Roth IRA income limits for 2024 determine who can contribute to this popular retirement savings account. These limits can impact your ability to take advantage of tax-free withdrawals in retirement. Understanding these limits is crucial for anyone considering a Roth IRA, as exceeding them could result in a reduced contribution or even disqualify you from contributing altogether.

The IRS sets these limits annually, and they can fluctuate based on factors like inflation and economic conditions. This year, the limits have been adjusted, affecting both single filers and married couples. We’ll explore these limits in detail, along with the phase-out rules and their implications for your retirement planning.

Contents List

Roth IRA Eligibility for 2024

The Roth IRA is a popular retirement savings plan that offers tax-free withdrawals in retirement. However, not everyone is eligible to contribute to a Roth IRA. The IRS sets income limits that determine whether you can contribute to a Roth IRA or not.

Don’t miss the tax deadline! Learn how to file taxes by the October 2024 deadline to avoid penalties and ensure your taxes are filed correctly.

These limits are adjusted annually to account for inflation.

401k contribution limits can vary based on your age. Learn about what are the 401k contribution limits for 2024 for different ages to make sure you’re maximizing your savings.

Income Limits for Roth IRA Contributions in 2024

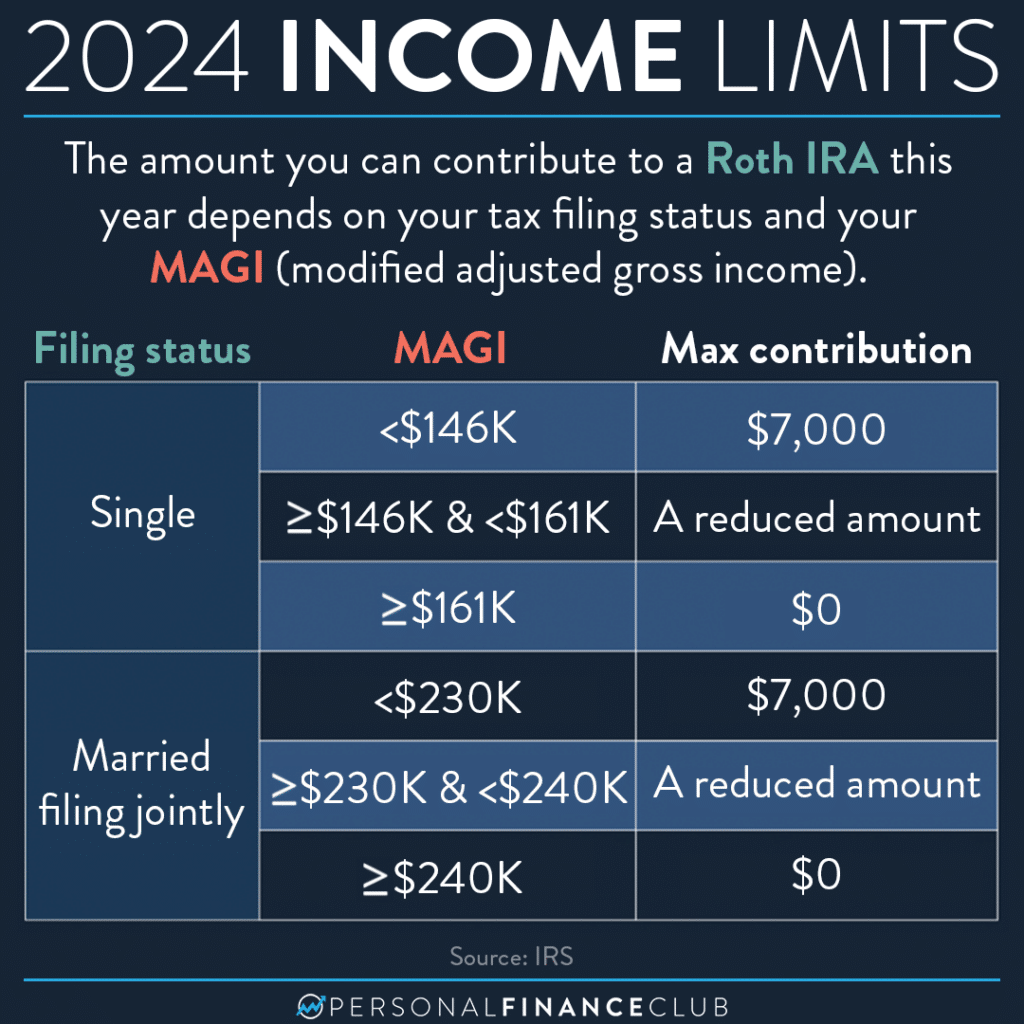

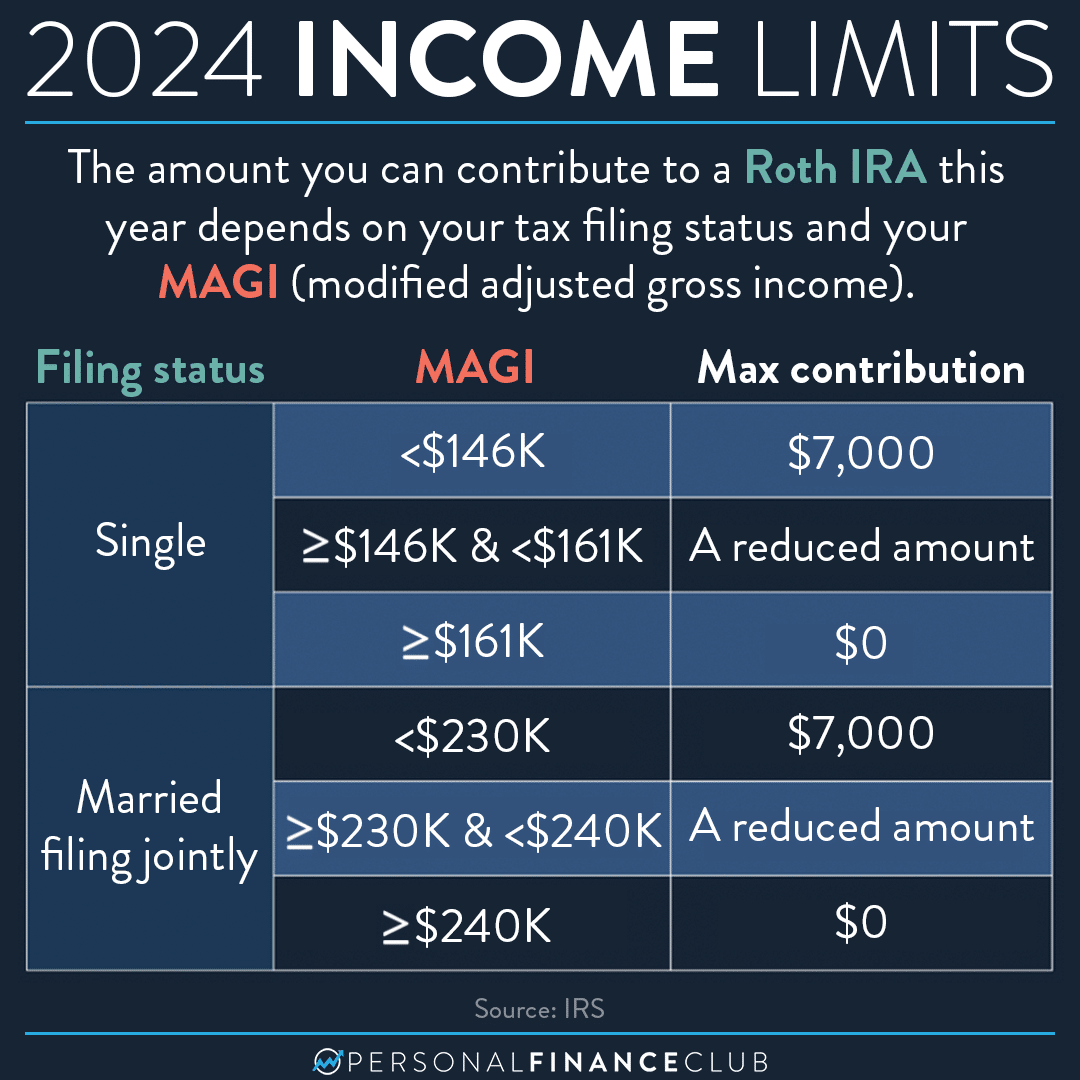

The income limits for contributing to a Roth IRA in 2024 are based on your modified adjusted gross income (MAGI). Your MAGI is your adjusted gross income (AGI) plus certain deductions, such as student loan interest. Here are the MAGI thresholds for 2024:

- Single Filers: If your MAGI is $153,000 or more, you cannot contribute to a Roth IRA.

- Married Filing Jointly: If your combined MAGI is $228,000 or more, you cannot contribute to a Roth IRA.

- Head of Household: If your MAGI is $204,000 or more, you cannot contribute to a Roth IRA.

If your income falls below the limit, you can contribute the full amount allowed for 2024, which is $6,500. If you are 50 or older, you can contribute an additional $1,000 for a total of $7,500.

401k contribution limits can vary based on your age. Check out the 401k contribution limits for 2024 by age to see what you can contribute based on your birth year.

Income Limits for Married Filing Separately

If you are married filing separately, the income limits for Roth IRA contributions are half the limits for married filing jointly. This means that if your MAGI is $114,000 or more, you cannot contribute to a Roth IRA.

If you use your car for business purposes, you can deduct mileage expenses. Find out the October 2024 mileage rate for business use to calculate your deduction.

Contribution Limits for 2024: Roth IRA Income Limits For 2024

The amount you can contribute to a Roth IRA in 2024 is limited. Knowing this limit is important because exceeding it can lead to penalties.

Tax calculators can be a valuable tool for understanding your tax liability. Learn how to use a tax calculator for October 2024 to make informed financial decisions.

Contribution Limit for 2024

The maximum amount you can contribute to a Roth IRA in 2024 is $7,000. If you are 50 years old or older, you can contribute an additional $1,000as a catch-up contribution, for a total of $8,000.

If you’re over 50, you might be eligible for catch-up contributions. Find out what are the 401k limits for 2024 for over 50 to boost your retirement savings.

Implications of Exceeding the Contribution Limit

Exceeding the Roth IRA contribution limit can result in penalties. The IRS will assess a 6% penalty on the excess contribution amount. The penalty applies to the entire amount of the excess contribution, not just the portion that exceeds the limit.

Similar to 401k limits, IRA contribution limits can also vary based on your age. Check out the IRA contribution limits for 2024 by age to see what you can contribute.

For example, if you contribute $8,000 to a Roth IRA in 2024 and the contribution limit is $7,000, you will be penalized 6% of the $1,000 excess contribution, or $60.

Catch-up contributions can be a great way to make up for lost time in retirement savings. Find out the 2024 401k limits for catch-up contributions to see how much extra you can contribute.

Contribution Limit Examples, Roth IRA income limits for 2024

Here are some examples of how the contribution limit might apply to individuals in different income brackets:

- Single Individual with $50,000 Income:This individual can contribute the full $7,000 to their Roth IRA in 2024.

- Married Couple with $200,000 Income:This couple can contribute a total of $14,000 to their Roth IRAs in 2024 ($7,000 each).

- Individual Over 50 with $100,000 Income:This individual can contribute up to $8,000 in 2024, as they qualify for the catch-up contribution.

Phase-Out of Roth IRA Contributions

The Roth IRA contribution limit is not available to everyone. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may be ineligible to contribute to a Roth IRA or your contribution limit may be reduced. This is known as the phase-out range.The phase-out range is determined by your filing status and the year.

The contribution limit is gradually reduced as your MAGI increases within the phase-out range. If your MAGI exceeds the upper limit of the phase-out range, you cannot contribute to a Roth IRA.

Want to know how much you can contribute to your 401k with catch-up contributions? Find out how much you can contribute to your 401k in 2024 with catch-up contributions to maximize your retirement savings.

Phase-Out Ranges for 2024

The phase-out ranges for 2024 are as follows:

| Filing Status | Lower Limit | Upper Limit |

|---|---|---|

| Single | $153,000 | $168,000 |

| Married Filing Separately | $76,500 | $84,000 |

| Married Filing Jointly | $228,000 | $248,000 |

| Head of Household | $204,000 | $224,000 |

For example, if you are single and your MAGI is $155,000, you will be able to contribute to a Roth IRA, but your contribution limit will be reduced. The exact amount of the reduction will depend on your specific MAGI.

Businesses need to understand the W9 Form October 2024 requirements for businesses to ensure they’re properly reporting their tax information.

Implications of Income Limits

Exceeding the income limits for Roth IRA contributions can have several consequences, affecting your tax planning and overall financial strategy. It’s crucial to understand these implications to make informed decisions about your retirement savings.

Want to understand how much you might owe in taxes? A tax calculator for October 2024 can help you determine your tax bracket and estimate your tax liability.

Impact on Roth IRA Contributions

If your modified adjusted gross income (MAGI) exceeds the income limits for Roth IRA contributions, you may not be able to contribute to a Roth IRA or may be subject to a reduced contribution limit. This means you may miss out on the tax benefits of Roth IRA contributions, such as tax-free withdrawals in retirement.

If you’re self-employed, you have the option of contributing to a Solo 401k. Learn about the 401k contribution limits for 2024 for self-employed to maximize your retirement savings.

For example, in 2024, if your MAGI is above $153,000 as a single filer or $228,000 as a married couple filing jointly, you cannot contribute to a Roth IRA. If your MAGI falls within the phase-out range, your contribution limit will be reduced proportionally.

The standard deduction is a great way to reduce your tax burden, but you need to know how to claim it. Check out this guide on how to claim the standard deduction on your 2024 taxes to make sure you’re getting the most out of your tax return.

Impact on Other Tax Benefits

Exceeding the Roth IRA income limits may also affect your eligibility for other tax benefits, such as the earned income tax credit (EITC) or the American Opportunity Tax Credit. These tax benefits are often based on income levels, and exceeding the Roth IRA limits could potentially disqualify you from claiming them.

Planning for retirement? You’ll want to know the 401k contribution limits for 2024 for traditional 401k to make sure you’re maximizing your savings. These limits are adjusted annually, so it’s important to stay up-to-date.

For instance, the EITC is a tax credit for low- and moderate-income working individuals and families. The credit amount depends on your income and the number of qualifying children. If your MAGI exceeds the limits for the EITC, you may not be eligible to claim it.

Comparison with Traditional IRA Contributions

While exceeding the Roth IRA income limits can limit your options, you may still be able to contribute to a traditional IRA, regardless of your income. Traditional IRA contributions are tax-deductible, meaning you can reduce your taxable income in the current year.

However, withdrawals in retirement will be taxed.

Tax season is coming up, and you’ll want to make sure you’re taking advantage of all the deductions and credits you’re eligible for. A tax calculator for deductions and credits in October 2024 can help you determine your potential tax savings.

In contrast to Roth IRA contributions, which are taxed upfront but grow tax-free, traditional IRA contributions are tax-deferred, meaning you pay taxes on the withdrawals in retirement.

Future Changes to Income Limits

It’s impossible to predict with certainty how Roth IRA income limits will change in the future. However, we can analyze historical trends and consider potential influencing factors to gain insights into potential future adjustments.

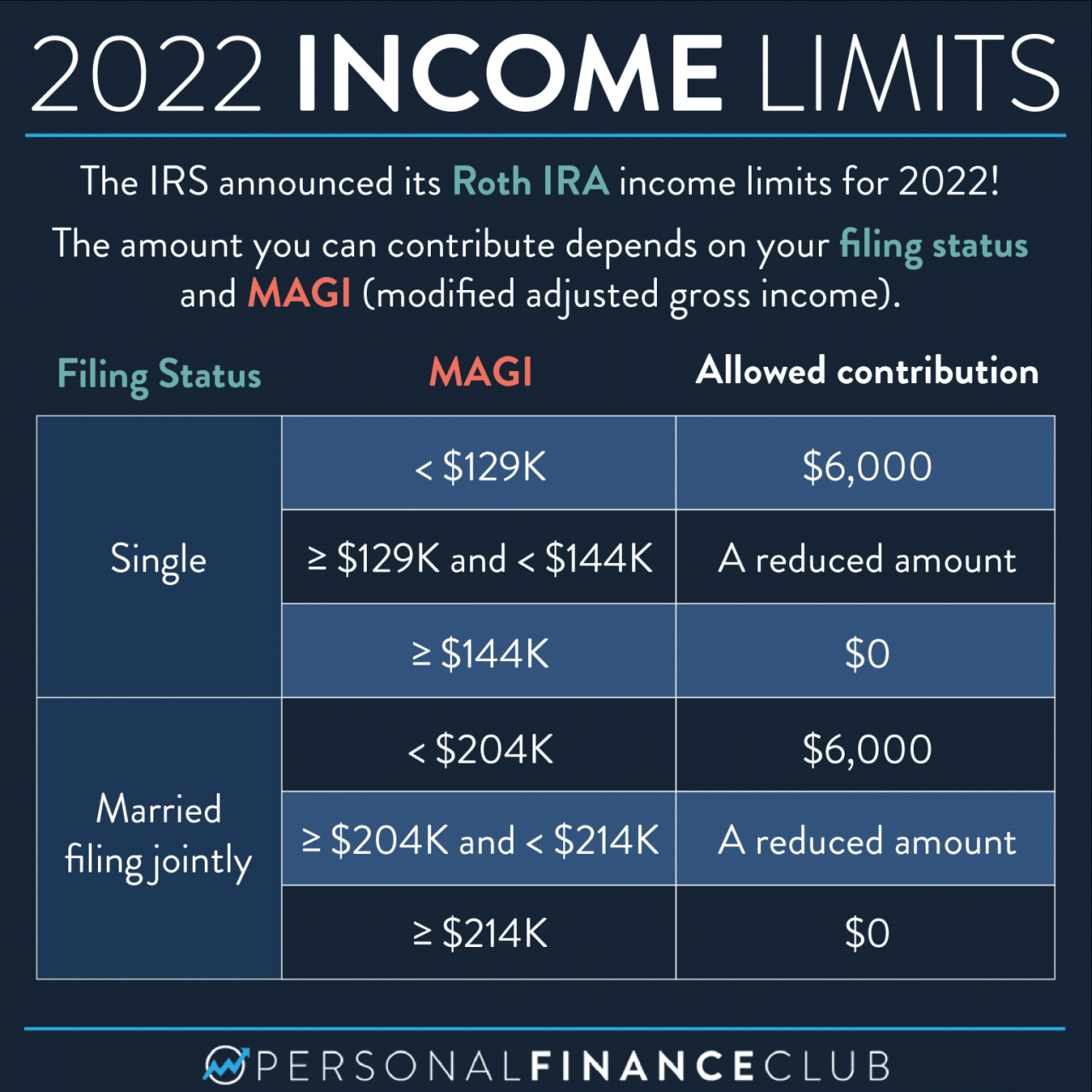

Historical Trends in Income Limit Adjustments

Income limits for Roth IRA contributions have been adjusted over time, reflecting changes in inflation and economic conditions. Generally, these limits have trended upwards, although not always at a consistent pace. For example, the 2023 limits were increased from 2022, reflecting inflation and economic growth.

Factors Influencing Future Changes

Several factors could influence future changes to Roth IRA income limits. These include:

- Inflation:Inflation is a key factor in determining the cost of living and, consequently, the amount individuals need to save for retirement. As inflation rises, income limits are likely to increase to maintain the purchasing power of contributions.

- Economic Growth:Strong economic growth often leads to higher wages and income levels, which may prompt adjustments to income limits to reflect these changes.

- Political Climate:The political climate can influence tax policies and retirement savings programs. If there is a push for broader access to retirement savings, income limits might be adjusted to make Roth IRAs more accessible to a wider range of individuals.

- Demographic Trends:As the population ages and life expectancies increase, there may be greater demand for retirement savings programs. This could lead to adjustments in income limits to encourage more individuals to save for retirement.

Last Word

Navigating the world of Roth IRAs can seem complex, especially when income limits come into play. By understanding the limits, phase-out rules, and potential strategies, you can make informed decisions about your retirement savings. Don’t let these limits deter you from exploring the benefits of a Roth IRA.

Consult with a financial advisor to determine the best approach for your individual circumstances.

Essential Questionnaire

What happens if I exceed the Roth IRA income limits?

If your income exceeds the limits, you may not be able to contribute to a Roth IRA. Alternatively, you may be subject to a phase-out, where your contribution limit is gradually reduced.

Can I still contribute to a traditional IRA if I exceed the Roth IRA limits?

Yes, you may still be eligible to contribute to a traditional IRA, regardless of your income. However, withdrawals from a traditional IRA are typically taxed in retirement.

Are there any exceptions to the Roth IRA income limits?

There are no exceptions to the Roth IRA income limits. The limits apply to all eligible individuals.