Union Bank Home Loan Interest Rate 2024: Navigating the current market can feel overwhelming, especially when searching for the best financing options for your dream home. Union Bank stands out as a prominent player in the mortgage landscape, offering a diverse range of loan products designed to cater to various needs and financial situations.

Finding the best mortgage in 2024 requires careful research and comparison. Consider your individual needs and financial situation when making your decision.

Understanding the intricacies of Union Bank’s home loan offerings, including their current interest rates, eligibility requirements, and loan features, is crucial for making informed decisions. This comprehensive guide aims to provide you with all the necessary information to navigate the process with confidence and secure the best possible financing solution.

Finding the best mortgage rates in 2024 can feel overwhelming, but it doesn’t have to be. Start by comparing rates from different lenders and considering factors like your credit score and loan term.

Contents List

- 1 Union Bank Home Loans: A Comprehensive Guide to Rates, Eligibility, and Features in 2024

- 1.1 Union Bank Home Loan Overview

- 1.2 Current Interest Rates

- 1.3 Loan Eligibility and Requirements, Union Bank Home Loan Interest Rate 2024

- 1.4 Loan Features and Benefits

- 1.5 Loan Application Process

- 1.6 Customer Reviews and Testimonials

- 1.7 Comparison with Other Lenders

- 1.8 Tips for Obtaining the Best Rate

- 2 Epilogue

- 3 FAQ Compilation: Union Bank Home Loan Interest Rate 2024

Union Bank Home Loans: A Comprehensive Guide to Rates, Eligibility, and Features in 2024

Navigating the home buying process can be overwhelming, especially when it comes to securing a mortgage. Union Bank, a well-established financial institution, offers a range of home loan options to cater to diverse borrower needs. This guide provides a comprehensive overview of Union Bank’s home loan offerings, including current interest rates, eligibility requirements, loan features, and the application process.

Freddie Mac is a government-sponsored enterprise that plays a significant role in the mortgage market. Freddie Mac mortgage rates can be a good benchmark to compare against rates from other lenders.

We’ll also delve into customer reviews and compare Union Bank’s offerings with other major lenders to help you make an informed decision.

An adjustable rate mortgage (ARM) can be a good option for those who plan to sell their home in the near future or who are comfortable with the potential for higher interest rates down the line.

Union Bank Home Loan Overview

Union Bank is a reputable financial institution with a long history of providing banking and lending services. The bank’s home loan offerings are designed to assist individuals and families in achieving their homeownership goals. Union Bank targets a wide range of borrowers, including first-time homebuyers, those looking to refinance existing mortgages, and individuals seeking to purchase investment properties.

Looking to get a mortgage in 2024? Sofi Mortgage might be a good option for you. They offer a range of loan products and services, including conventional mortgages, FHA loans, and VA loans.

Union Bank offers a variety of home loan options to suit different financial situations and preferences. These include:

- Fixed-rate mortgages:These loans offer a fixed interest rate for the entire loan term, providing predictable monthly payments. Fixed-rate mortgages are a popular choice for borrowers seeking stability and certainty.

- Adjustable-rate mortgages (ARMs):ARMs have an initial fixed interest rate that adjusts periodically based on market conditions. ARMs can offer lower initial rates compared to fixed-rate mortgages, but they come with the risk of higher payments in the future.

- FHA loans:The Federal Housing Administration (FHA) insures these loans, making them accessible to borrowers with lower credit scores and down payments. FHA loans often have more lenient eligibility requirements and offer lower interest rates compared to conventional loans.

- VA loans:The Department of Veterans Affairs (VA) guarantees these loans, making them available to eligible veterans, active-duty military personnel, and surviving spouses. VA loans typically have no down payment requirement and offer competitive interest rates.

Current Interest Rates

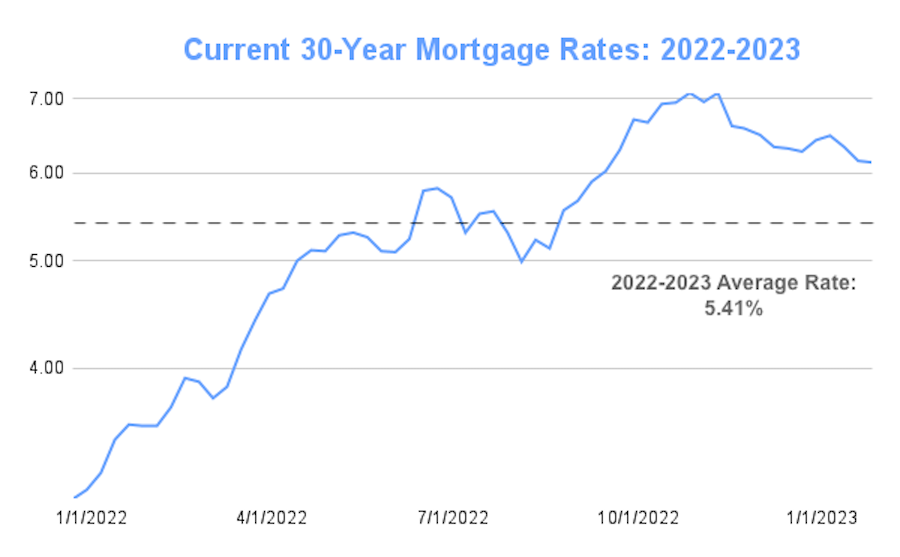

Union Bank’s current interest rates for home loans vary depending on the loan type, term, and borrower’s creditworthiness. It’s essential to check with Union Bank directly for the most up-to-date rates. Here’s a general overview of current interest rates:

- Fixed-rate mortgages:Rates for 30-year fixed-rate mortgages typically range from 4.5% to 6.5%, while 15-year fixed-rate mortgages may have rates between 4.0% and 5.5%.

- Adjustable-rate mortgages (ARMs):Initial rates for ARMs are generally lower than fixed-rate mortgages, but they can fluctuate over time. Current rates for 5/1 ARMs (fixed for five years, then adjust annually) might be around 4.0% to 5.0%.

- FHA loans:Interest rates for FHA loans are typically lower than conventional loans due to the government insurance. Current rates for 30-year FHA loans might be around 4.0% to 5.5%.

- VA loans:VA loans offer competitive interest rates for eligible borrowers. Current rates for 30-year VA loans may be around 4.0% to 5.0%.

Several factors influence Union Bank’s interest rates, including:

- Market conditions:Interest rates are influenced by broader economic factors, such as inflation, unemployment, and the Federal Reserve’s monetary policy.

- Borrower’s credit score:Individuals with higher credit scores generally qualify for lower interest rates.

- Loan amount and term:Larger loan amounts and longer terms may result in higher interest rates.

- Down payment:A larger down payment can lower the interest rate.

Comparing Union Bank’s current interest rates to those of other major lenders is crucial to finding the best deal. It’s advisable to shop around and compare rates from multiple lenders before making a decision.

If you’re over 62 and looking for ways to access your home equity, a reverse mortgage might be a good option. This type of loan allows you to borrow against your home’s value, with no monthly payments required.

Loan Eligibility and Requirements, Union Bank Home Loan Interest Rate 2024

To qualify for a Union Bank home loan, borrowers must meet certain eligibility criteria. These typically include:

- Credit score:The required credit score varies depending on the loan type. For conventional loans, a credit score of 620 or higher is generally required, while FHA loans may have a minimum credit score of 580. VA loans have no minimum credit score requirement, but a good credit history is still essential.

- Debt-to-income ratio (DTI):This ratio represents the percentage of your monthly income that goes towards debt payments. Lenders typically prefer a DTI of 43% or lower.

- Income verification:You’ll need to provide proof of income, such as pay stubs or tax returns.

- Down payment:The required down payment varies depending on the loan type. Conventional loans usually require a minimum down payment of 3% to 20%, while FHA loans may require as little as 3.5% and VA loans typically have no down payment requirement.

Keep an eye on residential mortgage rates in 2024. They can fluctuate based on economic conditions and Federal Reserve policies.

- Employment history:Lenders generally require a stable employment history, typically two years or more.

When applying for a Union Bank home loan, you’ll need to provide the following documentation:

- Proof of identity:This may include a driver’s license, passport, or social security card.

- Proof of income:This may include pay stubs, tax returns, or bank statements.

- Credit report:You’ll need to provide a copy of your credit report from all three major credit bureaus.

- Asset statements:This includes information about your savings, investments, and other assets.

- Property information:This may include a purchase agreement, appraisal, or property tax information.

Loan Features and Benefits

Union Bank’s home loans offer a range of features and benefits designed to make the home buying process smoother and more affordable. Some key features include:

- Competitive interest rates:Union Bank strives to offer competitive interest rates to its borrowers.

- Flexible loan terms:You can choose a loan term that suits your financial situation, ranging from 15 to 30 years.

- Various down payment options:Union Bank offers different down payment options, including low down payment programs for eligible borrowers.

- Closing cost assistance:Union Bank may offer assistance with closing costs, which can help reduce upfront expenses.

- First-time homebuyer programs:Union Bank may offer programs specifically designed to assist first-time homebuyers, such as down payment assistance or counseling services.

Choosing a Union Bank home loan offers several advantages, including:

- Reputation and stability:Union Bank is a well-established financial institution with a solid reputation for reliability and financial strength.

- Personalized service:Union Bank offers personalized service, with dedicated loan officers who can guide you through the process.

- Variety of loan options:Union Bank offers a wide range of loan options to suit different needs and financial situations.

- Convenience:Union Bank provides a convenient application process, with online tools and resources available.

Loan Application Process

The application process for a Union Bank home loan is straightforward and involves the following steps:

- Pre-approval:Get pre-approved for a loan to determine your borrowing capacity and provide a competitive offer when purchasing a home.

- Loan application:Submit a complete loan application with all required documentation.

- Credit and income verification:Union Bank will verify your credit history and income.

- Property appraisal:A professional appraiser will assess the value of the property you’re purchasing.

- Loan approval:Once all documents are reviewed and approved, Union Bank will issue a loan approval.

- Closing:The final step involves signing the loan documents and transferring ownership of the property.

The loan approval process typically takes several weeks, depending on the complexity of the application and the availability of required documentation. A mortgage broker or loan officer can guide you through the process and answer any questions you may have.

One of the biggest banks in the country, Chase also offers mortgage services. Chase Home Mortgage is a good option for those who prefer the convenience of working with a well-established institution.

Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into Union Bank’s home loan services. Many customers have praised Union Bank for its competitive rates, personalized service, and smooth application process. Positive reviews often highlight the bank’s commitment to transparency and communication throughout the loan process.

To get a good sense of the current mortgage market, it’s helpful to check out current home loan rates from different lenders.

Some customers have expressed satisfaction with the bank’s responsiveness to inquiries and its ability to address concerns promptly.

New Rez Mortgage is another lender to consider when searching for a mortgage. New Rez Mortgage specializes in FHA, VA, and USDA loans, offering competitive rates and flexible terms.

While Union Bank generally receives positive feedback, there may be instances where customers have experienced delays or challenges during the application process. It’s essential to consider both positive and negative reviews to gain a comprehensive understanding of the bank’s services.

Ready to take the plunge and apply for a mortgage in 2024? Make sure to gather all the necessary documents and shop around for the best rates.

You can find customer reviews on websites like Trustpilot, Yelp, and the Better Business Bureau.

Comparison with Other Lenders

Comparing Union Bank’s home loan offerings to those of other major lenders is essential to finding the best deal. While Union Bank strives to offer competitive rates and features, other lenders may have different strengths and weaknesses. Consider factors like interest rates, loan terms, down payment options, closing costs, and customer service when comparing lenders.

Want to pay off your mortgage faster? Consider a 15-year mortgage. While you’ll have a higher monthly payment, you’ll pay significantly less in interest over the life of the loan.

Here’s a table summarizing the pros and cons of choosing Union Bank over other lenders:

| Feature | Union Bank | Other Lenders |

|---|---|---|

| Interest rates | Competitive rates, but may not always be the lowest | May offer lower rates in some cases |

| Loan terms | Flexible loan terms, including 15- and 30-year options | Similar loan term options available |

| Down payment options | Various down payment options, including low down payment programs | Similar down payment options available |

| Closing costs | May offer assistance with closing costs | May offer similar or different closing cost assistance |

| Customer service | Personalized service with dedicated loan officers | May offer different levels of customer service |

Ultimately, the best lender for you depends on your individual needs and preferences. It’s recommended to shop around and compare offerings from multiple lenders before making a decision.

When researching mortgages, it’s helpful to compare options from different lenders. Five mortgages to consider include SoFi, Better, Rocket Mortgage, Chase, and Freddie Mac.

Tips for Obtaining the Best Rate

To secure the best possible interest rate on a Union Bank home loan, consider these tips:

- Improve your credit score:A higher credit score typically leads to lower interest rates. Pay your bills on time, keep your credit utilization low, and avoid opening new credit accounts unnecessarily.

- Increase your down payment:A larger down payment can reduce your loan amount and potentially lower your interest rate.

- Shop around for rates:Compare interest rates from multiple lenders to find the best deal. Don’t hesitate to negotiate with Union Bank for a lower rate.

- Consider a shorter loan term:A shorter loan term, such as a 15-year mortgage, generally comes with a lower interest rate. However, your monthly payments will be higher.

- Explore loan programs:Union Bank may offer programs specifically designed to help borrowers with lower credit scores or limited down payments. Inquire about these programs to see if you qualify.

By taking these steps, you can increase your chances of securing a favorable interest rate on your Union Bank home loan.

If you’re looking to buy a home in a rural area, a USDA home loan could be a great option. These loans offer low interest rates and no down payment requirements, making homeownership more accessible.

Epilogue

In conclusion, Union Bank presents a compelling option for homebuyers seeking competitive interest rates, flexible loan terms, and personalized customer service. By carefully considering your individual financial circumstances, exploring the available loan options, and utilizing the tips provided, you can confidently embark on your homeownership journey with Union Bank as your trusted financial partner.

FAQ Compilation: Union Bank Home Loan Interest Rate 2024

What is the current interest rate for a 30-year fixed-rate mortgage with Union Bank?

The current interest rate for a 30-year fixed-rate mortgage with Union Bank varies depending on your credit score, loan amount, and other factors. It’s best to contact Union Bank directly for a personalized rate quote.

Need to tap into your home equity? Rocket Mortgage’s HELOC offers flexible financing options for homeowners.

Does Union Bank offer any first-time homebuyer programs?

Yes, Union Bank offers several programs designed to assist first-time homebuyers, including down payment assistance and closing cost assistance. It’s recommended to inquire about these programs during your initial consultation with a loan officer.

What is the minimum credit score required for a Union Bank home loan?

The minimum credit score required for a Union Bank home loan varies depending on the loan type. Generally, a credit score of 620 or higher is considered good for most loan options. However, it’s best to contact Union Bank directly to discuss specific requirements for your desired loan product.

How long does it take to get approved for a Union Bank home loan?

The loan approval process typically takes 30-45 days, but it can vary depending on the complexity of your application and the availability of required documentation.