How much can I contribute to my Roth IRA in 2024? This question is on the minds of many Americans looking to secure their financial future. Roth IRAs offer a unique way to save for retirement with tax-free withdrawals, but understanding the contribution limits is crucial for maximizing your savings potential.

This guide will delve into the intricacies of Roth IRA contributions in 2024, including the maximum contribution amount, income limitations, and strategies for maximizing your contributions.

The annual contribution limit for Roth IRAs in 2024 is $6,500 for individuals under age 50 and $7,500 for those 50 and older. However, if your modified adjusted gross income (MAGI) exceeds certain thresholds, your contribution ability may be limited or even eliminated.

For instance, single filers with MAGI above $153,000 and married couples filing jointly with MAGI exceeding $228,000 cannot contribute to a Roth IRA in 2024. It’s important to note that these income limits are subject to change, so it’s always best to consult the latest IRS guidelines.

Contents List

Roth IRA Contribution Limits for 2024

The Roth IRA is a popular retirement savings option that allows you to withdraw your contributions tax-free in retirement. In 2024, the maximum amount you can contribute to a Roth IRA is $7,000 if you are under age 50. If you are 50 or older, you can contribute an additional $1,000, for a total of $8,000.

Income Limits for Roth IRA Contributions in 2024

The amount you can contribute to a Roth IRA may be limited based on your modified adjusted gross income (MAGI). If your MAGI is above certain limits, you may not be able to contribute the full amount or any amount at all.

Income Limits for Roth IRA Contributions in 2024

The following table Artikels the income limits for Roth IRA contributions in 2024:

| Filing Status | Phase-Out Begins | Phase-Out Ends |

|---|---|---|

| Single | $153,000 | $168,000 |

| Married Filing Jointly | $228,000 | $243,000 |

If your MAGI is above the phase-out limit, you may not be able to contribute the full amount to a Roth IRA. For example, if you are single and your MAGI is $160,000, you will not be able to contribute the full $7,000. You will need to calculate the amount you can contribute based on your specific MAGI.

October 2024 is the deadline for many tax-related tasks. Make sure you take advantage of all available deductions! The tax deductions for the October 2024 deadline can significantly reduce your tax liability, so it’s worth exploring your options.

Factors Affecting Contribution Amount

While the Roth IRA contribution limit for 2024 is $6,500 for individuals and $13,000 for couples filing jointly, several factors can affect how much you can actually contribute.

Not everyone qualifies for the standard deduction. The guide on who is eligible for the standard deduction in 2024 outlines the specific criteria you need to meet to claim this deduction.

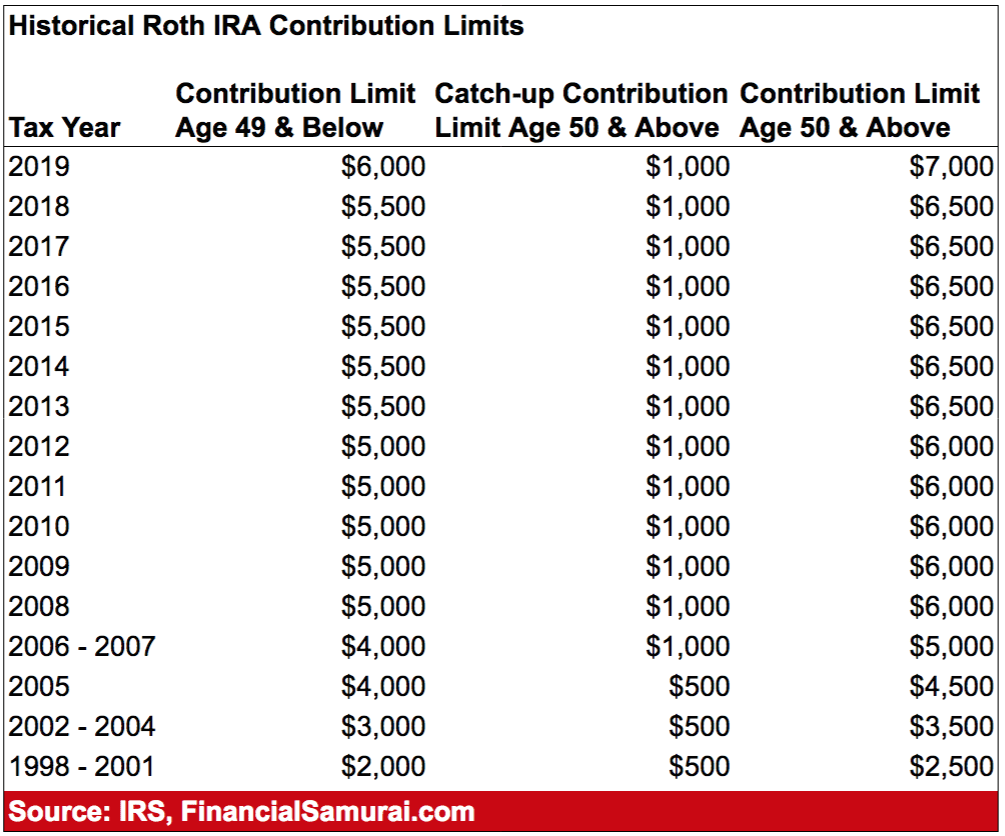

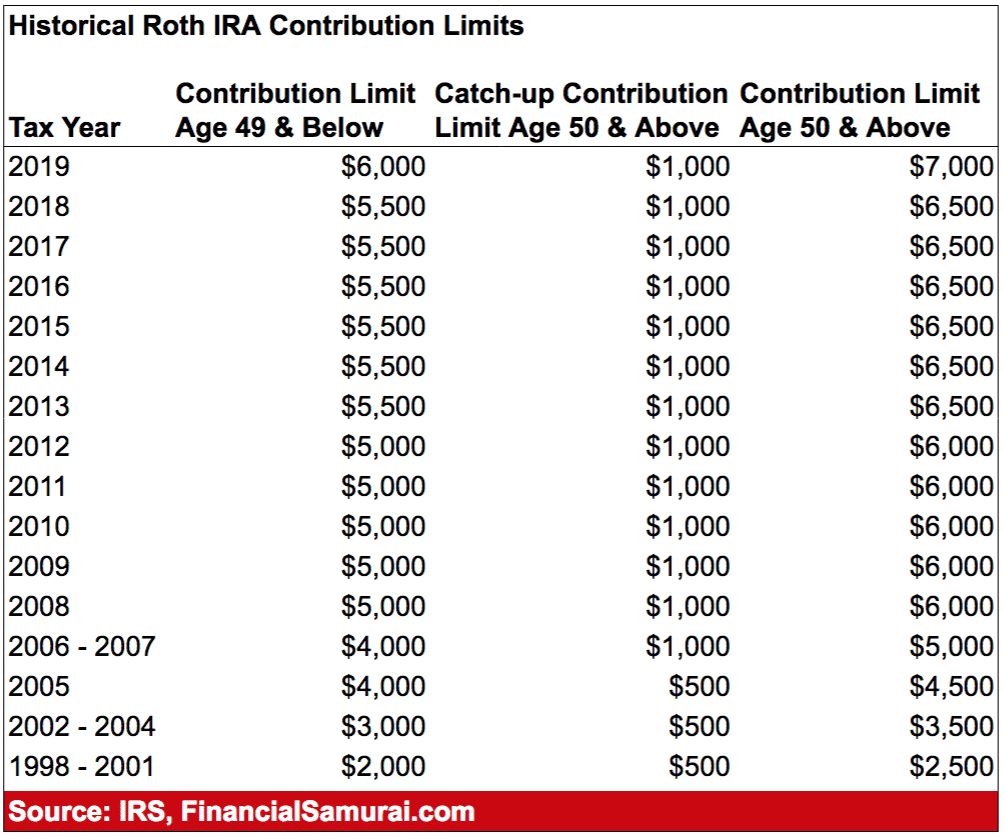

Age

Your age plays a role in determining your Roth IRA contribution limit. The maximum contribution amount applies to individuals of all ages. However, if you’re 50 or older in 2024, you can make additional “catch-up” contributions. This allows you to contribute an extra $1,000 on top of the regular limit, bringing the total contribution limit to $7,500 for individuals and $14,000 for couples filing jointly.

Tax brackets can significantly affect your overall income. Understanding how tax brackets affect your 2024 income can help you make informed financial decisions and plan for the future.

Years of Work

The number of years you’ve been working doesn’t directly affect your Roth IRA contribution limit. The limit is based on your age and income, not your work history. However, the longer you’ve been working, the more time you have to contribute to your Roth IRA and benefit from its tax advantages.

If you’re planning to contribute to a traditional 401(k) in 2024, you’ll want to be aware of the contribution limits. The 401k contribution limits for 2024 for traditional 401k are set by the IRS and can change each year. Knowing these limits will help you make the most of your retirement savings.

Income Level

Your income level plays a significant role in determining whether you can contribute to a Roth IRA. The IRS has income limits for Roth IRA contributions. If your modified adjusted gross income (MAGI) exceeds these limits, you may not be able to contribute the full amount or any amount at all.

For 2024, the income limits are:

| Filing Status | MAGI Limit (Single Filers) | MAGI Limit (Married Filing Jointly) |

| Single | $153,000 | $228,000 |

| Married Filing Separately | $76,500 | $114,000 |

| Head of Household | $153,000 | N/A |

If your MAGI exceeds these limits, you may not be able to contribute the full amount or any amount at all. For example, if you’re single and your MAGI is $160,000 in 2024, you won’t be able to contribute to a Roth IRA.

However, if your MAGI is $140,000, you can contribute the full $6,500.

Note: These income limits are for 2024 and may change in future years.

The standard deduction is a valuable tax benefit for many taxpayers. The guide on claiming the standard deduction in 2024 can help you determine if you’re eligible and how to maximize your savings.

Benefits of Contributing to a Roth IRA

Contributing to a Roth IRA offers several benefits, making it a valuable tool for retirement planning. You can enjoy tax-free growth on your investments and withdrawals in retirement.

To avoid penalties, it’s essential to pay estimated taxes throughout the year. A tax calculator for estimated taxes in October 2024 can help you determine the amount you should be paying quarterly to avoid any surprises at tax time.

Tax Benefits

A Roth IRA provides significant tax advantages, making it a popular choice for retirement savings.

If you’re over 50, you can contribute a bit more to your 401(k). The 401k contribution limit for 2024 for over 50 is higher than the standard limit, giving you an opportunity to save more for retirement.

- Tax-free growth:The earnings on your Roth IRA investments grow tax-free. This means you won’t owe any taxes on the profits when you withdraw your money in retirement.

- Tax-free withdrawals:When you withdraw your contributions and earnings in retirement, they are tax-free. This is a major advantage compared to traditional IRAs, where withdrawals are taxed in retirement.

Saving for Retirement

A Roth IRA helps you save for retirement by providing a secure and tax-efficient way to grow your savings.

The Roth 401(k) offers tax-free withdrawals in retirement, but there are contribution limits you need to be aware of. You can find the 401k contribution limits for 2024 for Roth 401k on the IRS website, which is updated annually.

- Long-term growth potential:You can invest your contributions in a variety of assets, including stocks, bonds, and mutual funds, allowing your savings to potentially grow over time.

- Tax-advantaged growth:The tax-free growth of your investments allows your savings to compound faster than in a taxable account.

Tax-Free Withdrawals in Retirement

The most significant benefit of a Roth IRA is the ability to withdraw your contributions and earnings tax-free in retirement.

If you’re self-employed, you might be considering a solo 401(k). The Ira contribution limits for solo 401k in 2024 are different from traditional 401(k) limits, so it’s essential to check the IRS guidelines.

- No tax liability:When you withdraw your money in retirement, you won’t owe any federal income taxes on it.

- Financial security:This tax-free income can provide you with financial security during your retirement years, allowing you to enjoy your hard-earned savings without worrying about tax implications.

Strategies for Maximizing Contributions

Maximizing your Roth IRA contributions can be a powerful strategy for building wealth and securing your financial future. This section explores effective strategies to help you reach the annual contribution limit and reap the benefits of tax-free growth.

Freelancers have unique tax needs. Using a tax calculator for freelancers in October 2024 can help you accurately estimate your tax liability and plan for payments. Many online tools are available, so find one that fits your needs.

Designing a Personalized Contribution Plan

A personalized contribution plan should consider your current financial situation, income level, and long-term financial goals. Start by evaluating your current budget and identifying potential areas for savings. Consider using budgeting tools or apps to track your expenses and identify areas where you can cut back.

Knowing the latest tax brackets is crucial for accurate tax planning. A tax calculator for October 2024 can help you understand how your income falls into different tax brackets and how it affects your overall tax liability.

For example, if you have a $50 monthly subscription to a streaming service you rarely use, cancelling it could free up $600 per year to contribute to your Roth IRA.

Next, determine how much you can realistically contribute each month or year. Remember, even small contributions can add up over time.

The October 2024 deadline for filing taxes is approaching quickly. The guide on how to file taxes by the October 2024 deadline can help you navigate the process and ensure you file your taxes accurately and on time.

For example, if you can only afford to contribute $100 per month, that translates to $1,200 per year. Over 30 years, this small contribution could grow to a substantial amount, depending on investment returns.

Choosing the right tax calculator can make a big difference in your tax planning. A best tax calculator for October 2024: A comparison of popular options can help you find the one that suits your needs and budget.

Lastly, consider your long-term financial goals. Are you saving for retirement, a down payment on a house, or your children’s education? Knowing your goals will help you determine how much you need to contribute and how long you need to save.

Investing in the stock market or other assets can have tax implications. A tax calculator for investments in October 2024 can help you understand how your investment gains or losses will be taxed and plan accordingly.

Finding Extra Money to Contribute

There are several strategies for finding extra money to contribute to your Roth IRA:

- Negotiate Bills:Contact your utility providers, internet and cable companies, and insurance providers to negotiate lower rates. Even small savings can add up over time.

- Reduce Unnecessary Expenses:Evaluate your spending habits and identify areas where you can cut back. This might include dining out less, reducing entertainment expenses, or finding cheaper alternatives for everyday items.

- Side Hustle:Consider taking on a side hustle or gig to generate extra income. There are many options available, from driving for a ride-sharing service to freelance writing or graphic design.

- Sell Unused Items:Declutter your home and sell unused items online or at consignment shops. This can be a great way to generate extra cash.

- Automate Savings:Set up automatic transfers from your checking account to your Roth IRA. This will help you stay on track with your savings goals and make contributions a regular habit.

Resources for Maximizing Contributions

- Financial Advisor:A financial advisor can help you develop a personalized savings plan and make sure you are maximizing your contributions. They can also provide guidance on investment strategies and tax implications.

- IRS Publication 590-A:This publication provides detailed information about Roth IRAs, including contribution limits, eligibility requirements, and tax implications.

- Online Resources:Many websites and online tools offer information and calculators to help you understand Roth IRAs and estimate potential returns.

Comparison to Traditional IRA

Choosing between a Roth IRA and a traditional IRA depends on your individual circumstances and financial goals. Both offer tax advantages, but the timing of those benefits differs significantly.

Missing the October 2024 deadline for filing an extension can come with penalties. The penalties for not filing an extension by October 2024 can include late filing fees and interest on unpaid taxes. It’s always best to file on time or get an extension if needed.

Tax Implications

The primary difference between Roth and traditional IRAs lies in how they are taxed.

- Roth IRA: Contributions are made with after-tax dollars, meaning you’ve already paid taxes on the money. This means qualified distributions in retirement are tax-free.

- Traditional IRA: Contributions are made with pre-tax dollars, reducing your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

Contribution Limits and Income Restrictions

Both Roth and traditional IRAs have contribution limits and income restrictions, but these differ slightly:

| Roth IRA | Traditional IRA | |

|---|---|---|

| Contribution Limit (2024) | $6,500 | $6,500 |

| Income Restrictions | Phase-out begins at $153,000 for single filers and $228,000 for married couples filing jointly. | No income restrictions for contributions, but tax deductions may be limited for higher earners. |

Benefits of Each Type of IRA, How much can I contribute to my Roth IRA in 2024

- Roth IRA: Ideal for individuals who expect to be in a higher tax bracket in retirement than they are today. It allows you to withdraw your contributions tax-free and penalty-free at any time.

- Traditional IRA: A better choice for individuals who expect to be in a lower tax bracket in retirement. You can deduct contributions from your current income, lowering your tax bill now.

Concluding Remarks: How Much Can I Contribute To My Roth IRA In 2024

Navigating the world of Roth IRA contributions can be complex, but understanding the contribution limits and income restrictions is essential for maximizing your retirement savings. By strategically planning your contributions and utilizing the available resources, you can ensure you’re taking full advantage of the benefits offered by a Roth IRA.

Remember, early planning and consistent contributions can significantly impact your financial well-being in the long run.

FAQ Section

Can I contribute to a Roth IRA if I’m already enrolled in a 401(k) plan?

Yes, you can contribute to a Roth IRA even if you participate in a 401(k) plan. There’s no restriction on contributing to both types of accounts.

What happens if I contribute more than the allowed amount to my Roth IRA?

If you contribute more than the allowed amount, you’ll be subject to a 6% penalty on the excess contribution. It’s crucial to stay within the contribution limits to avoid any penalties.

Can I withdraw my contributions from a Roth IRA before retirement?

Yes, you can withdraw your contributions from a Roth IRA at any time without penalty. However, if you withdraw earnings before age 59 1/2, you may be subject to taxes and penalties.