What is the 401k contribution limit for 2024? This question is on the minds of many Americans looking to secure their financial future. A 401(k) plan offers a powerful way to save for retirement, and understanding the contribution limits is crucial for maximizing your savings potential.

This article will delve into the 2024 contribution limits, exploring how they affect your retirement planning and highlighting strategies for maximizing your contributions.

The 401(k) plan is a retirement savings plan sponsored by your employer. It allows you to contribute pre-tax dollars to an account that grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them in retirement. This tax advantage makes it a popular choice for retirement savings.

Contents List

2024 401(k) Contribution Limit

The 401(k) contribution limit is the maximum amount of money you can contribute to your 401(k) plan each year. The limit is set by the IRS and is adjusted annually for inflation.

The tax brackets for 2024 are likely to be different from those in previous years. You can learn more about the tax brackets for 2024 in the United States by visiting the IRS website or talking to a tax professional.

It’s helpful to understand how these brackets affect your tax liability.

2024 401(k) Contribution Limits

The 2024 401(k) contribution limits are as follows:* Employees under 50 years old:$24,500

Tax brackets are a key part of the tax system, and they can change from year to year. If you’re wondering what are the new tax brackets for 2024 , you can find that information on the IRS website or by consulting a tax advisor.

Employees 50 years old and over

401(k) plans are a popular way to save for retirement, and the contribution limits can change from year to year. If you’re curious about the 401(k) contribution limits for 2024 , you can find that information on the IRS website or by talking to your employer.

$34,500 (includes the $10,000 catch-up contribution)

The contribution limits for IRAs can change from year to year. If you’re wondering how the limits for 2024 compare to those for 2023, you can find that information on the IRS website. It’s important to know the IRA contribution limits for 2024 vs 2023 to ensure you’re maximizing your retirement savings.

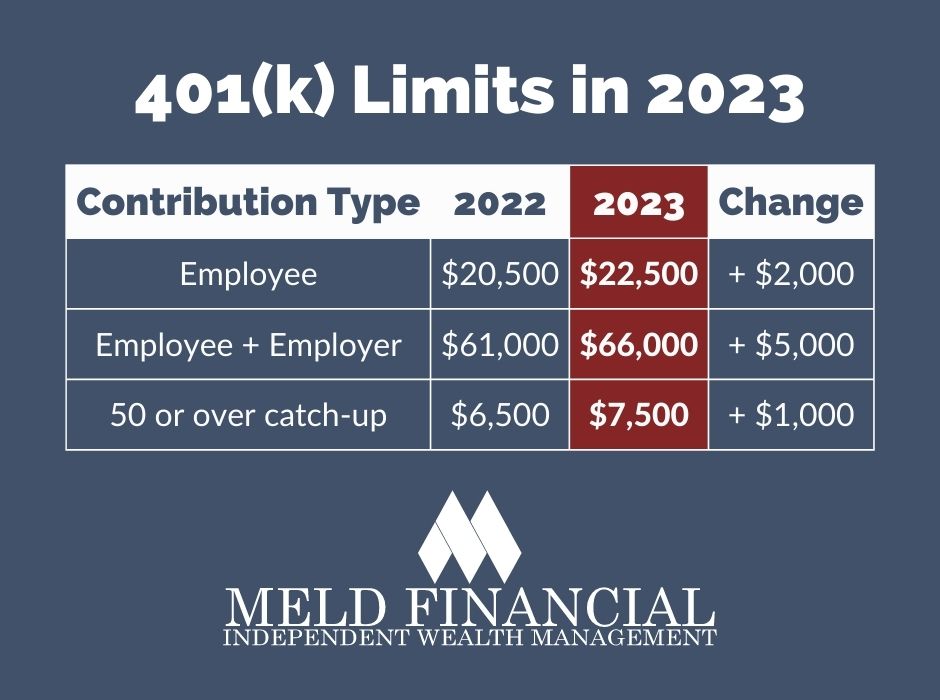

2024 401(k) Contribution Limits Compared to Previous Years

The following table compares the 2024 401(k) contribution limits to previous years’ limits:

| Year | Employee Limit | Catch-up Limit |

|---|---|---|

| 2023 | $22,500 | $7,500 |

| 2022 | $22,500 | $7,500 |

| 2021 | $20,500 | $6,500 |

| 2020 | $19,500 | $6,500 |

Catch-Up Contributions

Catch-up contributions are a valuable tool for those who are nearing retirement age and want to boost their retirement savings. These contributions allow older workers to save more in their 401(k) plans each year, increasing their retirement nest egg.

Students often have until October to file their taxes, but it’s important to know the exact deadline. Check out this article for the latest information on the October 2024 tax deadline for students. It’s a good idea to stay informed about any changes to the tax code, especially if you’re a student.

Catch-Up Contribution Limit for 2024

The catch-up contribution limit for 2024 is $7,500. This means that individuals who are age 50 or older can contribute an additional $7,500 to their 401(k) plans on top of the regular contribution limit, which is $22,500 for 2024.

If you’re over 50, you may be eligible for a higher IRA contribution limit. It’s worth checking to see if you can take advantage of this extra contribution room. You can find information about the IRA contribution limits for 2024 for those over 50 on the IRS website or by talking to a financial advisor.

Benefits of Catch-Up Contributions

Catch-up contributions offer several benefits to those who are eligible to utilize them:

- Accelerated Savings:Catch-up contributions allow individuals to significantly increase their retirement savings in a short period. This can be particularly beneficial for those who have not saved as much as they would have liked earlier in their careers.

- Tax Advantages:Catch-up contributions are tax-deferred, meaning that you won’t have to pay taxes on the money until you withdraw it in retirement. This can save you a significant amount of money in taxes over the long term.

- Increased Retirement Security:Catch-up contributions can help you reach your retirement goals faster and with more confidence. They can help you bridge the gap between your current savings and your desired retirement income.

Strategies for Maximizing Contributions

Maximizing your 401(k) contributions is a key strategy for building a secure financial future. By understanding the different strategies available, you can choose the approach that best suits your individual circumstances and financial goals.

Tax brackets can change from year to year, so it’s important to stay up-to-date on the latest information. You can find out more about the tax bracket changes for 2024 on the IRS website or by talking to a tax professional.

Contribution Strategies Based on Income Levels

Different income levels often require tailored approaches to maximizing 401(k) contributions. This table Artikels potential strategies based on income levels, showcasing the balance between contribution amounts, percentages, and potential benefits:

| Income Level | Contribution Amount | Contribution Percentage | Potential Benefits |

|---|---|---|---|

| Low Income | $10,000 | 10% | Maximizing tax benefits, building a solid foundation for retirement savings. |

| Mid-Range Income | $15,000 | 15% | Achieving a healthy savings rate, potentially qualifying for employer matching contributions. |

| High Income | $22,500 | 22.5% | Taking full advantage of the contribution limit, accelerating retirement savings growth. |

Benefits of Automatic Enrollment and Gradual Increases, What is the 401k contribution limit for 2024

Automatic enrollment in your employer’s 401(k) plan simplifies the process of contributing to your retirement savings. It ensures that contributions are automatically deducted from your paycheck, making it easier to save consistently.

The standard deduction is an important part of the tax system, and it can change from year to year. If you’re unsure about the standard deduction for 2024 , you can find that information on the IRS website or by talking to a tax professional.

“Setting it and forgetting it is the best way to maximize your contributions.”

If you’re married, you’ll need to know the contribution limits for your IRA. These limits can change from year to year, so it’s essential to stay up-to-date. You can find information about the IRA contribution limits for married couples in 2024 on the IRS website or by talking to a financial advisor.

Gradually increasing your contribution percentage over time can help you reach your retirement goals without feeling overwhelmed by a sudden large contribution. Starting with a small percentage and gradually increasing it over time can make saving for retirement feel more manageable.

Many people use the standard mileage rate for business travel expenses. It’s a good idea to check if the rate is changing before you file your taxes. You can find out more about whether the mileage rate is changing in October 2024 by visiting the IRS website or consulting a tax professional.

Pre-Tax vs. Roth Contributions

Pre-tax contributions are deducted from your paycheck before taxes are calculated, reducing your taxable income and lowering your current tax liability. This strategy can be particularly beneficial for individuals in higher tax brackets, as it allows them to save more money in the present.

The IRS offers a variety of resources to help taxpayers understand their obligations and file their taxes correctly. If you’re looking for information about the IRS resources for the October 2024 tax deadline , you can visit their website or contact them directly.

“Pre-tax contributions provide immediate tax savings, while Roth contributions offer tax-free withdrawals in retirement.”

Roth contributions, on the other hand, are made with after-tax dollars. While you don’t receive a tax deduction upfront, your withdrawals in retirement are tax-free. This can be advantageous for individuals who anticipate being in a higher tax bracket in retirement, as they can avoid paying taxes on their retirement income.

Importance of Financial Planning: What Is The 401k Contribution Limit For 2024

Knowing your 401(k) contribution limit is a crucial piece of the retirement planning puzzle, but it’s only one piece. To truly build a solid financial future, you need a comprehensive plan that considers all aspects of your financial life.

Choosing the right tax calculator can make filing your taxes much easier. There are many options available, but some are better than others. You can learn more about the best tax calculator for October 2024 by reading reviews and comparing features.

Other Retirement Planning Strategies

Beyond maximizing your 401(k) contributions, several other strategies can help you reach your retirement goals.

The standard mileage rate can vary, so it’s important to know the correct rate for your specific situation. If you’re looking for the mileage rate for October 2024 , you can find it on the IRS website or by contacting a tax advisor.

It’s important to stay up-to-date on these rates to ensure you’re filing your taxes correctly.

- Traditional and Roth IRAs:These individual retirement accounts offer tax advantages and flexibility. Traditional IRAs allow you to deduct contributions from your taxable income, while Roth IRAs offer tax-free withdrawals in retirement.

- Annuities:Annuities are insurance contracts that provide a stream of income during retirement. They can offer guaranteed payments and protection against outliving your savings.

- Real Estate:Investing in real estate can provide rental income and potential appreciation. This can be a good way to diversify your portfolio and build wealth over time.

- Savings Accounts:While not specifically for retirement, savings accounts can provide a safe place to store emergency funds and build a cash cushion.

Seek Professional Advice

Retirement planning can be complex. Consulting with a financial advisor can provide personalized guidance and help you create a plan that aligns with your individual needs and goals. A financial advisor can:

- Assess your current financial situation.

- Help you set realistic retirement goals.

- Develop a customized investment strategy.

- Review your retirement plan regularly to ensure it remains on track.

Final Wrap-Up

Understanding the 401(k) contribution limits for 2024 is essential for maximizing your retirement savings. By carefully considering your income level, age, and financial goals, you can develop a personalized contribution strategy that helps you reach your retirement aspirations. Remember to consult with a financial advisor to create a comprehensive plan that aligns with your unique circumstances.

As you navigate the world of retirement planning, remember that taking control of your financial future starts with informed decision-making.

Query Resolution

How do I know if my employer offers a 401(k) plan?

You can inquire with your Human Resources department or review your employee handbook.

What happens to my 401(k) contributions if I change jobs?

Your 401(k) contributions will remain in your account. You can choose to roll it over to a new employer’s plan or keep it in your old plan.

Can I withdraw money from my 401(k) before retirement?

You can withdraw money from your 401(k) before retirement, but you may be subject to taxes and penalties.

A tax bracket calculator can be a helpful tool for estimating your tax liability. If you’re looking for a tax bracket calculator for 2024 , there are many options available online. It’s a good idea to compare different calculators to find one that meets your needs.

Self-employed individuals often have a different tax deadline than those who work for an employer. If you’re self-employed, it’s essential to know the October 2024 tax deadline for self-employed individuals. You can find this information on the IRS website or by talking to a tax professional.