What is the Roth IRA income limit for 2024? This question is on the minds of many individuals looking to save for retirement, as the Roth IRA offers tax-free withdrawals in retirement. While this popular retirement savings option is attractive, income limits can affect your eligibility to contribute.

The Roth IRA, known for its tax-free withdrawals in retirement, is a valuable tool for those looking to build their retirement nest egg. However, the IRS sets income limits that determine who can fully contribute to a Roth IRA. Understanding these limits is crucial for maximizing your retirement savings potential.

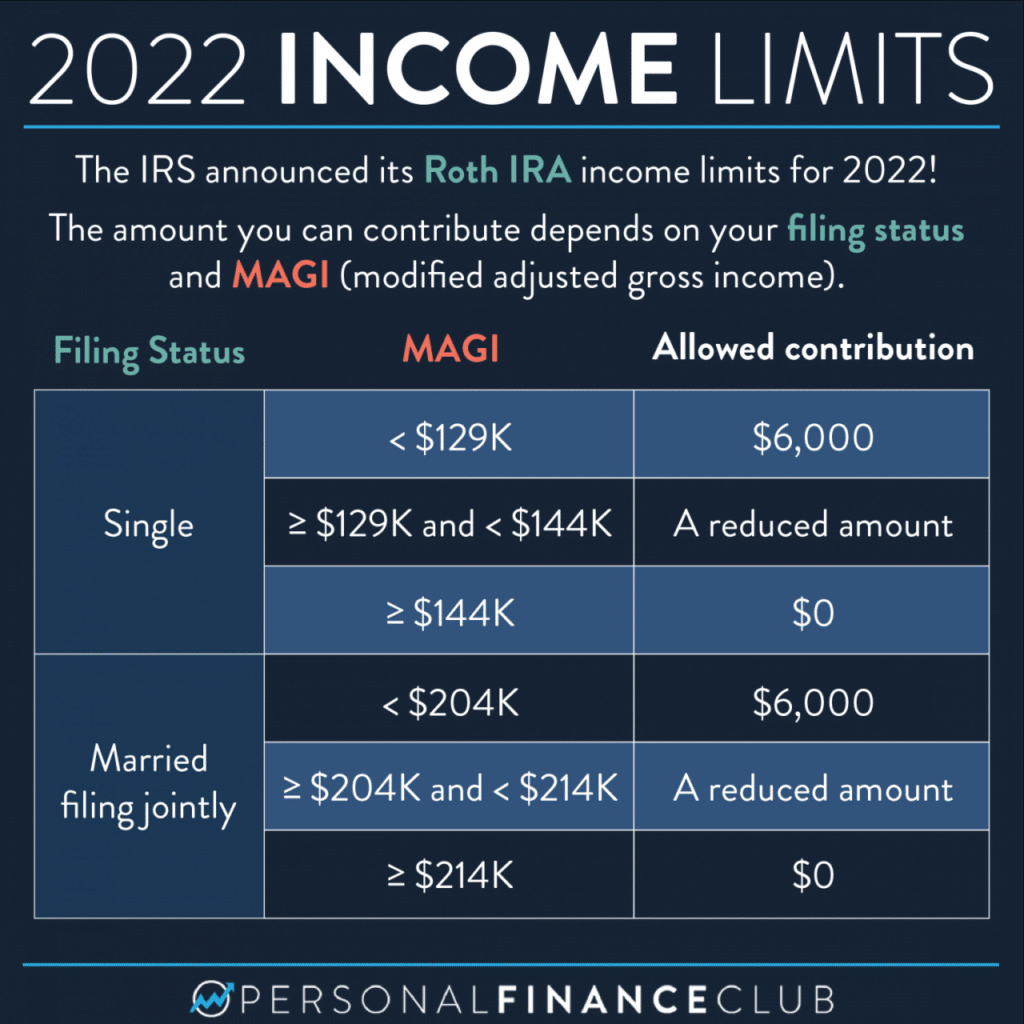

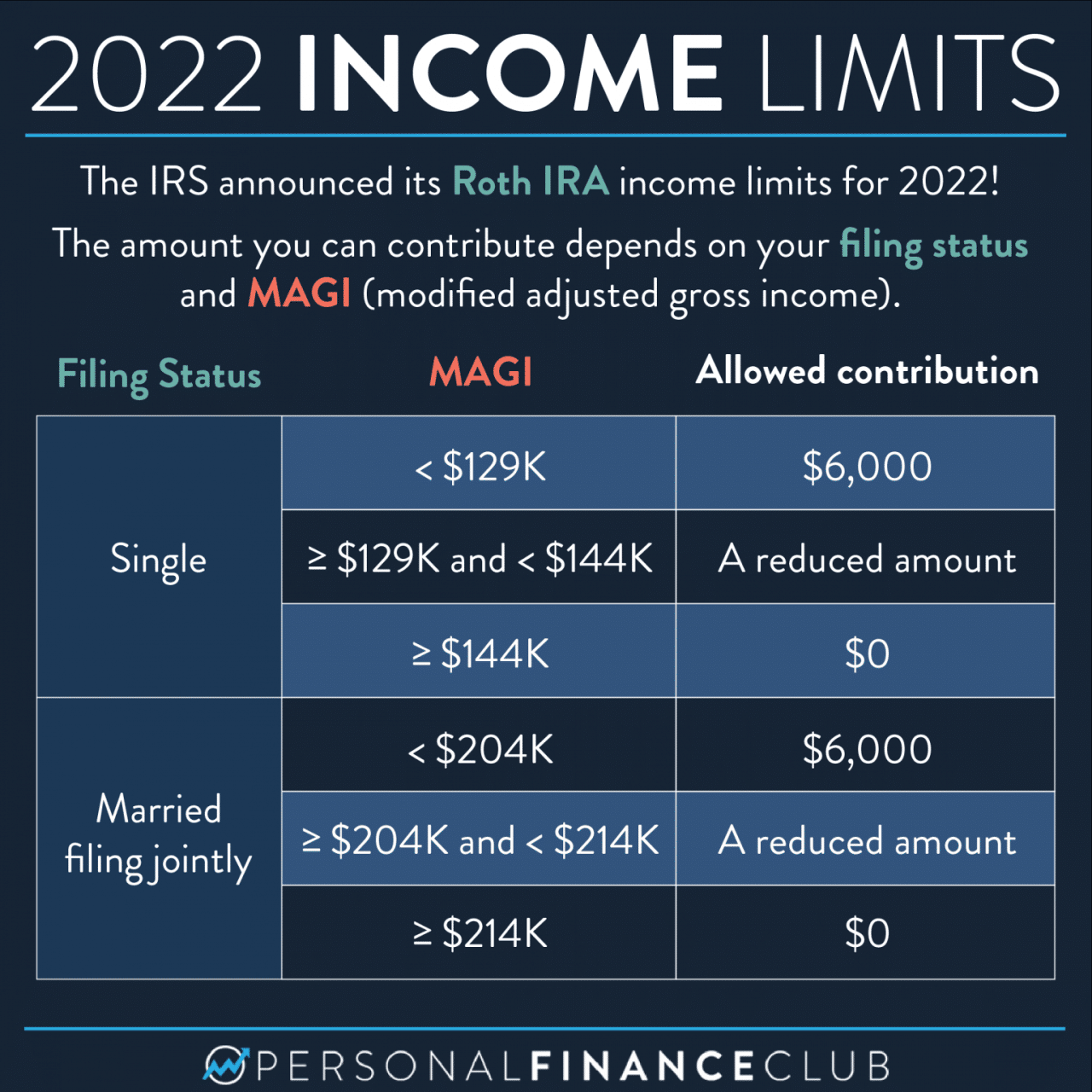

The IRS uses your modified adjusted gross income (MAGI) to determine your eligibility for a Roth IRA. This means your income, including sources like wages, salaries, and certain investment income, plays a role in your ability to contribute.

Contents List

Introduction to Roth IRA

A Roth IRA (Individual Retirement Account) is a retirement savings plan that allows individuals to contribute after-tax dollars and potentially withdraw their earnings tax-free in retirement. It’s a popular option for individuals who expect to be in a higher tax bracket in retirement than they are currently.The core concept of a Roth IRA is that you contribute after-tax dollars, meaning you’ve already paid taxes on the money you’re putting into the account.

Reaching retirement age and want to make the most of your 401k contributions? The maximum 401k contribution for 2024 for those over 50 can help you significantly boost your retirement savings.

This is in contrast to traditional IRAs, where contributions are made with pre-tax dollars, resulting in tax-free withdrawals in retirement.

Looking to maximize your retirement savings? The 401k catch-up contribution limits for 2024 might allow you to contribute even more if you’re over 50. This could significantly boost your retirement nest egg.

Benefits of Roth IRA

The Roth IRA offers several advantages compared to a traditional IRA, making it an attractive retirement savings option for many individuals:

- Tax-free withdrawals in retirement:One of the biggest benefits of a Roth IRA is that qualified withdrawals in retirement are tax-free. This means you won’t have to pay any taxes on the money you withdraw, even if you’re in a higher tax bracket in retirement.

As the October 2024 tax deadline approaches, make sure you’re prepared. Check out these tax preparation tips to ensure a smooth and stress-free filing experience.

- No Required Minimum Distributions (RMDs):Unlike traditional IRAs, there are no required minimum distributions (RMDs) for Roth IRAs. This means you can keep your money growing tax-deferred for as long as you want, without having to withdraw it at a certain age.

- Potential for higher after-tax returns:Because your Roth IRA contributions are made with after-tax dollars, the money you contribute can grow tax-free. This means your investment can potentially earn a higher return over time compared to a traditional IRA, where you may have to pay taxes on your earnings in retirement.

Planning for retirement? Knowing the IRA contribution limits for 2024 and 2025 can help you make informed decisions about your savings strategy. Make sure you’re maximizing your contributions.

Understanding Income Limits

The Roth IRA offers tax-free withdrawals in retirement, but there’s a catch: income limits. If your income exceeds certain thresholds, you may not be able to contribute to a Roth IRA, or your contributions may be phased out. This section will delve into the concept of income limits and how they apply to Roth IRA contributions.

It’s important to stay within the IRA contribution limits. If you exceed them, you might face penalties. Learn more about penalties for exceeding IRA contribution limits to avoid any unexpected surprises.

Modified Adjusted Gross Income (MAGI)

The IRS uses a specific measure called Modified Adjusted Gross Income (MAGI) to determine eligibility for Roth IRA contributions. MAGI is your adjusted gross income (AGI) with certain additions, including tax-exempt interest income, certain deductions, and half of your self-employment taxes.

There are limits to how much you can contribute to your 401k each year. While there’s a general limit, you might wonder if you can contribute more. Find out if you can contribute more than the 401k limit in 2024 and how that might impact your taxes.

This modified income figure is what determines whether you fall within the income limits for Roth IRA contributions.

Corporations have their own tax extension deadlines. The tax extension deadline for corporations in October 2024 can help you avoid penalties and ensure your taxes are filed on time.

Income Limits for Different Filing Statuses

The income limits for Roth IRA contributions vary based on your filing status. Here’s a breakdown of the limits for 2024:

| Filing Status | Income Limit |

|---|---|

| Single | $153,000 |

| Married Filing Jointly | $228,000 |

| Head of Household | $204,000 |

Consequences of Exceeding the Limit

If your modified adjusted gross income (MAGI) exceeds the income limits for Roth IRA contributions, you might not be able to contribute the full amount or contribute at all. This can have a significant impact on your retirement savings strategy.

Contribution Reduction or Disqualification, What is the Roth IRA income limit for 2024

If your income exceeds the limit, you may be subject to a reduction in the amount you can contribute to a Roth IRA. For example, if your income is slightly above the limit, you may be able to contribute a reduced amount, but not the full amount.

Non-profit organizations may have a different tax extension deadline than other entities. The tax extension deadline for non-profit organizations in October 2024 can help you stay on track with your filing obligations.

If your income significantly exceeds the limit, you may be completely disqualified from contributing to a Roth IRA for that year.

Want to know which tax bracket you fall into? Use a tax bracket calculator for 2024 to get a clear picture of your tax obligations based on your income. It’s a helpful tool for planning your finances.

Potential Impact on Retirement Savings

Exceeding the income limit for Roth IRA contributions can significantly impact your retirement savings strategy.

- Reduced Growth Potential:A Roth IRA allows your contributions to grow tax-free, so not being able to contribute the full amount or at all can limit your potential for tax-free growth.

- Missed Tax Benefits:Roth IRA contributions are made with after-tax dollars, so your withdrawals in retirement are tax-free. Exceeding the income limit can mean you miss out on these tax benefits.

- Limited Options for Retirement Savings:If you can’t contribute to a Roth IRA, you may need to explore other retirement savings options, such as a traditional IRA or 401(k), which may have different tax implications.

Strategies for Managing Income Limits

If you find yourself nearing the income limit for Roth IRA contributions, don’t despair! There are several strategies you can employ to maximize your retirement savings while staying within the guidelines.

Adjusting Income through Tax-Advantaged Accounts or Deductions

Adjusting your income can help you qualify for Roth IRA contributions. Consider these strategies:* Maximize 401(k) Contributions:Increasing your contributions to a 401(k) plan can reduce your taxable income. This can help you fall below the Roth IRA income limit.

Utilize Traditional IRA Deductions

If you’re eligible for a traditional IRA deduction, this can also lower your taxable income, potentially bringing you within the Roth IRA contribution limits.

If you’re over 50, you might be eligible for higher IRA contribution limits. Find out the IRA contribution limits for people over 50 in 2024 to maximize your retirement savings.

Explore Other Tax Deductions

When dealing with government agencies, you might need to fill out a W9 form. The W9 form for government agencies in October 2024 will help you provide the necessary information for tax purposes.

Take advantage of other available tax deductions, such as those for homeownership, education expenses, or charitable contributions. These deductions can reduce your taxable income and potentially help you qualify for Roth IRA contributions.

Running a small business? You’ll need to stay on top of your taxes. A tax calculator designed for small businesses can help you estimate your tax liability and make informed financial decisions.

Delaying Contributions Until the Following Year

Another option is to delay your Roth IRA contributions until the following year. If you anticipate a decrease in income in the future, waiting may be a good strategy. This can help you avoid exceeding the income limit and potentially losing the tax benefits of a Roth IRA.

Exploring Alternative Retirement Savings Options

If you’re above the income limit, you still have options for retirement savings. Consider these alternatives:* Traditional IRA:While traditional IRAs don’t offer tax-free withdrawals in retirement, they do allow for tax-deductible contributions, which can reduce your taxable income.

Wondering how much you can contribute to your 401k this year? The contribution limits for 2024 have been updated. Take advantage of these limits to secure your financial future.

401(k)

Your employer-sponsored 401(k) plan is a great way to save for retirement. Contributions are typically pre-tax, reducing your taxable income, and often come with employer matching contributions.

Students often have unique tax situations. A tax calculator designed for students can help you understand your tax obligations and potentially claim deductions or credits you might not be aware of.

SEP IRA

If you’re self-employed or have a small business, a SEP IRA can be a valuable retirement savings option. It allows for larger contributions than traditional IRAs, but withdrawals are taxed in retirement.

Solo 401(k)

This retirement plan is similar to a SEP IRA, but allows for both employee and employer contributions.

Resources and Further Information

It’s crucial to stay informed about the Roth IRA income limits and how they may impact your retirement savings. This section provides resources and suggestions for further research and guidance.

Official Government Websites

The Internal Revenue Service (IRS) is the primary source of information on Roth IRA income limits. The IRS website offers comprehensive guidelines, publications, and forms related to retirement savings plans.

Figuring out your estimated taxes for October 2024? Use a tax calculator to help you stay on top of your payments. It’s a quick and easy way to ensure you’re paying the right amount and avoid penalties.

- IRS Publication 590-A, Contributions to Individual Retirement Arrangements (IRAs)

- IRS Form 5329, Return for Additional Taxes Attributable to Qualified Pension, Profit-Sharing, and Stock Bonus Plans and Certain Annuities

Financial Institutions

Many financial institutions offer Roth IRA accounts and provide information on income limits and eligibility. These institutions can be valuable resources for understanding account details and investment options.

- Banks

- Credit Unions

- Brokerage Firms

Financial Planning Organizations

Professional financial planners can provide personalized advice and guidance on Roth IRA contributions, income limits, and overall retirement planning.

- Certified Financial Planners (CFPs)

- Registered Investment Advisors (RIAs)

- Financial Planning Associations

Last Point: What Is The Roth IRA Income Limit For 2024

Navigating the Roth IRA income limits can be a bit complex, but it’s important to understand how they impact your retirement savings strategy. If you’re nearing the income limit, exploring strategies like adjusting income through tax-advantaged accounts or delaying contributions can help you maximize your retirement savings potential.

Remember, seeking personalized financial advice from a qualified professional can provide valuable insights and guidance tailored to your specific circumstances.

Questions and Answers

What happens if my income exceeds the Roth IRA income limit?

If your income exceeds the limit, you may not be able to contribute the full amount to a Roth IRA, or you may be completely ineligible to contribute.

Can I still contribute to a traditional IRA if I exceed the Roth IRA income limit?

Yes, you can still contribute to a traditional IRA regardless of your income, but your contributions may be tax-deductible.

What are some other retirement savings options besides a Roth IRA?

Other options include 401(k) plans, 403(b) plans, and SIMPLE IRAs. Each option has its own contribution limits and tax implications.