Lakeview Loancare stands as a prominent player in the financial services industry, offering a diverse range of loan solutions tailored to meet the unique needs of individuals and businesses. Established with a commitment to providing exceptional customer experiences and fostering financial well-being, Lakeview Loancare has become a trusted name in the loan market.

Looking for the best VA mortgage rates? You’ve come to the right place! VA Mortgage Rates are designed specifically for veterans and active-duty military personnel, offering competitive rates and flexible terms.

This comprehensive guide delves into the company’s history, core offerings, customer service practices, and industry landscape, providing valuable insights into its operations and impact.

Looking for a personal loan from American Express? American Express Personal Loans offer competitive rates and flexible terms, making them a great option for borrowers with good credit.

From mortgage loans to personal loans and business financing, Lakeview Loancare caters to a wide spectrum of borrowers, offering competitive rates, flexible terms, and personalized support. The company’s commitment to transparency and ethical lending practices has earned it a reputation for reliability and integrity.

In need of a loan but don’t know where to start? Need A Loan is a great resource for finding the right loan for your situation. From personal loans to business loans, you can find a wide range of options to meet your needs.

With a focus on innovation and technological advancements, Lakeview Loancare continually strives to enhance its services and provide seamless digital experiences for its customers.

Want to see what rates Third Federal is offering? Third Federal Mortgage Rates can give you a good idea of what to expect when shopping for a mortgage. Remember to compare rates from multiple lenders to find the best deal.

Contents List

Lakeview Loancare: Company Overview

Lakeview Loancare is a leading provider of mortgage servicing and origination solutions. Established in 1997, the company has grown significantly over the years, becoming a trusted name in the financial services industry.

Looking to improve your credit score? Creditninja can help you understand your credit report, track your progress, and develop a plan to improve your credit score.

History

Lakeview Loancare was founded in 1997 by a group of experienced mortgage professionals with a vision to provide high-quality, innovative solutions to the mortgage industry. The company started as a small operation, focusing primarily on mortgage servicing. However, through strategic growth and a commitment to customer satisfaction, Lakeview Loancare expanded its services to include origination, default management, and other related services. Lakeview Loancare’s core business activities revolve around providing comprehensive mortgage solutions to borrowers, lenders, and investors. The company’s services encompass the entire mortgage lifecycle, from origination to servicing and default management. Lakeview Loancare offers a wide range of services, including:

- Mortgage Servicing

- Mortgage Origination

- Default Management

- Loan Administration

- Technology Solutions

Lakeview Loancare’s mission statement emphasizes its commitment to providing exceptional service, innovative solutions, and a customer-centric approach. The company’s core values include integrity, accountability, teamwork, and a passion for excellence.Lakeview Loancare is a large-scale operation with a significant presence in the mortgage industry. The company employs a substantial workforce and operates across multiple locations. Its scope of operations extends to servicing a vast portfolio of mortgage loans.

Ready to buy your dream home? Best Home Loans can help you find the perfect mortgage for your needs. Compare rates, terms, and lenders to find the best deal for your unique situation.

Lakeview Loancare: Products and Services

Lakeview Loancare offers a comprehensive suite of mortgage products and services tailored to meet the diverse needs of its customers.

Want to find the best mortgage deals? Mortgage Deals are constantly changing, so it’s important to shop around and compare rates from multiple lenders. You can also find special offers and promotions through online mortgage marketplaces.

Loan Types

Lakeview Loancare specializes in a variety of loan types, including:

- Conventional Loans

- FHA Loans

- VA Loans

- USDA Loans

- Jumbo Loans

The company offers a range of loan programs, each designed to cater to specific borrower profiles and financial situations. These programs include:

- Fixed-Rate Mortgages

- Adjustable-Rate Mortgages (ARMs)

- Conforming Loans

- Non-Conforming Loans

- Refinance Loans

Lakeview Loancare’s loan products are designed to serve a diverse target audience, including:

- First-time homebuyers

- Existing homeowners seeking to refinance

- Investors seeking to purchase rental properties

- Individuals with unique financial circumstances

Lakeview Loancare’s loan programs offer various benefits and features, such as:

- Competitive interest rates

- Flexible loan terms

- Low closing costs

- Personalized customer service

- Streamlined application process

| Loan Type | Interest Rate | Loan Term | Down Payment ||—|—|—|—|| Conventional Loan | Variable | 15-30 years | 3-20% || FHA Loan | Fixed | 15-30 years | 3.5% || VA Loan | Fixed | 15-30 years | 0% || USDA Loan | Fixed | 15-30 years | 0% || Jumbo Loan | Variable | 15-30 years | 20% |

Want to find the best rates for a house loan? House Loan Interest Rates vary depending on the lender, your credit score, and other factors. Shopping around and comparing rates from multiple lenders is essential to find the best deal.

Lakeview Loancare: Customer Experience

Lakeview Loancare is committed to providing a positive and seamless customer experience.

Want to find the lowest personal loan interest rates? Lowest Personal Loan Interest Rate can help you compare rates from different lenders to find the best deal. Remember to check your credit score before applying for a loan, as this can impact the interest rate you qualify for.

Customer Testimonials and Reviews, Lakeview Loancare

Customer testimonials and reviews consistently praise Lakeview Loancare for its exceptional service, responsiveness, and commitment to customer satisfaction. Many borrowers highlight the company’s knowledgeable and friendly staff, efficient processes, and clear communication.Lakeview Loancare prioritizes customer service and has implemented comprehensive practices and policies to ensure a positive experience for all borrowers. These include:

- 24/7 customer support

- Dedicated account managers

- Transparent communication

- Personalized solutions

Lakeview Loancare has streamlined its loan application process to make it convenient and efficient for borrowers. The application process typically involves:

- Pre-approval

- Loan application submission

- Documentation review

- Loan approval

- Loan closing

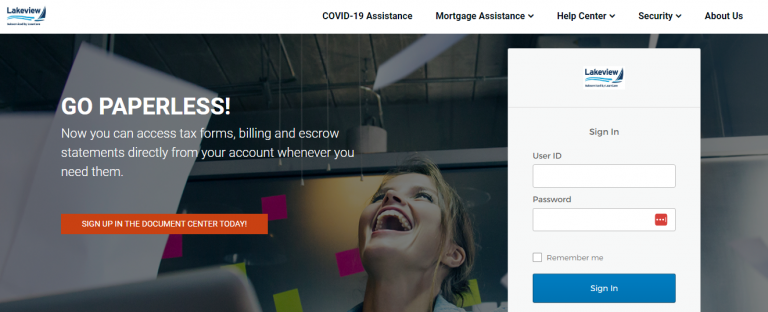

The approval timeline can vary depending on the complexity of the loan and the borrower’s financial situation. However, Lakeview Loancare strives to provide timely approvals and a smooth closing process.Lakeview Loancare’s website is user-friendly and provides comprehensive information about its products, services, and company.

Planning to build your dream home? Construction Loans provide the financing you need to cover the costs of building your new home. These loans typically cover the cost of labor, materials, and land, allowing you to build your dream home without breaking the bank.

The website features a secure online application portal, resources for borrowers, and a blog with informative articles and industry updates. Lakeview Loancare offers multiple communication channels to ensure seamless interaction with its customers. These include:

- Phone

- Live chat

- Social media

Lakeview Loancare: Industry Landscape

Lakeview Loancare operates in a dynamic and competitive mortgage industry.

Looking for a flexible way to access your home equity? Heloc (Home Equity Line of Credit) allows you to borrow against your home’s value, providing you with a revolving line of credit that you can use for a variety of purposes.

Comparison with Competitors

Lakeview Loancare competes with numerous other mortgage providers, including national banks, regional lenders, and online mortgage companies. The company differentiates itself through its focus on customer service, innovative solutions, and a commitment to providing a seamless borrowing experience.The mortgage industry is constantly evolving, driven by factors such as interest rate fluctuations, regulatory changes, and technological advancements. Lakeview Loancare navigates these trends and challenges by embracing innovation, adapting to changing market conditions, and prioritizing customer needs.The mortgage industry is subject to a complex regulatory environment, with laws and regulations designed to protect borrowers and ensure fair lending practices. Lakeview Loancare adheres to all applicable regulations and maintains a strong compliance program.Lakeview Loancare is well-positioned for continued growth in the mortgage industry. The company is exploring opportunities in areas such as:

- Expanding its technology solutions

- Developing new loan products

- Entering new markets

| Year | Event ||—|—|| 1997 | Lakeview Loancare is founded || 2000 | The company expands its services to include mortgage origination || 2008 | Lakeview Loancare navigates the financial crisis and strengthens its operations || 2015 | The company launches its online application portal || 2020 | Lakeview Loancare adapts to the COVID-19 pandemic and implements remote work solutions |

Need a loan for a high-value property? Jumbo Loans are designed for borrowers who need to finance amounts exceeding standard loan limits. They offer competitive rates and flexible terms, making them a great option for luxury homes or investment properties.

Lakeview Loancare: Financial Performance

Lakeview Loancare has consistently demonstrated strong financial performance.

Need a little extra cash on top of your existing loan? A Top Up Loan can help you borrow additional funds on top of your existing loan. This can be a great option if you need extra money for unexpected expenses or to make home improvements.

Financial Overview

Lakeview Loancare generates revenue primarily through mortgage servicing fees, origination fees, and other related services. The company has a track record of profitability and has consistently invested in its growth and expansion.Lakeview Loancare’s revenue streams are diversified, with a significant portion coming from mortgage servicing fees. The company’s profitability is driven by its efficient operations, strong risk management practices, and a focus on customer satisfaction.Lakeview Loancare’s financial performance is measured by various key metrics, including:

- Return on equity (ROE)

- Return on assets (ROA)

- Debt-to-equity ratio

- Earnings per share (EPS)

Lakeview Loancare has made strategic investments and acquisitions to enhance its capabilities and expand its reach. These include investments in technology platforms, acquisitions of smaller mortgage servicing companies, and partnerships with other financial institutions.[Insert a chart illustrating Lakeview Loancare’s financial performance over time]

Shopping for a new car? Capital One Auto Navigator makes the process simple and stress-free. With their user-friendly platform, you can compare loan options, get pre-approved financing, and even find your dream car all in one place.

Final Thoughts

In conclusion, Lakeview Loancare emerges as a leading provider of loan solutions, demonstrating a steadfast commitment to customer satisfaction and financial empowerment. Its diverse product portfolio, combined with its unwavering focus on transparency and ethical practices, positions the company as a trusted partner for individuals and businesses seeking financing options.

In a bind and need money now? I Need Money Now is a great resource for finding quick and easy loan options. Whether you need a personal loan, payday loan, or something else, you can find a solution here.

As the financial landscape continues to evolve, Lakeview Loancare remains at the forefront, embracing innovation and adapting to the changing needs of its customers.

FAQ Summary

What is Lakeview Loancare’s mission statement?

Lakeview Loancare’s mission is to empower individuals and businesses to achieve their financial goals by providing accessible, responsible, and innovative loan solutions.

How does Lakeview Loancare ensure customer satisfaction?

Lakeview Loancare prioritizes customer satisfaction through personalized service, transparent communication, and a commitment to resolving any issues promptly and effectively.

What are the eligibility requirements for a Lakeview Loancare loan?

Eligibility requirements vary depending on the specific loan product. However, generally, applicants must meet certain credit score, income, and debt-to-income ratio criteria.

What are the interest rates for Lakeview Loancare loans?

Interest rates for Lakeview Loancare loans are determined based on factors such as the loan type, loan amount, credit score, and current market conditions. You can find more detailed information on their website or by contacting their customer service team.