What is the Roth IRA contribution limit for 2024? This question is on the minds of many Americans looking to save for retirement. A Roth IRA allows you to contribute after-tax dollars, which can grow tax-free, and eventually be withdrawn tax-free in retirement.

It’s a powerful tool for building wealth and securing your financial future.

Understanding the contribution limits and eligibility requirements is crucial to maximizing the benefits of a Roth IRA. This article will delve into the specifics of the 2024 contribution limit, including how it affects individuals and couples, as well as potential changes.

We’ll also explore the income limitations and the advantages of contributing to a Roth IRA, giving you a comprehensive understanding of this valuable retirement savings option.

Contents List

Roth IRA Contribution Limit for 2024

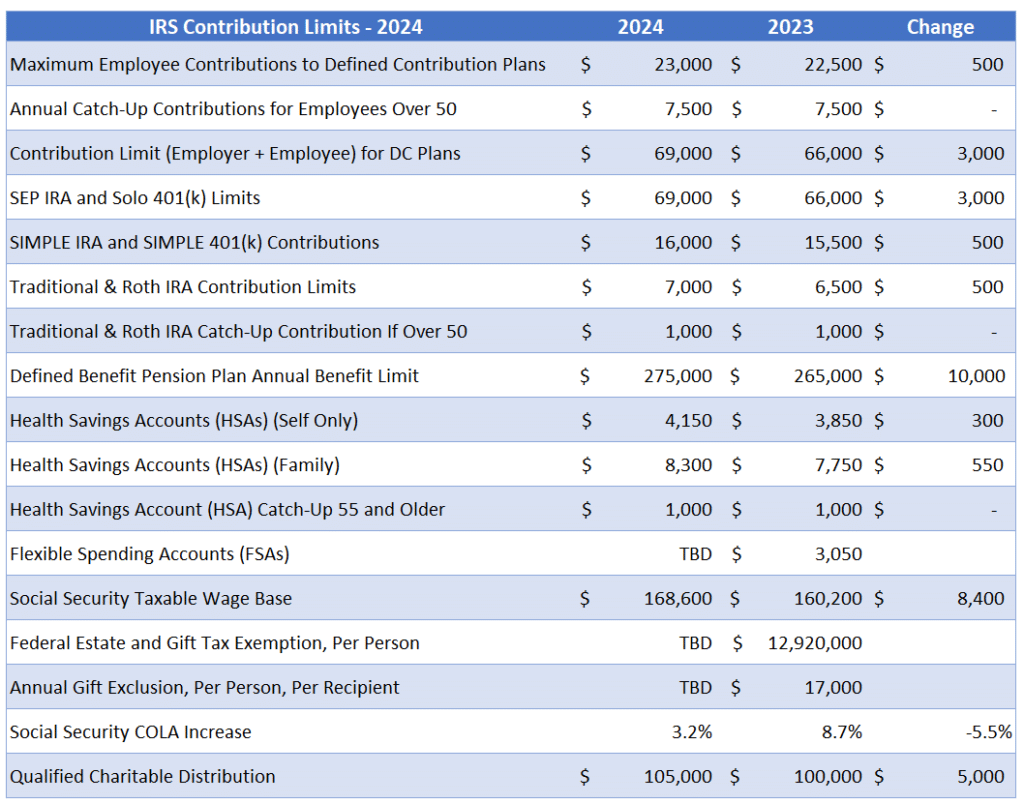

The Roth IRA contribution limit for 2024 is the maximum amount of money that individuals and couples can contribute to their Roth IRA accounts in a given year. These limits are set by the IRS and are subject to change each year.

Understanding the contribution limits for traditional 401ks is crucial for retirement planning. This article explains the 401k contribution limits for 2024 for traditional 401ks.

Roth IRA Contribution Limit for Individuals in 2024, What is the Roth IRA contribution limit for 2024

The Roth IRA contribution limit for individuals in 2024 is $7,000. This means that individuals can contribute up to $7,000 to their Roth IRA accounts in 2024.

Roth IRA Contribution Limit for Couples Filing Jointly in 2024

The Roth IRA contribution limit for couples filing jointly in 2024 is $14,000. This means that couples can contribute up to $14,000 to their Roth IRA accounts in 2024.

Potential Changes to the Roth IRA Contribution Limit in 2024

The Roth IRA contribution limit is subject to change each year. It is possible that the IRS could adjust the contribution limit for 2024. However, as of right now, there are no official announcements or proposals regarding any changes to the contribution limit.

The IRS typically announces any changes to the contribution limit in the fall of the year prior to the year in question.

Eligibility for Roth IRA Contributions

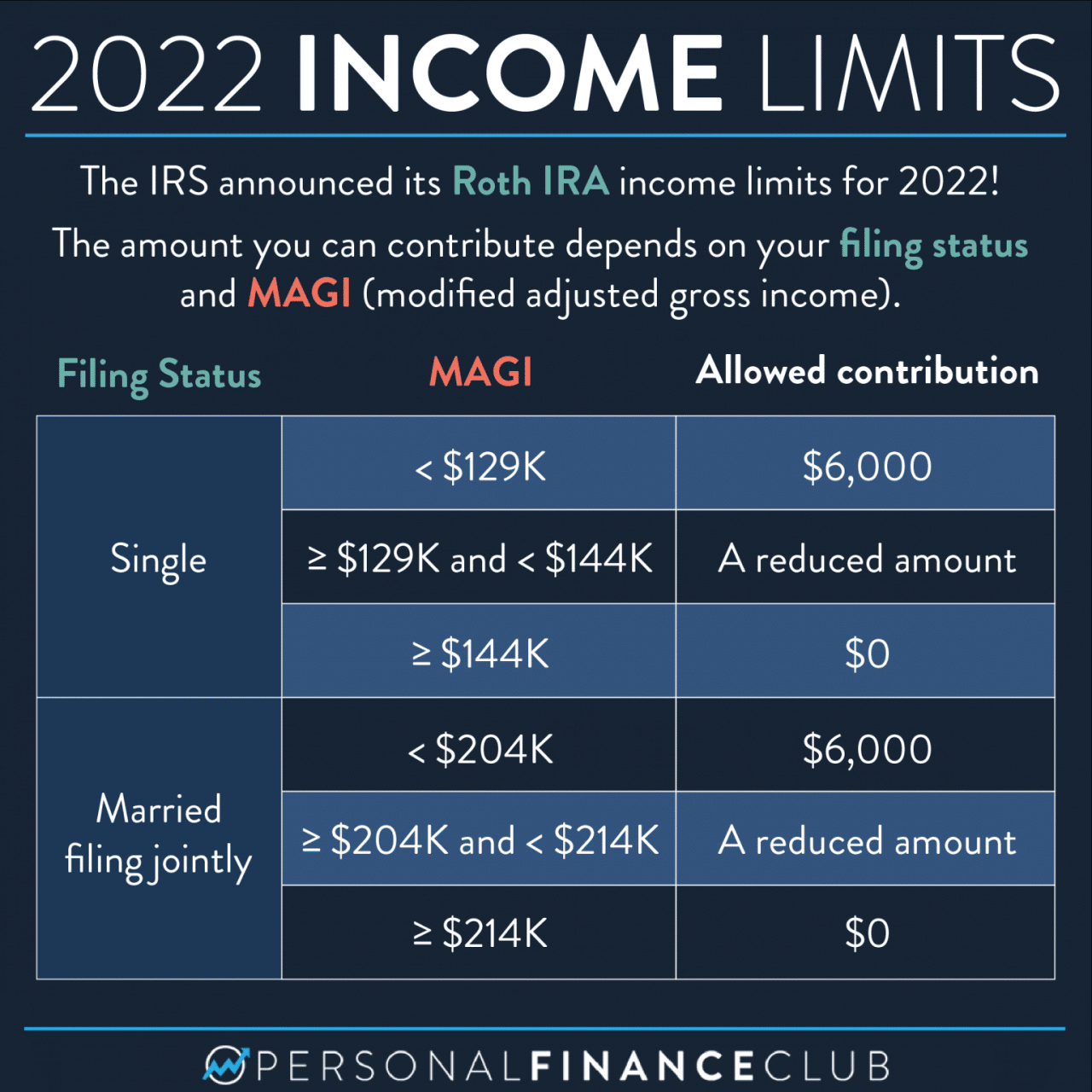

While anyone can open a Roth IRA, not everyone is eligible to make contributions. The IRS sets income limits that determine who can contribute to a Roth IRA.

Modified Adjusted Gross Income (MAGI)

To determine Roth IRA eligibility, the IRS uses a metric called Modified Adjusted Gross Income (MAGI). MAGI is your adjusted gross income (AGI) with certain adjustments added back in. These adjustments vary depending on your filing status and can include deductions for things like student loan interest and contributions to traditional IRAs.

Students often have unique tax situations. This article explains the standard deduction for students in 2024 to help you understand your options.

Income Limits for Roth IRA Contributions in 2024

The MAGI thresholds for Roth IRA contributions in 2024 are as follows:

| Filing Status | MAGI Limit |

|---|---|

| Single Filers | $153,000 |

| Married Filing Jointly | $228,000 |

| Head of Household | $186,000 |

| Qualifying Widow(er) | $228,000 |

If your MAGI is above these limits, you cannot contribute to a Roth IRA. However, if your MAGI falls below the threshold, you can contribute the full amount, which is $7,000 in 2024.

If you’re filing as head of household, it’s important to know your standard deduction. This article details the standard deduction for head of household in 2024.

If your MAGI is between the limit and the phase-out range, you may be able to contribute a reduced amount to your Roth IRA.

Advantages of Roth IRA Contributions

The Roth IRA offers several advantages, making it a popular retirement savings option for many individuals. These benefits stem from the unique tax treatment of Roth IRA contributions and withdrawals.

Tax-Free Withdrawals in Retirement

One of the most significant advantages of Roth IRA contributions is the potential for tax-free withdrawals in retirement. Unlike traditional IRAs, where withdrawals are taxed in retirement, Roth IRA withdrawals are tax-free if certain conditions are met. This means you can enjoy your retirement savings without having to pay taxes on them, potentially leading to a larger nest egg.

SEP IRAs offer retirement savings options for self-employed individuals. This article details the IRA contribution limits for SEP IRAs in 2024.

For withdrawals to be tax-free, you must have held the Roth IRA for at least five years and be at least 59 1/2 years old.

Figuring out how your income will be affected by tax brackets in 2024 can be a bit confusing, but it’s important to understand. Check out this article on how tax brackets will affect your 2024 income to get a clearer picture of what to expect.

Comparison to Traditional IRA Contributions

Traditional IRA contributions are tax-deductible, meaning you can deduct your contributions from your taxable income, potentially lowering your tax bill in the present. However, you’ll need to pay taxes on withdrawals in retirement. In contrast, Roth IRA contributions are not tax-deductible, but withdrawals in retirement are tax-free.

Non-profit organizations need to stay on top of tax deadlines. If you’re a non-profit, this article details the tax extension deadline in October 2024 for non-profit organizations.

- Traditional IRA:Tax-deductible contributions, taxable withdrawals in retirement.

- Roth IRA:Non-deductible contributions, tax-free withdrawals in retirement.

The best option for you depends on your individual circumstances, such as your current tax bracket, expected tax bracket in retirement, and your financial goals.

Considerations for Roth IRA Contributions

Before diving into the specifics of Roth IRA contributions, it’s essential to understand the potential benefits and drawbacks associated with this retirement savings strategy.

Freelancers need to stay on top of tax forms. This article provides information on the W9 Form in October 2024 for freelancers.

Contribution Limits

Here’s a table comparing the Roth IRA contribution limits for 2024 and 2023:| Year | Contribution Limit ||—|—|| 2024 | $7,000 || 2023 | $6,500 |The contribution limit is higher in 2024, allowing individuals to save more for retirement.

Those over 50 have the option to make catch-up contributions. This article explains the 401k contribution limit for 2024 for those over 50.

Potential Downsides of Roth IRA Contributions

While Roth IRAs offer tax-free withdrawals in retirement, there are some potential downsides to consider:

- Limited Income Eligibility:If your income exceeds certain thresholds, you may not be able to contribute to a Roth IRA or may face a phase-out of your contributions. For 2024, the phase-out range for single filers is $153,000 to $168,000, and for married couples filing jointly, it’s $228,000 to $243,000.

Catch-up contributions can help you maximize your retirement savings. This article answers the question of whether there’s a catch-up contribution limit for IRAs in 2024.

This means that high-income earners may not be able to take advantage of Roth IRA contributions.

- Opportunity Cost:Contributing to a Roth IRA means you’re foregoing the potential to invest that money elsewhere, such as in taxable accounts. If you believe you’ll be in a lower tax bracket in retirement, a traditional IRA might be a better option, as you can deduct your contributions now and pay taxes on withdrawals later.

When donating to charity, you can deduct mileage expenses. This article explains the October 2024 mileage rate for charitable donations so you can claim the right amount.

- Taxable Withdrawals Before Age 59 1/2:While Roth IRA withdrawals are tax-free in retirement, withdrawals before age 59 1/2 are generally subject to both income tax and a 10% penalty, unless you qualify for an exception. This is important to keep in mind if you need to access your retirement savings early.

Decision-Making Process for Choosing Between a Roth IRA and a Traditional IRA

Here’s a flowchart to help you decide between a Roth IRA and a Traditional IRA: Start1. Are you in a high tax bracket now?* Yes:Consider a Traditional IRA, as you can deduct your contributions now and pay taxes later.

Knowing the tax bracket thresholds is key to understanding how much you’ll pay in taxes. This resource provides information on the tax bracket thresholds for 2024.

No

If you’re contributing to a 401k, it’s important to know the limits. This article explains how much you can contribute to your 401k in 2024.

If you’re looking to maximize your retirement savings, it’s essential to know the 401k contribution limits. For those looking to catch up, this article covers the 401k contribution limits for 2024 for catch-up contributions.

Consider a Roth IRA, as your withdrawals will be tax-free in retirement. 2. Do you expect to be in a lower tax bracket in retirement?* Yes:Consider a Traditional IRA, as you’ll pay taxes on withdrawals at a lower rate.

No

Consider a Roth IRA, as your withdrawals will be tax-free. 3. Do you need to access your retirement savings early?* Yes:Consider a Traditional IRA, as withdrawals before age 59 1/2 are generally tax-deductible and penalty-free for certain reasons.

Maximize your retirement savings by understanding the IRA contribution limits. This article explains how much you can contribute to your IRA in 2024.

No

Consider a Roth IRA, as your withdrawals will be tax-free in retirement. End

Planning for retirement involves understanding IRA contribution limits. This article explains the IRA contribution limits for 2024 to help you make informed decisions.

Additional Information

This section delves into additional resources and examples to help you better understand the benefits and potential impact of Roth IRA contributions.

Resources for Further Information

To explore the nuances of Roth IRA contributions further, consider these resources:

- Internal Revenue Service (IRS):The IRS website offers comprehensive information on Roth IRAs, including eligibility requirements, contribution limits, and tax implications. You can access IRS publications, forms, and FAQs on their website.

- Financial Professionals:Consult with a qualified financial advisor or tax professional to get personalized advice tailored to your specific financial situation. They can help you determine if a Roth IRA is right for you and guide you through the contribution process.

- Financial Websites and Publications:Websites and publications dedicated to personal finance, such as Investopedia, NerdWallet, and The Balance, provide valuable insights into Roth IRAs and retirement planning.

Scenarios Where Roth IRA Contributions May Be Beneficial

Here are examples of scenarios where contributing to a Roth IRA might be advantageous:

- Individuals Expecting Higher Income in Retirement:If you anticipate earning a higher income in retirement, a Roth IRA can provide tax-free withdrawals, which can be beneficial in lower tax brackets.

- Individuals Concerned About Future Tax Rate Increases:If you’re concerned about potential future tax rate increases, a Roth IRA can help you lock in current tax rates and avoid paying higher taxes on your retirement savings.

- Individuals with High Current Income:If you have a high income, a Roth IRA can be a valuable tool for reducing your tax liability in the present while building tax-free retirement savings.

- Individuals Seeking Flexibility in Retirement:Roth IRA withdrawals are tax-free, providing flexibility in retirement as you can access your savings without worrying about tax consequences.

Potential Impact of Roth IRA Contributions on Retirement Planning

Contributing to a Roth IRA can have a significant impact on your retirement planning:

- Tax-Free Growth:Your contributions grow tax-free within the Roth IRA, allowing your savings to compound faster without being eroded by taxes.

- Tax-Free Withdrawals in Retirement:When you withdraw your contributions and earnings in retirement, they are tax-free, potentially boosting your retirement income and reducing your overall tax burden.

- Long-Term Financial Security:Regular Roth IRA contributions can help you build a substantial retirement nest egg, providing financial security and peace of mind during your golden years.

Ultimate Conclusion

The Roth IRA contribution limit for 2024 is a key factor to consider when planning your retirement savings strategy. By understanding the limits, eligibility requirements, and the tax benefits of contributing to a Roth IRA, you can make informed decisions about your financial future.

Whether you’re just starting your savings journey or are looking to optimize your existing retirement plan, a Roth IRA can be a valuable tool for building a secure and comfortable retirement. Don’t hesitate to consult with a financial advisor to discuss your specific situation and determine if a Roth IRA is the right choice for you.

FAQ Corner: What Is The Roth IRA Contribution Limit For 2024

What are the income limitations for Roth IRA contributions in 2024?

The income limitations for Roth IRA contributions in 2024 vary based on your filing status. If your modified adjusted gross income (MAGI) exceeds certain thresholds, you may not be able to contribute to a Roth IRA or your contribution amount may be limited.

What is the difference between a Roth IRA and a traditional IRA?

The main difference between a Roth IRA and a traditional IRA is the timing of the tax benefits. With a Roth IRA, you contribute after-tax dollars, and your withdrawals in retirement are tax-free. With a traditional IRA, you contribute pre-tax dollars, and your withdrawals in retirement are taxed.

What are some examples of different scenarios where contributing to a Roth IRA may be beneficial?

Contributing to a Roth IRA can be beneficial for individuals who expect to be in a higher tax bracket in retirement, those who want to avoid future tax liability on their retirement savings, and those who are looking for a tax-advantaged way to save for a down payment on a home or other major life expenses.