401k contribution limits for 2024 for high earners set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. High earners often face unique challenges when it comes to retirement planning.

They need to navigate complex tax implications, consider the impact of their high income on various savings strategies, and find ways to maximize their retirement contributions within the limitations set by the IRS. This guide will delve into the specific 401(k) contribution limits for high earners in 2024, exploring the implications of these limits, the benefits of catch-up contributions, and the most effective investment strategies for maximizing retirement savings.

Understanding these limits is crucial for high earners who want to secure a comfortable retirement. This guide will provide insights into the strategies they can employ to reach their financial goals, ensuring a smooth transition into their golden years.

Contents List

2024 401(k) Contribution Limits

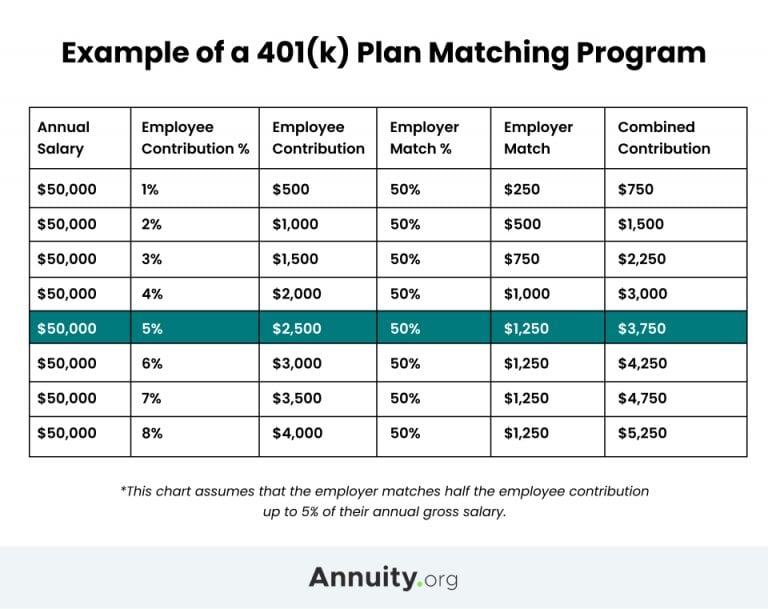

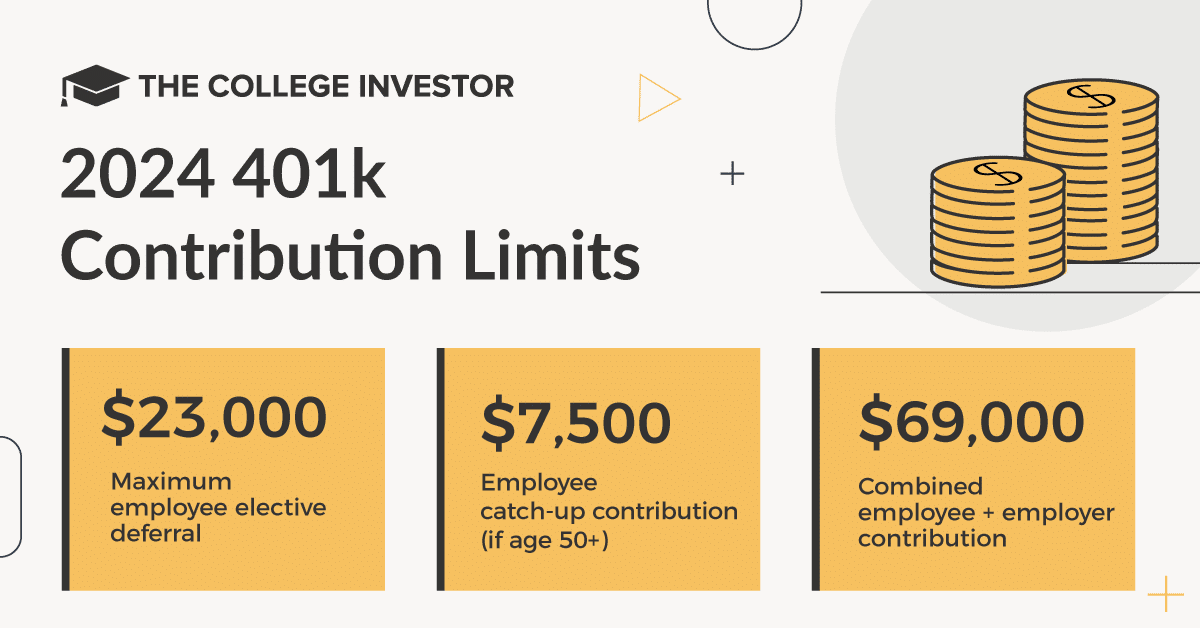

The 2024 401(k) contribution limits are designed to help individuals save for retirement. These limits can vary depending on the age and income of the individual.

Understanding the IRA contribution limits for 2024 is important, especially if you’re considering a Roth IRA. To learn more about IRA contribution limits for 2024, including Roth IRAs, check out this article: IRA contribution limits for 2024 and Roth IRA.

Contribution Limits for All Earners, 401k contribution limits for 2024 for high earners

The 2024 401(k) contribution limit for all earners is $22,500. This means that you can contribute up to $22,500 to your 401(k) account each year.

Contribution Limits for High Earners

For high earners, the contribution limit is slightly different. If you are 50 years old or older, you can contribute an additional $7,500 to your 401(k) account. This is called a catch-up contribution. The catch-up contribution limit is designed to help older workers make up for lost time in saving for retirement.

Impact on Retirement Savings

The 2024 401(k) contribution limit can have a significant impact on high earners’ retirement savings. By contributing the maximum amount, high earners can significantly boost their retirement savings. For example, if a high earner contributes the maximum amount of $30,000 to their 401(k) account each year, they will have saved $1.5 million by the time they retire at age 67, assuming an average annual return of 7%.

This is a significant amount of money that can help high earners live comfortably in retirement.

The tax deadline for October 2024 is typically the 15th, but it might change depending on the day of the week. To find out for sure, check out this article: What is the tax deadline for October 2024.

Catch-Up Contributions: 401k Contribution Limits For 2024 For High Earners

Catch-up contributions allow individuals aged 50 and older to contribute more to their 401(k) plans than the standard contribution limit. This additional contribution helps older workers accelerate their retirement savings and bridge the gap to a comfortable retirement.

If you’ve donated to charity and driven your car to do so, you might be eligible for a mileage deduction. To find out what the mileage rate is for charitable donations in October 2024, click here: October 2024 mileage rate for charitable donations.

Eligibility Criteria for Catch-Up Contributions

Catch-up contributions are available to individuals who are at least 50 years old by the end of the year. There are no other eligibility criteria, meaning anyone who meets the age requirement can make catch-up contributions regardless of their income level.

If you’re looking to save for retirement, an IRA is a great option. But how much can you actually contribute? To find out the IRA contribution limits for 2024, check out this article: How much can I contribute to my IRA in 2024.

Impact of Catch-Up Contributions on High Earners’ Retirement Savings

Catch-up contributions can significantly boost high earners’ retirement savings. High earners often face higher contribution limits, but catch-up contributions provide an extra opportunity to maximize their contributions. This can lead to substantial growth in their retirement accounts, especially with the power of compound interest.

You might be wondering how the standard deduction has changed for 2024. Well, there’s a good chance it has! To learn more about the standard deduction changes for 2024, check out this article: Standard deduction changes for 2024.

Examples of Catch-Up Contributions

Here are a few examples of how catch-up contributions can be used to maximize retirement savings:

- A 55-year-old high earner with a salary of $200,000 can contribute $24,500 to their 401(k) plan in 2024, including the catch-up contribution. This is $7,500 more than the standard contribution limit of $17,000. Over 10 years, this additional contribution can accumulate to a significant amount, depending on investment returns.

The mileage rate is used for tax purposes, and it can change from time to time. To find out if the mileage rate is changing in October 2024, check out this article: Is the mileage rate changing in October 2024?

.

- A 60-year-old high earner with a salary of $300,000 can contribute $34,500 to their 401(k) plan in 2024, including the catch-up contribution. This is $17,500 more than the standard contribution limit of $17,000. The catch-up contribution can help accelerate their savings and ensure they have enough to retire comfortably.

When it comes to business, the W9 Form is essential for tax purposes. You can find out more about the W9 Form requirements for businesses in October 2024 by visiting this link: W9 Form October 2024 requirements for businesses.

High Earner Considerations

High earners often face unique challenges when planning for retirement. Their high income can lead to a higher tax burden, potentially limiting their ability to save as much as they would like. Additionally, they may have more complex financial situations, requiring tailored strategies to maximize their retirement savings.

The mileage rate can change throughout the year, so it’s good to stay up-to-date. To learn about the mileage rate changes for October 2024, check out this article: October 2024 mileage rate changes.

Impact of High Income on Retirement Savings Strategies

High earners face a higher tax burden due to progressive tax brackets. This means that a larger portion of their income is subject to higher tax rates, potentially leaving less money available for retirement savings. For instance, in 2023, individuals earning over $200,000 are subject to a 37% federal income tax rate, which can significantly reduce their disposable income.

Furthermore, high earners may face additional taxes on their retirement accounts. For example, the 10% early withdrawal penalty for distributions before age 59 1/2 applies to traditional IRA distributions, but not to Roth IRA distributions. This can be a significant consideration for high earners who are considering early retirement.

Retirement Savings Options for High Earners

High earners have various retirement savings options, each with its benefits and drawbacks.

Traditional 401(k) and Roth 401(k)

- Traditional 401(k):Contributions are tax-deductible, lowering your taxable income in the present. However, distributions in retirement are taxed as ordinary income.

- Roth 401(k):Contributions are made with after-tax dollars, but distributions in retirement are tax-free. This can be advantageous for high earners who anticipate being in a higher tax bracket in retirement.

Traditional IRA and Roth IRA

- Traditional IRA:Contributions are tax-deductible, and distributions are taxed in retirement. This option can be beneficial for high earners who want to reduce their current tax liability.

- Roth IRA:Contributions are made with after-tax dollars, and distributions in retirement are tax-free. This option can be advantageous for high earners who anticipate being in a higher tax bracket in retirement.

Solo 401(k)

- Solo 401(k):This option is available to self-employed individuals and small business owners. It allows for higher contribution limits than traditional 401(k)s, potentially benefiting high earners who have higher income.

Defined Benefit Plan

- Defined Benefit Plan:This type of plan guarantees a specific monthly payment in retirement, based on factors such as years of service and salary. This can be a good option for high earners who want a predictable income stream in retirement.

Deferred Compensation Plan

- Deferred Compensation Plan:This plan allows executives to defer a portion of their salary until retirement. These plans are often subject to complex tax rules and regulations, so it is essential to consult with a financial advisor before participating.

Tax Implications

Understanding the tax implications of 401(k) contributions is crucial for high earners, as it can significantly impact their overall financial planning. The tax benefits of 401(k) contributions vary depending on whether you choose a traditional or Roth 401(k), and these choices can affect your current and future tax liabilities.

You might be wondering if you can contribute to an IRA even if you have a 401k. The answer is yes, in most cases! To learn more about contributing to an IRA if you have a 401k, check out this article: Can I contribute to an IRA if I have a 401k.

Traditional 401(k) Contributions

Traditional 401(k) contributions are made with pre-tax dollars, meaning you deduct your contributions from your taxable income. This reduces your current tax liability, but you’ll be taxed on the withdrawals in retirement. Here’s how it works:

You contribute $20,000 to your traditional 401(k) in 2024. This contribution reduces your taxable income by $20,000, potentially lowering your tax bracket for the year. However, when you withdraw the money in retirement, you’ll pay taxes on the entire amount.

Roth 401(k) Contributions

Roth 401(k) contributions are made with after-tax dollars, meaning you don’t receive a tax deduction in the current year. However, your withdrawals in retirement are tax-free. This can be advantageous for high earners who anticipate being in a higher tax bracket in retirement.

The standard deduction in 2024 depends on your filing status, but it’s a good idea to know how much it is. You can find out exactly how much the standard deduction is in 2024 by clicking this link: How much is the standard deduction in 2024.

You contribute $20,000 to your Roth 401(k) in 2024. This contribution doesn’t reduce your taxable income, but your withdrawals in retirement will be tax-free. If you anticipate being in a higher tax bracket in retirement, a Roth 401(k) can be beneficial.

Tax Bracket Impact

401(k) contributions can affect a high earner’s tax bracket by reducing their taxable income. This can lead to lower tax liability in the current year. However, it’s important to consider the long-term implications of these contributions, as they can affect your tax bracket in retirement as well.

For example, if you contribute the maximum amount to your 401(k) and your income is high, you might be able to move to a lower tax bracket in the current year. However, you’ll need to consider the potential impact on your tax bracket in retirement, as you’ll be taxed on withdrawals from your traditional 401(k) then.

Saving for retirement is a smart move, and contributing to a traditional IRA can be a great way to do that. You can learn more about how much you can contribute to a traditional IRA in 2024 by clicking here: How much can I contribute to a traditional IRA in 2024.

Investment Strategies

High earners have unique investment needs within their 401(k) plans due to their higher income levels and potential for larger contributions. Their strategies often prioritize long-term growth, tax optimization, and managing risk effectively.

It’s always a good idea to estimate how much you’ll owe in taxes. You can use a tax calculator to get a good idea of your tax liability. To find out how much you’ll owe in taxes, check out this article: Tax calculator 2024: How much will I owe in taxes?

.

Diversification for High Earners

Diversification is a crucial strategy for high earners, as it helps mitigate risk by spreading investments across various asset classes. A well-diversified portfolio typically includes a mix of stocks, bonds, and potentially other assets like real estate or commodities.

- Stocks:Stocks represent ownership in companies and offer the potential for high returns over the long term. High earners can consider investing in a mix of large-cap (large companies), mid-cap (medium-sized companies), and small-cap (smaller companies) stocks. They may also choose to invest in sector-specific stocks or specific industries they believe will grow.

- Bonds:Bonds are debt securities that pay interest to investors. They offer lower potential returns than stocks but provide more stability and protection against market volatility. High earners can consider investing in a mix of government bonds, corporate bonds, and high-yield bonds, depending on their risk tolerance and investment goals.

Students often have different tax situations, and the standard deduction can be helpful. To learn more about the standard deduction for students in 2024, check out this article: Standard deduction for students in 2024.

- Real Estate:Real estate can offer diversification benefits and potential for income generation. High earners can consider investing in real estate through REITs (Real Estate Investment Trusts) or direct ownership of properties.

- Commodities:Commodities are raw materials like gold, oil, and agricultural products. They can serve as a hedge against inflation and provide diversification benefits. High earners may consider investing in commodities through ETFs (Exchange-Traded Funds) or futures contracts.

Portfolio Design for High Earners

Designing a diversified investment portfolio for high earners involves considering their risk tolerance, time horizon, and financial goals.

It’s important to know about any tax deductions you might be eligible for. To learn more about the tax deductions available for the October 2024 deadline, check out this article: Tax deductions for the October 2024 deadline.

- Risk Tolerance:High earners may have a higher risk tolerance due to their higher income levels and potentially longer time horizons. However, they should still carefully consider their individual risk tolerance and choose investments that align with their comfort level.

- Time Horizon:High earners have a longer time horizon to invest for retirement, which allows them to take on more risk for potentially higher returns. However, they should also consider their individual circumstances and adjust their investment strategy accordingly.

- Financial Goals:High earners may have specific financial goals, such as early retirement, funding their children’s education, or leaving a legacy. These goals should be incorporated into their investment strategy.

Investment Options within a 401(k) Plan

| Investment Option | Risk Profile | Potential Returns |

|---|---|---|

| Target-Date Funds | Moderate | Moderate |

| Index Funds | Moderate | Moderate |

| Mutual Funds | Moderate to High | Moderate to High |

| Exchange-Traded Funds (ETFs) | Moderate | Moderate |

| Individual Stocks | High | High |

| Bonds | Low | Low |

Note:The risk profile and potential returns of investment options can vary depending on the specific fund or security. It’s essential to research and understand the risks and potential rewards before investing.

The standard deduction for married couples filing jointly can be a big help when it comes to taxes. You can find out exactly how much the standard deduction is for married couples filing jointly in 2024 by visiting this link: Standard deduction for married filing jointly in 2024.

Retirement Planning

Retirement planning for high earners requires a tailored approach that considers their unique financial situation, income potential, and long-term goals. High earners often face a complex set of considerations, including higher income taxes, potential for substantial wealth accumulation, and the need to navigate complex investment strategies.

Retirement Savings Needs for High Earners

Estimating retirement savings needs for high earners is crucial for ensuring a comfortable and financially secure retirement. Several factors come into play, including current income, desired retirement lifestyle, and estimated expenses.

The general rule of thumb is to aim for a retirement nest egg that can provide 80% of your pre-retirement income. However, this figure can vary based on individual circumstances.

Developing a Personalized Retirement Plan

Developing a personalized retirement plan is essential for high earners to achieve their retirement goals. This involves a step-by-step process that considers individual circumstances and financial goals.

- Define Retirement Goals: Clearly define your retirement goals, including desired lifestyle, travel plans, and financial aspirations. This will provide a framework for your retirement planning.

- Estimate Retirement Expenses: Project your annual retirement expenses, including housing, healthcare, travel, and entertainment. Consider potential inflation and adjust your estimates accordingly.

- Determine Savings Needs: Calculate the total amount of savings required to meet your projected expenses for the duration of your retirement. This can be done using retirement planning tools or consulting a financial advisor.

- Choose Investment Strategies: Develop an investment strategy that aligns with your risk tolerance, time horizon, and financial goals. Consider diversifying your portfolio across different asset classes, such as stocks, bonds, and real estate.

- Review and Adjust Regularly: Regularly review your retirement plan and make adjustments as needed. This ensures that your plan remains aligned with your evolving financial goals and market conditions.

Wrap-Up

By understanding the 401(k) contribution limits for 2024 and implementing the strategies Artikeld in this guide, high earners can make informed decisions about their retirement savings. Whether you’re just starting to plan for retirement or are looking to optimize your existing strategy, the information presented here will provide valuable insights and guidance.

Remember, a well-crafted retirement plan is essential for a secure and comfortable future. By taking proactive steps today, you can set yourself up for a successful and fulfilling retirement tomorrow.

FAQ Summary

What are the catch-up contribution limits for 2024?

For individuals aged 50 and over, the catch-up contribution limit for 2024 is $7,500. This means they can contribute an additional $7,500 to their 401(k) on top of the regular contribution limit.

Can I contribute to both a traditional and Roth 401(k)?

Yes, you can contribute to both a traditional and Roth 401(k) simultaneously, but the total contributions cannot exceed the annual limit.

How do 401(k) contributions affect my taxes?

Traditional 401(k) contributions are tax-deductible, meaning you pay taxes on the money when you withdraw it in retirement. Roth 401(k) contributions are made with after-tax dollars, so you don’t pay taxes on the withdrawals in retirement.

What happens if I exceed the 401(k) contribution limit?

If you exceed the 401(k) contribution limit, you may be subject to penalties. It’s essential to stay within the limits to avoid any financial repercussions.