What are the tax implications of getting married in 2024? This question is likely on the minds of many couples planning to tie the knot. Marriage can significantly impact your tax obligations, from filing status and income to deductions and credits.

Understanding these implications can help you navigate the complexities of the tax system and potentially save money.

The impact of marriage on taxes extends beyond simply combining incomes. It affects deductions, credits, and even estate planning. This guide will explore the key tax implications of getting married in 2024, providing insights into how your tax situation might change and what steps you can take to optimize your tax benefits.

Contents List

Filing Status Changes

Getting married significantly impacts your tax filing status. The status you choose determines your tax liability and the deductions and credits you’re eligible for. Understanding the different filing statuses and their implications is crucial for minimizing your tax burden.

If you’re self-employed, you’ll want to know the IRA contribution limits for self-employed in 2024 to maximize your retirement savings. These limits can change annually, so it’s essential to stay up-to-date.

Filing Status Options for Married Couples

The Internal Revenue Service (IRS) offers four filing statuses for married couples:

- Married Filing Jointly:This is the most common filing status for married couples. It allows couples to combine their incomes and deductions, potentially resulting in lower tax liability. This is usually the most advantageous option for married couples as it allows for the lowest tax rate and the highest standard deduction.

- Married Filing Separately:This option allows couples to file their taxes independently, reporting their own income and deductions. This can be beneficial if one spouse has a significantly higher income than the other, as it can prevent the higher-earning spouse from being pushed into a higher tax bracket.

However, it generally results in a higher overall tax liability compared to filing jointly.

- Head of Household:This filing status is not available to married couples. It’s designed for unmarried individuals who maintain a household for a qualifying child or dependent.

- Single:This filing status is also not available to married couples. It’s for unmarried individuals who are not eligible for the Head of Household filing status.

Tax Benefits and Drawbacks of Filing Status Options

The tax benefits and drawbacks of each filing status depend on the couple’s specific financial situation.

Married Filing Jointly

- Benefits:

- Lower overall tax liability due to combined income and deductions.

- Access to higher standard deduction and other tax benefits for married couples.

- Potential for lower tax rates on combined income.

- Drawbacks:

- Both spouses are equally responsible for all tax liabilities, regardless of who earned the income.

- If one spouse has a significantly higher income, the other spouse may be pushed into a higher tax bracket.

Married Filing Separately

- Benefits:

- Protects each spouse from the other’s tax liabilities.

- May be beneficial if one spouse has a significantly higher income and is in a higher tax bracket.

- Drawbacks:

- Higher overall tax liability compared to filing jointly.

- Limited access to tax benefits available to married couples filing jointly.

- May be disadvantageous if both spouses have similar incomes.

Examples of How Filing Status Changes Can Affect Tax Liability

Consider two married couples, both earning a combined income of $100,000:

Couple A: Filing Jointly

- Tax Liability:$15,000 (estimated based on 2023 tax brackets)

- Benefits:Lower tax liability due to combined income and deductions.

Couple B: Filing Separately

- Tax Liability:$18,000 (estimated based on 2023 tax brackets)

- Benefits:Protects each spouse from the other’s tax liabilities.

- Drawbacks:Higher overall tax liability compared to filing jointly.

This example demonstrates how filing status can significantly impact tax liability. Filing jointly allows for a lower tax burden, while filing separately can result in higher taxes.

Income and Deductions

Getting married can significantly impact your tax situation, particularly when it comes to your combined income and deductions. The way your income is taxed and the deductions you can claim can change based on your filing status and the income of your spouse.

Impact of Spousal Income on Tax Brackets and Deductions

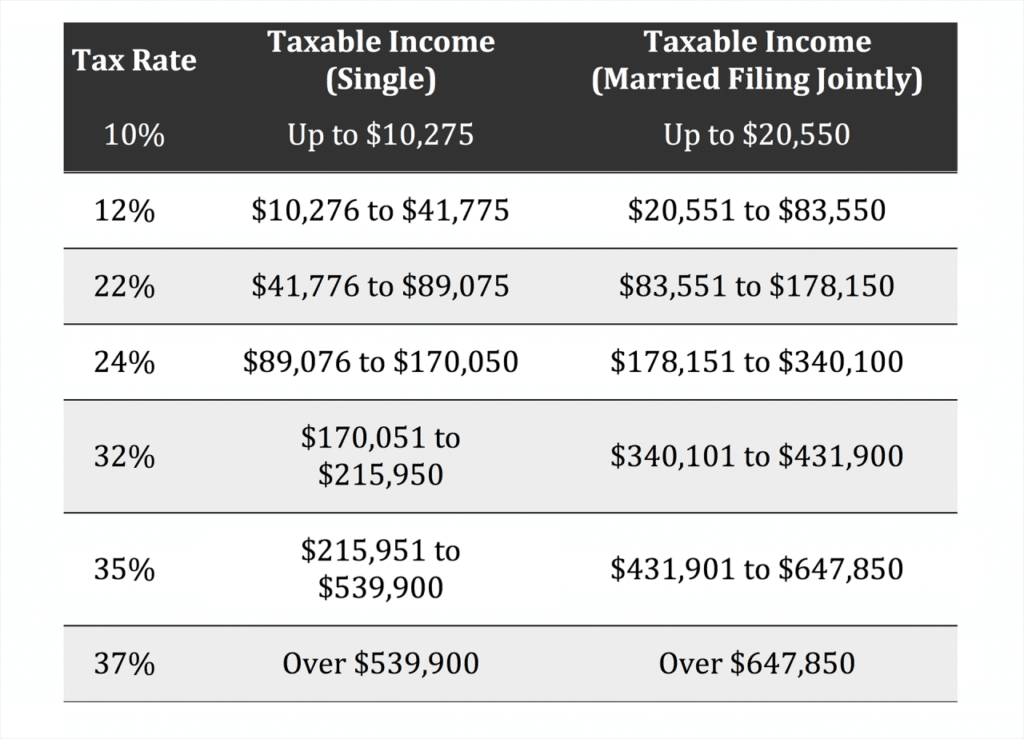

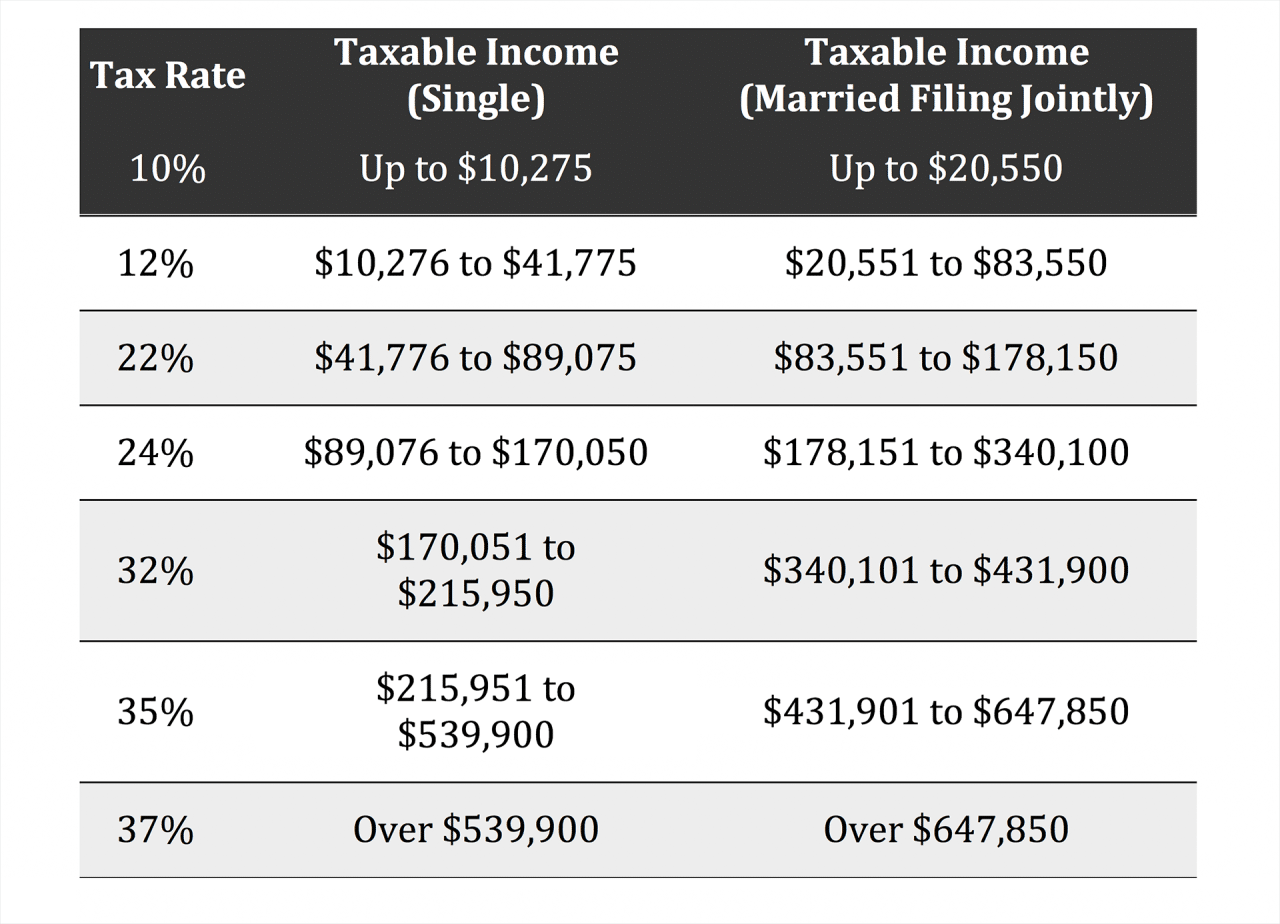

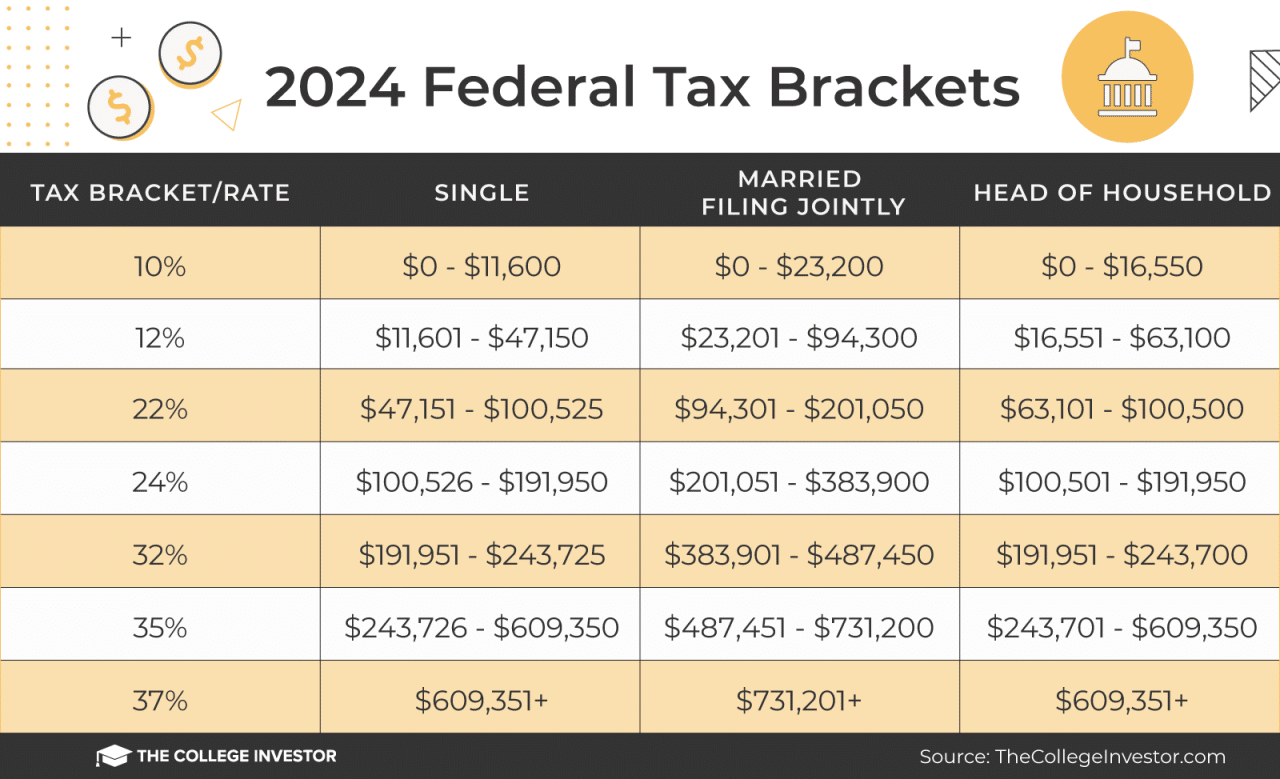

The income of both spouses is combined when filing jointly. This combined income determines your tax bracket, which can impact your overall tax liability. For example, if one spouse earns a high income and the other earns a low income, the higher-earning spouse’s income may push the couple into a higher tax bracket, leading to a greater tax burden.

The tax bracket you fall into depends on your combined taxable income.

In addition to tax brackets, deductions can also be affected by spousal income. Certain deductions, like the standard deduction, are based on your filing status, which changes when you get married. Itemized deductions, such as those for mortgage interest and charitable contributions, can also be impacted by the income of your spouse, depending on the specific deduction.

The mileage rate for business travel can fluctuate throughout the year. Check the mileage rate update for October 2024 to ensure you’re using the correct rate for your tax deductions.

Tax Credits

Tax credits can significantly reduce your tax liability, and getting married can affect your eligibility for certain credits. Let’s explore some common tax credits available to married couples.

Earned Income Tax Credit (EITC)

The Earned Income Tax Credit (EITC) is a refundable tax credit for low- to moderate-income working individuals and couples. This means that even if your tax liability is zero, you may still receive a refund from the government. The EITC amount is determined by your filing status, income level, and the number of qualifying children.

Failing to comply with the W9 form deadline can result in penalties. Learn more about the W9 Form October 2024 penalties for non-compliance to avoid any potential issues.

Marriage can impact your EITC eligibility and the amount you receive. For instance, if both spouses are working, your combined income may exceed the income limits for the EITC. Also, the EITC is generally larger for couples with children, so if you get married and have children, you may qualify for a higher credit.

Those over 50 have the opportunity to make catch-up contributions to their 401k. Learn about the 401k limits for 2024 for over 50 to maximize your retirement savings.

The EITC is a valuable tax credit for many families, especially those with children.

Child Tax Credit

The Child Tax Credit is a non-refundable tax credit that can help reduce your tax liability for each qualifying child under 17 years old. The credit amount is $2,000 per child. However, the credit begins to phase out for taxpayers with higher incomes.

Marriage can affect your Child Tax Credit eligibility and the amount you receive. For instance, if both spouses have children, you may be able to claim the credit for more children. However, your combined income may also affect the amount of the credit you receive.

If you’re a trust, you’ll need to file a W9 form to provide your tax information. Learn more about the W9 Form October 2024 for trusts and how to comply.

The Child Tax Credit can be a significant benefit for families with children.

Catch-up contributions allow those over 50 to contribute more to their 401k. The 401k contribution limits for 2024 for catch-up contributions can help you reach your retirement goals.

Estate Planning

Getting married can significantly impact your estate plan, especially if you have assets to pass on to your heirs. This is because marriage creates legal and financial ties that can affect how your assets are distributed after you pass away.

Wills, Trusts, and Inheritance

Marriage can change how your assets are distributed under your will. In most states, if you die without a will, your assets will be distributed according to the state’s intestacy laws. These laws typically favor a surviving spouse, but they may not distribute your assets exactly as you would have wanted.

- Creating a Will:Creating a will is essential to ensure your assets are distributed according to your wishes. A will allows you to name a beneficiary for your assets and specify how you want them distributed. After marriage, it’s crucial to review your will and update it to reflect your new marital status and any changes to your estate plan.

- Trusts:Trusts can be a valuable estate planning tool for married couples. A trust allows you to transfer your assets to a trustee, who will manage them for the benefit of your beneficiaries. This can be a good option if you want to protect your assets from creditors or taxes, or if you want to ensure that your assets are managed responsibly after you die.

Capital gains can be a complex part of your taxes. Use a tax calculator for capital gains in October 2024 to help you understand your tax liability and plan accordingly.

- Inheritance:In most states, a surviving spouse is entitled to a portion of their deceased spouse’s estate, even if the deceased spouse did not leave a will. The specific amount of inheritance varies depending on the state’s intestacy laws. It’s important to understand how your state’s laws will affect your inheritance if you die without a will.

Gift and Estate Taxes

The gift and estate tax laws can be complex, but they are important to understand, especially for married couples. The gift tax applies to gifts given during your lifetime, while the estate tax applies to your assets at death.

- Gift Tax Exclusion:The annual gift tax exclusion allows you to give up to a certain amount of money to any individual each year without having to pay gift tax. In 2024, the annual gift tax exclusion is $17,000 per person.

Not everyone is eligible to contribute to a Roth IRA. Check the Roth IRA eligibility requirements for 2024 to see if you qualify.

This means that you can give up to $17,000 to your spouse each year without paying gift tax. Married couples can also take advantage of the “gift splitting” rule, which allows them to give up to $34,000 to each other each year without paying gift tax.

A tax calculator can be a valuable tool for understanding your tax liability. Learn how to use a tax calculator for October 2024 and make informed financial decisions.

- Estate Tax Exclusion:The estate tax exclusion allows you to transfer a certain amount of your estate to your heirs without having to pay estate tax. In 2024, the estate tax exclusion is $13.000,000 per person. This means that you can pass on up to $13,000,000 of your estate to your heirs without paying estate tax.

Married couples can use the “portability” rule to double the estate tax exclusion. This means that if one spouse dies and has not used their entire estate tax exclusion, the surviving spouse can inherit the unused portion of the exclusion, which can be used to pass on even more assets to their heirs tax-free.

Students often have unique tax situations. The October 2024 tax deadline for students might be different than the standard deadline, so be sure to check.

Estate Planning Strategies

There are a number of estate planning strategies that can benefit married couples. Here are a few examples:

- Revocable Living Trust:A revocable living trust is a type of trust that allows you to transfer your assets to a trustee during your lifetime. The trustee will manage the assets according to your instructions. You can revoke the trust at any time.

If you’re using your personal vehicle for business travel, you’ll need to know the mileage reimbursement rate for October 2024 to calculate your deductions.

This type of trust can be beneficial for married couples because it can help to avoid probate, which is the court process of distributing assets after death. It can also help to protect your assets from creditors and preserve privacy.

- Irrevocable Life Insurance Trust:An irrevocable life insurance trust is a type of trust that is used to hold life insurance proceeds. The trust is irrevocable, which means that you cannot change it or revoke it after it is created. This type of trust can be beneficial for married couples because it can help to reduce estate taxes.

It can also help to protect the life insurance proceeds from creditors.

- Joint Ownership of Assets:Joint ownership of assets can be a simple way to transfer assets to your spouse after you die. If you own assets jointly with your spouse, the surviving spouse will automatically inherit the assets when you die. However, it’s important to note that joint ownership can have some drawbacks.

Government agencies often require W9 forms from contractors. The W9 Form October 2024 for government agencies has specific requirements that need to be met.

For example, if one spouse has debt, the creditor can claim the joint assets. Also, if one spouse is incapacitated, the other spouse can access the assets, even if they are not authorized to do so.

Retirement Planning

Getting married can significantly impact your retirement planning, as it affects your income, expenses, and savings goals. It’s crucial to understand how marriage affects your retirement accounts, contribution limits, and Social Security benefits to ensure you’re on track to achieve your financial goals.

Retirement Accounts

Marriage can affect your retirement accounts in various ways, including contribution limits and beneficiary designations.

- Contribution Limits: In most cases, your contribution limits for retirement accounts, such as IRAs and 401(k)s, remain unchanged after marriage. However, if your spouse has a higher income, you may be subject to income limitations for certain contributions, such as Roth IRA contributions.

Understanding how tax brackets work is essential for planning your finances. Learn more about the tax brackets for 2024 to see how your income will be taxed.

- Beneficiary Designations: When you get married, it’s essential to review and update your beneficiary designations for all retirement accounts, including IRAs, 401(k)s, and pensions. This ensures that your assets will be distributed according to your wishes in case of your death.

If you’re looking to save for retirement, you might be wondering, “How much can I contribute to my Roth IRA in 2024?” Find the answer to this question and more on the Roth IRA contribution limits for 2024.

You can choose to name your spouse as the beneficiary, or you can split the benefits among your spouse and other beneficiaries.

Social Security Benefits

Marriage can affect your Social Security benefits in several ways.

- Spousal Benefits: If your spouse is eligible for Social Security benefits, you may be entitled to spousal benefits, even if you haven’t worked enough to qualify for your own benefits. Spousal benefits are typically paid at 50% of your spouse’s full retirement benefit.

- Survivor Benefits: If your spouse dies, you may be eligible for survivor benefits, which can provide financial support during retirement. The amount of survivor benefits you receive will depend on your spouse’s earnings history and your age at the time of their death.

Retirement Planning Strategies

When planning for retirement as a couple, it’s essential to coordinate your strategies to maximize your benefits.

- Coordinate Contribution Strategies: If both spouses have access to employer-sponsored retirement plans, consider coordinating your contribution strategies to maximize your tax savings and retirement income. For example, one spouse might contribute more to their 401(k) while the other contributes more to a Roth IRA.

- Consider Spousal IRA Contributions: If one spouse is a stay-at-home parent or has a lower income, they may be able to contribute to a spousal IRA, even if they don’t have earned income. Spousal IRA contributions can help to build retirement savings for both spouses.

- Review Beneficiary Designations: Ensure that all retirement accounts have updated beneficiary designations to reflect your current financial goals and wishes.

Health Insurance: What Are The Tax Implications Of Getting Married In 2024

Getting married can significantly impact your health insurance options and premiums. This is because your health insurance status may change, and you may be eligible for new plans or have different coverage options.

Employer-Sponsored Health Insurance

Your employer-sponsored health insurance plan can be affected by your marriage. For instance, if you are married to someone who also has employer-sponsored health insurance, you may be able to choose to stay on your own plan or switch to your spouse’s plan, depending on the coverage offered and the cost.

- Eligibility for Coverage:You may become eligible for your spouse’s employer-sponsored health insurance plan if you are not already covered under your own employer’s plan. You might also become eligible for coverage if you are a dependent of your spouse.

- Cost and Coverage:When you become eligible for your spouse’s plan, you will need to consider the cost and coverage compared to your own plan. You may find that your spouse’s plan has better coverage or lower premiums. However, it’s crucial to compare the plans carefully to make an informed decision.

Health Insurance Plans for Married Couples, What are the tax implications of getting married in 2024

Married couples have access to a variety of health insurance plans, including:

- Employer-Sponsored Plans:These plans are often offered through an employer and are typically more affordable than individual plans.

- Individual Plans:These plans are purchased directly from an insurance company and are available to individuals and couples.

- Marketplace Plans:These plans are offered through the Affordable Care Act (ACA) and are available to individuals and couples who meet certain income requirements.

- Medicare:This federal health insurance program is available to individuals aged 65 and older, as well as younger individuals with certain disabilities.

State and Local Taxes

Getting married can have a significant impact on your state and local tax obligations. This is because marriage can affect your filing status, income, and deductions, which can lead to changes in your tax liability.

Income Tax

Marriage can affect your income tax liability in several ways. For example, if you and your spouse live in different states, you may need to file separate state income tax returns. You may also be eligible for certain deductions or credits that are only available to married couples.

The W9 Form October 2024 deadline for filing is important for both individuals and businesses. It’s crucial to submit this form correctly to ensure your tax information is accurate and timely.

Property Tax

Property tax is a tax on the value of real estate, such as your home. In many states, property tax rates are based on the assessed value of your home. When you get married, the assessed value of your home may increase, which could lead to higher property taxes.

However, some states offer tax breaks for homeowners, such as homestead exemptions or property tax caps.

Sales Tax

Sales tax is a tax on the sale of goods and services. The sales tax rate varies from state to state and even from city to city. In some states, married couples may be eligible for certain sales tax exemptions or deductions.

For example, some states offer a sales tax exemption on certain items, such as groceries or clothing.

Tax Rates and Deductions

The impact of marriage on your state and local tax rates and deductions can vary depending on the specific laws in your state. It is important to consult with a tax professional to determine how marriage will affect your tax liability.

Resources for Finding Information About State and Local Tax Implications of Marriage

Here are some resources for finding information about the state and local tax implications of marriage:

- Your state’s tax website

- The IRS website

- A tax professional

Last Point

Getting married is a significant life event that comes with various financial considerations, including tax implications. By understanding the tax landscape for married couples, you can make informed decisions about your finances and potentially save money. From filing status and income to deductions, credits, and estate planning, there are numerous factors to consider.

Seeking professional advice from a tax expert can help you navigate these complexities and ensure you’re taking advantage of all available tax benefits.

FAQ Section

What is the best filing status for married couples?

The best filing status for married couples depends on their individual financial situations. Married filing jointly typically offers the lowest tax liability, while married filing separately may be beneficial in certain situations, such as when one spouse has significantly higher income or deductions.

How does marriage affect my eligibility for tax credits?

Marriage can impact your eligibility for various tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit. The specific eligibility requirements and credit amounts vary depending on factors like income and the number of dependents.

Can I claim a deduction for my spouse’s medical expenses?

Yes, you can claim a deduction for your spouse’s medical expenses if they are eligible. However, the deduction is subject to certain limitations, including a 7.5% threshold based on your adjusted gross income.

Do I need to update my estate planning documents after getting married?

Yes, it’s crucial to update your estate planning documents after getting married. Marriage can significantly alter the distribution of your assets, and failing to update your will or trust could lead to unintended consequences.