How to use a tax calculator for October 2024 can be a daunting task, but it doesn’t have to be. Tax calculators are valuable tools that can help you understand your tax obligations and make informed financial decisions. With the right calculator, you can easily estimate your tax liability, identify potential deductions and credits, and even plan for future tax years.

This guide will walk you through the process of choosing, using, and maximizing the benefits of a tax calculator, ensuring you’re prepared for the October 2024 tax season.

Contents List

Using a Tax Calculator Effectively: How To Use A Tax Calculator For October 2024

Tax calculators are powerful tools that can help you estimate your tax liability, identify potential deductions and credits, and make informed financial decisions. However, to get accurate results, you need to input your data correctly. This section will guide you through the process of using a tax calculator effectively.

When filing taxes as a married couple filing separately, it’s important to be aware of the specific deductions available. The standard deduction for married filing separately in 2024 can impact your overall tax liability, so understanding its implications is crucial.

Inputting Data Accurately

To ensure accurate results, it’s crucial to input your personal information, income, deductions, and credits correctly.

Retirement planning is essential, and knowing the IRA contribution limits for 2024 and 2025 can help you maximize your savings. These limits can vary depending on your age and other factors, so it’s essential to stay informed.

- Personal Information:Provide your name, Social Security number, filing status (single, married filing jointly, etc.), and any dependents.

- Income:Enter all sources of income, including wages, salaries, tips, interest, dividends, and self-employment income. Be sure to include any income from investments, rental properties, or other sources.

- Deductions:Tax calculators allow you to input various deductions, such as standard deduction, itemized deductions, and above-the-line deductions.

- Standard Deduction:This is a fixed amount that you can claim instead of itemizing your deductions. The amount varies based on your filing status.

The standard deduction is a valuable tax benefit, and it’s important to understand how it applies to your specific situation. The standard deduction for qualifying widow(er) in 2024 may be different from other filing statuses, so it’s crucial to review the relevant guidelines.

- Itemized Deductions:These are specific expenses that you can deduct from your taxable income. Common itemized deductions include mortgage interest, property taxes, charitable contributions, medical expenses, and state and local taxes.

- Above-the-Line Deductions:These are deductions that are taken before calculating your adjusted gross income (AGI). Common above-the-line deductions include contributions to traditional IRAs, student loan interest, and certain business expenses.

- Standard Deduction:This is a fixed amount that you can claim instead of itemizing your deductions. The amount varies based on your filing status.

- Credits:Tax credits directly reduce your tax liability. Common tax credits include the Earned Income Tax Credit (EITC), the Child Tax Credit, and the American Opportunity Tax Credit.

Interpreting Results, How to use a tax calculator for October 2024

Once you’ve inputted your data, the tax calculator will generate results that include:

- Estimated Tax Liability:This is the amount of tax you owe based on your income, deductions, and credits.

- Refund or Payment:If your withholdings exceed your tax liability, you will receive a refund. If your withholdings are less than your tax liability, you will need to make a payment.

Maximizing Tax Deductions and Credits

Tax calculators can help you identify potential deductions and credits that you may not be aware of. By exploring different scenarios and inputting various deductions and credits, you can maximize your tax savings.

As a freelancer, it’s crucial to stay up-to-date with tax regulations. The W9 Form for October 2024 is a vital document that helps determine your tax obligations. Understanding the requirements for this form can help you avoid potential penalties and ensure smooth tax filing.

- Consider Itemizing:If you have significant medical expenses, charitable contributions, or other deductible expenses, it may be beneficial to itemize your deductions instead of taking the standard deduction.

- Explore Tax Credits:Tax credits can significantly reduce your tax liability. Research available credits that you may qualify for, such as the Earned Income Tax Credit, the Child Tax Credit, or the American Opportunity Tax Credit.

Conclusive Thoughts

Navigating the complexities of taxes can be overwhelming, but utilizing a tax calculator can simplify the process. By understanding your options, choosing the right tool, and using it effectively, you can confidently navigate the tax landscape and ensure a smooth tax filing experience.

Remember, tax calculators are powerful resources, and with a little guidance, you can leverage them to your advantage.

FAQ Compilation

What is the difference between a free and paid tax calculator?

Free tax calculators offer basic features and may have limitations on the number of calculations you can perform. Paid tax calculators typically provide more comprehensive features, including advanced deductions and credits, detailed reporting, and personalized advice.

Is it safe to use an online tax calculator?

Reputable online tax calculators use encryption and other security measures to protect your personal information. However, it’s essential to choose a calculator from a trusted source and ensure it has a strong privacy policy.

How often should I use a tax calculator?

It’s recommended to use a tax calculator at least once a year before filing your taxes. You can also use it throughout the year to track your income, expenses, and tax liability.

For those who use their vehicles for work, understanding the IRS mileage rate for October 2024 is essential for accurate tax deductions. This rate can fluctuate throughout the year, so staying informed is crucial for maximizing your tax benefits.

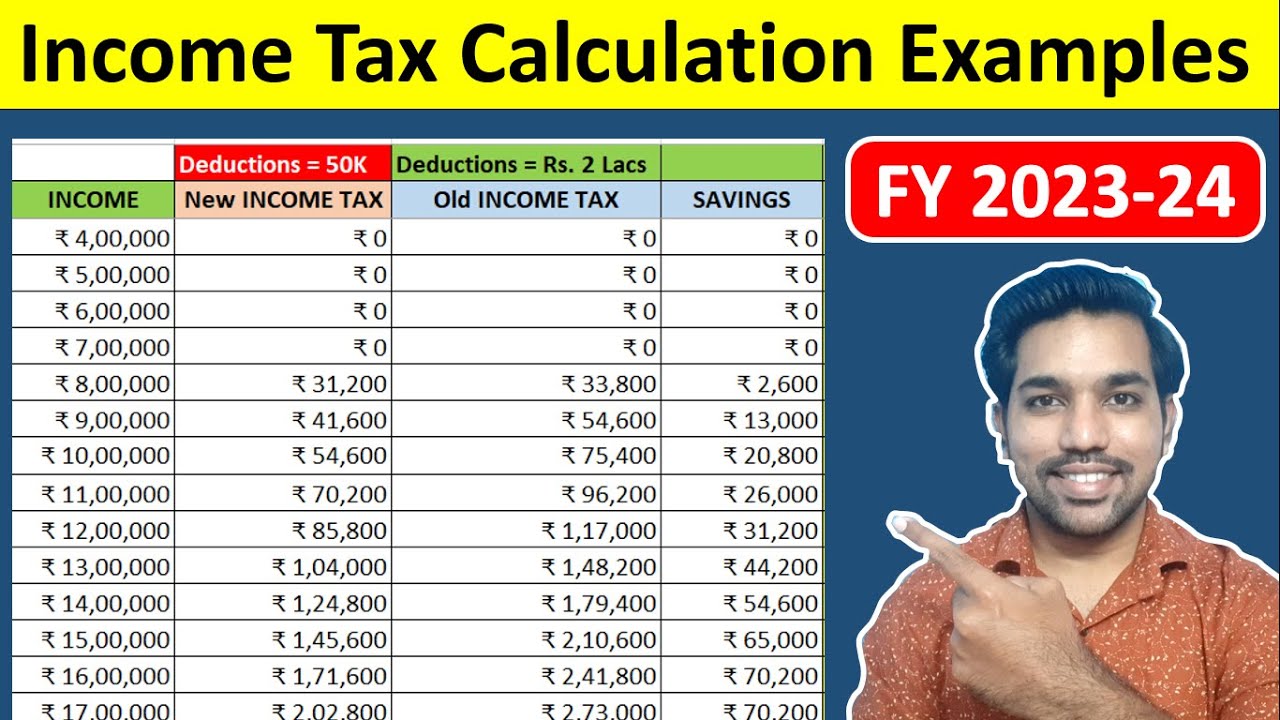

Tax brackets determine the percentage of your income that’s taxed at different rates. Knowing the highest tax bracket in 2024 can help you understand the potential tax implications of your income.

Similar to freelancers, independent contractors also need to complete the W9 Form for October 2024. This form provides essential information for your clients to accurately report your income for tax purposes.

The tax bracket thresholds for 2024 are crucial for understanding how your income is taxed. Referencing the tax bracket thresholds for 2024 can help you determine the tax rate that applies to your income level.

For those with a 401(k), it’s a common question whether you can also contribute to an IRA. The answer is yes, you can contribute to an IRA even if you have a 401(k). The ability to contribute to an IRA depends on your income level and other factors.

Understanding how tax brackets affect your income is essential for financial planning. The tax brackets for 2024 can influence your overall tax liability and impact your take-home pay.

It’s essential to know the tax rates that apply to each income bracket. The tax rates for each tax bracket in 2024 will determine the percentage of your income that is taxed at different levels.

IRA contribution limits can vary depending on your age. The IRA contribution limits for 2024 by age are set to help individuals maximize their retirement savings based on their age and income.

Knowing the maximum IRA contribution for 2024 can help you plan your retirement savings strategy. This limit can change annually, so it’s crucial to stay informed.

Tax changes can impact important deadlines. It’s important to be aware of any tax changes impacting the October 2024 deadline to ensure you meet all filing requirements.

Failing to comply with W9 Form requirements can result in penalties. The W9 Form October 2024 penalties for non-compliance can be significant, so it’s essential to ensure you complete the form accurately and submit it on time.