What are the penalties for not filing an extension by October 2024? This question is crucial for taxpayers, as the IRS imposes penalties for late filing and payment. While extensions provide temporary relief, failing to meet the extended deadline can lead to significant financial consequences.

Understanding these penalties is essential for navigating the tax system effectively.

The October 2024 deadline applies to various tax forms and situations, including individuals, businesses, and specific tax scenarios. This deadline provides a grace period for those who need more time to prepare their tax returns. However, it’s important to note that extending the filing deadline doesn’t automatically extend the payment deadline.

Failing to pay taxes by the original due date can result in interest and penalties, even if an extension is granted.

Contents List

Understanding the Extension Deadline

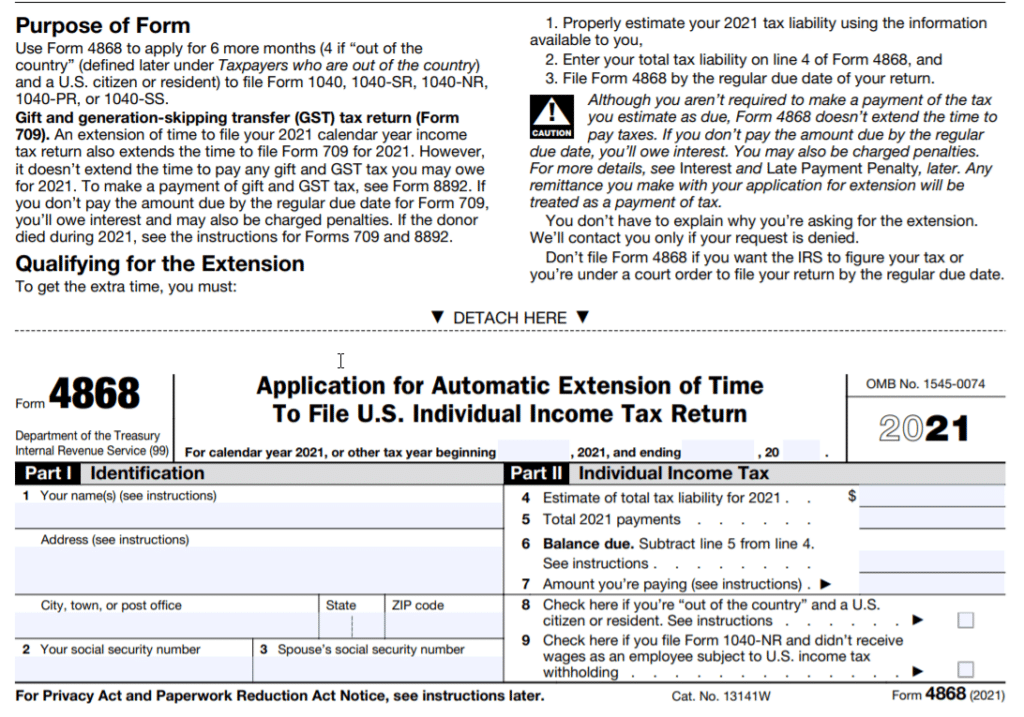

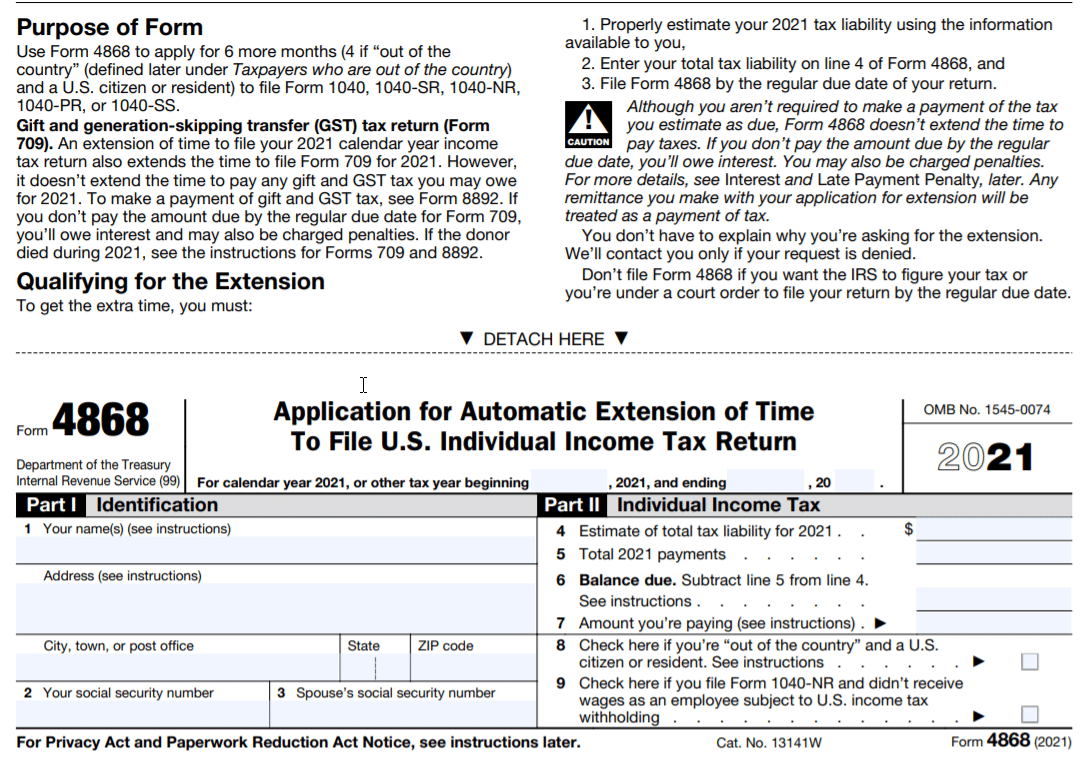

The October 2024 deadline for filing tax extensions is crucial for taxpayers who need additional time to complete their returns. While the standard deadline for filing federal income taxes is typically April 15th, the extension deadline allows taxpayers to postpone filing their returns until October 15th.

Don’t ignore the W9 form deadline! Check out the penalties for non-compliance and make sure you’re following the rules.

This extra time can be invaluable for individuals and businesses facing complex tax situations or needing more time to gather necessary documentation.

Don’t miss the October 2024 deadline for your taxes! Check out the potential penalties if you’re late, and get your paperwork in on time.

Tax Forms and Situations Requiring Extensions

Taxpayers may require extensions for various reasons, including:

- Form 1040:Individuals who need more time to gather all necessary documents, such as W-2s, 1099s, and other income statements, may request an extension to file their Form 1040.

- Form 1040-X:Individuals who are filing amended tax returns to correct errors or omissions on their original returns may need an extension to ensure they have all the necessary information.

- Form 1041:Estates and trusts that require additional time to finalize their financial statements or determine beneficiaries may need an extension to file their Form 1041.

- Form 1120:Corporations that have complex financial structures or require more time to compile their financial data may request an extension to file their Form 1120.

- Form 1065:Partnerships that need additional time to finalize their financial statements or distribute income and expenses among partners may need an extension to file their Form 1065.

Situations Where Extensions Are Granted

Taxpayers are often granted extensions if they can demonstrate a legitimate reason for needing additional time. Common reasons include:

- Missing Documentation:If taxpayers are missing critical documents, such as W-2s, 1099s, or other income statements, they may request an extension to allow time to obtain these documents.

- Complex Tax Situations:Taxpayers facing complex tax situations, such as those involving international income, foreign trusts, or significant business transactions, may need more time to complete their returns.

- Natural Disasters or Other Unexpected Events:Taxpayers who have experienced natural disasters, serious illnesses, or other unexpected events that have disrupted their ability to file their taxes may be granted an extension.

- Military Service:Individuals serving in the military may be granted an extension for filing their taxes if they are deployed or stationed overseas.

Penalties for Late Filing

If you fail to file an extension by October 2024, you could face penalties. These penalties are designed to encourage taxpayers to meet their filing obligations on time.

Don’t let your part-time status limit your retirement savings. Learn about IRA contribution limits for part-time workers in 2024 and start building your nest egg.

Failure to Pay Penalty

The failure to pay penalty applies when you owe taxes and do not pay them by the due date, even if you file your return on time. This penalty is calculated on a monthly basis, and it is charged on the unpaid balance of your tax liability.

The penalty is calculated at a rate of 0.5% of the unpaid amount for each month or part of a month that the tax remains unpaid.

Want to know where you fall in the tax bracket system? Use this tax bracket calculator for 2024 and get a better understanding of your tax obligations.

Exceeding IRA contribution limits can lead to penalties. Learn about the potential penalties and avoid any unwanted surprises.

For example, if you owe $10,000 in taxes and do not pay them by the due date, you will be charged a penalty of $50 for the first month. The penalty will continue to accrue until you pay the full amount of taxes owed.

If you’re over 50, you can contribute more to your 401k. Find out the maximum 401k contribution for 2024 for those over 50 and boost your retirement savings.

Failure to File Penalty

The failure to file penalty is assessed when you do not file your tax return by the due date, even if you do not owe any taxes. This penalty is calculated on a daily basis, and it is charged on the unpaid balance of your tax liability.

If you’re a foreign entity, you’ll need to file a W9 form by October 2024. Learn more about the requirements and make sure you’re following the rules.

The penalty is calculated at a rate of 0.5% of the unpaid amount for each month or part of a month that the tax remains unpaid.

For example, if you owe $10,000 in taxes and do not file your return by the due date, you will be charged a penalty of $50 for the first month. The penalty will continue to accrue until you file your return.

Tax brackets can make a big difference in how much you owe. See how the 2024 tax brackets could affect your income and plan accordingly.

Factors Influencing Penalties

The severity of penalties for failing to file an extension by the October 2024 deadline can vary based on several factors. The IRS considers several factors when determining the amount of penalties, including the amount of unpaid taxes and the taxpayer’s circumstances.

If you’re a corporation, you’ll need to file a W9 form by October 2024. Get the details on the requirements and make sure you’re compliant.

Mitigating Circumstances, What are the penalties for not filing an extension by October 2024

The IRS may consider mitigating circumstances when assessing penalties. These circumstances can include situations beyond the taxpayer’s control, such as:

- A serious illness or death in the family

- A natural disaster that affected the taxpayer’s ability to file

- A significant change in the taxpayer’s financial situation

- A delay caused by the IRS itself

If the IRS finds that the taxpayer had reasonable cause for not filing an extension, they may waive the penalty.

Wondering how much you can contribute to your IRA in 2024? Find out the limits here and make the most of your retirement savings.

Penalty Waivers or Abatements

Taxpayers can request a penalty waiver or abatement from the IRS. To be successful, taxpayers must provide sufficient documentation to support their claim. For example, they may need to provide medical records, proof of a natural disaster, or other evidence to demonstrate that they had reasonable cause for not filing an extension.

The standard deduction can save you money on your taxes. Learn how to claim the standard deduction on your 2024 taxes and maximize your refund.

Avoiding Penalties

Navigating the complexities of tax filing can be challenging, especially when it comes to extensions. However, understanding the intricacies of the process and implementing effective strategies can help taxpayers avoid penalties for late filing. This section Artikels key steps to ensure timely compliance with tax obligations.

The W9 form is important for tax purposes, and the deadline for filing is October 2024. Get the details on the deadline here and make sure you’re compliant.

Strategies to Avoid Penalties

To avoid penalties for late filing, taxpayers should take proactive steps to ensure their tax obligations are met within the stipulated deadlines. This includes:

- File an Extension on Time:The first and most crucial step is to file an extension by the original due date, which is typically April 15th. Filing an extension does not extend the time to pay taxes, but it provides an additional six months to file the return.

If you’re self-employed, you might be wondering about IRA contribution limits for your solo 401k. Find out the details here and start saving for your future.

This gives taxpayers more time to gather necessary documentation and complete their tax calculations.

- Keep Accurate Records:Maintaining accurate records of income, expenses, and deductions is essential. This includes receipts, invoices, bank statements, and any other relevant documentation. Accurate record-keeping simplifies the tax filing process and reduces the risk of errors that could lead to penalties.

Looking to maximize your retirement savings? Check out the 401k limits for 2024 for those over 50 and start planning your future.

- Estimate Tax Liability Accurately:Taxpayers should make a reasonable estimate of their tax liability throughout the year and make timely payments to avoid penalties for underpayment. This can be done by using IRS withholding tables or making estimated tax payments.

- Seek Professional Guidance:If taxpayers are unsure about their tax obligations or find the process overwhelming, seeking professional guidance from a qualified tax advisor is highly recommended. Tax professionals can provide expert advice, ensure compliance with tax laws, and help minimize the risk of penalties.

Wondering if the mileage rate is changing in October 2024? Find out here and make sure you’re claiming the right amount on your taxes.

Tips for Timely Filing of Extensions

Timely filing of extensions is crucial to avoid penalties. Taxpayers should follow these tips to ensure they meet the deadlines:

- Plan Ahead:Don’t wait until the last minute to file an extension. Plan ahead and gather all the necessary documents well in advance.

- Use Electronic Filing:Electronic filing is faster and more efficient than paper filing. This method reduces the risk of errors and ensures timely submission.

- Confirm Filing:After filing the extension, confirm its receipt by contacting the IRS or checking the status online. This ensures that the extension was filed correctly and on time.

Seeking Professional Assistance

Seeking professional assistance from a qualified tax advisor can significantly reduce the risk of penalties and ensure compliance with tax laws. Tax professionals can provide:

- Expert Advice:Tax advisors can offer expert guidance on tax obligations, deductions, and credits, helping taxpayers maximize their tax benefits and avoid penalties.

- Accurate Tax Preparation:Tax professionals are trained to prepare accurate tax returns, minimizing the risk of errors and penalties.

- Representation During Audits:In the event of an audit, tax professionals can represent taxpayers and advocate for their interests, ensuring a fair and accurate outcome.

Final Wrap-Up

Navigating the tax system can be complex, and understanding the consequences of late filing is crucial. By understanding the penalties associated with missing the October 2024 extension deadline, taxpayers can take proactive steps to avoid financial repercussions. Remember, timely filing and payment are essential for maintaining compliance and avoiding potential penalties.

Consulting a tax professional can provide valuable guidance and ensure you are fully informed about your obligations.

Top FAQs: What Are The Penalties For Not Filing An Extension By October 2024

What happens if I can’t afford to pay the taxes by the extension deadline?

If you can’t afford to pay the taxes by the extension deadline, you can request a payment plan from the IRS. This allows you to pay off your tax liability in installments. However, interest and penalties may still apply.

What are the penalties for not filing an extension if I owe no taxes?

Even if you don’t owe taxes, failing to file an extension by the deadline can result in penalties. The IRS may assess a penalty for failure to file, which is typically a percentage of the unpaid taxes.

Can I file an extension online?

Yes, you can file an extension online using tax preparation software or through the IRS website. However, it’s important to ensure you are using a reputable and secure platform.