housing Coalition:This non-profit organization advocates for affordable housing in rural communities and provides resources and information about USDA loans. (https://www.ruralhousingcoalition.org/)

- Housing Counseling Agencies:Local housing counseling agencies can offer guidance and support throughout the USDA loan process. You can find a housing counseling agency in your area through the HUD website. (https://www.hud.gov/states/find_an_agency)

USDA Loan Providers and Counselors

You can find a list of lenders that participate in the USDA loan program on the USDA Rural Development website. It’s advisable to contact multiple lenders to compare rates, fees, and loan terms.

Thinking about a reverse mortgage? Find out about Reverse Mortgage Rates 2024 and explore if this option is right for you.

USDA loan counselors can provide personalized guidance and support throughout the loan application process. You can find a USDA loan counselor through the USDA Rural Development website or through local housing counseling agencies.

Frequently Asked Questions

- What is the maximum loan amount for a USDA mortgage?The maximum loan amount varies based on location and can be found on the USDA Rural Development website.

- What is the minimum credit score required for a USDA loan?While the minimum credit score requirement can vary, a score of at least 640 is generally recommended for better loan terms.

- How long does it take to get approved for a USDA loan?The approval process can take anywhere from 30 to 60 days, depending on the lender, the property, and the borrower’s financial situation.

- Can I refinance my USDA mortgage?Yes, you can refinance your USDA mortgage to lower your interest rate, shorten your loan term, or access cash for other needs.

- What are the closing costs for a USDA mortgage?USDA loans generally have lower closing costs compared to other mortgage types. However, closing costs can vary depending on the lender and the property.

If you have additional questions about USDA mortgages, contact a lender or a housing counseling agency for personalized assistance.

Ending Remarks

Navigating the world of USDA mortgage rates in 2024 can be complex, but with the right information and guidance, securing affordable financing for your dream home is achievable. Remember to carefully evaluate your eligibility, compare rates from reputable lenders, and explore available resources to make informed decisions.

By taking these steps, you can unlock the potential of the USDA loan program and pave the way for a brighter financial future.

FAQ Corner

What is the maximum income limit for a USDA loan?

Income limits vary by location. You can find the specific limits for your area on the USDA website.

What are the credit score requirements for a USDA loan?

While there’s no official minimum credit score, most lenders prefer a score of at least 640 for USDA loans. However, some lenders may consider borrowers with lower scores.

What are the closing costs associated with a USDA loan?

Closing costs can vary depending on your location and lender. They typically include appraisal fees, origination fees, and title insurance.