Google Tasks 2024: The Future of Task Management sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Google Tasks, the simple yet powerful task manager, has evolved significantly since its inception, and 2024 promises to be a year of groundbreaking advancements.

Subway Surfers is a popular mobile game, and GameGuardian 2024 can help you achieve greatness. Explore how GameGuardian 2024 can be used for Subway Surfers and become the ultimate runner.

With the rise of artificial intelligence, automation, and a growing emphasis on seamless collaboration, Google Tasks is poised to become a central hub for managing both personal and professional responsibilities.

This exploration delves into the current state of Google Tasks, examining its strengths and weaknesses in comparison to other popular task management tools. We’ll explore the emerging trends that are shaping the future of task management, including the integration of AI, automation, and mobile-first design.

Snapdragon processors are known for their performance, and now they’re available in budget phones. Learn about Snapdragon 2024 for budget phones and experience powerful performance without breaking the bank.

Finally, we’ll speculate on the potential features and enhancements that Google might introduce to Tasks in 2024, considering its impact on user productivity and collaboration.

Glovo offers fantastic deals and discounts for its customers. Discover the best deals and discounts offered by Glovo and save money on your next delivery.

Contents List

- 1 Google Tasks 2024: The Future of Task Management

- 1.1 Google Tasks: Evolution and Current State, Google Tasks 2024: The Future of Task Management

- 1.2 Future Trends in Task Management

- 1.3 Google Tasks 2024: Anticipated Features and Enhancements

- 1.4 Impact of Google Tasks 2024 on Productivity and Collaboration

- 1.5 Google Tasks 2024: Potential Challenges and Opportunities

- 2 Final Thoughts

- 3 Essential Questionnaire

Google Tasks 2024: The Future of Task Management

In the ever-evolving landscape of productivity tools, Google Tasks has emerged as a popular and accessible option for managing daily tasks. This article explores the evolution and current state of Google Tasks, examines the future trends shaping task management, and speculates on the potential features and enhancements that Google might introduce in 2024.

We will also analyze the impact of these anticipated changes on user productivity, collaboration, and the overall role of Google Tasks in the task management market.

If you’re looking to enhance your gaming experience, GameGuardian 2024 is a powerful tool for Android devices. Learn how to use GameGuardian 2024 for Android and unlock its potential to modify game values and gain an edge.

Google Tasks: Evolution and Current State, Google Tasks 2024: The Future of Task Management

Google Tasks has come a long way since its initial release as a simple to-do list manager. It has undergone several updates and enhancements, evolving into a more robust and integrated task management tool.

Foldable phones are becoming increasingly popular, and Android Authority has you covered with their reviews. Check out Android Authority’s 2024 foldable phone reviews to find the perfect device for your needs.

- Early Versions:Google Tasks was initially launched as a basic to-do list manager, integrated with Gmail. Users could create lists, add tasks, and mark them as complete.

- Integration with Google Calendar:A significant update integrated Google Tasks with Google Calendar, allowing users to view their tasks alongside their calendar events. This improved the overall task management experience by providing a more comprehensive view of their schedule and commitments.

- Cross-Platform Availability:Google Tasks is now available across multiple platforms, including web browsers, Android, and iOS devices. This cross-platform availability makes it accessible to a wider audience and ensures a seamless experience across different devices.

- Collaboration Features:Google Tasks has introduced limited collaboration features, allowing users to share lists with others. This enables basic teamwork but lacks the advanced collaboration features found in other task management tools.

While Google Tasks has evolved significantly, it still faces certain limitations. In 2024, it lacks advanced features such as:

- Project Management Capabilities:Google Tasks lacks robust project management capabilities, making it unsuitable for managing complex projects with multiple tasks, dependencies, and deadlines.

- Advanced Task Prioritization:While Google Tasks allows users to mark tasks as important, it lacks sophisticated task prioritization algorithms that can automatically rank tasks based on their urgency, importance, and dependencies.

- Real-Time Collaboration Tools:Google Tasks’ collaboration features are limited to sharing lists. It lacks real-time collaboration tools, such as shared task views, comments, and notifications, which are essential for effective teamwork.

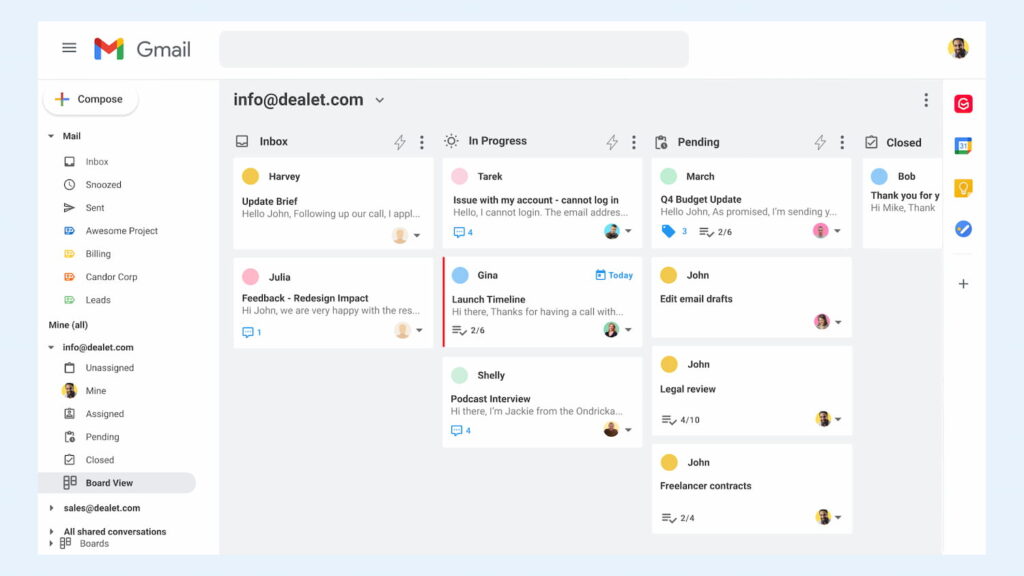

When compared to other popular task management tools, Google Tasks stands out for its simplicity and accessibility. It is a good choice for individuals who need a basic to-do list manager that integrates seamlessly with other Google services. However, it falls short in terms of advanced features and capabilities compared to dedicated task management solutions like Asana, Trello, and Monday.com.

Future Trends in Task Management

The task management landscape is rapidly evolving, driven by emerging trends that are transforming how individuals and teams manage their work. These trends include:

- AI Integration:Artificial intelligence (AI) is playing an increasingly important role in task management. AI-powered tools can automate repetitive tasks, suggest priorities, and provide insights based on user behavior and data.

- Automation:Task automation is becoming more prevalent, allowing users to automate repetitive tasks and workflows. This frees up time for more strategic and creative work.

- Collaboration Features:Collaboration is becoming increasingly important in task management. Tools are emerging with advanced features that enable real-time collaboration, shared task views, and communication channels.

These trends are expected to have a significant impact on the future of Google Tasks. Google is likely to integrate AI-powered features, automation capabilities, and enhanced collaboration tools to remain competitive in the evolving task management market.

Pushbullet lets you seamlessly send notifications from your computer to your phone. Learn how to use Pushbullet to send notifications from your computer to your phone and stay connected across devices.

Mobile-first design and cross-platform compatibility are also crucial in today’s task management landscape. Users expect to access their tasks from any device, at any time. Google Tasks is already available on multiple platforms, but further improvements in mobile design and cross-platform functionality are expected in the future.

Want the best camera phone on the market? Android Authority has compiled a list of the top contenders. Check out Android Authority’s 2024 top camera phone picks and find the perfect device for capturing stunning photos and videos.

Google Tasks 2024: Anticipated Features and Enhancements

Based on current trends and Google’s history of innovation, it is reasonable to speculate on the potential features and enhancements that Google might introduce to Tasks in 2024.

Android 14 is packed with exciting new features and updates. Read Android Authority’s insights on Android 14 features and updates and see what’s in store for your Android device.

- Enhanced Task Prioritization:Google could introduce more sophisticated task prioritization algorithms that consider factors like deadlines, dependencies, and user preferences. This would help users focus on the most important tasks and manage their time more effectively.

- Project Management Capabilities:Google might expand Google Tasks’ capabilities to include project management features. This could involve adding subtasks, dependencies, and milestones, enabling users to manage complex projects within the platform.

- Real-Time Collaboration Tools:Google could introduce real-time collaboration tools, such as shared task views, comments, and notifications. This would enable teams to work together more effectively on shared tasks.

- Integration with Other Google Services:Google Tasks could become more tightly integrated with other Google services, such as Google Calendar, Drive, and Gmail. This would provide a more seamless and integrated experience for users.

These anticipated features could significantly enhance the functionality and usability of Google Tasks, making it a more powerful and versatile task management tool.

You don’t need root access to use GameGuardian 2024! Learn how to use GameGuardian 2024 without root access and enjoy its benefits without compromising your device’s security.

Impact of Google Tasks 2024 on Productivity and Collaboration

The anticipated features and enhancements in Google Tasks 2024 could have a positive impact on user productivity and collaboration.

GameGuardian 2024 is a popular choice for Roblox players looking to enhance their gameplay. Discover how GameGuardian 2024 can be used for Roblox and unlock new possibilities in the virtual world.

- Improved Task Organization:Advanced task prioritization algorithms and project management capabilities could help users organize their tasks more effectively, improving overall productivity.

- Enhanced Time Management:AI-powered insights and automation features could help users manage their time more effectively, allowing them to focus on high-priority tasks.

- Improved Teamwork:Real-time collaboration tools and seamless integration with other Google services could improve teamwork by facilitating communication, shared task views, and efficient task delegation.

By improving task organization, time management, and teamwork, Google Tasks 2024 could become a more central hub for managing personal and professional tasks.

Clash of Clans players often turn to GameGuardian 2024 to gain an edge. Discover how GameGuardian 2024 can be used for Clash of Clans and dominate the battlefield.

Google Tasks 2024: Potential Challenges and Opportunities

While Google Tasks 2024 has the potential to become a more powerful and versatile task management tool, it also faces certain challenges and opportunities.

Google Tasks is more than just a simple to-do list app. Learn how to use Google Tasks effectively for productivity with this comprehensive guide.

- Competition:Google Tasks faces stiff competition from established task management solutions like Asana, Trello, and Monday.com. Google will need to differentiate its product and offer compelling features to attract and retain users.

- User Adoption:Google Tasks already has a large user base, but it needs to expand its reach and attract new users to become a more dominant player in the task management market.

- Catering to Specific User Segments:Google Tasks could focus on catering to specific user segments, such as students, professionals, or teams. This could involve developing features and functionalities that are tailored to the needs of these specific user groups.

By addressing these challenges and capitalizing on the opportunities, Google Tasks 2024 has the potential to become a more prominent and impactful task management tool, helping users stay organized, manage their time effectively, and collaborate more efficiently.

Pushbullet is a great tool for cross-platform communication, but there are alternatives available. Explore the best Pushbullet alternatives for cross-platform communication and find the perfect solution for your needs.

Final Thoughts

As we look towards 2024, Google Tasks is positioned to play a pivotal role in how we manage our tasks and collaborate with others. The potential for AI-powered features, seamless integration with other Google services, and enhanced collaboration tools promises to revolutionize the way we approach task management.

Whether you’re a student, a professional, or part of a team, Google Tasks is poised to become a more central hub for organizing your life and getting things done.

Glovo, the popular delivery app, is expanding rapidly. Explore Glovo’s future plans and expansion strategy to see how they’re shaping the delivery landscape.

Essential Questionnaire

Will Google Tasks be completely free in 2024?

Google Tasks is currently free for all users with a Google account, and it’s likely to remain free in 2024. However, there might be premium features or add-ons offered for a subscription fee.

How will Google Tasks integrate with other Google services in 2024?

Expect deeper integration with Google Calendar, Drive, and Gmail. This could include automatic task creation from emails, seamless scheduling of tasks, and improved file sharing capabilities.

Will Google Tasks be available for all platforms in 2024?

Google Tasks is a fantastic tool for staying organized, but did you know there are hidden tricks to maximize its efficiency? Discover tips and tricks for using Google Tasks and take your productivity to the next level.

Google Tasks is currently available on web, Android, and iOS. In 2024, we can expect continued support for these platforms and possibly even expansion to other platforms like desktop operating systems.