Can I contribute more than the 401k limit in 2024? This question often arises for individuals who are eager to maximize their retirement savings. The 401(k) plan, a cornerstone of retirement planning, offers tax advantages and employer matching contributions, making it an attractive savings vehicle.

However, the annual contribution limit, which stands at $22,500 for 2024, may not be enough for everyone, especially those with higher incomes or a strong desire to accelerate their retirement nest egg.

This article delves into the intricacies of 401(k) contribution limits, explores alternative retirement savings options, and Artikels strategies for maximizing retirement savings, even beyond the 401(k) framework. We’ll examine how individual financial circumstances, including income level and age, can influence retirement savings goals and discuss the importance of consulting with a financial advisor for personalized guidance.

Contents List

- 1 Understanding the 401(k) Limit

- 2 Exploring Alternative Retirement Savings Options

- 3 Strategies for Maximizing Retirement Savings

- 4 Financial Planning and Personal Circumstances

- 5 Conclusion: Can I Contribute More Than The 401k Limit In 2024

- 6 Frequently Asked Questions

Understanding the 401(k) Limit

The 401(k) plan is a popular retirement savings option for employees in the United States. It allows you to contribute pre-tax dollars to a retirement account, which grows tax-deferred. However, there is a limit on how much you can contribute each year.

This limit changes annually and is intended to help ensure that retirement savings are distributed fairly across all participants.

Understanding your tax bracket can help you make informed financial decisions. The understanding tax brackets for 2024 can guide your strategies for saving, investing, and planning for the future.

The 2024 Contribution Limit

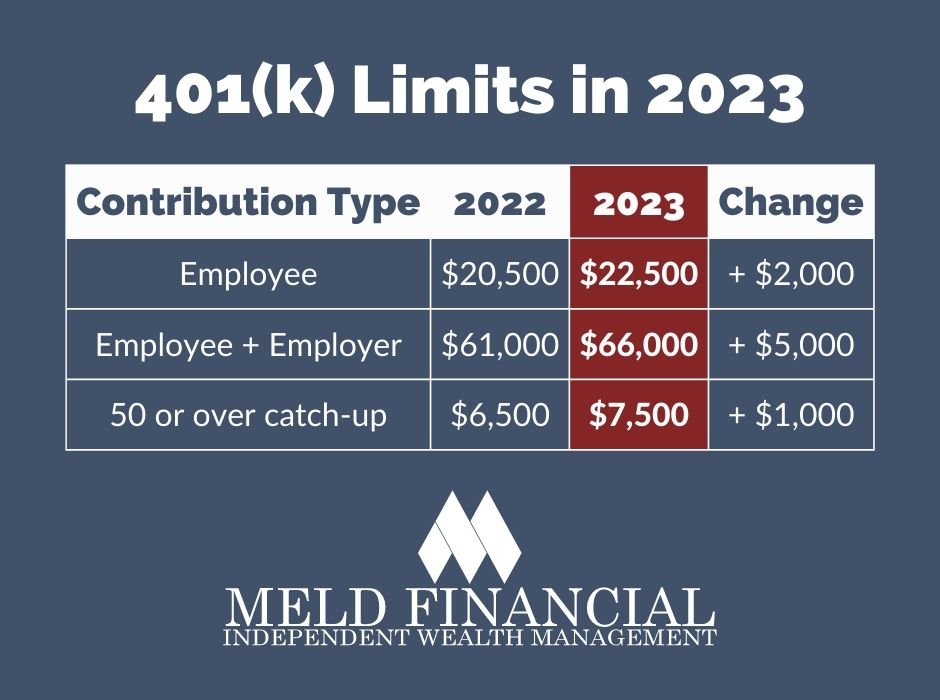

The 2024 contribution limit for 401(k) plans is $22,500. This means that you can contribute up to $22,500 to your 401(k) plan in 2024, regardless of whether you contribute to a traditional or Roth 401(k). However, if you are 50 years old or older, you can make additional “catch-up” contributions of up to $7,500 in 2024, bringing your total annual contribution limit to $30,000.

Planning for retirement? It’s wise to understand the IRA contribution limits for 2024 for married couples to maximize your savings. This can help you build a strong financial foundation for your future.

Traditional vs. Roth 401(k) Contributions

The main difference between traditional and Roth 401(k) contributions lies in when you pay taxes. With a traditional 401(k), you contribute pre-tax dollars, meaning that you don’t pay taxes on the contributions until you withdraw the money in retirement. This can be beneficial if you expect to be in a lower tax bracket in retirement.

With a Roth 401(k), you contribute after-tax dollars, meaning that you pay taxes on the contributions upfront. However, withdrawals in retirement are tax-free. This can be beneficial if you expect to be in a higher tax bracket in retirement.

For those over 50, there are catch-up contributions available for IRAs. Discover if there’s a catch-up contribution limit for IRAs in 2024 to boost your retirement savings.

Reasons for Contributing More Than the Limit, Can I contribute more than the 401k limit in 2024

There are a few reasons why someone might want to contribute more than the 401(k) limit. These reasons can be categorized as:

- Catching up on retirement savings:If you have not been saving enough for retirement, you may want to contribute more than the limit to make up for lost time.

- Maximizing retirement savings:Some individuals may have a high income and want to maximize their retirement savings to ensure a comfortable retirement.

- Taking advantage of employer matching:Some employers offer matching contributions to their employees’ 401(k) plans. If you are contributing the maximum amount allowed, you may be missing out on free money from your employer.

Exploring Alternative Retirement Savings Options

If you’ve reached the 401(k) contribution limit for 2024, you might be looking for other ways to save for retirement. Fortunately, there are several alternatives available, each with its own set of advantages and disadvantages.

The W9 form is used for tax reporting. Stay informed about any W9 form October 2024 changes and updates to ensure accurate reporting.

Traditional IRA

A Traditional IRA is a retirement savings account that offers tax benefits. Contributions are tax-deductible, reducing your taxable income in the current year. However, withdrawals in retirement are taxed as ordinary income.

Even if you have a 401k, you might be eligible to contribute to an IRA. Learn more about contributing to an IRA if you have a 401k to maximize your retirement savings.

Contribution Limits and Tax Implications

- The contribution limit for 2024 is $6,500 for individuals under age 50 and $7,500 for those 50 and older.

- Traditional IRA contributions are tax-deductible, meaning they reduce your taxable income in the current year.

- Withdrawals in retirement are taxed as ordinary income.

Investment Flexibility

Traditional IRAs offer a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. You have control over your investment choices and can adjust your portfolio as needed.

Looking ahead to retirement? Knowing the IRA contribution limits for 2024 and 2025 can help you plan your savings effectively.

Benefits and Drawbacks

- Benefits:Tax-deductible contributions, tax-deferred growth, investment flexibility.

- Drawbacks:Taxable withdrawals in retirement, potential for income limitations.

Roth IRA

A Roth IRA is another retirement savings account, but with a different tax structure. Contributions are made with after-tax dollars, meaning they are not tax-deductible. However, qualified withdrawals in retirement are tax-free.

It’s essential to be aware of the standard deduction in 2024 to optimize your tax filing strategy. This can help you minimize your tax liability.

Contribution Limits and Tax Implications

- The contribution limit for 2024 is $6,500 for individuals under age 50 and $7,500 for those 50 and older.

- Roth IRA contributions are not tax-deductible, meaning they do not reduce your taxable income in the current year.

- Qualified withdrawals in retirement are tax-free.

Investment Flexibility

Roth IRAs offer similar investment flexibility to Traditional IRAs, allowing you to invest in a wide range of assets.

Self-employed individuals have different rules for retirement contributions. Check out the IRA contribution limits for self-employed in 2024 to ensure you’re maximizing your savings.

Benefits and Drawbacks

- Benefits:Tax-free withdrawals in retirement, no income limitations.

- Drawbacks:Contributions are not tax-deductible, potential for higher taxes in retirement if you withdraw before age 59 1/2.

Solo 401(k)

A Solo 401(k) is a retirement savings plan designed for self-employed individuals and small business owners. It allows you to contribute as both an employee and an employer.

Retirees also have a specific tax deadline. The October 2024 tax deadline for retirees ensures that your retirement income is properly accounted for.

Contribution Limits and Tax Implications

- The contribution limit for 2024 is $66,000 for individuals under age 50 and $73,500 for those 50 and older.

- Contributions are tax-deductible, reducing your taxable income in the current year.

- Withdrawals in retirement are taxed as ordinary income.

Investment Flexibility

Solo 401(k)s offer a wide range of investment options, similar to traditional 401(k)s.

Benefits and Drawbacks

- Benefits:Higher contribution limits, tax-deductible contributions, investment flexibility.

- Drawbacks:Administrative burden, potential for higher taxes in retirement.

Health Savings Account (HSA)

An HSA is a tax-advantaged savings account specifically for healthcare expenses. While not strictly a retirement savings account, HSAs can be used for retirement healthcare costs.

Contribution Limits and Tax Implications

- The contribution limit for 2024 is $3,850 for individuals and $7,750 for families.

- Contributions are tax-deductible, reducing your taxable income in the current year.

- Withdrawals for qualified medical expenses are tax-free.

Investment Flexibility

HSAs offer investment options, allowing you to grow your savings over time.

Benefits and Drawbacks

- Benefits:Tax-deductible contributions, tax-free withdrawals for qualified medical expenses, potential for tax-free growth.

- Drawbacks:Limited to healthcare expenses, potential for penalties for non-medical withdrawals.

Annuities

An annuity is a contract between you and an insurance company that provides a stream of income for a specified period of time. Annuities can be a valuable tool for retirement planning, but they can be complex and require careful consideration.

Knowing the maximum IRA contribution for 2024 is crucial for maximizing your retirement savings. This limit can change annually, so staying informed is important.

Contribution Limits and Tax Implications

- Contribution limits vary depending on the type of annuity.

- Annuity payments may be taxed as ordinary income.

Investment Flexibility

Annuities offer different investment options, including fixed annuities, variable annuities, and indexed annuities.

If you drive for business purposes, you might be eligible for a mileage deduction. Stay updated on when the mileage rate will be updated for October 2024 to maximize your tax benefits.

Benefits and Drawbacks

- Benefits:Guaranteed income stream, potential for tax-deferred growth.

- Drawbacks:Complex, potential for high fees, limited flexibility.

Strategies for Maximizing Retirement Savings

Maximizing your retirement savings requires a strategic approach, encompassing both maximizing contributions within your 401(k) and exploring additional savings options. By implementing these strategies, you can significantly enhance your financial security for the future.

Businesses have a different tax deadline than individuals. The October 2024 tax deadline for businesses provides ample time for filing and planning.

Maximizing Contributions Within the 401(k) Limit

To fully leverage the benefits of your 401(k), consider these strategies:

- Contribute the Maximum Amount:The IRS sets an annual limit on 401(k) contributions. For 2024, the limit is $22,500. Contributing the maximum allows you to take full advantage of tax-deferred growth and compound interest over time.

- Increase Contributions Gradually:If contributing the maximum amount seems daunting, consider gradually increasing your contributions over time. Start with a small increase and gradually raise it as your income grows.

- Take Advantage of Employer Matching:Many employers offer matching contributions to their employees’ 401(k) plans. This is essentially free money, so make sure you are contributing enough to receive the full match.

- Review Your Asset Allocation:Regularly review your 401(k) asset allocation to ensure it aligns with your risk tolerance, investment goals, and time horizon. Adjust your investment mix as needed to optimize your portfolio’s growth potential.

Boosting Retirement Savings Outside the 401(k) Framework

Beyond the 401(k), several other options can help you build a robust retirement nest egg:

- Traditional IRA:Similar to a 401(k), a traditional IRA offers tax-deductible contributions, allowing you to reduce your current tax liability. Contributions can grow tax-deferred, and withdrawals are taxed in retirement. The annual contribution limit for 2024 is $6,500 for individuals under 50 and $7,500 for those 50 and older.

Small businesses have specific rules for retirement contributions. Explore the 401k contribution limits for 2024 for small businesses to make sure you’re taking advantage of all available options.

- Roth IRA:Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. The annual contribution limit for 2024 is $6,500 for individuals under 50 and $7,500 for those 50 and older.

If you’re over 50, you can contribute more to your 401k. Check out the maximum 401k contribution for 2024 for over 50 to maximize your retirement savings.

- Health Savings Account (HSA):If you have a high-deductible health insurance plan, an HSA allows you to save pre-tax dollars for healthcare expenses. These accounts offer triple tax advantages: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses.

- Taxable Investment Accounts:While not offering tax advantages like retirement accounts, taxable investment accounts can provide flexibility and growth potential. You can invest in a wide range of assets, including stocks, bonds, and mutual funds.

- Real Estate:Investing in real estate can provide rental income, appreciation potential, and tax benefits. However, real estate investments can also be illiquid and require significant capital and management time.

Comparing Retirement Savings Options

| Savings Option | Contribution Limit (2024) | Tax Advantages | Risk Level |

|---|---|---|---|

| 401(k) | $22,500 | Tax-deferred growth, potential employer match | Moderate (depends on investment choices) |

| Traditional IRA | $6,500 ($7,500 for 50+) | Tax-deductible contributions, tax-deferred growth | Moderate (depends on investment choices) |

| Roth IRA | $6,500 ($7,500 for 50+) | Tax-free withdrawals in retirement | Moderate (depends on investment choices) |

| Health Savings Account (HSA) | $3,850 (individual), $7,750 (family) | Triple tax advantages (contributions, growth, withdrawals) | Low (typically invested in conservative options) |

| Taxable Investment Accounts | No limit | No tax advantages on growth or withdrawals | High (depends on investment choices) |

| Real Estate | No limit | Potential tax benefits (depreciation, deductions) | High (illiquid, requires management) |

Financial Planning and Personal Circumstances

Your individual financial circumstances play a crucial role in determining your retirement savings goals and strategies. Factors like income level, age, and existing savings can significantly impact your approach to retirement planning.

Assessing Individual Financial Situations

Understanding your current financial situation is the foundation of effective retirement planning. This involves a comprehensive assessment of your income, expenses, assets, and debts.

- Income:Analyze your current and projected income, considering potential salary increases, bonuses, and any anticipated changes in employment status.

- Expenses:Carefully track your current spending habits and categorize them into essential and discretionary expenses. Estimate future expenses, such as healthcare costs and housing, considering inflation.

- Assets:Inventory your existing assets, including savings accounts, investments, real estate, and other valuable possessions. Evaluate their potential growth and liquidity.

- Debts:List all outstanding debts, including mortgages, student loans, and credit card balances. Consider their interest rates and repayment terms.

Adjusting Savings Strategies Based on Individual Needs

Once you have a clear understanding of your financial situation, you can tailor your retirement savings strategy to your specific needs and goals.

If you’re over 50, you might be eligible for catch-up contributions. Check out the 401k contribution limits for 2024 for over 50 to see how much you can contribute to your retirement plan.

- Higher Income Individuals:Individuals with higher incomes may have greater flexibility to contribute more to retirement accounts. They may consider maximizing contributions to 401(k)s and other retirement plans, exploring alternative investment options, and potentially even exceeding the annual contribution limits.

- Younger Individuals:Younger individuals have the advantage of time on their side. They can benefit from the power of compounding by starting to save early and consistently. While their income may be lower, they can focus on building a solid foundation for retirement.

- Individuals with Significant Debt:Those with substantial debt may need to prioritize debt reduction before maximizing retirement savings. They can consider a strategy that balances debt repayment with contributions to retirement accounts, prioritizing high-interest debts first.

Conclusion: Can I Contribute More Than The 401k Limit In 2024

While the 401(k) limit may seem restrictive, there are numerous ways to boost your retirement savings. Exploring alternative options like Roth IRAs, traditional IRAs, and even taxable investment accounts can significantly enhance your overall retirement portfolio. By strategically combining different savings strategies, you can build a robust retirement plan that aligns with your unique financial circumstances and aspirations.

Remember, the key is to seek professional guidance, stay informed about your options, and commit to consistent savings throughout your working years.

Frequently Asked Questions

What happens if I contribute more than the 401(k) limit?

If you exceed the 401(k) contribution limit, the excess amount will be considered an overcontribution. This can lead to penalties and taxes. It’s crucial to stay within the limit to avoid any financial repercussions.

Are there any exceptions to the 401(k) contribution limit?

Yes, there are some exceptions. For instance, if you are 50 or older, you can make catch-up contributions, allowing you to contribute more than the regular limit. However, these exceptions have their own specific rules and regulations.

Can I contribute to both a 401(k) and an IRA?

Yes, you can contribute to both a 401(k) and an IRA, as long as you stay within the respective contribution limits for each account.

What is the best way to choose a financial advisor?

When selecting a financial advisor, consider their experience, credentials, and fees. Look for someone who specializes in retirement planning and has a proven track record of success. It’s also important to feel comfortable and confident in their expertise and communication style.