Tax calculator for families in October 2024 takes center stage, a time when families across the country are strategizing their financial futures. With tax season looming, navigating the complexities of family tax planning can feel overwhelming. This guide aims to empower families with the knowledge and tools needed to make informed decisions, ultimately minimizing their tax burden and maximizing their financial well-being.

Understanding the intricacies of family tax planning is crucial for families of all sizes and income levels. Tax calculators are invaluable tools that simplify the process by providing personalized estimates and insights. These calculators take into account various factors unique to families, such as dependents, child tax credits, and deductions, offering a clear picture of potential tax liabilities and opportunities for savings.

Contents List

- 1 Introduction

- 2 Features of Tax Calculators for Families

- 3 Factors Influencing Family Tax Calculations: Tax Calculator For Families In October 2024

- 4 Tax Planning Strategies for Families

- 5 Choosing the Right Tax Calculator

- 6 Utilizing Tax Calculators for Effective Tax Planning

- 7 Importance of Professional Tax Advice

- 8 End of Discussion

- 9 Detailed FAQs

Introduction

Tax planning is an essential aspect of financial management for families, as it helps them optimize their financial well-being by minimizing their tax liabilities. By strategically planning their income and expenses, families can maximize their savings and achieve their financial goals.

Don’t forget, the October 2024 tax deadline for self-employed individuals is coming up. Make sure you’re prepared.

Tax calculators are valuable tools that simplify the complex process of tax calculations, enabling families to understand their tax obligations and explore potential tax savings opportunities.

If you’re a student, you might be eligible for a standard deduction. Find out more about the standard deduction for students in 2024 to see if you can save on your taxes.

Tax Calculators: Simplifying Tax Calculations

Tax calculators are user-friendly online tools that streamline the process of calculating taxes. These calculators take into account various factors, such as income, deductions, and credits, to provide an estimate of a family’s tax liability. By using a tax calculator, families can gain a clear understanding of their tax obligations and identify potential areas for tax savings.

Need to reimburse someone for mileage? The mileage reimbursement rate for October 2024 is a good place to start.

Importance of October 2024 in Tax Planning

October 2024 is a crucial month for tax planning as it marks the end of the fiscal year for many countries. This means that families have the opportunity to review their financial activities and make adjustments to minimize their tax liability before the end of the fiscal year.

Wondering how much you can contribute to an IRA based on your age? The IRA contribution limits for 2024 by age can help you figure that out.

Features of Tax Calculators for Families

Tax calculators designed for families are specialized tools that help individuals and families navigate the complexities of tax filing, particularly when dealing with dependents, child tax credits, and other family-specific deductions. They provide a user-friendly way to estimate tax liability and explore potential savings strategies.

Features Tailored for Family Tax Situations

Tax calculators designed for families offer a range of features that cater to the unique tax situations families encounter. These features include:

- Dependent Information:Family tax calculators allow users to input information about their dependents, including their ages, Social Security numbers, and relationship to the filer. This data is crucial for determining eligibility for various tax credits and deductions, such as the Child Tax Credit, the Dependent Care Credit, and the Earned Income Tax Credit.

Make sure your business is compliant. Check out the W9 Form October 2024 requirements for businesses to stay on top of things.

- Child Tax Credit:These calculators help families understand the Child Tax Credit, a significant tax benefit available to families with qualifying children. The calculators incorporate the latest rules and eligibility requirements, including the income thresholds and phase-out limits. They also consider the potential impact of the credit on a family’s overall tax liability.

Are you a small business owner with a SIMPLE IRA? Check out the IRA contribution limits for SIMPLE IRA in 2024 to maximize your retirement savings.

- Deductions for Families:Family tax calculators offer guidance on deductions specific to families, such as the deduction for qualified child care expenses, the adoption tax credit, and the student loan interest deduction. These calculators help families identify and claim the deductions they are eligible for, maximizing their potential tax savings.

Planning to save for retirement? Check out the IRA contribution limits for married couples in 2024 to see how much you can contribute.

- Tax Planning Tools:Family tax calculators often include tax planning tools that allow users to explore different scenarios and strategies. These tools can help families determine the impact of various financial decisions, such as choosing between filing jointly or separately, on their tax liability.

Are you eligible for catch-up contributions? The 2024 401k limits for catch-up contributions might help you save more for retirement.

They can also assist in understanding the potential tax consequences of making changes to their income or deductions.

User-Friendly Interfaces and Functionalities

Tax calculators for families are designed with user-friendliness in mind. Here are some common features that enhance their usability:

- Interactive Questionnaires:Many calculators employ interactive questionnaires that guide users through the necessary steps to gather relevant information. This step-by-step approach simplifies the data entry process and reduces the likelihood of errors.

- Clear and Concise Explanations:Family tax calculators often provide clear and concise explanations of tax terms, concepts, and eligibility requirements. They use plain language and avoid technical jargon, making it easier for users to understand the information presented.

- Personalized Reports:Upon completion, tax calculators generate personalized reports that summarize the user’s tax situation, including estimated tax liability, potential refunds, and recommended deductions and credits. These reports provide a clear overview of the user’s financial position and potential tax savings.

Factors Influencing Family Tax Calculations: Tax Calculator For Families In October 2024

Navigating the complex world of family taxes can be challenging. Several factors come into play when determining your family’s tax liability. Understanding these factors is crucial for effective tax planning and maximizing potential savings.

Make sure you’re aware of the IRA limits for October 2024 so you can make the most of your retirement savings.

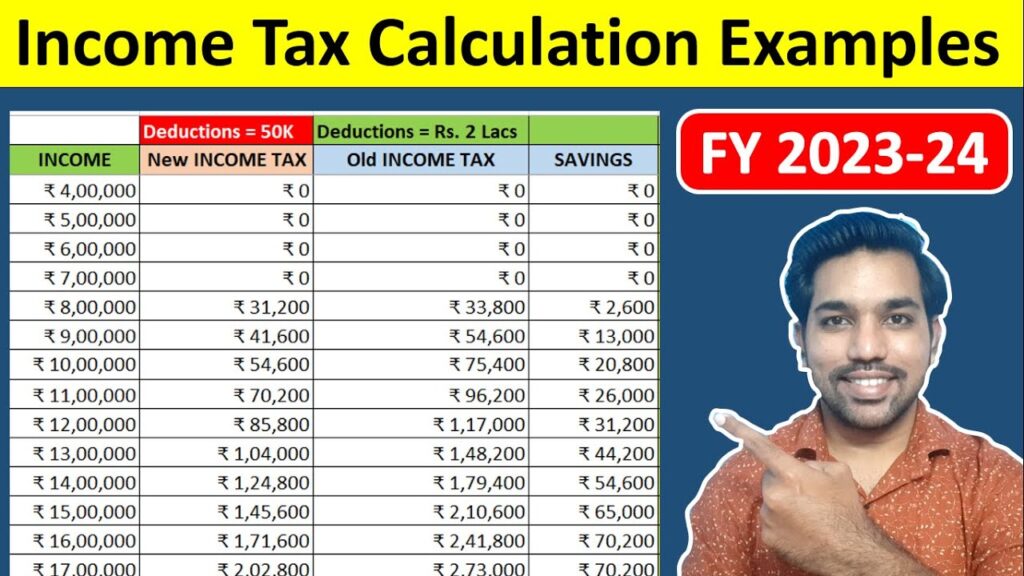

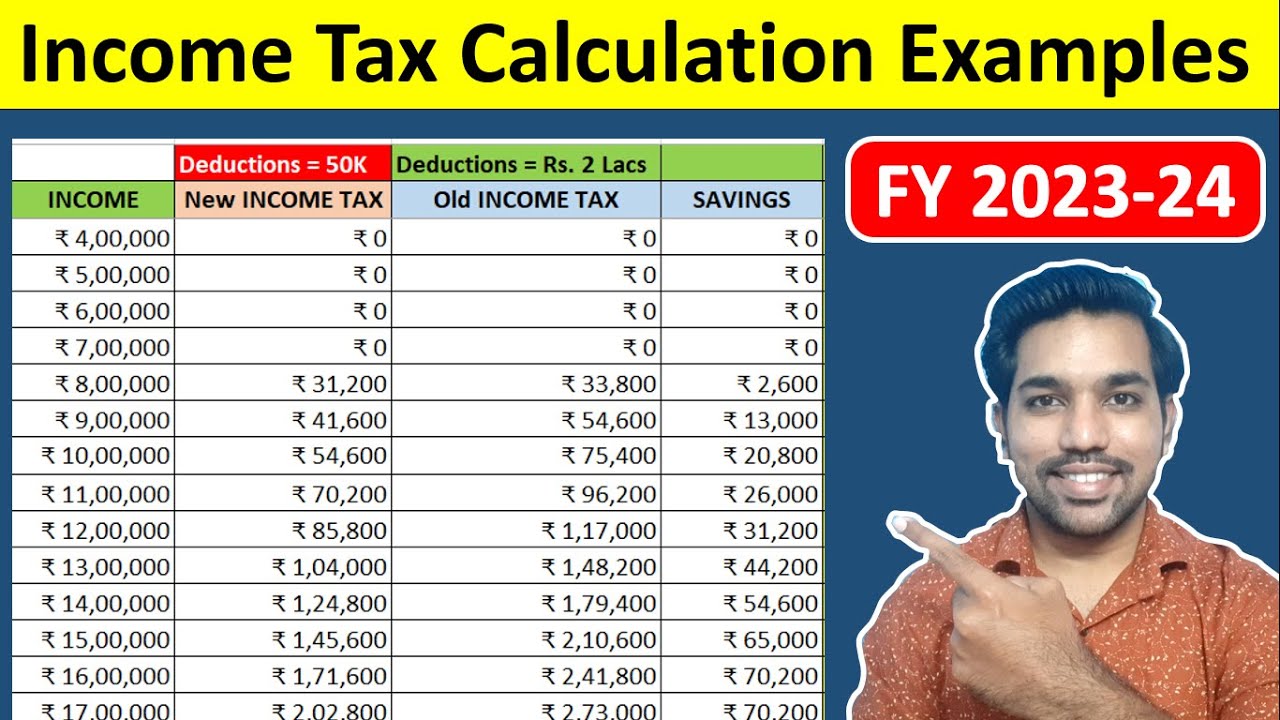

Income Levels

Income is the foundation of tax calculations. The more you earn, the more taxes you generally pay. Family income includes all sources, such as wages, salaries, investments, and business profits. The specific income thresholds that determine tax brackets and rates are subject to change annually, so it’s essential to consult updated tax information for the current year.

Deductions

Deductions reduce your taxable income, ultimately lowering your tax bill. There are various deductions available for families, each with its own eligibility criteria. Some common deductions include:

- Standard deduction:A fixed amount that can be claimed instead of itemizing deductions. The standard deduction amount varies based on filing status and age.

- Itemized deductions:Allow you to deduct specific expenses, such as mortgage interest, state and local taxes, charitable contributions, and medical expenses. Itemizing may be advantageous if your total itemized deductions exceed the standard deduction.

- Child tax credit:A credit that can be claimed for each qualifying child under 17 years old. The credit amount varies depending on the child’s age and income.

- Dependent care credit:A credit for expenses related to caring for a dependent, such as childcare or adult care. The credit amount depends on your income and the number of dependents.

Credits

Tax credits are direct reductions of your tax liability, offering a dollar-for-dollar decrease in taxes owed. Credits are often more valuable than deductions because they directly reduce your tax bill, rather than just reducing your taxable income.

- Earned Income Tax Credit (EITC):A refundable credit for low-to-moderate-income working individuals and families. The credit amount depends on income, filing status, and the number of qualifying children.

- American Opportunity Tax Credit (AOTC):A credit for qualified education expenses, such as tuition and fees. The credit is available for the first four years of post-secondary education and is phased out based on income.

- Premium Tax Credit (PTC):A credit for health insurance premiums purchased through the Marketplace. The credit amount depends on income and the cost of the plan.

Tax Brackets

Tax brackets are income ranges with corresponding tax rates. As your income increases, you move into higher tax brackets, resulting in a higher tax rate on the portion of your income within that bracket. Understanding tax brackets helps you estimate your tax liability and plan accordingly.

For example, in 2024, if your taxable income falls between $41,775 and $89,075, you’ll be in the 12% tax bracket. This means that 12% of your income within that range will be taxed at that rate.

Tax Planning Strategies for Families

Tax planning is crucial for families, as it can help them minimize their tax burden and maximize their financial well-being. By understanding the various tax strategies available, families can make informed decisions about their finances and ensure they are taking advantage of all available tax benefits.

It’s important to understand tax brackets for 2024 to estimate your tax obligations.

Maximizing Deductions

Maximizing deductions is a key tax planning strategy for families. Deductions reduce taxable income, ultimately lowering the amount of taxes owed.

The standard deduction in 2024 can help you reduce your tax liability. It’s a good idea to understand how it works.

- Child Tax Credit:This credit can provide up to $2,000 per qualifying child under 17 years old. The credit is fully refundable, meaning families can receive a refund even if they don’t owe any taxes.

- Child and Dependent Care Credit:This credit helps families offset the costs of childcare for qualifying dependents. The credit is nonrefundable, meaning it can only reduce the amount of taxes owed, not result in a refund.

- Education Credits:Families with students pursuing higher education can claim various education credits, such as the American Opportunity Tax Credit and the Lifetime Learning Credit, to help offset tuition and other education expenses.

- Medical Expenses:Medical expenses exceeding a certain percentage of adjusted gross income are deductible. This can be a significant benefit for families facing high medical costs.

- Homeownership Deductions:Homeowners can deduct mortgage interest and property taxes, potentially saving them a substantial amount on their taxes.

Utilizing Credits

Tax credits directly reduce the amount of taxes owed, offering a more significant benefit than deductions.

Do you have a SEP IRA? The IRA contribution limits for SEP IRA in 2024 can help you plan for retirement.

- Earned Income Tax Credit (EITC):This credit is available to low- and moderate-income working families. The amount of the credit depends on income, family size, and other factors.

- Premium Tax Credit (PTC):Families enrolled in the Affordable Care Act’s health insurance marketplace can receive a tax credit to help offset the cost of health insurance premiums.

- Retirement Savings Contributions Credit:This credit is available to individuals and families contributing to retirement savings plans, such as 401(k)s and IRAs.

Optimizing Income Splitting

Income splitting can help families reduce their overall tax liability by strategically distributing income among family members.

Tax laws are constantly changing. Stay up-to-date on any tax changes impacting the October 2024 deadline that might affect your filings.

- Spousal Deduction:This deduction allows married couples to deduct a portion of their spouse’s income from their own taxable income, lowering their tax burden.

- Child Tax Credit:Families can use the child tax credit to offset the income of their children, potentially reducing their tax liability.

- Trusts and Estates:Families can utilize trusts and estates to distribute income strategically and potentially lower their overall tax burden.

Choosing the Right Tax Calculator

Finding the right tax calculator for your family’s needs can feel overwhelming. Many options exist, each with its own strengths and weaknesses. To make the best choice, it’s essential to consider several factors.

Key Criteria for Choosing a Tax Calculator

A tax calculator is a valuable tool for estimating your tax liability and exploring potential tax savings. However, not all tax calculators are created equal. When choosing one, it’s important to consider the following key criteria:

| Criteria | Explanation |

|---|---|

| Accuracy | The tax calculator should use accurate tax laws and regulations to provide reliable estimates. Look for calculators that are regularly updated to reflect changes in tax legislation. |

| Ease of Use | The calculator should be user-friendly, with a clear and intuitive interface. It should be easy to input your information and understand the results. |

| Cost | Tax calculators can range in price from free to premium subscriptions. Consider your budget and the features offered at different price points. |

| Features | Different calculators offer varying features, such as the ability to calculate different types of taxes, analyze tax deductions, and generate tax reports. Choose a calculator that meets your specific needs. |

| Data Security | Ensure the tax calculator provider uses robust security measures to protect your personal and financial information. Look for calculators that use encryption and other security protocols. |

Reputable Tax Calculator Providers

Several reputable tax calculator providers offer reliable and user-friendly tools. Here are a few examples:

- TurboTax:A well-known provider offering a wide range of tax calculators, including free and paid options. TurboTax is known for its user-friendly interface and comprehensive features.

- H&R Block:Another popular provider with a variety of tax calculators. H&R Block offers calculators for both individuals and families, with options for different tax situations.

- TaxAct:A reputable provider offering affordable and user-friendly tax calculators. TaxAct provides calculators for various tax needs, including those specific to families.

- TaxSlayer:A reliable provider offering a range of tax calculators at different price points. TaxSlayer provides calculators for various tax situations, including those for families with children.

Utilizing Tax Calculators for Effective Tax Planning

Tax calculators are powerful tools that can help families understand their tax obligations and make informed decisions about their finances. By leveraging the features and functionalities of these calculators, families can optimize their tax planning strategies, potentially reducing their tax burden and maximizing their financial well-being.

Inputting Accurate Information

To ensure accurate and reliable results, it is crucial to provide the tax calculator with precise and complete information. This involves gathering all necessary documentation, such as income statements, tax forms, and relevant financial records.

Foreign nationals need to be aware of the October 2024 tax deadline for foreign nationals to avoid any penalties.

- Income Sources:Accurately report all income sources, including wages, salaries, investments, and self-employment earnings.

- Deductions and Credits:Identify and include all eligible deductions and tax credits, such as mortgage interest, charitable donations, and child tax credits.

- Dependents:Provide information about dependents, including their ages, Social Security numbers, and relationship to the taxpayer.

- Tax Filing Status:Select the appropriate tax filing status, such as single, married filing jointly, or head of household.

Interpreting the Results

Once the tax calculator has processed the input information, it will generate a report outlining the estimated tax liability, potential refunds, or any taxes owed.

- Tax Liability:The calculated tax liability represents the total amount of taxes owed based on the provided information.

- Refund or Payment:The calculator will indicate whether a refund is expected or if additional taxes need to be paid.

- Tax Brackets:The report may also show the tax brackets applicable to the taxpayer’s income level.

Exploring Different Tax Scenarios

Tax calculators allow families to explore various tax scenarios by adjusting the input parameters. This feature empowers families to understand the potential impact of different financial decisions on their tax obligations.

- Income Adjustments:Families can simulate income changes, such as salary increases or investment gains, to see how these adjustments affect their tax liability.

- Deduction and Credit Adjustments:Exploring the impact of various deductions and credits, such as homeownership deductions or education credits, can help families identify strategies for tax optimization.

- Tax Filing Status Changes:Families can compare tax liabilities under different filing statuses, such as married filing jointly versus married filing separately.

Understanding Tax Implications

Tax calculators can be invaluable tools for understanding the tax implications of various financial decisions. For instance, families can use the calculator to analyze the impact of:

- Investing in Retirement Accounts:Tax calculators can help determine the tax benefits of contributing to traditional or Roth IRAs.

- Purchasing a Home:The calculator can estimate the tax deductions associated with homeownership, such as mortgage interest and property taxes.

- Starting a Business:Families can explore the tax implications of self-employment income and business deductions.

Importance of Professional Tax Advice

While tax calculators offer a helpful starting point, they cannot fully capture the complexity of individual family situations and tax laws. Consulting with a tax professional can provide valuable personalized advice, ensuring you take advantage of all available deductions and credits, minimize your tax liability, and avoid costly errors.

Limitations of Tax Calculators, Tax calculator for families in October 2024

Tax calculators rely on general information and cannot account for unique circumstances that may influence your tax situation.

The standard deduction for 2024 might be helpful in lowering your tax burden. It’s worth checking out.

- Specific Deductions and Credits:Tax calculators may not include all applicable deductions and credits, such as those related to education, healthcare, or charitable contributions.

- State and Local Taxes:Tax calculators often focus on federal taxes, neglecting state and local tax implications, which can significantly impact your overall tax burden.

- Changes in Tax Laws:Tax laws are constantly evolving, and tax calculators may not be updated to reflect the latest changes.

- Complex Financial Situations:For families with complex financial situations, such as self-employment income, investments, or multiple income sources, tax calculators may not provide accurate results.

Scenarios Where Professional Help is Crucial

Seeking professional tax advice is particularly important in these situations:

- Significant Life Changes:Major life events like marriage, divorce, birth of a child, or retirement can significantly impact your tax obligations.

- Business Ownership:If you are a business owner or self-employed, understanding tax implications for your business structure and income is essential.

- Investment Strategies:Complex investment strategies, such as stock options, real estate investments, or cryptocurrency holdings, require specialized tax expertise.

- High-Income Earners:Individuals with high incomes often face more complex tax situations and may benefit from personalized advice to minimize their tax liability.

- Tax Audits:If you are facing a tax audit, professional guidance can help you navigate the process and protect your interests.

End of Discussion

As we conclude our exploration of tax calculators for families in October 2024, remember that while these tools are incredibly helpful, they should not replace the expertise of a qualified tax professional. Seeking personalized advice can help ensure you’re taking full advantage of all available deductions and credits, ultimately optimizing your tax strategy and achieving your financial goals.

Detailed FAQs

What is the difference between a tax calculator and tax software?

Tax calculators provide estimates and insights into your potential tax liability, while tax software allows you to file your actual tax return.

Is it safe to use online tax calculators?

It’s essential to choose reputable tax calculator providers that prioritize data security and privacy. Look for platforms with strong encryption and security measures.

How often should I use a tax calculator?

It’s recommended to use a tax calculator at least once a year, especially during tax season, to assess your current tax situation and identify potential adjustments.

Can I use a tax calculator for multiple family members?

Many tax calculators allow you to create separate profiles for different family members, enabling you to calculate individual tax liabilities and explore various scenarios.