401k contribution limits for 2024 by age sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Planning for retirement can be a complex endeavor, with numerous factors influencing your savings journey.

One crucial aspect is understanding the contribution limits associated with your 401(k) plan, as these limits can significantly impact your retirement nest egg. This guide will explore the 401(k) contribution limits for 2024, taking into account the age-based adjustments and other relevant factors that can affect your savings strategy.

Navigating the world of 401(k)s can be a bit daunting, especially when considering the impact of age-based contribution limits. As you approach retirement, the rules change, and understanding these nuances is essential for maximizing your savings potential. This guide will provide a comprehensive overview of 401(k) contribution limits for 2024, offering insights into the age-related adjustments and other factors that can influence your retirement savings strategy.

Contents List

Age-Based Contribution Limits: 401k Contribution Limits For 2024 By Age

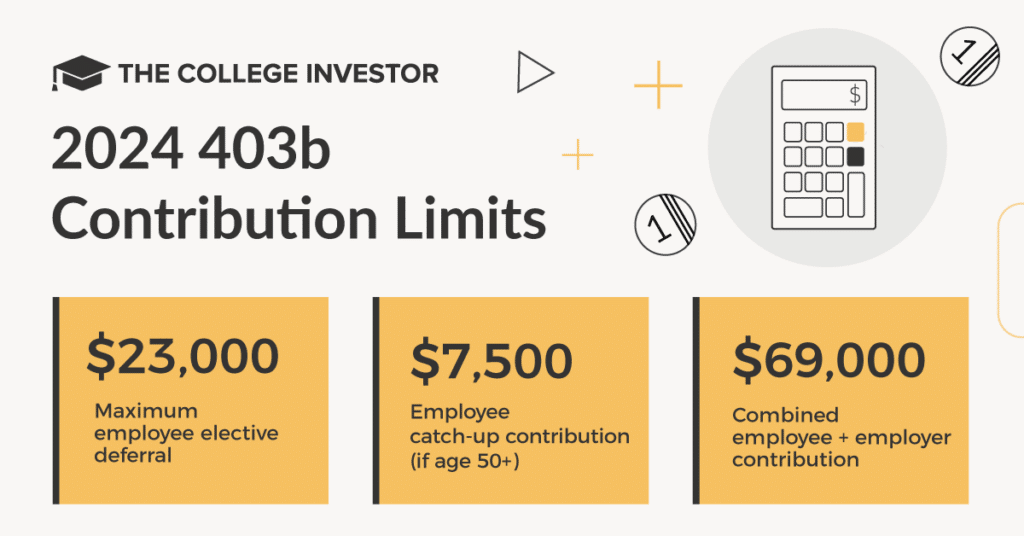

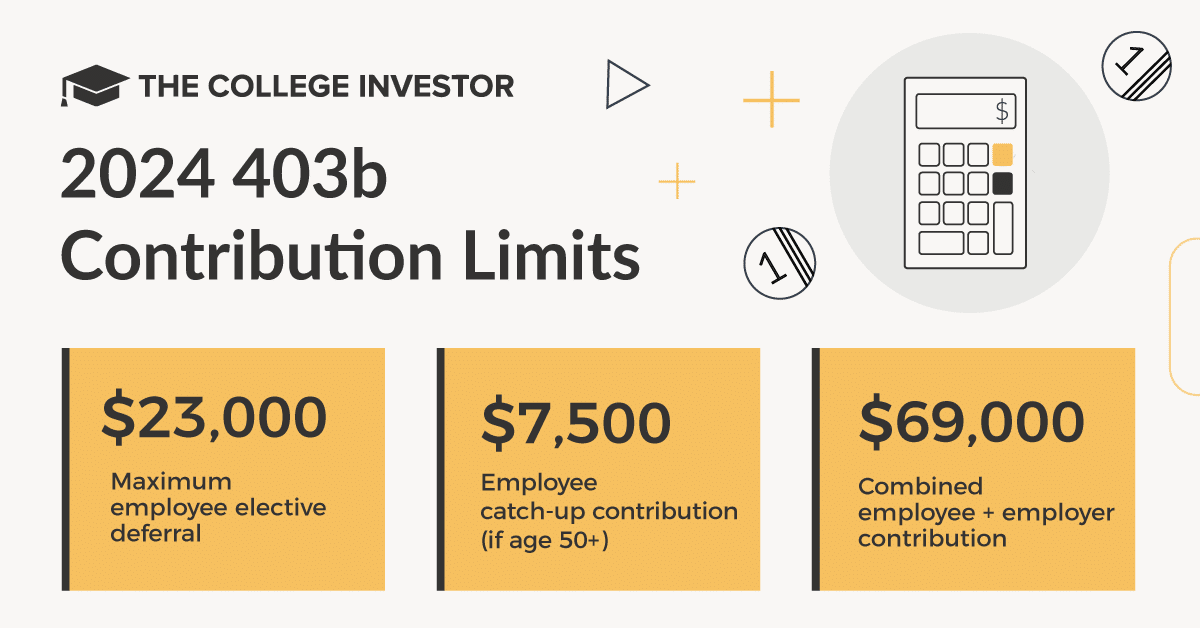

The 2024 contribution limits for 401(k) plans are based on your age. This means that there are different maximum amounts you can contribute to your 401(k) depending on whether you are under 50 or 50 or older. These limits are set by the IRS and are subject to change each year.

It’s always good to be aware of any changes to mileage rates. The October 2024 mileage rate changes could impact your deductions.

Catch-Up Contribution

For individuals aged 50 and above, the IRS allows an additional contribution amount known as the “catch-up” contribution. This provision aims to help older workers make up for lost time in saving for retirement. It allows individuals to contribute more to their 401(k) plans, potentially boosting their retirement savings.

To accurately calculate your mileage deductions, make sure you’re using the correct rate. The standard mileage rate for October 2024 is updated regularly.

2024 Contribution Limits

The following table Artikels the 2024 contribution limits for different age groups:

| Age Group | Employee Contribution Limit | Catch-Up Contribution Limit | Total Contribution Limit |

|---|---|---|---|

| Under 50 | $22,500 | $0 | $22,500 |

| 50 and over | $22,500 | $7,500 | $30,000 |

Implications for Retirement Planning

These contribution limits have significant implications for retirement planning. The higher contribution limits for individuals aged 50 and over can help them accelerate their retirement savings. However, it’s important to note that these limits are just guidelines. Your actual contribution amount should be based on your individual financial situation, retirement goals, and risk tolerance.

The standard deduction changes for 2024 could impact your tax liability, so it’s wise to familiarize yourself with the new guidelines.

It is important to consult with a financial advisor to determine the appropriate contribution amount for your specific circumstances.

If you’re moving, the October 2024 mileage rate for moving expenses can help you calculate your deductions.

Factors Affecting Contribution Limits

While age is a primary factor determining 401(k) contribution limits, other factors can influence how much you can contribute each year. Understanding these factors can help you maximize your retirement savings.

If you’re looking to deduct mileage for business use, you’ll need to know the current rates. The October 2024 mileage rate for business use is updated periodically, so it’s essential to stay informed.

High-Deductible Health Plans

High-deductible health plans (HDHPs) are often paired with health savings accounts (HSAs). These accounts offer tax advantages for both contributions and withdrawals for qualified medical expenses. The IRS allows for a higher contribution limit to a 401(k) if you’re enrolled in an HDHP.

The Seahawks had a close game this week! Check out the Rapid Reactions: Seahawks Comeback Falls Short In Week 5 Loss for a recap.

For 2024, if you have an HDHP, you can contribute up to $24,500 to your 401(k), an additional $1,000 above the standard limit.

If you’re considering a Roth IRA, you’ll want to know the IRA contribution limits for 2024 and Roth IRA to make informed decisions about your retirement savings.

This increased limit is designed to encourage individuals to save for both retirement and healthcare expenses. It’s a valuable perk for those who opt for HDHPs and can help you accelerate your retirement savings.

The tax brackets for 2024 in the United States are a key factor in determining your tax liability.

Employer Matching Contributions

Many employers offer matching contributions to their employees’ 401(k) plans. This means your employer will contribute a certain amount to your account for every dollar you contribute. Matching contributions are often a percentage of your salary, with a maximum limit.

The 401k contribution limits for 2024 by age are a great way to plan your retirement savings strategy.

For example, your employer might match 50% of your contributions up to 6% of your salary.

Small business owners can benefit from understanding the IRA contribution limits for small business owners in 2024 to plan for their retirement.

While employer matching contributions don’t directly impact the overall contribution limit, they effectively increase your retirement savings. If your employer offers a match, take full advantage of it to maximize your returns.

Are you taking advantage of available tax credits? The tax credits for the October 2024 deadline could save you money.

Tax Advantages of 401(k) Contributions

A 401(k) plan offers significant tax advantages that can help you save for retirement. By contributing to a 401(k), you can reduce your taxable income, lower your current tax liability, and potentially grow your savings tax-deferred.

Need to know the current reimbursement rate? The mileage reimbursement rate for October 2024 can help you determine how much you should be reimbursed for business travel.

Pre-Tax vs. Roth Contributions, 401k contribution limits for 2024 by age

There are two main types of 401(k) contributions: pre-tax and Roth. Understanding the differences between these contributions is crucial for making informed decisions about your retirement savings strategy.

If you’re married, the IRA contribution limits for married couples in 2024 can help you maximize your retirement savings.

- Pre-Tax Contributions: With pre-tax contributions, you deduct your contributions from your taxable income before taxes are calculated. This means you pay taxes on your earnings later, when you withdraw them in retirement.

- Roth Contributions: Roth contributions are made with after-tax dollars. This means you pay taxes on your contributions upfront, but your withdrawals in retirement are tax-free.

Tax Implications of Pre-Tax and Roth Contributions

The tax implications of pre-tax and Roth contributions differ significantly, impacting your financial situation both now and in retirement.

The IRS mileage rate for October 2024 is the official rate used for tax purposes.

| Contribution Type | Tax Treatment Now | Tax Treatment in Retirement |

|---|---|---|

| Pre-Tax | Taxes are deferred until retirement. | You will pay taxes on withdrawals in retirement. |

| Roth | You pay taxes on contributions upfront. | Withdrawals in retirement are tax-free. |

Example:Imagine you contribute $10,000 to your 401(k) in a year. If you choose pre-tax contributions, your taxable income will be reduced by $10,000, resulting in lower taxes owed for that year. However, when you withdraw the money in retirement, you’ll pay taxes on the $10,000.

If you choose Roth contributions, you’ll pay taxes on the $10,000 upfront, but your withdrawals in retirement will be tax-free.

Potential Drawbacks of 401(k) Contributions

While 401(k) plans offer significant tax advantages and a path to a comfortable retirement, it’s crucial to understand the potential drawbacks before making substantial contributions. These drawbacks can affect your financial flexibility and potentially impact your retirement savings.

Planning for retirement? The IRA contribution limits for 2024 and beyond are a crucial factor in your retirement savings strategy.

Market Fluctuations and Investment Risk

Investing in the stock market, a common strategy within 401(k) plans, inherently carries the risk of market fluctuations. These fluctuations can negatively impact your retirement savings, especially in the short term. For example, during a market downturn, the value of your investments might decline, potentially eroding your accumulated savings.

Limited Access to Funds Before Retirement

One of the most significant drawbacks of 401(k) plans is the limited access to funds before retirement. While some exceptions exist, such as hardship withdrawals or loans, these options often come with penalties and restrictions.

Early withdrawals from a 401(k) plan are generally subject to a 10% penalty, in addition to your regular income tax rate.

For instance, if you need to access your 401(k) funds before age 59 1/2 for reasons other than a hardship, you might face significant financial consequences.

Epilogue

Understanding the 401(k) contribution limits for 2024 by age is a crucial step towards a secure and comfortable retirement. By carefully planning your contributions and maximizing your savings potential, you can lay the foundation for a financially sound future.

Remember, retirement planning is a journey, and it’s never too early to start. Consult with a financial advisor to tailor a personalized plan that meets your specific needs and goals.

FAQ Section

What is the maximum 401(k) contribution limit for 2024?

The maximum contribution limit for 401(k) plans in 2024 is $22,500.

Can I contribute more to my 401(k) if I’m over 50?

Yes, individuals aged 50 and older can contribute an additional $7,500 as a “catch-up” contribution in 2024, bringing the total contribution limit to $30,000.

How do 401(k) contribution limits differ for Roth vs. traditional contributions?

The contribution limits for both Roth and traditional 401(k) contributions are the same. The difference lies in the tax treatment of the contributions and withdrawals.

Can my employer reduce my 401(k) contribution limit?

No, your employer cannot reduce the 401(k) contribution limit set by the IRS. However, they may have their own matching contribution limits or rules.