What is the Roth IRA contribution limit for 2024 for married filing separately? This question is crucial for married couples who choose to file their taxes separately and are considering maximizing their retirement savings. Understanding the contribution limits and eligibility requirements is essential for making informed decisions about retirement planning.

The Roth IRA offers a unique advantage for retirement savings – tax-free withdrawals in retirement. However, the contribution limit for married individuals filing separately differs from other filing statuses, potentially impacting how much you can contribute each year. This guide will explore the specific details of the Roth IRA contribution limit for this filing status, including eligibility requirements and how it compares to other filing options.

Contents List

- 1 Roth IRA Contribution Limit for Married Filing Separately in 2024: What Is The Roth IRA Contribution Limit For 2024 For Married Filing Separately

- 2 Eligibility Requirements for Roth IRA Contributions

- 3 Comparison to Other Filing Statuses

- 4 Considerations for Retirement Planning

- 5 Impact of Tax Law Changes

- 6 Summary

- 7 Question Bank

Roth IRA Contribution Limit for Married Filing Separately in 2024: What Is The Roth IRA Contribution Limit For 2024 For Married Filing Separately

The Roth IRA contribution limit for married individuals filing separately in 2024 is $6,500. This means that if you are married and file your taxes separately, you can contribute up to $6,500 to your Roth IRA in 2024.

Understanding how tax brackets work is essential for planning your finances. Understanding tax brackets for 2024 can help you estimate your tax liability and make informed decisions about your income and expenses.

Impact of the Contribution Limit on Tax Liability

The Roth IRA contribution limit can significantly impact your tax liability, especially if you are in a higher tax bracket. Because Roth IRA contributions are made with after-tax dollars, your tax liability will not be affected by your contributions. However, qualified withdrawals from a Roth IRA are tax-free in retirement.

If you’re planning to contribute to a traditional 401k in 2024, you’ll want to know the contribution limits. 401k contribution limits for 2024 for traditional 401k provides the most recent information on these limits.

This means that you will not have to pay taxes on your withdrawals in retirement, which can be a significant benefit, especially if you are in a higher tax bracket.

If you’re planning on contributing to a traditional 401k in 2024, it’s good to know the contribution limits. You can find the latest information on What are the 401k contribution limits for 2024 for traditional 401k , so you can plan your finances accordingly.

Examples of How the Contribution Limit Can Affect Retirement Planning for Married Couples Filing Separately

Here are a few examples of how the Roth IRA contribution limit can affect retirement planning for married couples filing separately:

- If you are a high-earning individual and your spouse does not work, you may want to consider contributing the full $6,500 to your Roth IRA. This will help you save for retirement and reduce your tax liability in the long run.

The mileage rate for business travel can fluctuate, so it’s always a good idea to stay updated. To find out the current mileage rate for October 2024, you can check How much is the mileage rate for October 2024? for the most accurate information.

- If you are both high-earning individuals, you may want to consider contributing the full $6,500 to your Roth IRAs. This will help you save for retirement and reduce your tax liability in the long run.

- If you are both low-earning individuals, you may want to consider contributing a smaller amount to your Roth IRAs. This will help you save for retirement without significantly impacting your current income.

Eligibility Requirements for Roth IRA Contributions

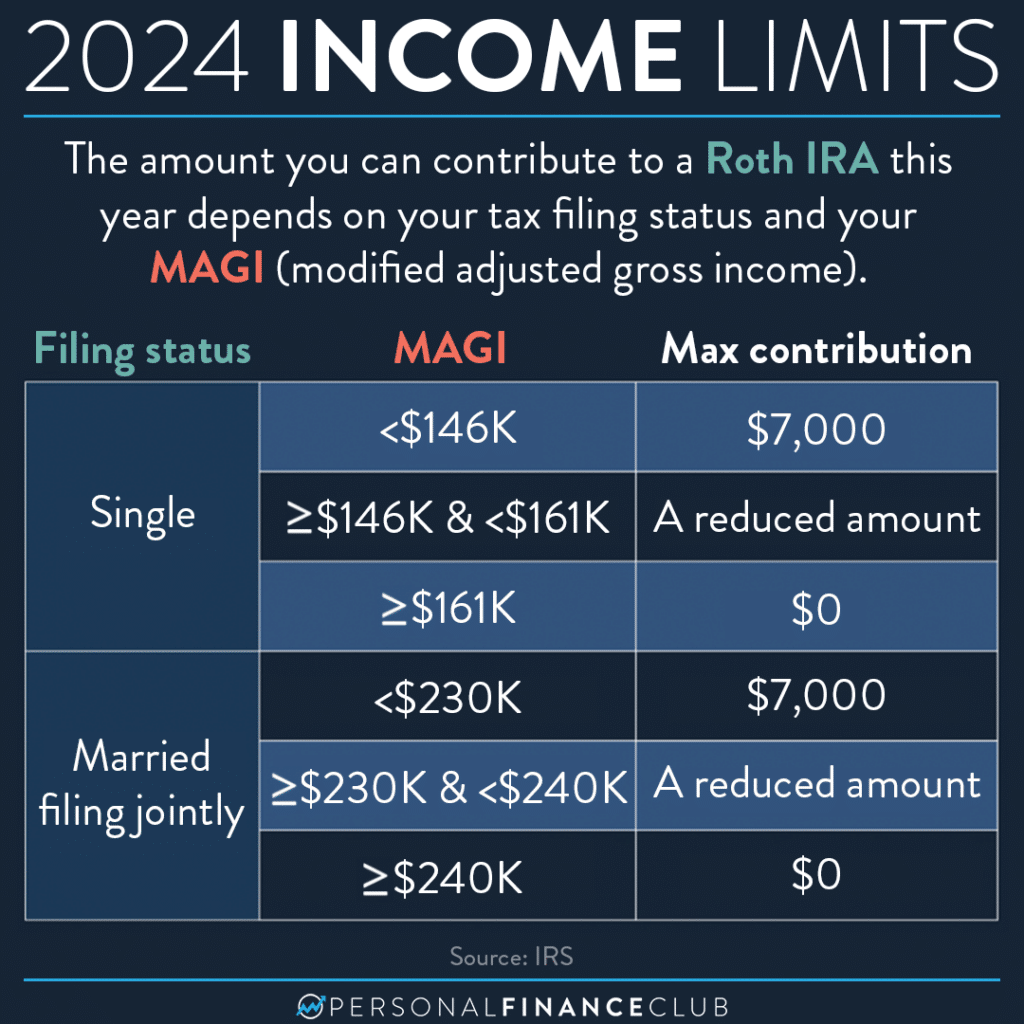

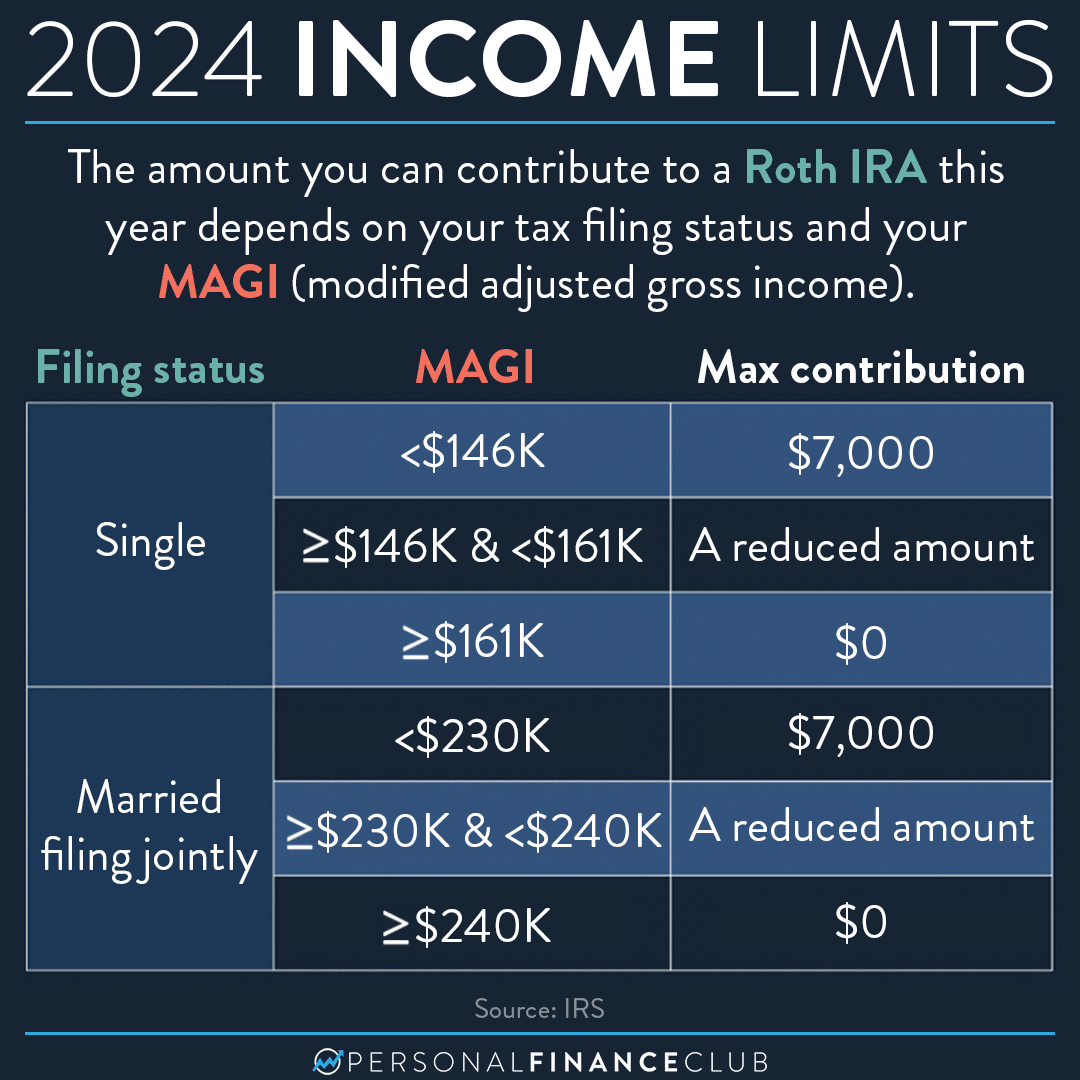

To contribute to a Roth IRA in 2024, you must meet certain income requirements. The maximum income you can earn and still contribute to a Roth IRA depends on your filing status. For married individuals filing separately, the income limits are different than for other filing statuses.

Trusts have their own requirements when it comes to W9 forms. If you need to fill out a W9 form for a trust in October 2024, you can find the necessary information on W9 Form October 2024 for trusts to ensure accuracy.

Modified Adjusted Gross Income (MAGI)

The eligibility requirements for Roth IRA contributions are based on your modified adjusted gross income (MAGI). MAGI is your adjusted gross income (AGI) plus certain deductions and additions, including:

- Taxable interest income

- Half of your self-employment taxes

- Certain deductions for student loan interest and tuition

- Certain foreign income exclusions

Income Limits for Married Filing Separately

In 2024, the MAGI limits for married individuals filing separately are:

- If your MAGI is $153,000 or greater, you cannot contribute to a Roth IRA.

- If your MAGI is between $143,000 and $153,000, you can only contribute a partial amount to a Roth IRA.

- If your MAGI is less than $143,000, you can contribute the full amount to a Roth IRA.

Examples of Income Scenarios

Here are some examples of income scenarios that may or may not qualify for Roth IRA contributions:

- A married couple filing separately, with a combined MAGI of $286,000, cannot contribute to a Roth IRA. This is because each spouse’s MAGI is greater than the limit of $153,000.

- A married couple filing separately, with a combined MAGI of $250,000, may be able to contribute to a Roth IRA. If one spouse’s MAGI is less than $143,000, they can contribute the full amount. The other spouse, with a MAGI between $143,000 and $153,000, can only contribute a partial amount.

Tax brackets can significantly affect your income. If you’re curious about how the tax brackets might impact your 2024 income, you can find helpful information on How will tax brackets affect my 2024 income? to understand how your income might be taxed.

- A married couple filing separately, with a combined MAGI of $200,000, can contribute to a Roth IRA. This is because each spouse’s MAGI is less than the limit of $143,000.

Comparison to Other Filing Statuses

It’s important to understand how the Roth IRA contribution limit for married filing separately compares to other filing statuses. This comparison helps you determine the maximum amount you can contribute based on your individual tax situation.

The standard deduction is an important factor in your tax calculations. To find out the standard deduction amount for the 2024 tax year, you can visit Standard deduction amount for 2024 tax year to get the most up-to-date information.

Contribution Limits for Different Filing Statuses, What is the Roth IRA contribution limit for 2024 for married filing separately

The Roth IRA contribution limit for 2024 is the same for all filing statuses, including married filing separately. This means that regardless of your filing status, you can contribute up to $7,500 to a Roth IRA in 2024. However, it’s crucial to note that your eligibility for Roth IRA contributions can be affected by your income, even if you’re within the contribution limit.

Tax brackets are a big part of figuring out your tax liability, and they can change from year to year. To see how the tax brackets for 2024 compare to 2023, check out Tax bracket changes for 2024 vs 2023 to see how they might impact your taxes.

| Filing Status | Contribution Limit (2024) | Relevant Details |

|---|---|---|

| Single | $7,500 | Individuals with modified adjusted gross income (MAGI) of $160,000 or less can contribute the full amount. |

| Married Filing Jointly | $7,500 | Couples with a combined MAGI of $228,000 or less can contribute the full amount. |

| Head of Household | $7,500 | Individuals with MAGI of $160,000 or less can contribute the full amount. |

| Married Filing Separately | $7,500 | Individuals with MAGI of $10,000 or less can contribute the full amount. |

Considerations for Retirement Planning

The Roth IRA contribution limit can significantly impact retirement savings strategies for married couples filing separately. Understanding the potential benefits and drawbacks of maximizing contributions is crucial for making informed financial decisions.

Corporations often need to fill out W9 forms for tax purposes. If you need to fill out a W9 form for a corporation in October 2024, you can find the necessary information on W9 Form October 2024 for corporations to ensure accuracy.

Advantages and Disadvantages of Maximizing Roth IRA Contributions

Maximizing Roth IRA contributions offers several potential advantages, including tax-free withdrawals in retirement and potential for tax-free growth. However, it’s essential to consider the potential drawbacks, such as limited access to funds before age 59 1/2 and potential for lost investment opportunities due to limited contribution space.

Non-profit organizations often have different tax deadlines than regular businesses. If you’re a non-profit, you can find out the tax extension deadline for October 2024 on Tax extension deadline October 2024 for non-profit organizations to ensure you meet the requirements.

- Advantages:

- Tax-free withdrawals in retirement: Roth IRA withdrawals in retirement are tax-free, which can significantly reduce your tax burden in your later years.

- Potential for tax-free growth: Earnings within a Roth IRA grow tax-free, potentially leading to greater accumulation of wealth compared to traditional IRAs.

- Flexibility in retirement: Roth IRA withdrawals are not subject to required minimum distributions (RMDs), providing greater flexibility in retirement planning.

- Disadvantages:

- Limited access to funds before age 59 1/2: Early withdrawals from a Roth IRA are generally subject to a 10% penalty, unless certain exceptions apply.

- Potential for lost investment opportunities: Maximizing Roth IRA contributions may limit your ability to invest in other potentially high-growth assets.

- Limited contribution space: The annual contribution limit for Roth IRAs is $6,500 for 2024. This limit can be restrictive for high-income earners or those with significant savings goals.

Benefits and Drawbacks of Roth IRA Contributions for Married Filing Separately

| Benefit | Drawback |

|---|---|

| Tax-free withdrawals in retirement | Limited access to funds before age 59 1/2 |

| Potential for tax-free growth | Potential for lost investment opportunities |

| Flexibility in retirement | Limited contribution space |

Impact of Tax Law Changes

While the current Roth IRA contribution limit for married individuals filing separately stands at $7,500 for 2024, it’s crucial to remember that tax laws are constantly evolving. Understanding the potential impact of future changes on this limit is essential for informed retirement planning.

Tax brackets for married couples filing separately are unique. To find out the tax brackets for married filing separately in 2024, you can visit Tax brackets for married filing separately in 2024 for specific information.

The Roth IRA contribution limit, along with other aspects of tax law, can be subject to adjustments based on various factors, including inflation, economic conditions, and political priorities.

Students often have different tax deadlines than other taxpayers. If you’re a student, you can find out the tax deadline for October 2024 on October 2024 tax deadline for students to avoid any penalties.

Potential Tax Law Changes

Tax law changes can affect the Roth IRA contribution limit in various ways. For instance, the limit could be:

- Increased: To encourage retirement savings, the contribution limit might be raised to keep pace with inflation or economic growth. This could benefit married individuals filing separately by allowing them to contribute more to their Roth IRAs and potentially accumulate larger retirement nest eggs.

Qualifying widow(er)s have specific tax brackets that apply to them. To find out the tax brackets for qualifying widow(er)s in 2024, you can check Tax brackets for qualifying widow(er)s in 2024 for detailed information.

- Decreased: In times of economic uncertainty or to address budget deficits, the contribution limit could be reduced. This would impact married individuals filing separately by limiting their annual contributions, potentially slowing their retirement savings progress.

- Eliminated: While unlikely, in extreme scenarios, the Roth IRA itself could be subject to elimination or significant changes. This would have a major impact on retirement planning for married individuals filing separately, forcing them to explore alternative savings options.

Implications for Married Individuals Filing Separately

Changes to the Roth IRA contribution limit could significantly affect married individuals filing separately in several ways:

- Reduced Savings Potential: A decrease in the contribution limit would directly limit the amount of money married individuals filing separately could contribute to their Roth IRAs annually. This could negatively impact their long-term retirement savings goals.

- Increased Tax Burden: If the Roth IRA were eliminated or significantly altered, married individuals filing separately might have to rely on traditional IRAs, which are taxed upon withdrawal. This could result in a higher tax burden during retirement.

- Impact on Retirement Planning Strategies: Changes in the Roth IRA contribution limit could necessitate adjustments to retirement planning strategies. Married individuals filing separately might need to reconsider their savings goals, asset allocation, and overall financial plans.

Staying Informed

Staying informed about tax law updates and their impact on retirement planning is crucial for married individuals filing separately. This can be achieved through:

- Following Financial News and Publications: Keeping up with financial news sources, reputable publications, and industry experts can provide valuable insights into potential tax law changes.

- Consulting with a Tax Professional: Regular consultations with a qualified tax advisor can help understand the implications of tax law changes and their impact on individual retirement planning.

- Utilizing Online Resources: Websites like the IRS website, reputable financial institutions, and government agencies can offer information about tax law updates and retirement planning resources.

Summary

Navigating the complexities of Roth IRA contribution limits for married couples filing separately can be challenging, but understanding the specifics is vital for maximizing your retirement savings. By carefully considering your income, eligibility, and the impact of tax law changes, you can make informed decisions about your retirement planning and ensure you’re taking full advantage of the benefits the Roth IRA offers.

Remember, seeking professional financial advice tailored to your specific circumstances is always recommended for optimal retirement planning.

Question Bank

Can I contribute to a Roth IRA if my spouse’s income is above the limit?

Yes, the Roth IRA contribution limit is based on your individual income, not your spouse’s. As long as your income falls within the eligibility requirements, you can contribute to a Roth IRA, even if your spouse’s income exceeds the limit.

What happens if I contribute more than the limit to my Roth IRA?

If you contribute more than the allowed limit, you may face penalties and taxes. It’s essential to stay within the contribution limits to avoid any potential issues.

Does the Roth IRA contribution limit change every year?

Yes, the Roth IRA contribution limit can change annually due to inflation adjustments and potential tax law changes. It’s important to stay updated on the latest limits for the current year.

Can I withdraw contributions from my Roth IRA before retirement?

Yes, you can withdraw contributions from your Roth IRA at any time without penalties or taxes. However, withdrawals of earnings before retirement are typically subject to taxes and penalties.

The mileage rate can change periodically, so it’s important to be aware of any updates. If you’re wondering if the mileage rate is changing in October 2024, you can find the answer on Is the mileage rate changing in October 2024?

to stay informed.

IRAs have a catch-up contribution limit for those over a certain age. To find out if there’s a catch-up contribution limit for IRAs in 2024, you can check Is there a catch-up contribution limit for IRAs in 2024 for the latest information.