Tax Calculator for Freelancers in October 2024: Your Guide to Filing – navigating the world of freelance taxes can be a daunting task, especially with ever-changing regulations. This guide aims to simplify the process, offering valuable insights into understanding your tax obligations and utilizing helpful tools to ensure accurate and timely filing.

Freelancing offers a unique path to financial independence, but it also comes with specific tax responsibilities. Understanding these responsibilities is crucial for maximizing your earnings and avoiding potential penalties. A tax calculator designed for freelancers can be a valuable tool, providing real-time estimates of your tax liability based on your income and expenses.

This information allows you to plan effectively, adjust your financial strategies, and ensure you’re prepared for tax season.

Contents List

Key Tax Considerations for Freelancers

As a freelancer, understanding your tax obligations is crucial for financial success. This section explores key tax considerations for freelancers, including common deductions, income and expense tracking, and estimated taxes.

Common Tax Deductions for Freelancers

Freelancers can deduct various business expenses to reduce their taxable income. These deductions can significantly impact your tax liability.

- Business Expenses:This category includes expenses directly related to your freelance work, such as office supplies, software, professional subscriptions, and marketing costs. For example, if you are a graphic designer, you can deduct the cost of design software, printing costs for client presentations, and marketing expenses incurred to attract new clients.

The tax deadline for October 2024 is an important date to remember. Understanding what is the tax deadline for October 2024 ensures you’re prepared to file your taxes on time and avoid potential penalties.

- Home Office Deduction:If you use a portion of your home exclusively for your freelance business, you can deduct a portion of your home expenses, including rent, mortgage interest, utilities, and insurance. This deduction is calculated based on the percentage of your home used for business purposes.

- Health Insurance Premiums:If you are self-employed, you can deduct the cost of health insurance premiums for yourself and your dependents. This deduction can be claimed even if you are eligible for coverage through a spouse’s employer.

Tracking Income and Expenses

Accurate record-keeping is essential for freelancers. Tracking your income and expenses throughout the year allows you to accurately calculate your tax liability and claim all eligible deductions.

IRA contribution limits are an important aspect of retirement planning. Familiarizing yourself with the IRA limits for October 2024 allows you to make informed decisions about your savings strategy.

It is recommended to maintain detailed records, including receipts, invoices, bank statements, and other relevant documents. This helps you avoid penalties for inaccurate reporting.

Traditional 401k plans offer valuable retirement savings opportunities. Understanding what are the 401k contribution limits for 2024 for traditional 401k helps you maximize your contributions and plan for a secure financial future.

Estimated Taxes

Freelancers are required to pay estimated taxes throughout the year, as they do not have taxes withheld from their income like traditional employees. This involves making quarterly payments to the IRS based on your projected income and tax liability.

Underpayment penalties can apply if you do not pay enough estimated taxes. These penalties are calculated based on the amount of underpayment and the length of time it remains unpaid.

Understanding Tax Forms and Deadlines

As a freelancer, you’re responsible for filing your own taxes, and understanding the relevant forms and deadlines is crucial. This section Artikels the primary tax forms you’ll likely need to file and provides a guide on completing them.

Tax Forms for Freelancers, Tax calculator for freelancers in October 2024

You’ll primarily use two tax forms as a freelancer: Schedule C and Schedule SE. * Schedule C:This form reports your business income and expenses. It helps calculate your net profit or loss from your freelance work.

Schedule SE

This form calculates your self-employment tax, which covers Social Security and Medicare contributions. You pay both the employer and employee portions of these taxes as a freelancer.

If you’re self-employed or part of a small business, you might be eligible for a SIMPLE IRA. Make sure you’re aware of the IRA contribution limits for SIMPLE IRA in 2024 to take advantage of these valuable retirement savings opportunities.

Filling Out Tax Forms

The process of filling out these forms may seem daunting, but it can be streamlined by following these steps:* Gather Your Records:Collect all your income and expense records, including invoices, receipts, bank statements, and any other documentation.

For individuals over 50, there are additional contribution limits for retirement savings. Being aware of what are the 401k limits for 2024 for over 50 allows you to maximize your retirement savings potential.

Complete Schedule C

Small business owners have unique retirement savings options. Knowing the IRA contribution limits for small business owners in 2024 allows you to take advantage of these opportunities and plan for your future.

Line 1

For partnerships, the W9 form is crucial for tax purposes. Be sure to familiarize yourself with the W9 Form October 2024 for partnerships to ensure accurate reporting and avoid potential tax issues.

Enter your total business income for the year.

Lines 4-28

Deduct your business expenses, such as supplies, travel, advertising, and professional fees.

Line 31

This line shows your net profit or loss.

Maximizing your retirement savings is a priority for many. Knowing how much can I contribute to my 401k in 2024 helps you make informed decisions about your financial future.

Complete Schedule SE

Line 1

Enter your net profit from Schedule C, line 31.

Line 4

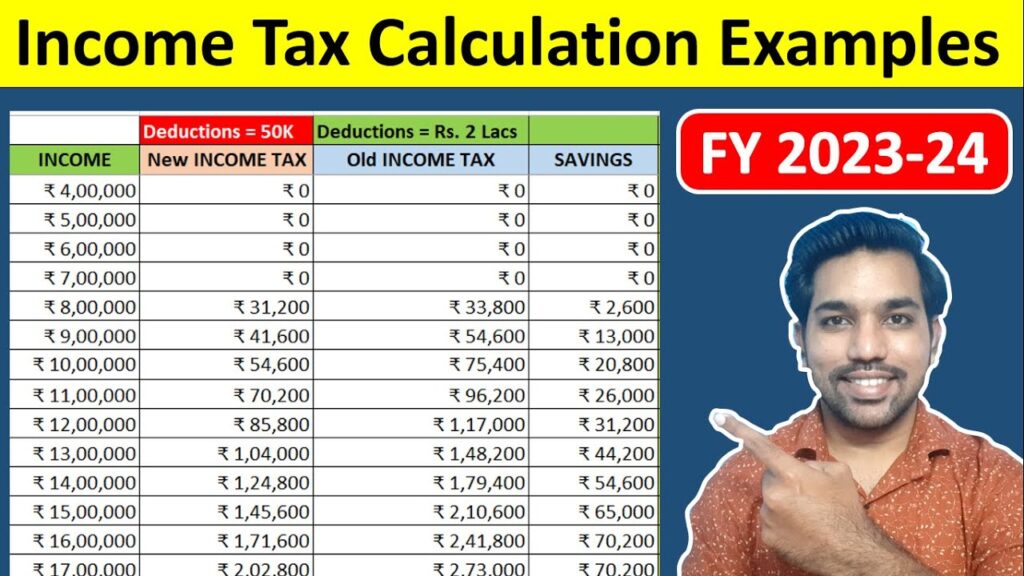

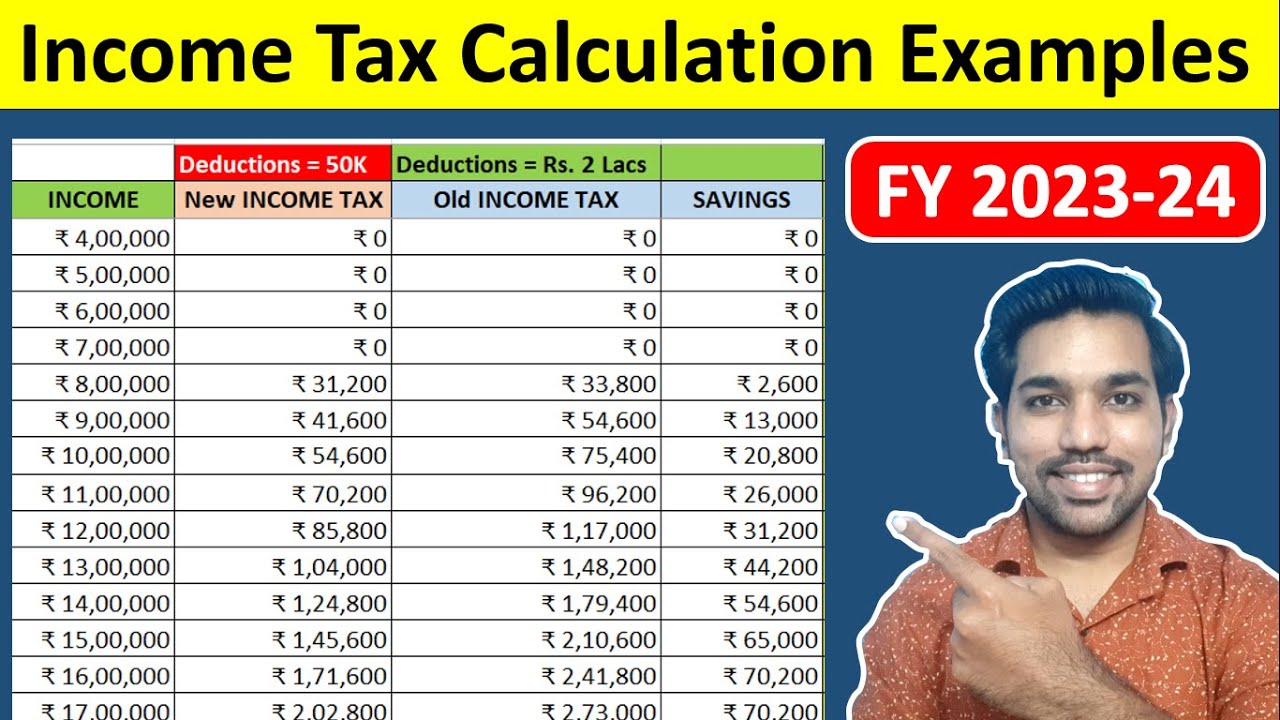

Tax brackets are a significant factor in determining your tax liability. Staying informed about what are the new tax brackets for 2024? helps you plan for your financial obligations and potentially adjust your income strategies.

Calculate your self-employment tax based on the instructions.

File Your Taxes

Use Form 1040 to report your total income and taxes. Attach Schedule C and Schedule SE to your Form 1040.

Tax Filing Deadlines

Freelancers typically have the same tax filing deadlines as other taxpayers. The standard deadline is April 15thof each year. However, if April 15th falls on a weekend or holiday, the deadline is extended to the next business day.

For example, if April 15th is a Sunday, you would have until Monday, April 16th to file your taxes.

If you’re filing taxes as married filing separately, it’s essential to understand the tax brackets for married filing separately in 2024. This knowledge helps you accurately calculate your tax liability and plan accordingly.

You may also be eligible for an extension, which would give you until October 15thto file your taxes. However, remember that an extension only gives you more time to file your taxes, not to pay them. You still need to pay your taxes by the original deadline.

Using a Tax Calculator for Freelancers

Freelancing offers flexibility and independence, but it also comes with the responsibility of managing your own taxes. A tax calculator can be a valuable tool for freelancers, helping them estimate their tax liability and make informed financial decisions throughout the year.A tax calculator designed specifically for freelancers can simplify the process of calculating your tax obligations.

It can provide a more accurate estimate of your tax liability compared to general tax calculators that may not account for all the deductions and credits available to freelancers.

Popular Tax Calculators for Freelancers

Several popular tax calculators are available online, offering various features and functionalities to cater to different needs.

Individuals with disabilities may be eligible for a higher standard deduction. Understanding the standard deduction for people with disabilities in 2024 can help you maximize your tax benefits.

- TaxAct: TaxAct is a popular online tax preparation software that offers a free tax calculator for freelancers. It allows you to enter your income and expenses to estimate your tax liability, including self-employment tax, estimated taxes, and potential deductions.

Planning for retirement? It’s important to understand the 401k contribution limits for 2024 by age to maximize your savings. These limits vary based on your age, so knowing your specific contribution range can help you strategize your financial future.

It provides detailed breakdowns of your tax calculations, making it easier to understand your tax obligations.

- TurboTax: TurboTax, another popular online tax preparation software, also offers a free tax calculator for freelancers. It provides a comprehensive overview of your potential tax liability, including estimated taxes, deductions, and credits. It also offers a helpful guide to understanding tax terminology and filing requirements.

Tax brackets can significantly impact your take-home pay, so it’s helpful to understand how will tax brackets affect my 2024 income? This knowledge allows you to plan for potential tax liabilities and adjust your financial strategies accordingly.

- H&R Block: H&R Block, a well-known tax preparation service, provides a free tax calculator specifically for freelancers. It allows you to input your income, expenses, and deductions to estimate your tax liability, including self-employment tax and potential credits. It offers a user-friendly interface and clear explanations of the calculations.

Tax deductions can significantly reduce your tax burden, so it’s crucial to know about the available tax deductions for the October 2024 deadline. This information can help you optimize your tax filing and potentially save money.

Comparison of Tax Calculator Features

Different tax calculators may offer varying features and functionalities, which can impact their suitability for your specific needs.

- Deductions and Credits: Consider whether the calculator includes a comprehensive list of deductions and credits available to freelancers, such as home office expenses, business expenses, and healthcare premiums. This can significantly impact your estimated tax liability.

- Estimated Tax Calculations: Ensure the calculator can calculate your estimated tax liability for the year. This helps you plan your tax payments and avoid penalties for underpayment.

- Tax Planning Tools: Some tax calculators offer additional features, such as tax planning tools and retirement planning calculators, which can be beneficial for freelancers. These tools can help you make informed financial decisions and optimize your tax savings.

- User Interface and Support: Evaluate the calculator’s user interface and customer support options. A user-friendly interface and responsive customer support can make the tax calculation process more efficient and less stressful.

Choosing the Right Tax Calculator

The best tax calculator for you depends on your individual needs and preferences. Consider the following factors when choosing a tax calculator:

- Ease of Use: Select a calculator with a user-friendly interface and clear instructions. It should be easy to input your information and understand the results.

- Accuracy: Choose a calculator that uses accurate formulas and calculations to ensure reliable estimates of your tax liability.

- Features: Consider the features that are most important to you, such as deduction and credit options, estimated tax calculations, and tax planning tools.

- Cost: While many free tax calculators are available, some offer premium features for a fee. Evaluate whether the additional features are worth the cost.

It’s important to remember that tax calculators are only estimations. Consult with a tax professional to ensure accurate tax planning and compliance.

Tax Tips and Strategies for Freelancers: Tax Calculator For Freelancers In October 2024

As a freelancer, understanding tax obligations and minimizing tax liability is crucial for financial success. This section explores strategies for maximizing deductions, utilizing tax credits, and navigating tax forms and deadlines effectively.

If you use your vehicle for business purposes, you can deduct mileage expenses. Staying updated on the October 2024 mileage rate for business use helps you accurately calculate your deductions and potentially save on taxes.

Maximizing Deductions

Deductions reduce your taxable income, ultimately lowering your tax bill. Freelancers have access to a variety of deductions, including:

- Home Office Deduction:If you use a dedicated space in your home for business purposes, you can deduct a portion of your home’s expenses, such as rent, utilities, and insurance.

- Business Expenses:Expenses directly related to your business activities, such as supplies, software, travel, and professional fees, are deductible.

- Depreciation:If you purchase business equipment, you can deduct a portion of its cost over time through depreciation.

- Health Insurance Premiums:If you are self-employed, you can deduct the premiums you pay for health insurance.

Utilizing Tax Credits

Tax credits directly reduce your tax liability, offering a dollar-for-dollar reduction in taxes owed. Some relevant tax credits for freelancers include:

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income individuals and families, including self-employed individuals, based on their earned income and family size.

- Retirement Savings Contributions Credit (Saver’s Credit):This credit helps individuals with modest incomes save for retirement by providing a tax credit for contributions to eligible retirement plans.

- Child Tax Credit:If you have qualifying children, you may be eligible for a tax credit for each child. The credit amount depends on your income and the child’s age.

Consulting a Tax Professional

Navigating the complexities of tax laws and maximizing deductions and credits can be challenging. Consulting a tax professional can provide personalized advice tailored to your specific situation. A tax professional can:

- Identify all eligible deductions and credits:They have in-depth knowledge of tax laws and can ensure you claim all eligible deductions and credits.

- Develop a tax plan:They can help you create a tax plan to minimize your tax liability and maximize your financial benefits.

- Prepare your tax return:They can accurately prepare your tax return, ensuring compliance with all applicable tax regulations.

Essential Tax-Related Tasks for Freelancers

Maintaining accurate records and meeting deadlines is crucial for successful tax management. Here’s a checklist of essential tax-related tasks for freelancers:

- Track Income and Expenses:Maintain detailed records of all income received and expenses incurred for your business activities.

- File Estimated Taxes:If your income exceeds certain thresholds, you are required to file estimated taxes quarterly to avoid penalties.

- Keep Tax Documents Organized:Organize all tax documents, including receipts, invoices, bank statements, and tax forms, for easy access and future reference.

- Meet Tax Deadlines:Stay informed about tax deadlines and file your tax return by the required date to avoid penalties.

Last Point

As you embark on your freelance journey, remember that staying organized, keeping accurate records, and utilizing available resources can significantly simplify the tax process. Don’t hesitate to seek guidance from a tax professional for personalized advice, especially when navigating complex situations.

By understanding your tax obligations and utilizing tools like tax calculators, you can confidently navigate the world of freelance taxes and achieve financial success.

FAQ Guide

What is a tax calculator and how does it work?

A tax calculator is a digital tool that helps you estimate your tax liability based on your income, deductions, and credits. It works by taking your financial information and applying relevant tax laws and regulations to calculate your estimated tax burden.

Is using a tax calculator mandatory?

No, using a tax calculator is not mandatory. However, it is highly recommended, especially for freelancers, as it can help you plan your finances and avoid surprises during tax season.

What are some popular tax calculators for freelancers?

There are many reputable tax calculators available online, including TurboTax, H&R Block, and TaxAct. These platforms offer user-friendly interfaces and comprehensive features designed specifically for freelancers.